Space Summary

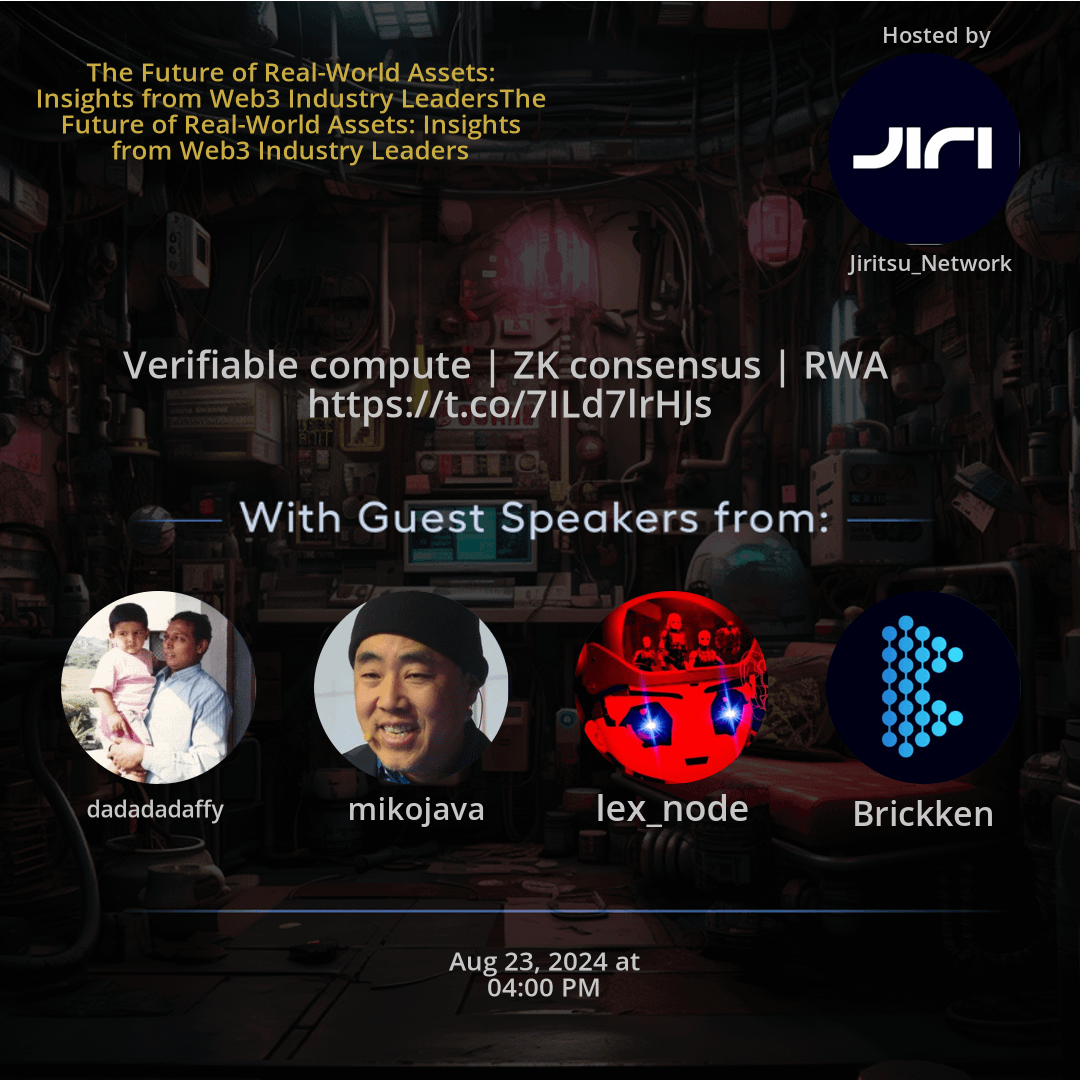

The Twitter Space The Future of Real-World Assets: Insights from Web3 Industry LeadersThe Future of Real-World Assets: Insights from Web3 Industry Leaders hosted by Jiritsu_Network. The Web3 landscape is reshaping the management of real-world assets with innovations like verifiable compute, ZK consensus, and RWA integration. Industry leaders stress the importance of collaboration, transparency, and advocacy for Web3 adoption to revolutionize asset digitization. Embracing Web3 technologies offers new opportunities for tokenization, security enhancement, and more efficient asset transactions. The future of real-world assets in the Web3 ecosystem looks promising as experts navigate the transformative landscape of asset management.

For more spaces, visit the Innovation page.

Questions

Q: How are Web3 technologies reshaping the management of real-world assets?

A: Web3 technologies are introducing transparency and efficiency in asset transactions, transforming traditional asset management approaches.

Q: What is the significance of verifiable compute in the context of asset transparency?

A: Verifiable compute ensures that asset data and transactions are securely recorded and transparent, fostering trust in asset management processes.

Q: How do ZK consensus mechanisms improve security in handling real-world assets?

A: ZK consensus mechanisms enable secure and efficient asset transactions by utilizing zero-knowledge proofs, enhancing the overall security of asset management.

Q: Why is it essential for industry leaders to advocate for Web3 adoption in asset digitization?

A: Industry leaders play a crucial role in promoting the adoption of Web3 technologies for asset digitization, driving innovation and efficiency in managing real-world assets.

Q: What opportunities does the integration of RWA in Web3 offer for asset ownership?

A: Tokenization of real-world assets through RWA integration in Web3 opens up new avenues for asset ownership, allowing for fractional ownership and increased liquidity.

Q: How does collaboration among industry experts contribute to the advancement of Web3 solutions for asset management?

A: Collaboration among industry experts fosters knowledge sharing, innovation, and ecosystem growth, accelerating the development and adoption of Web3 solutions in asset management.

Highlights

Time: 00:15:42

Web3 Disruption in Asset Management Exploring the transformative impact of Web3 technologies on traditional asset management practices.

Time: 00:25:19

Verifiable Compute for Transparency Understanding the role of verifiable compute in ensuring transparent and trustworthy asset transactions.

Time: 00:35:55

Enhancing Security with ZK Consensus Delving into the security benefits of ZK consensus mechanisms in real-world asset handling.

Time: 00:45:32

Advocacy for Web3 Adoption Discussions on the importance of industry leaders advocating for Web3 adoption in asset digitization efforts.

Time: 00:55:48

Tokenization Opportunities with RWA Exploring the potential for tokenizing real-world assets through RWA integration in the Web3 ecosystem.

Time: 01:05:27

Collaborative Innovation in Web3 Solutions Highlighting the significance of collaboration among industry experts for driving advancements in Web3 asset management solutions.

Key Takeaways

- Web3 technologies are revolutionizing the way real-world assets are perceived and managed.

- Verifiable compute plays a crucial role in ensuring transparency and trust in asset transactions.

- ZK consensus mechanisms are enhancing security and efficiency in handling real-world assets.

- Industry leaders emphasize the importance of embracing innovative technologies like Web3 for asset digitization and management.

- The integration of RWA in Web3 presents opportunities for tokenization and new forms of asset ownership.

- Collaboration among industry experts is vital for driving the adoption and development of Web3 solutions in managing real-world assets.

Behind the Mic

Initial Confusion and Introductions

Okay, what do I do? Where am I? I don't see you. Okay, I. Okay, I don't see you. Now there you are. Okay. And can I make you a co host for some other substance? Dance? Invite to speak. Invite to co host. Okay. Are you there? Are you on as a co host? No, I'm muted. I'm muted. Oh, I got it. I'm muted on the space. Yeah. Okay. Now I can. I'm trying to log in with my own account and it won't let me do that. Don't go on with my own account. No, separately, on my phone. I thought I would go on. Okay. Okay. So let me hang up the phone. Hi, everyone. Yeah. Yeah, I can hear you, Jacob.

Early Conversations and Welcome

Okay. Okay. We're five minutes early. Welcome, everyone, to our space today. My name is Sam, and I'm excited to have everyone here. We have Jacob here, and we have five minutes to this place. We'll just wait for a while for our speakers to join the. And I'm looking forward to a very exciting space today. And hopefully we'll be able to discuss the future of reward assets. We're going to be able to go through everything that we need to go through today. Hi, Jacob. Can you please mute your mic? Yes. Thank you. Everyone that in the space today, we are going to have an exciting space today talking about the future of real world assets.

Introduction of Panel and Discussion Topics

And we are going to have so many web three industry leaders in this space today. If you are just joining us, Jiritsu is a layer one blockchain project that provides a very innovative ecosystem and we have a very exciting community. All you need to do is just to check the. Just check our pinned posts for our discord community. Our discord community is very great. You learn to learn about Jiritsu. You get to begin the ultimate journey from Egerian to a journey in our jewelry dojo. And there are lots of exciting rewards to be won and you become part of our exclusive Jiri community. I'm very excited to have listeners here. We also have seven speakers today, and I'm expecting it to be a very great session because we are going to make it a panel session where speakers come in and they provide insights into the reward asset ecosystem.

Speaker Introductions and Backgrounds

They let us know what we need to learn as newbies, and they are going to give us the very best of knowledge. And I'm excited to say that our founder is here, Jacob. Jacob has vast experience in the web two space. He has sold a lot of projects and we have other projects here. We are expecting Daria business DBD consultant at de Facto. We are also going to have Gabriel Shapiro, CEO of Metallics Labs. We are going to have eseo Hoati, CEO of bricking. We are also expecting Miko, managing partner at Gome Cryptos. And we also have a few chaos that would also be speaking in this space. And I'm very excited to have to be part of this space. And I'm looking forward to everyone joining and adding their insights to this space. You can also find the twitter handles of our speakers in the posts of the space, and you can follow them because these are top RWA speakers, they are top influencers in the space and they are always building.

Vision for Collaboration and Community Engagement

One of the things that we are looking to do in JV two is to partner with RWA ecosystem leaders projects to ensure that we are able to take this sector to the next level. And before we start, I would also like to tell our listeners to explore our discord community is the best discord community in the RWA space. You learn, we play games and we grow in the gv way. So we are going to have. I can see that all our speakers are here. I'm excited to have everyone here. So we're going to have a quick introduction of our speakers. And firstly, we have Jacob Guedelia, the founder of Jiritsu Network. Jacob, can you please give us a brief introduction of yourself to those that don't know about you?

Jacob Guedelia's Experience and Insights

Hey everybody. Super excited to be here, as I like to say every time I have an opportunity. I've been involved in a lot of startups and a lot of emerging technology markets, and there's none that compares to the blockchain ecosystem for excitement. Interesting people, good people, disruption in the best possible way. So really happy that I'm here with all of you guys. My background is technical. Along with the team, we're physicists, mathematicians, cryptography, PhDs who set out to solve a fundamental problem in that the blockchain has limitations in terms of compute automation because it can't act on itself and access to external data.

Innovative Solutions in Blockchain

We solved that with our mesh network of ZKNPC nodes, which tend to confuse people as to what it means. But that means it's a privacy preserving compute platform that has a consensus mechanism built into it so it can keep secrets and verify what it's done. And we are extremely focused on solving a core problem of tokenized assets, which is to say, tokenized assets should better money, not just the same old thing that existed before, because you can do better on blockchain than anywhere else. And as transactions, trillions of dollars of transactions move to the blockchain. What Juritsu does is it ensures that you cannot tokenize an asset unless you have value to back it up.

Ensuring Value and Trust in Tokenization

So we have real time and automated policy that's enforced where we make sure that the value is there to back up the asset that's being tokenized. So the anti rug full, the anti FTX, the anti Celsius, creating trust, transparency, and reality in real world assets. So excited to tell you more. I totally agree with you, Jacob, and I'm also excited that you're on this space. We are going to learn more about Javitsu's ecosystem, and I'm also excited to have Gabriel here the last time that he joined our space. I got a lot of insights from him. Gabriel, can you introduce yourself?

Gabriel Shapiro Introduction

Sure, yeah. My name is Gabriel Shapiro. I'm the founder and CEO of Metalex Labs, and we're building cybernetic entities, also known as cybernetic organizations, aka Borgs. And I'm a 14 year corporate attorney and venture attorney and that sort of thing. So, yeah, happy to be here. Thank you for the brief introduction, Gabriel. And I'm also excited to have Jake, I'm also excited to have Miko from Gome Cryptoz. Thank you for having time to come for our space. Can you please introduce yourself?

Miko's Perspective and Early Investments

Yeah, sure. Happy to do so. Great to be here. So, yes, I'm with gumi Cryptos Capital. We're actually early stage investors in Jiritsu and excited about the emergence of this, broadly speaking. You know, we do early stage venture capital. We did go early into things like yield guild games, one inch, the Dex aggregator, and then things like OpenSea. So definitely have been, you know, active in the space since 2018. And, you know, part of our thesis is really very simplistic, which is that we think there's fundamental superpowers that were not built into the Internet, right?

Insights on Centralization and Financial Infrastructure

So, you know, what you can see is you can see that the security model of the Internet is broken, and it's broken as a function of centralization, right? So when you really look at the big picture, you or I could go onto the dark web today and buy a file with 10 billion name password pairs in it. We could buy the entire Social Security database. So this idea of centralized data, while insanely powerful, by the way, so we're not denigrators of centralization. We just think that new technology systems have arisen that will really transform our world. And my background is in open source software, and given enough time, open source infrastructure will produce the best software.

Replacing Closed Financial Infrastructure

And so, you know, really the best way to reason about this is that open source financial infrastructure is going to replace all of the closed financial infrastructure of the world. And, you know, this is really, it's just because it's better, right. And if the software isn't better software, then we don't deserve to be here. So, you know, really that's the battle cry is, you know, we're going to produce better software. Obviously it's better as a function of reliability, transparency, it's auditability. It's, you know, ideally performance, you know, and trust.

Performance in Financial Systems

Right? So that's when I say performance, you know, it may not be technical performance, right? So performance like, you know, systems that are trustless or at least trust minimized, you know, will always have a technical performance. That's you know, verification. Verification always costs something, right? So non verifying is always cheaper. Right. But I would. But to me, performance isn't measured that way. Performance is measured in ways like, oh, you lost all your money. Right? Like that's bad performance. Right? So we want to build systems that have good performance. So that's kind of where I'm coming from.

Further Insights on Currency and Reserve Assets

Miko. Miko, my, I'm so happy that you're here. My, my way of thinking about it is we just want to make better money. Yeah, absolutely. Absolutely. Open source money. Money is sort of the ultimate financial infrastructure. But I think the term, I've used the term open source money since very early on, but to me, I've definitely extended it broadly because I think one of the big misunderstandings is money as equated to things like currency. So people are, you know, people say cryptocurrency, and then they say bitcoin is a cryptocurrency, and then they say bitcoin isn't the currency.

The Nature of Bitcoin as a Reserve Asset

Right. And, you know, at some level, you could argue that it's sort of not, right, because it's a reserve asset, right? So, like, I think the thing that we've never seen before is the central bank of what I call myself a stan, right? Like, right now there's Jerome Powell, who's signaling that the rate policy is going to go towards a completely new regime. So this is a really big, pretty seismic event. Obviously, some of the job market indicators are giving him a little bit of a decision to sort of turn because he's between a rock and a hard place.

Understanding Bitcoin's Role in Financial Systems

But I think that when we really look at this idea of what bitcoin is, it's a reserve asset, right? And to me, the thing that surprises people, right? So, for example, if you think about gold, people don't go to the corner store with a bar of gold and try to buy something, you know, six pack, and then just shaving off some gold for the shopkeeper. Like, that's a reserve asset, right? And as reserve assets go, the purpose of reserve asset is to hold it. You hold it.

Central Bank's Functions and Individual Sovereignty

And what happens when you need to support your working currency is you buy the working currency back with the reserve asset. So really, the thing that I think people don't understand is that most people have never run a central bank, myself included, have never run a central bank before. So the idea that each of us has a self sovereign central bank of myself, a stan, is something that they don't have. They don't. It doesn't really click. And so, you know, the people who really understand it, I think, are, you know, achieving self sovereignty, right?

The Essence of Satoshi Nakamoto's Philosophy

So I think that's the base, honestly. And that's the base of the transformation. You know, if you. If you deconstruct the name Satoshi Nakamoto, which is a, you know, manufactured name, Sato is. Is like satori, right? So Sato is. It means the light, right? And then. So Satoshi is the kind of enlightened one, or it's the light, the illumination. And then Nakamoto, the pseudonymous creator of bitcoin, obviously, Nakamoto Naka is inside, and Moro is base, right?

Bringing Transparency to Financial Systems

So, you know, so it's really that the idea of Satoshi Nakamoto is the sort of illumination or enlightenment, you know, at the center, right? Because Naka is like, not only inside, but it's at the center of the base, right? So when you think about the base of financial infrastructure, bringing the illumination to the center of the financial infrastructure, that's what this game is about. And when we talk about light is a disinfectant, and light is basically the idea of open source. Open source is transparency.

The Role of Open Source in Financial Transparency

Light and transparency. It's really just illumination is the central idea that we can just see everything. When you look on the bitcoin blockchain, everyone is entitled to see every transaction. Right? Now, obviously, the pseudonymity of the wallet holders is what gives privacy to some extent. Obviously, bitcoin isn't a privacy network, but the principle is that everyone can see everything. That's the illumination in the base of the world financial infrastructure. So anyhow, that's where I'm coming from. That's a beautiful insight from Miko towards bitcoin and the open money as you open source money, as you call it.

Introduction of Inova Property

I'm the co founder and CEO of Inova Property. So we are focused on disrupting the traditional real estate investment space by basically integrating blockchain tech. And our core focus is specifically high end real estate, bringing transparency, efficiency, making it secure, and also providing accessibility to anyone, regardless of their financial background or their experience in the space. That's an exciting prospect for Inova Property and I'm looking forward to your insights into this space.

Introducing Yasuo Hautsu

I would also be introducing Yasuo Hautsu, the COO of Brikan. I hope I pronounced your name very well. Can you please introduce yourself? Hey, everyone, thank you for the invite today. I'm Jacir, co founder and CEO of Brikan RwA Tokenization and digital asset management platform. We help real world asset owners deploy their assets on chain so we can say we're the first gate for real world assets to be deployed on chain. And we empower the tokenizers with AI powered tools for efficient management. Myself, I have a background of digital systems engineering and mastering innovation and research informatics in Spain. We are based in Barcelona. So yeah, happy to be here today and excited to deep dive in the discussion.

Introduction of Daria from Defacto

Thank you for your introduction. And we have our final speaker, Daria, the BD consultant at Defacto and RWA project. Can I introduce yourself, Daria? Yes, of course. Thank you guys for having me. So, I'm Daria Mitchell, I'm very happy to be speaking today with such amazing speakers. So basically, I do business development consulting for Defactor. And what we do at Defactor is that we supercharge other RWA companies and projects. So what I mean by that is that there is much more things you can do with your tokenized assets than only tokenizing them. Right? So as an example, I will give two of our toolkits. So, first one is called engage. And engage allows you to stake your tokenized assets, which is a great additional utility. And another toolkit is called pools, which allows you to lend and borrow against your tokenized assets. So for example, you see a project that tokenizes gold, or it can be real estate or literally anything in the world, and then what we can do is we normally plug in our solution and then within just a couple of weeks, the users are ready to utilize those additional utilities as well as decrease the selling pressure on the token and so much more. So that's in a nutshell about me and Defactor and also myself. I'm coming from the supply chain management background, so also really bullish on a case of tokenization in logistics industry, but we can talk about that later.

Discussing Challenges in Tokenization

Thank you, Daria, for your introduction. And we're going to be heading over to the first stage of the panel session, and I would like to set the stage with a general overview. The concept of reward assets is gaining significant traction in the web three space. To kick off, I would like to ask Jacob, we've seen the trend towards reward assets. We've seen the reports from different top statistics platform about the impact that reward assets has in web three. Why do you believe the reward asset is considered a transformative force in the web three ecosystem? I'm on. I'm on mute. Sorry. I think primarily because it will be tremendous amounts of liquidity and that it delivers value to institutional capital and gives them a meaningful ROI on their effort to move transactions to the blockchain. I would like to say hello to Gabriel. I really enjoyed your comments when we were on that space together, and I'm very excited to hear your thoughts, and I would love to know what you think about that question.

Insights from Metalix Labs

Yeah, hi. Okay. I think Jacob just took my role in terms of introducing you. Great insights. Jacob Gabriel, from your perspective at Metalix Labs, how do you think reward assets can bridge this gap between the traditional finance and the decentralized finance ecosystem? Because when most people think of reward assets, I've heard many people talk about DeFi, which is an integral part of the entire system. What are your thoughts on that? Well, yeah, I mean, I just go back to a few things. I mean, number one, I think it's important to recognize what are the obstacles to really using real world assets in DeFi. And a lot of it is, some of it is regulatory, and some of it is just custom. We had this long evolution of traditional capital markets where at one point things were trading a lot on paper certificates that wasn't very scalable, and there also were a lot of bearer assets at that time, and that led to a lot of, you know, fraud and crime. Really, bearer bonds were to criminals. What, what crypto is to criminals in some cases nowadays, right? And kind of two things happened.

Centralization and Scalability

Number one, in order to scale, things became very centralized. We moved away from certificates that people can hold and trade peer to book entries that are basically owned and controlled by very large institutions, right? And that enabled scaling. Right. It enabled faster trading, but. But at the expense of immediacy and directness and disempowerment of individuals. Right? And then also, you know, on sort of the regulatory side, bearer instruments, bearer securities became disfavored, I wouldn't say outright prohibited, but they, in many cases, they carry heavy tax penalties and things like that, right? So we have these kind of two trends. One is for efficiency, one is for regulation. And both of them have led to the current heavily intermediated state of affairs in, quote, unquote, real world assets. So now, however, we have crypto, right, which is a type of bearer asset that can be, can trade at scale, right? Unlike, unlike paper certificates, right, you don't need intermediaries, and yet it's still very scalable.

Opportunity in Tokenization

It's scalable. It's scalable through DeFi. It's scalable, you know, through a variety of means. And, you know, and we have a bit of a, you know, bunch of regulatory stuff to figure out with that. But what it does mean is that now we could go back to a kind of system like we used to have with paper certificates, except with tokens representing the assets rather than paper, right? And so this is the opportunity. And once you kind of get to that framework. Yeah. Then you can park things into DeFi and you probably need a new set of rules. Just like creditors can perfect possession of a security interest in shares by holding the certificates. We probably need some rules that says they can do the same thing with tokens. Right? So things like this. But it's all going to happen. It's all inevitable.

The Future Landscape of Investments

And what it means is we'll move from a world where everyone needs to pay a broker dealer and have a broker dealer that has an account with some bigger broker dealer, that has an account with some investment bank that has an account up to DTCC that owns some jumbo certificate with basically all the shares of Apple. And then Apple doesn't even know who its shareholders are. It's just accountable to this DTCC entity. Instead, instead of all that, we can go back to a place where if you hold Apple shares and you can directly vote on Apple, and Apple knows who you are. And it's going to open up a vast world to make holding things like stock cool again and much more effective and a lot more like DAOs and things like that. That's the aspect that I'm most excited about personally.

Key Challenges in Adoption

That's very interesting, and I've been able to get some points from that. We'll move to Daria. Daria, as someone who is deeply involved in the business development in the crypto space, what are the key challenges that you see in driving the adoption of reward assets among traditional businesses and financial institutions? Well, the one that I would like to point out the most is definitely the educational background, because what I myself found is that not only retail users, but neither do institutions, really know what it comes when we talk about tokenization. And tokenization is even too far. Even when they talk about blockchain in general, it is quite hard for them to comprehend their idea of it. And let's be honest, right now, the tokenization process is quite complicated, especially when we talk about more regulated assets rather than, for example, art or gold or. Yeah, these type of things.

Simplifying Education for Wider Adoption

So for me, I would really start with education first and just simplify education without the crypto slang. Even though I love my fellow DJ's and I consider myself one of them, still, for the next million users, we do need more adaptive language and more understandable terms and so on. And of course, as was discussed before, regulations once again and again. Yeah, that's quite interesting, Mikko, from an investment perspective, what do you think? Hello? Oh, oh, yeah. Sorry. I was on mute.

Asserting the Value of Fake World Assets

Yeah. So to us, the thing that's interesting, obviously, is, you know, I have a slogan that's a little amusing, which is, you know, my slogan is, I prefer fake world assets. Right. And it's the reason why I like to say such a thing is, you know, that the contrast between so-called real world assets and so called as opposed to what? Right, like, is bitcoin not real. Right. Like, how. Is. How are the other assets not real? Right. So to me, the thing that's amusing is obviously, the point really has to do with integration. That's the point.

Integration Between Various Financial Realms

Right? Like, I'll give you an example, is there's already a very popular real world asset in the market, and it's stable coins. So if you take something like USDC, right? That's an RWA, right? Super popular, right? And, you know, you mentioned DeFi. Like, what is happening in DeFi? Like, to me, the thing that's fascinating is when you look at the beginning of the RWA, you can't help but to look at something like Ondo finance, which provides treasuries, US treasuries. Right. And so US treasuries that are on chain are used in DeFi. And the way that they're used, it makes perfect sense, right? Which is its integration between the traditional finance and DeFi.

Focusing on Integration

Right. So, you know, so I think integration is the watchword, right. So really, in a sense, like, sorry, there's a little background noise. I think it's your side, cypher. Oh, sorry about that. That's fine. Yeah, yeah. So, you know, just to close off that loop, right. Like, if it's just the assets, real world assets by themselves. Right. That's less interesting, honestly. Right. Because the point of this is really to have trading pairs like bitcoin, apple stock, right. That's the, that's the point. Right. Which is, in a sense, you can go back and forth. Because the thing that I think is really important is that if you think about the concept of fungibility, is that things can be exchanged.

Digitalization and Fungibility

If something is non-fungible, it can't be exchanged. The idea of an exchange is that if you have bitcoin, really, RWA just allows bitcoin to become anything else. And obviously anything else should include every possible thing in the world, right? So the topic really just becomes a question of digitization or digitalization of everything, right? And then obviously, you know, that gives the so-called fake world assets, things to buy, right? Like, if you look at the rise of Opensea, one of our early investments, right? People wanted to buy NFTs because they're digitally native assets, right? But the thing that's really interesting is the world when you can use a digital asset to buy anything at all, right? So I think that's the key.

Technological Innovations in the Financial Sector

So for us, like, we're excited about integration, and obviously, you know, to give a shout out to juritsu driven by core technologies, right? You know, really ultrasound, cryptography, multi-party computation, you know, use of basically verification proofs, zero knowledge proofs, these kinds of cryptographic and mathematic proofs. So when we see this kind of appropriate technology and we see this kind of appropriate use case of integrating all of the financial system with DeFi, then we get excited. Thanks for the plug, first of all, obviously, but so can I see if I can rephrase what I think I heard from you, which is that the real impact of, quote unquote, real world asset revolution, let's say the tokenization of assets that are not on chain and bringing them on chain, is that it creates a basis for everything in bitcoin.

Pricing Everything in BTC

So in some sense, once those assets and the ownership of those assets happen on chain, which is then a common protocol with. With BTC, you can now basically price everything in BTC, which isn't possible till. Till that integration happens. Yes, yes. So, for example. For example, for example, like, you know, when you look at the speed of light, c, you know, it's. It's measured in. You know, it's really the basis for the meter, right, as a measurement. So I think that it's pretty important, right? It's three times ten to the 8th meters per second. That's the speed of light, which is obviously, Einstein said it was invariant.

Instability of Traditional Currency

So the reason why I'm going after measurements is that people measure the price of bitcoin in dollars, which is kind of absurd. And not only what's absurd is that people call the dollar a stable coin. You all know that the dollar has lost 93% of its purchasing power since 1913. You know that. And you know that the dollar precipitously lost value after Nixon removed the bimetallic standard and pushed us into Keyensian modern monetary theory, right? Which is basically that it's backed by nothing, right? The dollar is really backed by. If you look very carefully, it's backed by two things.

Backing of the US Dollar

The full faith and credit of the United States of America, right? That's what it's backed by. And then the second thing it's backed by is, you know, in God we trust. That's basically what you see on the. I would argue, Miko, it's backed by one. I would say it's backed by one more thing, which is the things that you can buy with the dollar. Like, if you want to buy apple stock. Me, break it down, which is the deepest layer of the dollar, has gotten even further uncoupled, which is the petrodollar relationship with Saudi was actually the fundamental energy backing of the dollar.

Comparative Backing of Bitcoin

So if you look at bitcoin mining has also energy backing, which is electricity. Electricity backs bitcoin the way that petroleum backs the dollar. But that relationship ended. So now there's no petrodollar relationship with Saudi, which, you know, is going to cause some problems and that. But what you're describing, Jacob, is the social contract, right? The social contract is if I give you 10,000 bitcoins, you know, I could probably convince you to deliver me to Papa John's pizzas, as happened with Laszlo in the early days of bitcoin.

Social Contracts in Cryptocurrency

Right? You know, and that's the social contract. I could probably pay you fewer bitcoins, you probably still do it, but, you know, but my point is that, you know, it's. That's a social contract. But the thing that's super interesting about people who say bitcoin is backed by nothing is that the absolute bottom layer of what the dollar is backed by is the. Is violence. Right. Which is, you know, if you're like, you know, if you're going to do things to the United States, the national interest will basically cause, you know, military objectives to appear.

Living in America

Like, people want to live in America because of the overall quality of life in America, which, among other things, is backed by violence, because that's how America protects its way of life and. Correct. Correct. And as such, the value of the dollar is that you can easily participate in the American way of life. Was. But I think the thing that. But I want to emphasize this, right. Which is what's exciting about the potential of bitcoin is that it is an open source consent currency, right? So in a sense, like, the way that bitcoin exists is it exists on the Internet and basically says, if you want to use this, go ahead. And if you don't want to use it, that's also fine. And there's no way we can compel you to use it. Like, that's it. Like, it's a consent currency. There's no army, there's no prisons, there's no enforcement. It's just consent. Totally.

Value of Bitcoin

And not to be too typecast in my nerdiness, but I come at it from a different level, which is like, the only way to have, call it consensus or consent to participate in a monetary system is if you have some way for everyone to agree to what something is worth. And I think the point of the gold standard was it's very. It was very hard to physically move gold around, and it was a bookkeeping method. Right. And that. And that bitcoin has emerged as this once in a lifetime ledger that's got a finite framework for it. I, you know, it's immutable. And as such, once it hits a level of consensus that everyone just agrees that this is kind of the base ledger by which every economy is going to say, this is how much value I have here, and it will land there, that's when it really takes on that perspective and it becomes like the esperanto of money. Yeah, correct.

Real World Assets

Really interesting point I think you were making earlier. Like, once we can bring real world assets on chain. And we can solve the problems that some of the people here we're talking about, and we're all collectively working on. What you've achieved is you've achieved, you know, a uniform, call it translation layer or protocol or language or conversion for every asset in the world. Because now every asset can be price in bitcoin. And there's a way to get to a consensus that can say, you know, ten chickens is worth this much bitcoin, which. Correct, correct. And the reason this works is that we have programmatic inflation that asymptotically approaches 21 million units, right? So similar to the speed of light being invariant, right? You know, three times ten to the 8th meters per second, you know, it's a. The number of possible future bitcoins is invariant, right? So when you say one bitcoin equals one bitcoin as a measuring stick, it becomes a fundamental measuring stick, right?

Measuring Against Bitcoin

It basically becomes, okay, like, what's everything measured against bitcoin? Measuring things against the dollar makes no sense because people just print more dollars. So the measuring stick, it's this reality distortion. The only reason why the yen and the euro track the dollar is they're all printing money at the same speed and they're all declining at the same speed. So, like, if you look at those pairs relative to each other, it looks like everything's stable. But when you look at things compared to bitcoin, people are like, bitcoin can't keep going up and up in price forever. And it's like, that's not what's happening. All national currencies are going down and down in price forever. That's what's happening. The analogy in my mind, because it was kind of a lived reality for me, was what happened with. With IP, right? And call it TCP IP, where, you know, it started out as moving a data packet, and then it turned into how many data packets are there in a word?

The Future of Data and AI

And now I can send text, but now I can send photos, now I can send images, now I can send voice, now I can stream video. And in some sense, when it comes down to it's like, how much bandwidth? Everything is denominated in bandwidth. And it's like, you know, can I afford the bandwidth that I need for the data consumption? And I can look at that data consumption and just say, you know, like I experienced, and you travel in Europe and you're on the Verizon plan, and it's like, oh, it's $10, and I can do anything I want. But at some point, they're like, well, you can't stream any more video, so you have. Yeah, I think to me that's helpful, because that's something that we've lived through an experience where we've gone from, we ultimately have this underlying denomination, which is data that limits our access to information, but it's all information. It's the idea of multimodality. And I think we're going to go through something similar with AI, where initially AI is really great for language, but then as AI becomes great for video and images and everything else, everything gets denominated that way.

Denomination in Bitcoin

But to your point, Miko, it all goes back to electricity in some sense, and then you can denominate electricity. You can denominate electricity in bitcoin, and that becomes the immutable base of everything. That's right, that's right. Because when you really think about energy, like, you know, energy performs the fundamental function of the biosphere, right? So, like, the fact that, you know, when you look at the diversity of life and you look at everything, every meaningful pixel that you can currently see is the result of solar input, right? So it's, you know, 4.6 billion years of solar input. So, you know, is energy fundamental to, you know, civilization? Absolutely. You know, if, you know, the Kardashev scale, you basically know that the civilizations can be actually measured by the amount of energy they're capturing, you know, and that's, that's the measure of civilization.

Economic Transitions

So, you know, I think, well, it's. It'S, it's why I'll expose myself here a little bit. It's why I think carbon credits are very nefarious, because it's basically allows somebody to buy somebody else's energy from them as opposed to let them utilize it themselves for the benefit of their society and their culture, and really winds up suppressing, you know, transitions from, call it third world to first world. Yeah. But I think zeroing back to RWA, like, the way I look at RWA is that it's sort of endgame in terms of financial infrastructure replacement, right? And I think people who. People are misunderstanding the replacement process, right? Which is like, imagine that the world financial system is the beating heart of our civilization at some level, right? Because financial energy is what builds buildings and factories and houses and, you know, that's the financial energy, right?

The Future of Financial Systems

So, like, that's the beating heart of our civilization, right? And the thing is that the patient needs a heart transplant, right? So, you know, we're doing open heart surgery on the world financial system. You know, on human civilization, and people are shocked that there's blood. Like, people are, like, when you look at hackers hacking away things like this, like, the reality is this is that the blockchain world is basically a world of pure competition. And obviously some of the competitors are hackers. Right. But the point that I'm making is that the wolf or predator, is not the enemy of the herd. The wolf is the enemy of the individual sheep, right? So obviously, like, a weak sheep is going to get eaten. Maybe even a strong sheep will be eaten once in a while. Right? But the point that I'm making is that people who are shocked to see hacking are basically not appreciating that ethereum has probably advanced more in the last 6 hours than ACH has in 60 years of history.

Reframing Investments

So, like, you know, we're doing. But if I can, if I. If I can reframe what you're saying, which it seems extremely powerful and deep. And I guess I have to admit myself, I hadn't really thought this way until I heard you say it, which is that what RWA is doing is it's moving everything on a ledger. And that ledger is measured in BTC, and BTC is measured in energy. And so in some sense, you're recalibrating like, you're moving everything. All activity, all. Anything that can be measured is moving on to a new scale, not. Not a metric scale, but a BTC scale, because BTC is the invariant, the same way you can. And just to capture some percentage of. The speed of light, just to close. Off this thread and tie it back to Satoshi, this idea of the illumination inside the base.

Illumination in Finance

Right. Is absolutely this almost smuggling operation. Right. Which is that what we're really selling to traditional finance is better software. What they don't know is we're effectively not debasing their currency by any means. We're rebasing it. We're rebasing it onto basically a completely Internet centric asset consent currency. So anyhow, that's my perspective. It looks like Cypher's jumping in here. Yeah. Thank you for your insight. I think we really enjoyed it. And we would have to move to the next part, which is the market potentials and investment opportunities in the RWA ecosystem. And this is to Cody. Cody, from your perspective at Innova property, what unique opportunities do RWAs represent for investors, particularly in the real estate sector?

Investment Opportunities

And how can they assess the value and risk associated with these investments? Because we have. I've noticed that we have a lot of pointers towards the real estate ecosystem when it comes tokenization. Yeah, sure. So obviously, I mean, the immediate benefits and what we most excited for is just when you look at the accessibility to real estate, you know, it's become so expensive, it's priced pretty much most people out of the market. You know, forget about owning your own home. It's, it's, you know, you can't even invest in real estate these days, it's become so expensive. So that's something that we really looking forward to. You know, by taking real estate and breaking it up into pieces, you can really make it accessible for everyone.

The Importance of Caution in the Digital Space

So that's why you need to be careful who that is, right. Because, for example, you know, I could make you a beautiful website that says you can have 300 shares of Apple stock for a dollar. And, you know, you pay me the dollar and then the website tells you have the Apple shares. Right? So that's, that is. That's what's scary, is there's no real, you know, there's the. There's. There's no real solid way to know whether you're entering a house of mirrors. So I definitely think that's something that people need to be careful about.

The Need for Regulation in Blockchain

Yeah, that's an interesting perspective, Miko. Boy, is that nowhere regulation comes in, because one of the things I've noticed about the blockchain space is most bitcoin maximalists are usually against regulation, but I believe that in the real world assets ecosystem, we are going to need regulation to prevent some of those things. What do you think about that? Yeah, I think that's tremendously insightful and valuable. For example, if you think about the concept of property is protected by property law. Yeah. So, you know, so the point is that, like, you know, otherwise the social contract gets real thin, right? Like, because it's essentially, you know, the answer of who owns your house, right? Is whoever has the most guns and the most willingness to perform violence. Right. That's not a good solution.

Challenging the Status Quo with Regulation

That's a bad solution. Regulation is actually a decent solution. Right. Regulation is a good solution. I see hands going up, and I think this is. This is. You know, there's definitely a hot topic, so, you know, but I feel like you're right. You know, if you look at the most essential RWA regulation coming now in Europe is Mika with the stablecoin regulation. So I'll close with that and open the floor. Okay. We can have your thoughts from bricken. Yeah. Just wanted to mention, I do completely agree on the challenge brought up by Miko. We have actually encountered this challenge back in our beginnings on 2020, 2021 with our clients.

Proposed Solutions to Legal Challenges

So the solution we came up with is we are hosting or uploading the legal or physical legal documents into the token smart contract, the smart contract of the tokenized asset. So, for the investors, they can check the legal documents directly from the smart contract of the asset or of the tokenized asset. So, yeah, I would love to hear your feedback about this proposed solution. And, yeah, if it can be a starting point for a discussion, that's an interesting perspective. What do you think about that, Mikko and Jacob? I'm gonna kick it over to Jacob. So can you reframe the question for me? I'm sorry, I didn't. I think the question was regards regulation and from brick, and said one of the ways in which they served that was uploading the legal documents into the blockchain, like, into the tokenized smart contract, and that was.

The Role of Cryptography in Ensuring Trust

That's one of the ways in which they've been able to come up with the solution. I have a side commentary on that. Right. Which is that I think uploading a document may be the wrong mindset. It may be the wrong mindset, right. I think we really have to go into cryptography, right. Because we're entering a new age of data fabrication. Like, I can get AI to generate an incredibly realistic document with even appropriate metadata. Like, I can even get it to create a PDF, right? So the thing that I really need is a cryptographic signature from the government. Right. That's what I want. Yes.

Summarization and Proof of Ownership

I would go. I would, first of all, reference, like, a core technology that we speak about rarely at jurisdiction. So one of the things that we have is the ability to, let's say, take a summary of a document that came from AI and give a cryptographic proof that summary came from that source document, right. So, to Mikko's point, if the government creates a document, right. And signs it, or the regulatory body signs it cryptographically, like what Jiritsu does. And it's a cryptographic capability, is have the ability to take a summary and have a cryptographic proof that summary came from that document.

The Importance of Automation and Structure

So why does that matter? Because you now have a cryptographic trace, right? That goes back to the original document and the trusted author of that document, which is unforgeable. And the reason that's important, I come back to it all the time, is the automation. So it's not enough that information is on the blockchain, but it needs to be formatted and set up in a way that it's useful to create something meaningful on the blockchain, which is an action, right? Because if you just put a document there, now you're at the point where the person has to read the document.

Challenges in Automation and Verification

So, yes, you've made the document immutable, and you've made a representation that the document says this at this point in time, because it was commitment at that point in time. But, you know, I've said for a long time, there's only going to be two technologies left in the world. It's AI and cryptography. AI can't do cryptography can't do AI, but none of that matters except for at the level of automation, right? So at the end of the day, if you have an AI agent that's capable of doing something, let's say you have an AI agent that's capable of summarizing a document.

Ensuring Trust with Cryptographic Tracking

Unless you can, to Nico's point, cryptographically, trace that back to a trusted source that can't forge. You can't then entrust that AI agent or the information that came from that AI agent to go to the next level. So if you look at how that would stack up from the jurisdiction implementation standpoint, you'd have the source document that was signed, let's say, by the government, and that's the baseline. We talk about turtles all the way down, and we talk about giving you the ability to audit the turtle at the very bottom.

Utilizing Automation in Document Verification

So the bottom turtle in the stack of turtles is the government that signed the document. And now you can have an AI agent that says, okay, I need you to extract from this document, you know, the average, you know, you have a portfolio of documents that are mortgages. You need to extract from document the average credit score in this portfolio of mortgages in order to value that, right? But you want to be able to automate that. So you want the agent to be able to go extract that information and have cryptographic proof that it indeed came from the government document, which is sort of speak the source of truth.

The Integration of Policy Engines

And then you want to be able to take that cryptographic proof and pass that on to the policy engine. And the policy engine says, okay, you can only tokenize this much money. Right? Yeah, I think you're in a nice one up here. Okay, Yusuf, I see that you want to respond to the feedback they've gotten so far. Yeah. So just a quick follow up on the side comment presented by Miko. Yeah. It shows that in order to overcome this specific challenge, there is a need for actions from both operators and the government.

Collaborative Efforts for Effective Regulation

Right. So, yeah, from the operators side, we already proposed solutions, and in order to take the action with the government, we thought of partnering with governments in order to create regulatory sandbox for the different regulations. For example, in the past quarter, we joined hands with the european legal or regulatory sandbox for the creation of a framework for tokenization in Europe. And we have been approached by also other governments that I can't disclose so far.

Understanding Government Processes in Blockchain

Most of them are in Africa. And in the discussions, we always understand that from the government side, they still don't clearly see the processes to be regulated in the space. So, yeah, that's why they also are looking to join hands with operators to create the frameworks. Yeah, I think that's an important aspect that you just brought up now, because it's quite important. And that's one of the bane of blockchain technology, which is education.

The Necessity of Government Education

There has to be a way in which the blockchain leaders and ecosystem partners have to educate these governments to be able to bring about proper regulations to ensure that things go smoother. I think Cody has. Cody has been waiting for a while. Yeah. You can speak, Cody. Yeah. Thanks, guys. Yeah, very good stuff. I actually want to tie in something to just the verification.

Partnerships in Verification and Regulation

And this goes back to my point earlier of number one. How do you verify that we tokenizing what we say we're doing. And for now, as there's not an existing, clear, easy way to do this, we found the best way for us to tackle this is by, you know, partnering with guys that this is their bread and butter, like legal and compliance regulation. So we have actually partnered with Schindler's, which is a prestigious law group, and they basically then went on to launch Schindler's X, which is the RWA marketplace run by attorneys.

Assurance Through Third-Party Verification

Now, this is good for two things, right? Because going back to verification, every time we take on a project, they. The ones that provide the third party due diligence. All of the facts, information, the tying of the asset to the digital, like, basically tying digital assets to the physical. And they also provide an escrow management service for us, knowing that when we're doing a specific project in the. In the tokenization space, which is actually in the real world, those funds are going to an escrow account overseen by them, and that creates that element of trust, knowing that there's a process to this, that there's a party involved that is basically looking after the investors interests and making sure that there's no bad actor going on, there's no processes being overlooked.

Accountability in Legal Representation

Apart from that, they also provide us with an integrity officer for each and every project that we do. Now, that's good, because you can imagine you've got an attorney representing the investors interests. Can I just. Yeah. Can I interject something? How do you imagine. How do you imagine a world based on the ideas that you have that are very solid, but just imagine one in which you basically have an AI that takes the place of the attorney.

The Role of AI in Legal Practices

Yeah. Now. Now you not only have the decision system, but you have that fully automated. And then through the cryptography, which is some of the work we're doing, I'm not saying we're the only ones doing it, but you have the ability to have full trust and verification, traceability and explainability for that AI agent. Look how much better that is than, you know, a room full of lawyers. Yeah, absolutely. That's all I'm saying.

Current Limitations in Automation

I couldn't agree with you, and I'm absolutely all for it, but I just don't think we're there yet. I mean, it would be great, but it might take some time before we get there. But. But I was just saying that two years. Yeah, that's one of the ways we basically found to get around that problem of providing that transparency, providing that extra layer of trust and comfort where you've got a third party that's reputable, that's accountable, that provides updates, transparency over everything, where it's actually a verifiable source.

The Business Model in Tokenization

And it's not just we're saying we're doing this, and you actually have no way of verifying if we're doing what we're saying and then going on to the regulation side. That's another good point, because, you know, tokenization and RWA, it's a very great space. So to navigate that, our core business model is. Is on the real world, business side. Right. The real estate side. So we want to be keeping our focus on the business side and working with our partners where they're at the forefront of leading this charge to get that clarity, to make sure we're on the right side of compliance and regulations.

The Future of Regulatory Development

So I just think to conclude my point here, I think it's going to take a lot more professionals like this stepping into the space, speaking up, working with governments to get us that clear, you know, regulation that actually makes sense, not just taking regulation from 50 years ago and plugging it into something that's an emerging market just to end off on that.

Final Thoughts on Regulations

Thank you, Cody. Daria, do you have any thoughts on this, on the discussions with regards regulatory and regulations? Not really, to be honest, because at defactor, we're mostly just a technology provider and we're not really engaged with anything legal. So I cannot support you on that. But great points, guys. I'll make sure to note it for future.

Closing Remarks and Announcements

Yeah. Okay. Thank you. And for our listeners, we've been on this space for close to an hour now, and it's been an interesting space. We've got some insights from our web three industry leaders. We've spoken extensively on different aspects of reward assets, and Jacob Brickens got his. Hand up and as. Okay, do you have any other. Let them speak before we wrap up.

The Need for Continuous Engagement

Okay. Yeah, I still have a final set of quick questions just to go around before we end the call breaking. Do you have anything to add to the call so far? Yeah, well, we look forward for the mass adoption of the technology, obviously, and for the audience to be more educated about the space so we can see more innovations coming up in the industry as it's still having a lot of innovation opportunities and. Yeah. Good luck, everyone.

Future Trends in RWA and Web3

Yeah. Thank you. For the concluding part, I think I just have one last question, and this for Mikko. As we look into the future, what trends do you see emerging in the RWA space over the next five years, and how will this trend shape the broader web three ecosystem? Yeah, I definitely see this space being really dynamic. And I totally agree that this space will actually follow regulation.

Regulation as a Catalyst for Growth

Right. Because that's really the strongest source of assurance and attestation is the government. And so I think that we're going to see that, obviously. So I would watch that space quite a lot. I think the secular trend that's going to impact everyone the most overall is actually going to be what Jacob mentioned, which is the AI segment of. So I think it's a whole nother panel to talk about that intersection.

AI's Impact on the Future

But I would say that AI plus anything is going to cause the other thing to change. So I think that's it's not that I'm specifically calling out AI plus RWA. I'm really just saying AI is so fundamentally disruptive to society and civilization that it's for sure going to change our world. Yes. I also agree with that. Jacob, do you have any insights on that?

Convergence of Ideas

I think everything that I said that Miko agrees with is correct. Okay. Everything that I've said that Miko didn't agree with might be correct. Yeah. Yeah. Thank you. Thank you to all our panelists today for sharing their insights. And if it's been very good listening to different perspectives from different experts in the space, and for our listeners, don't forget to join the Jiritsu discord community.

Community Engagement and Future Events

We have a lot of exciting events happening there, and you get to move from Jerian to become a journey and move through the ladder in our ecosystem. And one more time, I just have to thank our panelists today, and I'm looking forward to subsequent spaces. Take care and have a great weekend. Cheers.

Final Appreciation and Wrap-Up

Thanks, everyone. Yeah. Cool. Thanks, guys. That was great. Yeah. Thank you very much.