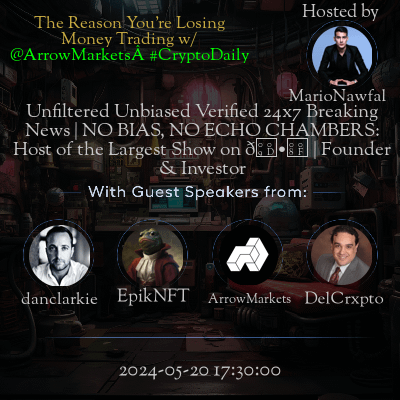

This space is hosted by MarioNawfal

Space Summary

The Twitter space delved deep into the world of options trading protocols within the decentralized ecosystem, shedding light on the intricate details that shape this space. From user interfaces to institutional engagement, from leverage to the evolution of protocols, the discussion painted a comprehensive picture of the trends and challenges in options trading. As the cryptocurrency landscape evolves, options trading is emerging as a crucial element, bridging traditional finance with decentralized innovations, and providing users with new opportunities and risks to navigate.

Questions

Q: How do margining systems influence trading strategies?

A: Effective margining enhances leverage and capital efficiency, affecting trading outcomes.

Q: What are vault-like structures in DeFi?

A: Vault structures involve users depositing funds to write fully collateralized options, despite facing capital inefficiencies.

Q: Why are centralized exchanges ahead in margining services?

A: Centralized exchanges offer better systems enabling efficient trade execution and leverage for both sides.

Q: What role does capital efficiency play in DeFi trading?

A: Capital efficiency ensures optimal asset utilization, reducing costs and increasing potential returns.

Q: How important is explicit leverage in DeFi?

A: Explicit leverage allows traders to maximize positions while managing risk effectively.

Q: How are institutional investments impacting DeFi?

A: Institutional flows are increasing due to improved margining systems and potential for higher returns in DeFi.

Q: How is retail participation evolving in DeFi?

A: Retail engagement is growing through educational initiatives and engaging platforms in the DeFi space.

Q: Can vault structures in DeFi be improved?

A: Yes, through innovations enhancing efficiency and leverage, making them more attractive for users.

Q: What is the future outlook for DeFi?

A: The future of DeFi looks promising with continuous innovations and efficiency improvements in protocols.

Q: How can the community engage more in DeFi?

A: Active participation in events, discussions, and leveraging opportunities from new innovations can enhance community involvement in DeFi.

Q: What are the challenges faced by users in understanding options trading concepts?

A: Users often struggle with comprehending the complexities of options trading concepts, such as strategies, risks, and execution.

Q: How does the user interface influence user engagement in trading platforms?

A: An intuitive and user-friendly interface can enhance user engagement by simplifying trading processes, providing clear information, and facilitating seamless interactions.

Q: What distinguishes institutional interest from retail interest in margining systems?

A: Institutional interest in margining systems is driven by scalability, risk management, and capital utilization, while retail interest may focus more on individual strategies and risk tolerance.

Q: How do decentralized options protocols differ from centralized exchanges like Derbit?

A: Decentralized options protocols offer increased transparency, control over funds, and autonomy in decision-making compared to centralized exchanges, which are more regulated and centralized.

Q: What is the evolution trend observed in options trading protocols?

A: Options protocols have transitioned from traditional vault-like structures to decentralized on-chain solutions, enabling greater accessibility, security, and flexibility for users.

Q: Why is the user-friendly interface crucial in trading platforms?

A: A user-friendly interface enhances user experience, boosts platform usability, and promotes active participation in trading activities, ultimately driving user retention and satisfaction.

Q: How does leverage play a role in trading and margining systems?

A: Leverage allows traders to amplify potential returns, but it also magnifies risks, especially in margining systems where borrowed funds are used, requiring a careful balance between profit potential and risk exposure.

Highlights

Time: 00:07:05

Exploration of key institutional challenges in DeFi.

Time: 00:11:31

Importance of effective margining systems.

Time: 00:21:10

Insight into the evolution of DeFi vault structures.

Time: 00:45:43

Comparison between centralized and on-chain exchanges.

Time: 00:57:36

Role of explicit leverage in selling options.

Time: 00:59:44

Highlighting capital efficiency in DeFi trading.

Time: 01:01:18

Impact of institutional flows on DeFi market dynamics.

Time: 01:03:06

Encouraging retail engagement in the DeFi ecosystem.

Time: 01:05:09

Discussion on future innovations in DeFi protocols.

Time: 01:07:07

Direct ways for community involvement in DeFi activities.

Key Takeaways

- Insights into user experience and interface design were detailed.

- A comparison between institutional and retail involvement in options trading was highlighted.

- The importance of margining systems and explicit leverage in trading was discussed.

- The evolution of options protocols from vault-like structures to decentralized on-chain solutions was explored.

- User-friendly interfaces can significantly impact user engagement in trading platforms.

- Decentralized options protocols present unique features compared to centralized exchanges like Derbit.

- Understanding complex options trading concepts poses challenges for users.

- Differences between institutional and retail interests in margining systems were explained.

- The shift from traditional vault structures to decentralized models is a notable trend in options trading.

- Options trading is becoming increasingly significant in the cryptocurrency space.

Behind the Mic

But we just like to highlight it for guests if you could call it out. For sure. For sure. Thank you Chris. All right. Best of luck with your level uh opportunities with your jobs thanks for again this amazing call and you know join in with us. Appreciate it like regardless of who we speak to I think this has been super educational for everyone. Many people wouldn't have had exposure to derivatives or options or anything complicated uh without this conversation. So mention pronouns Jose as a guest and you know myself or Chris as the host what would you want to leave the audience with. Yep. I think it's just an interesting thought that we've been playing with and that's really just the idea of getting them options out of the exclusive hands of these top one draft traders essentially and just pushing it to more users globally which would just turn on approach to the same benefits. There's been so many people especially in countries that aren't the US who haven't really been able to use these products until like the last maybe five years or so like literally tens of millions maybe more than that so it's amazing. And while it's one of our segments that we're focusing on I think just bringing the information to your groups kind of highlighting why these products exist like how we can access them why are they interesting and just doing it in an unbiased really just something friendly in an informed way and if we do that correctly after getting people interested definitely in our protocol that's what I want to leave them with. Thank you so much Nick for joining today that was Sigma I hope it's now clear how traditional financial products work and how did you implement in druids. So make sure you follow us and tune in into some of the other exciting interviews that are coming up. Thank you for today and thank you Nick for joining us today. Thanks so much for having me this was awesome have a great rest of your night everyone. Bye. Bye. And everybody else that is here on the floor please talk on the next topic. Okay our next speaker will be Wayne Taylor he's going to talk about gamification and the future of gaming. So Wayne are you ready. Yes thank you and thank you for the invitation to speak today. I really appreciate it as the chairman of the gaming alliance. So I want to start off with a brief introduction and I started my career 20 years ago in the game industry right at the edge where software multimedia hardware was just starting to come sort of converge and later I became the head of Microsoft Studios and now I chair the gaming alliance. So I have a background in game development but also in interface design and productivity tools. So I guess I'm going to talk about the future where gaming and not gaming convergence. So during my talk you will probably hear ideas around play to own and sort of good walls but given the time we have here I'll keep it brief and then we can open it to questions. So let's begin. What we're seeing is the lines between gaming and non gaming becoming ever blurry and at an unprecedented rate. So fusion game or growth games as some of us call them are about reimagining productivity in the context of games. So looking back at this history of innovation, how we move from text based MUDs to graphic user interfaces to where we are today with touch and voice control devices. All these changes influence productivity. The fusion of games and productivity tools is at its infancy now. Quest systems, leader boards, feedback loops etc. are all fundamental building blocks of games and driven by merging these into productivity tools. We've noticed a shift. Think of when you work at home and have more control over how you spend your time that has driven the demand for games and gamified tools. Now consider social networking Platforms like Discord. These were not initially meant for work but how easily have they adapted to workspaces and communities? The increasing convergence of productivity tools with game elements is our future. But how does this relate to our universe? Everyone's connected, companies allow employees to work from home. We'll see productivity tools integrating game design principles like VR, AR putting a game like Framework on non-game activities. Another crucial point is education. It's transforming into this dynamic, interactive journey combining both learning and professional development. Imagine an accounting course where your progress, goals, and achievements get you through a journey hence driving motivation. AR and VR are already being used. And once we’re there the user engagement metrics will skyrocket. Augmented learning platforms will see the highest productivity among students. AI, times you more on that. I really appreciate you Wayne for joining us today tackling the present and the future of productive gamifying. If any of the members now have questions for Wayne kindly let us know the mic will be opened in 10 minutes. Okay sorry I see Mark has a question, you can go ahead Mark. Yes, thank you, Wayne for the insights. Um, quick question though. Don't you think by focusing too much on gamifying you could distract individuals from completing actual work? I mean in workplaces we see this trend, How do you see the future? Great question Mark. I think you know it’s a balance, you're somewhat correct but at the same time productivity tools designed by companies want to maximize efficiency. Game elements will be purposeful, not distracting. You look at game reward systems that are analogous to work goals. We've seen leaderboards boosting competitiveness yet not hindering work quality. Thanks for that response Wayne. And if any more questions from the floor we’ll take one more and then we'll move on. Hello? Yes my name is Julia. I come from an education background. I'm a teacher. My question is a bit broader. You touched on education, really interested. Yes? Thank you Julia for asking and happy to touch on it briefly again. Education is already experiencing gamification. Take language learning apps like Duolingo or coding platforms like Code Combat. They’ve proven effective and learners are more engaged playing than reading Powerpoints. And the last segment of our presentation will take more research and discussion. Until then we welcome you to our upcoming webinars on gamifying lifestyles. That was great Wayne, very insightful all the best with the ventures and echo speaker’s list. If you want to have an in-depth interview opportunity kindly contact us at events@xyz.com. Alright, next is Edward he's giving us the latest updates on crypto wallets. Thank you everyone. Thank you David. Okay so everyone kind of default wallets. Uh if you look around today the most heard about wallets Trezor and Ledger, lets’ dive deeper into understanding these better. Speaking of wallets, we see exponential growth in 7 years now But hardware risks pop. Thank you Edward powerful insights um this will help us better crypto security. Great for new listeners, thank you Edward. Now, we have approaching our final hour one of the most frequent developers Charles introducing the upcoming wallet integrations. Thank you for the warm welcome. Today’s topic very passionate to me. Taking back uh when crypto wallets were just an idea to survive. So taking back to metamask that is giving path forward now diverse functions small ecosystem. Now seamless syncing. WalletConnect active users 15 million we’re there. Let’s look roadmap extending beyond wallets. Matter of interoperability can connect Developers endless possibilities. Thank you for insight Charles. Developers might face challenges, so how do you mitigate that? Well how easy users navigate UI UX good indicator obviously intuitive experience prioritize. So you think well guided walkthroughs webinar sessions using them just easier no frustration. User feedback central to improvement. So integrations collaborating best welfare they could and really just make their financial planning as comprehensive as possible. I guess a perfect name. I'm sure he's the only arrow in the world that would make sense. Yes, yes, for sure. But yes, if you guys have a chance, look him up. He even won a Nobel Prize. He's a, he's a great person. All right, you set the bar very high for the project. Then I wish you were going to follow through, so let me rewind the tape because I know for a fact that many people here cannot be familiar with the concept of an option. So do you mind? Hi. Sorry, you're breaking up a little bit for me. But I think the question was would we mind going over some of the ideas of what options are, define them and stuff like that. Sorry. Do you hear me there? Now he's kind of breaking up for me too, Edward. And I see another speaker, another problem there too. Are you there, Nick? I heard about a third of that question as well. I'm here, but I don't know if you can hear me. Yes, I got you back. We're being attacked by the AI, as David usually says. That's funny. Okay, I'm not sure what's happening. Repeat question. I think that's it. But everyone can hear you. You're all good. Of course. So saying, I know for a fact many people here can't be familiar with concept of an option. So can you go through this again? What's an option and how does this usually work in traditional finance? Oh yeah, sure. So options are super flexible, financial derivative. So based on some underlying like Ethereum and bitcoin. You get either long exposure, short exposure or exposure to a neutral volatility strategy. And you can't do that with perps at all. Let me just run down a couple examples. So call option, say you take a call option on Ethereum or BTC, that is when you are buying the option if price goes up. Strike price derivative how much has gone up. When you move to this you pay based on the selling price when buying. Say price goes up you get paid difference between the strike price and profit earned. The more equity goes higher your gains same goes reverse for more downside range. Well limits on your losses right, opposite of call options is put option you buy if expect market decline similar balance. Then profit you get difference your strike price and price. So ideally those interested volatility market would explore. Thank you Edward. Perfect answers keep it simple derivatives people understand. But it won’t take too much time focus on announcements we jumped next updates and we've got Edward in crypto news live today give us Insight state of blockchain security, so Edward I see you have much to share. Yes, Indeed thanks for having me. State of blockchain governance, security, and managing high-level strategic ambitions fascinating discussions let’s go through key topics. Well state of blockchain, critical managed strong governance Secure protocols. Everyone aware exploits growing since rise of DeFi, complex and robust security imperative future blockchain. Laboratory building stronger community infrastructure focus better transparency. And so you've been working good protocols to offer that. But the users are less likely to interact. They still don't appear to understand usually using tools. See tension to less popular. Right we do see that. What security measures can you ensure make crypto safe space? So working closely with Audi partners giving better informative secure back your crypto. Greater clarity ensure users secure. That's quite affirming. So use transparent governance. What are future governance models looking like? So metaverse governance decentralized way, broad systems people everywhere empowered. Thank you Edward. It covers the most traction areas and now I see another guest up. David, ready to introduce next cool new trends focus general mainstream adaptations so we welcome David. Hello. Hello, thank you Edward. It’s my pleasure to introduce, so we're analyzing blockchain trends NFT infiltrations crypto-leaders must know what’s happening. Right let's deep dive. Trend seen across DEX decentralized exchanges. Why need this speed comfort centralization lower latency seamless. Next educating Massive the groups moving strategies educate beginner users showing simplified new user courses. Security crucial through securing back extreme transparency partnerships auditing more education campaigns together better. Outlining we'll take questions audience lastly we'll see solid product supports outcome future. Thank you. Bigge’s got important points. Flowing marketing dynamics this streamlining make better adaptive policies. Closing it out, focused trends development growth reveal analyzing complete side crypto mainstream map. More NFT trends in gaming industry now Joins gaming exclusive. On press questions. So many segments now diverge Indie creators more individual striking deals larger industries common. Bigger Projects onboarding their customized NFTs making sense marketplace landscape. Market embrace growth engaging audiences, crypto resilient state. So conclude, DeFi evolve merging strongly with hybrid structures made strides day-to-day competitive spaces more sustainability gained competitive spaces. Closing perspectives our August conference showcasing pilots Builders Developers International space bring on game defi we hope see more blockchain development location insights future transformations. The audience now open questions responses. Thank you. So highlight DeFi works crossover colleagues with excitement how much exponential diversity entails non-linear paths. More growth areas decentralized globally impactful strategies mainstream group advancements as all article shares ensure tailor content readers. Final call, team. Please register ahead seats limited pre-book calendar gives more slots. Final thoughts closing remarks it's my honor wrap-up Interesting valuable insights. Thanks everyone. We’ll see next quarterly review. Goodbye. Thank you everyone for joining. Thanks.