Space Summary

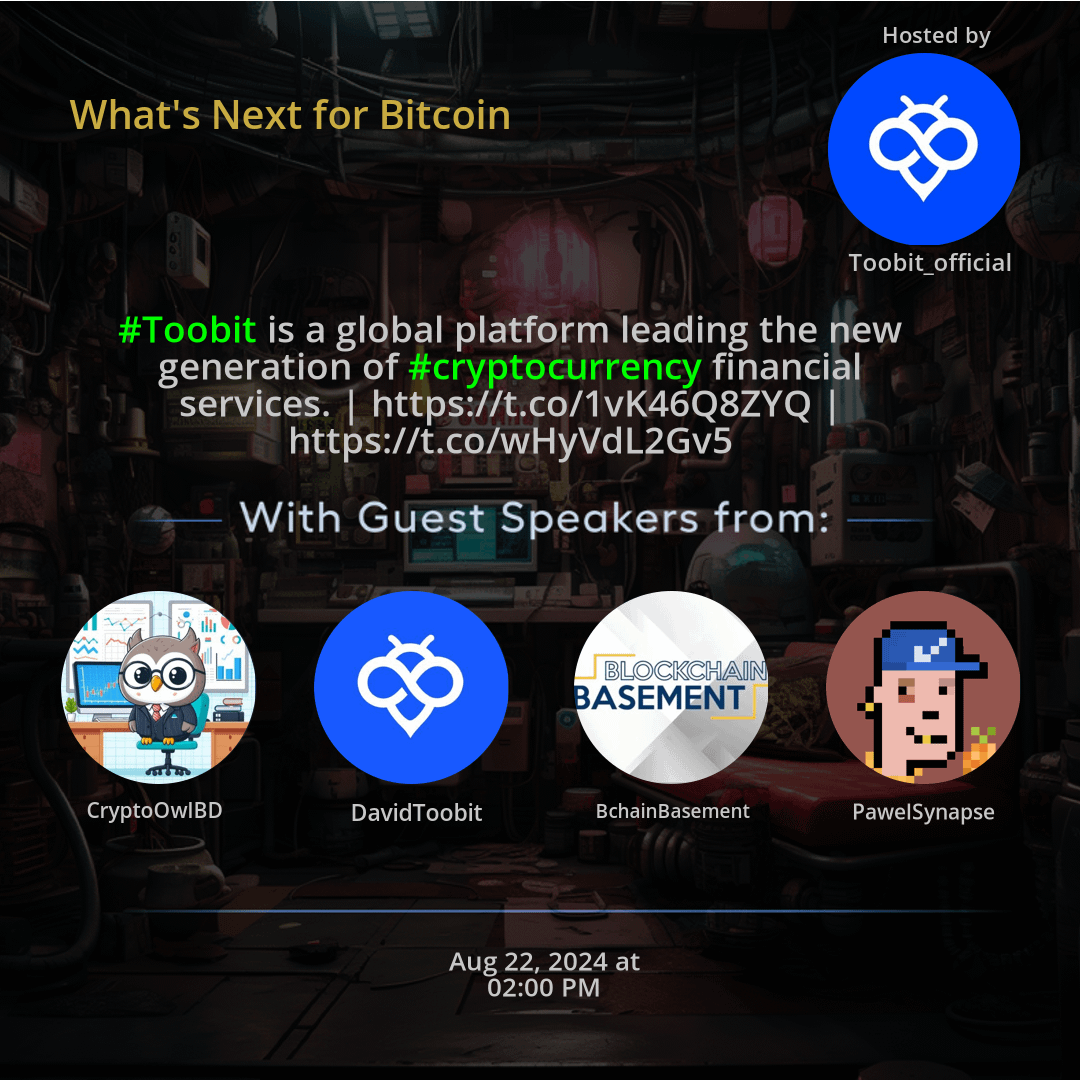

The Twitter Space What’s Next for Bitcoin hosted by Toobit_official. Delve into the future landscape of Bitcoin and cryptocurrency services with #Toobit as the guide. Explore how innovation, DeFi trends, and infrastructure developments are shaping the realm of digital assets. Uncover the impacts of AI integration, unique projects, and the evolving Metaverse on the cryptocurrency space. Witness the growth of wallets, Alpha Group's initiatives, and the exciting intersection of Gaming and cryptocurrencies. Stay informed about the latest advancements driving technological progress and innovation in the crypto ecosystem.

For more spaces, visit the Innovation page.

Questions

Q: Why is innovation important in the cryptocurrency space?

A: Innovation drives progress, fosters competitiveness, and enhances user experiences.

Q: How do DeFi trends influence the financial systems of cryptocurrencies?

A: DeFi trends promote decentralized structures, improve accessibility, and offer novel financial instruments.

Q: Why is infrastructure development crucial for the scalability of Bitcoin?

A: Infrastructure development enhances transaction speed, security, and network efficiency, crucial for the scalability of Bitcoin.

Q: What role does AI play in the security of cryptocurrency transactions?

A: AI integration enhances cybersecurity measures, detects anomalies, and improves transaction verification processes in cryptocurrency transactions.

Q: Why are unique projects significant in the cryptocurrency space?

A: Unique projects introduce innovation, diversify offerings, and attract new audiences, driving growth and exploration.

Q: How does the Metaverse influence the value and use of digital assets?

A: The Metaverse introduces immersive experiences, virtual asset ownership, and new opportunities for utilizing cryptocurrencies in virtual environments.

Q: What does the growth of cryptocurrency wallets indicate?

A: Increasing adoption of cryptocurrency wallets signifies expanding utility, user engagement, and integration of digital assets in everyday transactions.

Q: How do Alpha Group initiatives contribute to the cryptocurrency ecosystem?

A: Alpha Group initiatives bring expertise, resources, and collaboration opportunities, fostering a vibrant and innovative cryptocurrency ecosystem.

Q: What benefits arise from collaboration between Development Agencies and cryptocurrency platforms?

A: Collaboration enhances technological development, promotes innovation, and accelerates progress in the cryptocurrency industry.

Q: Why is the intersection of Gaming and cryptocurrencies particularly exciting?

A: The intersection provides unique opportunities for tokenization, virtual economies, and enhanced user experiences, blending gaming and financial elements for immersive interactions.

Highlights

Time: 00:16:45

Innovative Solutions in Crypto Services Exploring cutting-edge solutions and advancements in cryptocurrency services.

Time: 00:27:59

DeFi Trends and Financial Evolution Delving into the trends shaping decentralized finance and its impact on traditional financial systems.

Time: 00:39:20

AI Integration for Secure Transactions Understanding the role of AI in enhancing security and efficiency in cryptocurrency transactions.

Time: 00:52:15

Metaverse Impact on Digital Assets Analyzing how the Metaverse is reshaping the value and utilization of digital assets.

Time: 01:05:40

Alpha Group's Influence on Crypto Ecosystem Exploring Alpha Group's contributions to innovation and growth in the cryptocurrency landscape.

Time: 01:18:30

Gaming-Crypto Convergence Unveiling the synergies between gaming environments and cryptocurrencies for enriched user experiences.

Key Takeaways

- Innovation plays a key role in shaping the future of cryptocurrency services.

- DeFi trends are crucial for the evolution of financial systems in the cryptocurrency realm.

- Infrastructure development is essential to support the growth and scalability of Bitcoin and other cryptocurrencies.

- AI integration is revolutionizing the efficiency and security of cryptocurrency transactions.

- Exploring unique projects can uncover new opportunities and advancements in the cryptocurrency space.

- Understanding the impact of the Metaverse on digital assets is becoming increasingly important.

- Growth in cryptocurrency wallets is indicative of expanding adoption and utility in the digital economy.

- Alpha Group initiatives are contributing to a dynamic ecosystem for cryptocurrencies and blockchain technology.

- Collaboration between Development Agencies and cryptocurrency platforms is fostering innovation and progress.

- The intersection of Gaming and cryptocurrencies offers exciting possibilities for user engagement and virtual economies.

Behind the Mic

Introduction to the Crypto Space

All right. Hello, everybody. Welcome today's crypto space. I see we got some of my other speakers joined already. Everybody wanted to introduce yourself a bit. What is up, everybody? I'm Drew, known as the Drew from the blockchain basement. Glad to join you guys and excited for this bitcoin bull market. I've seen some pretty interesting metrics. I'm excited to talk about today on just the timing, kind of how close we are following the four year cycle, and kind of what to expect. So I'm stoked, man. All right, cool. Thanks, Drew. Thanks for being here. All right, everybody else, want to introduce yourselves? So we all know who we're talking to. Hello? Hello, Laura, are you there?

Introducing Laura

Hey, everybody. My name is Laura. I'm working at two bit. So nice to meet all of you. Hi, Laura. Thank you. All right, well, we have some other speakers that I guess haven't joined yet. Hopefully they'll be on soon. As they join, we can see who they are. So for anybody who's new to two bit, I guess we should give you a bit of a little introduction. Why would you choose two bit over anything else? So maybe I can pass that on to Laura. You're the expert here. Can you give a little brief overview of two bit? Yeah, sure. Definitely. So, yeah, my name is Laura. I'm working at two bit. Two bit is monkey receipt futures trading exchange. So it's a very great space to trade your cryptos at the moment.

Opportunities with Two Bit

Well, you know, there are a lot of restrictions all around the world, so, yeah, happy to work with a team. We have very international team working all across different places, so, yeah, it's really great career opportunity to work at two bit. All right, thanks, Laura. Well, still waiting on some speakers, so let's just dive into it. Maybe I'll get some feedback from Drew here. So our main topic is bitcoin right now. Drew, let's see. So what emerging trends in the bitcoin space are you finding most exciting right now as far as the last month or so has gone? Absolutely, man. I'm really like, the bitcoin trends that I've seen is pain and dismay for the smaller wallet holders. But what's been going on is these massive hedge fund managers, these massive organizations, we're talking BlackRock, Franklin, Templeton, they have remained stacking and adding to their ETF's.

Current Bitcoin Trends

And just for context, like, you know, this ETF release for bitcoin is one of the most, if not the most bullish and fastest trajectory to the upside ETF releases in history of our economy. So what I see is a lot of, you know, people that are trying to hold onto their bags in the midst of a hard economy and their dollar, their buying power dropping, these massive organizations are buying up all of the bitcoin under them. And, you know, it's a painful thing to see people selling right now in the market. I understand there's all the macro fears, but I usually, you know, I watch what they do, but, you know, I also do what they do and just listen to what they say. And they have been stacking through this entire pain period of bitcoin falling back down and we punched down to pressure got increased.

Whale Holdings and Market Dynamics

This is also I saw Microstrategy's velocity on their purchases have began to try to capture and match the velocity of Blackrock's purchases of bitcoin on their exchanges, not on the exchange, but on the balance sheet. But something, a nuance within that is I do see total whale holdings. This is, you know, just larger whale wallets. They have been slightly on the downside, like they've been slightly curling over. So they're calming down a little bit. So, you know, we got to keep that in mind. I really think that what we just experienced with this trap zone from, you know, up to then down to 49k was a very, very strong accumulation moment for the people that had really good conviction. And now the people from the outside looking in, they're going to realize we're going to breach 70 74 again.

Future Market Expectations

And that's when the real retail FOMO is going to begin. And it's all kind of timing out with how it does every single cycle. With the US election, the institution of quantitative easing, and money is definitely on the money flow for bitcoin on the larger timeframes is also looking very healthy as well. So there's a lot of time frames. You'Re looking at there. Yeah, on the monthly, okay. Yeah. So the monthly and the weekly are looking very normal to previous bull markets. And actually, you know, it does look like the money flow has a much larger upside potential for this bull market. If I'm looking at it from the forest through the trees, on the monthly, it looks, you know, the front end of it. And where we are right now looks very normal to past bull markets.

Bitcoin and Dollar Dynamics

But something that was kind of a nuanced conversation that I've been having with some of the best traders in the planet have been talking about the diminishment of the buying power of the dollar has actually our true all time high for bitcoin was that first pump when we hit 64k, last bull market. Since then, the dollar's buying power has really kind of taken a nosedive. So when we're looking at, you know, breaching the all time high for bitcoin before the having this current cycle, it got a lot of people overly excited. But then also the concern that the top was in, right, was that it is that all we got? And now it's just a slow ride to hell. But I have to remind people that diminishment of the buying power within the dollar is a hardcore indicator of why bitcoin breached that on paper, in fiat, an all time high.

Market Ranges and Valuation

But really we're ranging exactly where we should be in terms of bitcoin value. And that's the difference. And that's a tough thing, is because we're valuing bitcoin and USD, right? It does, it does. And this is some of the concern with all of this, you know, marriage with tradfi. Yes, it's gonna pump our bags, but I also cover, you know, the sicknesses within the macroeconomic situation. And a big part of what my channel is doing is not only are we finding the best projects out there to get into while the getting's good, but I have a very concise plan on exit strategies for myself that I talk about very publicly. And those are, you know, if I see new information, if I see that, you know, Nvidia's revenue catches up with its speculation on valuation, then I'm not going to be talking about that a year from now.

DCA Strategy and Market Timing

But as it sits right now, Nvidia is a highly speculative tech play that the revenue needs to catch up with the valuation for us to not experience a.com bubble type burst in 2026. So, yeah, that's kind of what I'm watching. But as far as bitcoin in the bull market, like, I'm feeling right on track. I'm seeing, you know, like, in terms of the having and the bitcoin dominance levels, this is the portion that I utilize to assess when altcoin season, because I get asked that constantly. Oh, yeah. I mean, the bitcoin dominance, there's something interesting to keep in mind is the second halving of bitcoin. We saw 231 days to the t of bitcoin dominance holding on, and then it fell off a cliff. Thus, the altcoin season began.

Historical Trends of Bitcoin Dominance

The same exact time frame happened in the third halving. 231 days, and then boom, you fall off a cliff. Ethereum starts running, all these other cool altcoins start running, and people, the average person is able to create generational wealth out of those smaller plays, you know. So where we're sitting right now, we're only 100.2125 days after the having. So, you know, I'm not going to try to wait all the way up to 231 days. I think I'm going to have until about the middle of November. That's, that's like my, I don't DCA constantly. I'm a seasonal DCA. Er, and that's my plan is to basically DCA all the way up into the middle of November. Then what I got is what I got.

Trading Opportunities and Market Enthusiasm

So the getting is good now and I'm making that very clear and going after the good projects while I can. All right, cool. Yeah, I meant I may, I'll probably be coming back to you for some altcoin questions in a bit, but I did see that Joris joined us. So I wanna. Joris, can you introduce yourself real quick? And then I wanna throw a question at you. Yeah. Hello guys. I'm Joris, working currently at two bit exchange. And yeah, feel free to ask me any questions. All right. For sure. I'm gonna ask you one right now. So were just talking about the current market situation. You have a bit more insight on two bit.

Market Opportunities at Two Bit

I was wondering what opportunities is two bit seeing in the future regarding the current market situation? Well, from what we can see, actually the trading activity is increasing in the platform, especially during this jump from the, we've seen a lot of new joiners the market. So I think that the current market situation actually gets the market excited and even new people join that. I feel that there is a lot of uncertainty in the market. Some people say that we topped, some people say it's the beginning of the bear market. Now, for me, it's hard to believe that I still think that we might go to 100k. But I also remember that we had a similar situation a couple of years ago where everybody was saying for 100k, if you were there, you probably remember that.

Viewer Participation and Signups

But coming back to your initial question, I see that more new people joined. We've seen a lot of signups at two bit platform itself. And from what I've seen is that people are excited to trade spot and people are excited to trade derivatives right now. Okay. How's the increase in spot and derivatives trading looked? Has it been recent or past year? What's the timeframe on that? Well, what I mentioned in the increase is we've seen a big increase since the, in the last couple of months. Well, that what we have seen yeah, it's very recent data, and usually when this happens, market continues.

Market Behavior Insights

Right. So we've seen a very, like a big decrease in volumes, big decrease in new signups, usually at the end of the bull market. Then we see, you know, lower volumes, lower signups. But right now in summer, I feel that people are still bullish. I feel that people still want to trade and they didn't get enough. And, you know, like, my personal opinion, it has nothing to do with the company. I think that people didn't make enough money on altcoins. And I want to think, and I want to know what you guys think about it. Now, in the last bull market, it seemed that whatever we buy, we make money, but this time it was much harder.

Reflections on Altcoin Performance

And some altcoins actually, they did a round trip went to say went to $1 or more than $1 and came back. Yeah, yeah, that's a good point about the altcoins. It did seem easier to pick one at random during the last bull run. So while we're still on two bit, this could be for either of you guys, whether it be Joris or Laura. How about stupid's product roadmap? Like, are there any new features or services you're working on the horizon, either Laura or Joris, if you have some insight. Laura? Laura, would you mind talking about that? Hi, Laura, are you there? Hi. Yes, I'm here.

Plans for Trader Onboarding

Yeah. So myself, actually, I'm working now very hardly onboarding great traders into exchange. So that's the goal, I think, at the moment. Yeah.

Current Market Conditions

And I just wanted to add about, we talked a lot about the current market conditions, so, you know, I see it very simply. We can just simply keep selling and, you know, all the indicators looks good. So, yeah, let's keep stacking, I think.

Expansion into Latin America

Well, for as long as two bit. Two bit still has to expand to Latin America. And that's actually the next kind of the next market where we are going. And were strong in Asia, we are strong in Europe, but we are not yet there in Latin America. So that's what the, let's say at least the business development team is focusing at two bit.

User Submitted Questions

That actually brings me to another question. I'm going to go a bit out of order and go ahead and bring out one of the user submitted questions because henrynrythegod with two ds asked what barriers to entry still exist for bitcoin in developing countries and what initiatives could help bridge these gaps. So anybody, any of the speakers here, feel free to add some insight on that. Joris, what do you think about that?

Barriers to Entry for Bitcoin

Well, it's the lack of on ramp and onboarding tools in the exchanges. I believe this must be done much faster. And also other exchanges should start supporting onboarding tools like credit card and transfers, immediate bank transfers. If this is solved, then it will be much easier to really onboard people and onboard people's money. Now, in some countries, that takes a lot of time to on ramp money into an exchange. Well, this is not the case. Two bit. In two bit, things are much faster. People can use a credit card to onboard money. However, we would like to support more currencies and especially more fiat currencies from other countries. However, there are some legal barriers that make this process much longer and we have to comply with them.

Developing Countries and Bitcoin Adoption

From what I've seen, sometimes the developing countries can kind of contribute to more, I guess, real use case adoption, I would say. Because if you're in a place where your financial system is pretty set up, then you kind of have to be adventurous to want to get into bitcoin, I guess. But in places where the financial system is kind of getting messed up, then it can actually be a real world use case of like really getting into bitcoin as an alternative. Just a little insight for me. I don't know what you guys think about that.

Access to Crypto

Well, I mean, you brought up a good point. It's like the systems that are breaking is where people need access to crypto the most. But in those situations, you know, those countries that have their fiat valuation falling off a cliff, they're, they increase their controls, their capital controls, and it's really, you know, it's kind of a double edged sword. So the more avenues that you can open up for them to get access, the more on ramps and off ramps you can create. Obviously working within the parameters of what's available within the legal system, that is super important for the average person. You know, the average person is not some government bureaucrat trying to control their currency usage as everyone's watching it fall off a cliff, you know, and that's like the whole design of why crypt, like bitcoin is invented.

Bitcoin's Historical Context

During the housing crisis, you know, and it really, you know, part of what spurred it was not only stopping spam emails, but stopping our dollar valuation from being printed into nothing. And it's like America has some issues, but it's really bad across the board, you know, and we saw the sickness within tradfi. We really saw that in a glaringly obvious time when the Japanese yen and that carry trade situation absolutely crushed, bitcoin for a hot second. It punched bitcoin down to all coins, got a big beating from it, so now we're rebuilding from that.

Traditional Finance and Cryptocurrency

and it does have this double edged sword where we see ETF's and all these traditional finance tools being cooked in to crypto, but then we're married to the problems with it down the road as well. So, you know, that's why I love two bit and organizations that respect, you know, user privacy and lift up the average person, rather than lifting up who's already on top.

Competition in the Bitcoin Space

Let me throw another question at Laura and Joris. How does two bit view the competition in the bitcoin space? And are there any opportunities for collaboration or partnerships that you guys are looking at? Yeah, so, Laura, if you want to take this. Yeah, sure. So, yeah, there is lots of competition, actually, especially in Europe. There are many different exchanges here. Right. What is a very good point of two bit? But two bit provides a really great space for futures trading and do it in non kyc way, so that's a really great advantage. But, yeah, competition is very big. So you always have to look, you know, from the partnership perspective, how you can partner with another, you know, exchange or, you know, some local community.

Local Engagement and Communities

So, yeah, we are really working now, you know, hard to engage with local communities all across different countries here in Europe because, you know, Europe is relatively small, but it's very different. And, you know, there are a lot of different trading communities. So, yeah, that's. That's our big focus now to build. Yeah. Organic engagement here.

Regulatory Changes Impacting Bitcoin

Well, then, speaking of the regulatory changes that might have been part of the effect of having the KYC on the other places. So I have another relevant user submitted question from stay, which is a Morgan one. How do you foresee global regulatory changes affecting bitcoin in the near future? And what steps are being taken to address potential regulatory changes? So basically, the regulatory question about bitcoin, if anybody has some insight on that, Joris or Drew or Laura, what do you think about the regulatory changes and how they might be affecting bitcoin in the near future?

The Fight for Crypto

Absolutely. I mean, I'm looking at the regulatory changes, at least here in America. It's basically a fight to the top. And the real winner in this argument between the right and the left here in the United States on who's more bullish for crypto is us, the crypto holders, right? They see that it's got extreme use case across the world. They see other nations trying to integrate and outpace them on those innovations and just the open ardenness for companies to come in and develop within the country, because that's capital flow. They see the opportunity there and they're racing to the top right now. So, like at bitcoin Nashville, for instance, we had, RFK is a third party candidate. He was talking about buying 4 million bitcoin and putting it on the us treasury balance sheet to backstop the us dollar.

Political Perspectives on Bitcoin

Now Trump comes in, he's a little bit less, but he does want to have a plan to back the us dollar with bitcoin to a degree. But we see this double edged amazing situation where now RFK is now potentially going to be joining teams with Trump. And RFK knows a lot about bitcoin and about the use case of it. And after the left saw this movement from the right, then all of a sudden the left and their presidential candidate comes out. I'm pro bitcoin too, guys. So they're just trying to race to the top.

Understanding Bitcoin's Value

And you know, they really understand that bitcoin holders and the freedom fighters of crypto are loud and they have monetary weight to throw around because they haven't been sitting here watching their dollar fizzle in their hands. They've been involved with the space they've been building in the next generation of what I call the next industrial revolution, which is crypto, bitcoin and data being the new gold. They see this happening. And the real winners here are people that were involved with crypto before all of these agencies get their chance to be bullish as well.

The Essence of Bitcoin

So honestly, you know, it. I have basically summed it up as this many times, bitcoin is this unstoppable force meeting the immovable object of government. And now they're having to figure out a way to coexist. They understand it's not going away, and the governments across the world are learning ways to leverage it to hoist their fiat currency up rather than try to get into a battle with something they truly can't kill.

User Question on German Bitcoin Sales

So that actually brings me to another user question perfectly, which is from Emmerich at Ugo, Chuckwooimur two. You know who you are, I'm not going to spell it out. So anyway, the question is, are we still seeing the aftereffects caused by the german government selling off all their bitcoin? Which I guess is a little bit in opposition to what you were just saying, drew, but maybe you have some insight on that.

Legal Obligations in Germany

Yeah, absolutely. I mean, the german law is they have to let go of seized assets within a certain amount of time, so they actually were legally obligated to do so. Us, not so much. You know what I mean? Us, they seize and hold that stuff. So it is a little nuanced. Just within the lawfare of Germany, they were required to offload those assets because they had been seized. And maybe they'll change that law in the future because Germany is going to watch bitcoin absolutely crush this cycle and they'll probably shift a little bit about that around in their own legal infrastructure.

Market Effects of the Sale

But, yeah, there's no denying that cell brought us down very quickly to 53k. But something that I like seeing is that bitcoin didn't keep the death spiral going. It basically has just been over the last. I'm looking at it since. I mean, we had the ETF's the front end of the year, right. it pumped us up to that original moment of hyper euphoria. Everyone is talking about the March 13 moment of 2024. We hit $73,000. And across the board, all coins absolutely ripped.

Investing in Cryptocurrency

And I wanted to mention on the all coins ripping during this timeframe, a lot of people round tripped them. Me in the basement, not so much. We took tons of profits and I built a building on my property with it. I bought a vehicle because I'm actively involved with crypto to better my life. And when I have a. I have a baseline rule. When I see a three x, I take the profits. When I see a five x, I take even more profits. And then I leave a bag on the table for the moon. Sure, it might be the next ethereum.

Profits and Strategy

You might have just found the next ethereum. Or Solana leave a moonbag on the side in case it keeps running. But I'm not in crypto to just watch the number go up and then all the way down. I've been through multiple cycles and, you know, I have a very concise intention to turn the profits into real estate power, into local power. I got a bunch of gardens.

Personal Investment Philosophy

I like producing my own food. And I think that, you know, there's a lot of. There's a lot of incentive for myself to take that money off the table when it's there so that I don't have to be holding, like, for instance, ICP. One of the best moves I made this cycle, I absolutely slammed into ICP at $3 and then 16, $17. I was taken, a huge chunk of it off the table. Now I got house money playing for me, and it's still, it didn't fall back down to $3. It's sitting here playing around eight, $7.

Market Resilience and Profit Taking

That's fine. I feel great about it, and it's just a lesson for myself. And, you know, I'm not trying to give everyone, you know, their exact path, but I've been through this cycle multiple times, and it can absolutely change your life. But you cannot like the narrative of a million dollar bitcoin is coming this cycle. And guess what's not going to happen? You need a $20 trillion market cap for bitcoin to hit a million bucks.

Moving Slowly in Trading

So be wary of that move too far. I was curious, whenever you're talking about selling three x and five x, do you like to buy and then just set a limit order at your. Those price points just so it happens automatically or. No, I mean, not necessarily because I'm watching it every day anyways, you know what I mean? I kind of track it myself. But if I was in a situation where I'm not on the charts all the time, and it wasn't literally my job for the last few years to be looking at the charts and the news, then, yeah, I mean, those limit orders are very powerful to utilize. But me, myself, basically, I just know where my entry points are off the top of my head. Even though I'm holding like 20 or 30 different coins right now. I know each one of them, I know why I got into them.

Profit Taking Strategy

I know my original entry, and I know my, you know, and essentially that three x that initiates like a 40% to 50% exit for me. And then that five x is another 25, and then, you know, I'll leave like 2025 on the table just in case it keeps running to the moon. Yeah. All right, cool. Yeah, that's one of those early lessons that I'm sure you. I'm sure you had as well whenever you first started of not taking profits. Well, it was kind of interesting last cycle, like, you know, when March 14 happened, in 2020, everyone in the United States was like, fever pitched to go buy toilet paper instead of crypto. But Ethereum was like, $180, bro. And so, like, I already had, you know, six months, a year worth of goods in my house because I've been watching the decay of everything for decades. And so I didn't go to Costco.

Capitalizing on Market Conditions

I didn't have any need to go there and fight to get that checkout done. I went to Coinbase, and Coinbase was dead. There was no one out there buying crypto. And at like, the worst moment for crypto, bitcoin. I got my bitcoin for four grand and then a bunch of ethereum at 180 a unit, and then Chainlink was like a dollar 90 or something ridiculous. So I did hammer in everything right at that moment. And then, you know, when we did hit $4,500 in Ethereum, for some reason, I sold it. I sold everything and I turned it into vehicles and I saw it reset. The one thing I did hold round trip style was bitcoin. And then I bought my original XRP. I bought it like seventeen cents.

Changing Market Positions

And there was this whole narrative that it's going to be the bankers coin and stuff like that. So, you know, and there's so much data. There's so much. It's not really data. It's news articles that come out for XRP that keep people locked into the project. And just watching it over the years and seeing the diminished ability, the diminished trajectory of its escape velocity made me sell my entire position of XRP when it was seventy cents. I don't think it's even reclaimed that level since then. I. But what I did is I took that 70 cent exit on XRP and I moved into near at like $1.80 or something like that. I moved into all of these other speculative plays because what I see happening at large is the RWA for real world assets and decentralized GPU projects being the new hot squeeze.

Real World Assets and Market Infrastructure

I really feel strongly about that because we have this whole release of artificial intelligence systems. But guess what? You need a massive infrastructure of computing power to compliment that, to make that actually happen. People don't think about that. But that's why I see render, I see aether, I see i o.net on the Solana side. And also, something that makes me so excited about two bit is you or this exchange is one of the few places I can get access to flux, and I am extremely excited about what I'm seeing from flux. So that is a main thing that I'm really quite pleased about having access to, because, you know, it's like, you can know about a good project, but it's already available to everyone, and everyone's already in it. How much upside really left there? You know what I mean?

Bitcoin as a Foundation

So I'm always trying to find things that are not popular yet, but that's just have a rock solid foundation and a good place to build from. So. Yeah, all right, well, so for me, I'm curious, how about. I'm curious what you think about this. For me, I kind of usually see bitcoin as. I don't mind round tripping bitcoin, as you said it, because for me, that's always, like, the long term sort of safe place to put some of what I've made. Then, basically, most of the alts, there's ones that I believe in more or less, but for me, nothing really comes close to bitcoin. But I know a lot of other people don't necessarily feel that way. So I do want to tie that in to this next question that somebody has submitted.

Evolving Bitcoin and Blockchain Technologies

Stella Sphere at Manhasara three. How do you see bitcoin evolving in the face of regulatory changes? We already talked about that. We can skip that part. And the rise of other blockchain technologies like DeFi and nfTs. So for me, I feel like bitcoin is always still the backbone of sort of the whole thing. But the question is, like, is bitcoin evolving in the face of the other things? Specifically, what they mentioned was defined nfts. But we could talk about any of the other parts of the crypto space. Drew or Laura or Joris, anybody can chime in. Yeah, I mean, when he pops it all hop off, but I mean, basically stacks, I feel good about. I felt good about for a long time.

Speculative Nature of Bitcoin

You know, it's very speculative, and it's a new environment to have a layer two for bitcoin. But I think that a lot of people faded, not only the layer two aspect and the Defi within bitcoin, but they also faded ordinals hard. And that proved to be a very incorrect thing to do. And honestly, I was, you know, it's new. When it came out, I. I was trying to hammer in to the pepe on bitcoin very early, but actually, I got shut off by my credit card company. They wouldn't let me do it, you know what I mean? And I. So I just threw my hands up. I still covered them and stuff like that. And I've followed the price explosion on all of them.

Productive Trading Decisions

And shout out, I got a buddy that he also set up a note. He was running, you know, this ordinals type play for a long time. He's in pizza ninjas and all those other kind of cool projects, and a lot of people faded him. And it was the exact opposite of correct to do because those things have shown extreme strength in comparison. If you, if you stack up the velocity of growth on bitcoin nfts compared to ethereum or Solana NFTs, it's not even close right now. So it leaves the question, are ETh and the other Nfts going to have their moment in the sun? Outside of pudgy penguins, I haven't seen really anything pop its head out and really demand that respect to this cycle.

Maintaining Stability in Bitcoin

All right, how about if we are taking the question at face value of how do you see bitcoin evolving? So bitcoin, by its nature, intentionally doesn't change that much. Do you think there's any, just specifically from bitcoin, do you think there's any way it needs to evolve to sort of keep up with the changes, or do you think. I don't know if it needs to, but I think it's going to. I think that building out, there's a lot of interest that I got, I was listening to in bitcoin Nashville about loans backed by bitcoin and about kind of a more sound infrastructure for those options to be available.

Regulatory Challenges

I think a lot of reasonable takes from the collapse of Celsius have kind of stuck in the minds of major money and bag holders that saw a pretty trusted avenue for that type of option just absolutely get crushed. And I really think that the DeFi side and really the infrastructure, the ecosystem around bitcoin is going to be built out because it is the King Kugla crypto. And I think that it's going to be the more trusted option, not just because of its longevity, but because now we have coinbase custodying a wallet that's in comparison to Satoshi's wallet. We have massive organizations that have fully leaned into crypto.

Forced Evolution of Bitcoin

And I want to keep. There is a reason in my mind why Blackrock decided to do this is because, you know, if everyone remembers 2023, BlackRock was not that excited about crypto. In fact, they looked at it like their enemy. But what happened was in 2024, in March. Well, actually, no, it was. I think it was March of 20. 316 attorney generals from the United States took aim at BlackRock for investing industry focuses that were actually counterintuitive to their local GDP and their local production. So Blackrock, all of a sudden, hey, I'm bullish on proof of work. I'm bullish on bitcoin.

Industry Transition and Bitcoin's Future

They definitely changed their tune the moment that those attorney generals took aim at them for trying to arbitrage their economies. And ever since then, it's been just a big old kiss fest between bitcoin and blackrock. I really think that change happened by force. I think that JPMorgan has been developing their own proprietary blockchain this whole time. It's onyx blockchain. They wanted to make it insular to themselves, but they got forced into accepting bitcoin and proof of work as a institutional instrument for these massive funds.

Investing with Caution

All right, thank you. All right, thank you. That's really good insight on that. Let me go ahead and hit this last user question here. It's from Cybertruck lover at Baya Tesla. I guess we know what that guy likes. So the question is, sometimes when I'm trying to convince people to venture into crypto and maybe trade, they cite lack of funds as their barrier. Is there some way someone can start their crypto journey on two bit with little or no money? I think this would be a good one for Laura to jump into.

Starting Your Crypto Journey

Laura, do you have some insight on that? Somebody starting their crypto journey on two bit with limited funds? Hello, Laura, are you there? Yes, I'm there. Yeah. Basically you should get starting with trading on tobit. Take $100, you know, and buy some low caps and. Yeah. All right. Yeah, yeah. So I think that would be a great strategy. All right. I'd say also, if they're interested in futures trading with little to no money, especially the no money option, is doing a bit of the, what do you call it? The.

Trading Strategies

The trading where you're using fake funds, but it follows the real trades. I know that option is on there, so that's a great way to get started if you want to make sure that you kind of understand the trading strategies and use them yourself. Why am I forgetting the word for that? What do you think, Drew? Did you, do you trade futures or spot generally? Yeah, I mean, I do both. Really. You know, for context, 99.5% of my bag remains spot, but I do take half of a percent, and I'm actively trading it right now.

Market Analysis and Positioning

And really you know, in the trend that we're all we're in right now, I am not comfortable shorting this market by any degree. So, you know, how I approach it is I look for good signs of weakness and levels where I think that bitcoin actually has flushed out enough liquidations of longs to find that support and then begin its next leg up, I think we're going to be seeing if you're backed up for us to the trees. Looking at this thing a year from now, I think you're going to see higher lows being created.

Future Market Predictions

So I'm looking for those moments of higher lows to put in those trades. And again, I am not shorting this market by any means, but that mindset, because we are following the four year cycle still, that mindset will publicly shift from me to more looking for signs of weakness at the end of 2025. And, you know, with all of the things on the macro that I see, I think that there is going to be a violent move to the downside at the end of 2025, beginning of 2026, especially in all points now, bitcoin, that's still to be determined.

Historical Market Movements

But what I did, just for context on why I'm a seasonal dCaer, my first bag that I, you know, finally built the capital up and hammered into of my life savings on the March 14 crash, I basically built everything up, bought it all up, and then took the profits on the Ethereum at, you know, dang, near the top. But I waited till essentially we hit that $17,000 level in December of 2022 with a very basic trend line of the top that bitcoin experienced in 2017, in December, again. And that was my moment.

Investment Rationale

In comparison with the cost of mining bitcoin, which at that time was nineteen k, and bitcoin was selling for seventeen k, I looked at that as a screaming deal. So once again, I backed up the truck, refilled everything that I could, and, yeah, I mean, I did DCA along the way until I didn't feel comfortable DCA. And after the, you know, the ETF was really, least until now, because I do not buy gigantic green candles. I'm there to experience them, but I am not buying them.

Strategies in Trading

So my whole intent is to sell on green candles and make money and not just be part of a community. That's all thinking they're going to the moon immediately. This stuff doesn't happen overnight. You have to be locked in. And it takes a lot of, honestly, a lot of resilience and a lot of stubbornness in your trading plan to. Be able to, for the resilience and stubbornness, you kind of got to build it up.

Introduction and Strategies for Beginners

Right? So, like, yes. How about if we're bringing it back to the question of, like, somebody starting out, especially if they've got little to no funds, what do you. What strategies would you recommend for somebody kind of getting their toes wet? Yeah, I mean, I know that. That feeling, like I'm a very, you know, middle class dude. I mean, I have done really great in the markets, but again, I put it right back into real estate and stuff like that. And I don't keep much cash on hand. And really, you know, in this current realm, what I'm doing is increasing my output into the workforce, you know what I mean? Because I'm mining as much fiat as possible to put into crypto, especially with the weakness in the market right now. So. But then, you know, I've heard people that do utilize, you know, credit to do so. I am not necessarily in that camp, though. I like to minimize the amount of debt that I have to an extreme low level by any means possible, because the baseline of why I got into crypto, I'm here in America, and I see the average person buried in debt that they will never escape and likely their children will never escape.

Long-term Focus and Financial Education

And I'm here to change generations of my children. So that is the focus that I take, is not piling a bunch of debt. I'm out here mining fiat currency while it's buying. Power is still at levels that it is right now. Even though it's down 99.8% since its inception, it's still being used, and it's still what we get paid for employment in a large degree. So that is finding new ways to generate that revenue. Like, for instance, the Avac or the Avax and ICP profits that I took. We built a alterations and fashion design shop on my property for my wife because that's her industry and that's what she likes to do. And now she's able to increase that income as well. And all of a sudden, we have more buying power, more DCA power, because we're turning those gains into money making opportunities for ourselves. And then we can stack our bags even while the gettings good. All right, so for a new person, do you think you'd recommend, as a first step, doing a bit of just easy buy and hold some spot or immediately start trying to.

Caution in Trading

Yeah, no, I don't think that jumping into the deep end and trading actively is the move at all for people that are new to this. If you do have that intention, you're going to have to take a long time and a lot of focus to understand fibs, to understand what money flow means this four year cycle, what bitcoin dominance means, and even the nuance between ethereum to bitcoin valuation or bitcoin to cardano valuation, because that stuff matters a lot, especially if you're trading now. Spot, you know, a lot of people dog it. They're like, there's not enough upside. I'm telling you guys, I've absolutely changed my life and I have a huge family I'm taking good care of right now from spot movements. Like, again, 99.5% of the bag is all spot, and it has done wonders for me. And I do think that there's an extreme power to spot buying, but you have to have an idea of what number would change your life, what number would actually make a difference in your life over the next six months. And then you have that number in your mind. It makes it much easier to pull the trigger and take those profits when it comes.

Experience with Market Volatility

Sorry, I got muted. Baxton. Yeah. It's good to have a nice. It's good to try to pull out your timeframe a little bit longer as well. Be okay with making gains over time and what they add up to. Powell, I see that you've joined and your hand is raised. Please. Yeah. So what I wanted to add to this, like, I completely agree, because, like, when you analyze the statistics for the last two years, so the volatility on bitcoin is super big. So being a trader is like doing trading, like, for the newbies in the space, for the new people that are joining the space, it's a big risk because of the volatility they can spot in the market. And very often those people are playing with leverage and they are overlooked, of course. So checking that and looking onto those variables, like risk and volatility, it's much better for the new people in the space, in terms of bitcoin, of course, to buy and hold because of how the market behaves instead of doing the trading.

Education and Risk Management

Because, like, knowing the trading and understanding the trading is a very tough word. Like, you need to have a statistics that will follow the results you generate. So it's not like I met, like, hundreds of different traders and in most cases, like, in the long run, they will lose its money. The main issue was they were not able, in most cases, to properly do risk management because after they won a few trades, they were increasing, they were entering this gap mode. They were increasing the risk. They were increasing the leverage. They were trying to make a million dollars from $1,000. And that's the big trap for the new people in the space. So that's why looking onto this statistics and risk reward ratio, when you are trading and when you are holding bitcoin and checking the statistics for the last two years, bitcoin grew up like 100, 150% or even more over that time. And how many times you would lose or you would make your account equal to zero because of being over leverage of the course of trying to make much more capital.

Identifying Market Trends

You feel me, right? Yeah, yeah, for sure. Yeah. That's where you got a longer time frame, right? Yeah, of course. It's when you try to do the longer time frame. Yeah, exactly. In the short time frame, it's really tough. So the education is the most important thing for the people. If they are joining the space, they want to do trading, they want to be guts of making transactions and making money on the market. It's not easy because of how hard you need to keep the rules that you will use. Most of the people are, after some fourth period of time, they are starting to break the rules that they were, you know, setting for each for themselves. So that's why I would say that the first thing before you will start trading is like, very proper education and, you know, working with your head, because the hat is usually the weakest point of every trader.

Market Behavior and Sideways Movement

Right. Yeah. So, speaking of which, if you're looking at the chart for the past month, I guess the past maybe two weeks ish, we've seen sort of just a sideways action, which I think for a beginner, it's kind of, they don't want to see that. But, you know, once you kind of are into it a little bit more, you know, some, a lot of people, a lot of traders I know really enjoy sideways action. So I'm curious, maybe Powell and then Drew can give a little bit of your thoughts on sideways action. Is that something you like to see and make use of? So, I like it because I'm. I'm a quant trader, so I use a lot of quants. So volatility is something that I love because I make mainly money on volatility.

Last Thoughts on Trading and Strategy

But I have friends like crypto burp, you. You may know him, the big trader as well, but his strategy is mainly to play along some bitcoin. So he's a trend following trader. So, like, 70% of his trades are in loss because the sideways market is a very big problem for him because he enters the position, he's being kicked out of the field center. The position is he needs to be in the position all the time because he never knows when the market will skyrocket and he will make, you know, a decent portion of capital. Plus, he will, you know, cover all the losses he was having in the sideways market. So, like, for us, for me, it's a, it's the best market we have right now because I love that market. Our quads, my quads are making profit. But for most of the people who are playing or were playing trend following, and they are looking for trend following movement, it's a very bad market because they are entering.

Closing Remarks

They are entering and they are being kicked out all the time, and they need to get those losses right. Cool. How about you, Drew? What do you think of a sideways market? I mean, they make me, I agree with a lot of what Paul just said. They make me very happy because, and obviously, we see these massive sell off candles coming every now and again. But I just. The market flushing out people that are long and that are under, they're overexposed, they're over leveraged, and then their stop loss is just below where they put in the trade ad. But on these sideways movements, essentially what I do is find, like, for instance, chain link. Chain link is one of my biggest bags. And the experience that I had with chain link is watching it through the accumulation market of 2023 all the way up till September.

Identifying Opportunities in Sideways Markets

I was able to set it up so that I watched the accumulation moment all the way to nearly the last two weeks until the breakout. I was insulated till bitcoin. And just watching the money flow and then watching the overall flow of bitcoin as a whole helped me time that out. So then I was, you know, I knew that it was a good time to hammer into Chainlink, hammer into ICP. ICP was like $3 at the time. Link was $5, and it did really good. Now, we did have a little bit extra fireworks in bitcoin, but now that we've seen the pullback and this sideways movement in it, this is the time where I actually turn up the heat on my dollar cost averaging. It's not necessarily, I shouldn't call it dollar cost averaging. It's filling up a small section of the truck.

Final Insights on Market Dynamics

It's not a full back of the truck moment because I leave some capital on the side in case we do get that flush down to around the, you know, the 50k level like we saw for just a brief moment on that carry trade with the yen, but at large right now, I'm scared to death to shorten this market because I see everything lining up for a massive breakout in November. It always times out with the elections in the US. And I really think that history is just going to simply repeat itself. Maybe it's a coincidence that it's lined up with that, but I've seen the bitcoin dominance fall off a cliff at the same time over the last two cycles when I've had altcoins to compare to the rest of the market. I think that we're on track for the similar type of thing, but with better fireworks to be found.

Conclusion and Market Outlook

All right, gotcha. All right, thanks, Powell and Drew. I think we're coming up to an hour here, so maybe I should start closing it out. But yeah. Thanks, you guys, for joining and thanks for Laura, who's still here. Laura, maybe you want to say one more thing, I guess for everybody wanting to use or follow two bit, obviously, there's this Twitter account and there's twobit.com. laura, do you have any other input for following or staying in contact with two bit? Hi, Laura, are you there? Yes. So thank everyone for participating. Let's. Let's keep rolling. All right, cool. All right, so, yeah, well, you guys are on the Twitter right now, so keep following the Twitter. Go to two bit.com if you're trying to keep up with two bit and everything.

Final Thoughts from Participants

And Powell and Drew, thanks again for joining. Is there any last things you want to say before we close out here? Yeah, man. Just lock in. This is the season. Like, you have to do the research, do the due diligence. This is the moment that. Absolutely. I've seen it change people's lives in a very serious way. And people that fade, these moments that we have on the precipice of a nasty bull market, they regret it. They ask you how long lucky you got. It's not luck. It's because you locked in. You did the time, you did the research. And you know, it's a risky endeavor to be involved with this speculative asset class, but I've changed my life once.

Awareness of Market Volatility

I'm going to do it again. All right, thanks, Drew. I will just say that you need to keep an eye on the risk that you are taking, because in the next few weeks and two, three months, we will see a big volatility on the market because of the economical reasons globally, but also because of the US elections that are going to be heavily based on blockchain and crypto because we have, like, two different candidates that are going to try to use crypto as a political leverage for each other. So we need to be aware of that because one day we can have, like, big upside because of some decisions or some, you know, promises, and another day we can see a big downtrend because of the change of some poll that have been made. Who gonna win?

Caution for Traders

Right. So we need to keep an eye on that and not to take too big risk on yourself because this market that you will see in the next few weeks might reset your account. So keep an eye on the risk you're taking. Yes, for sure. All right, well, I think I'm going to go ahead and end it there. Thanks again for you guys. Thanks, Drew. Thanks, Powell. Hopefully next time we get to talk a bit more and, yeah, see you guys around. Thanks, everybody, for joining. Don't forget to follow this account if you're not following already, and go to two bit.com to get started.