Space Summary

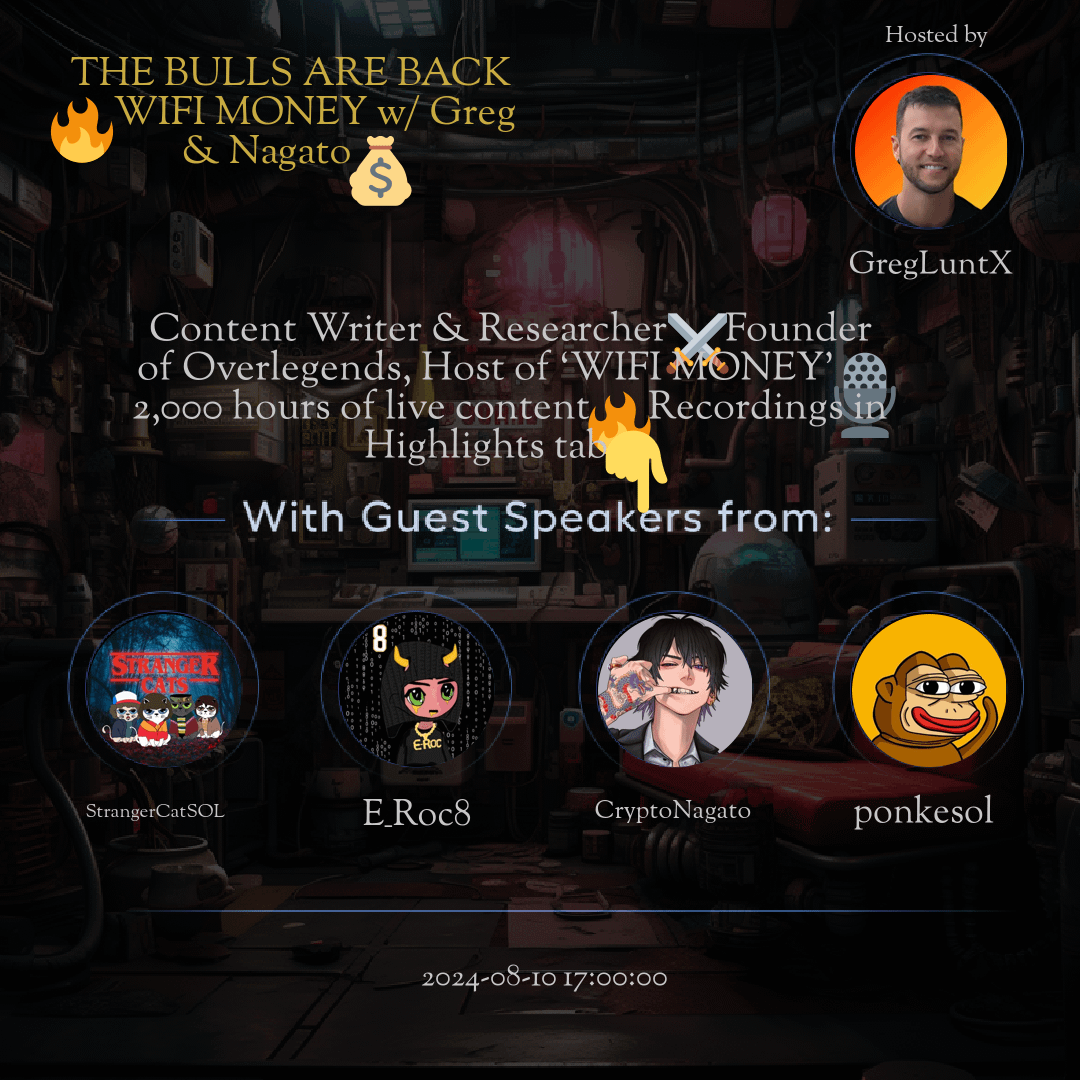

The Twitter Space THE BULLS ARE BACK WIFI MONEY w/ Greg & Nagato hosted by GregLuntX. The Twitter space 'THE BULLS ARE BACK ? WIFI MONEY w/ Greg & Nagato ?' was a compelling discussion on content creation strategies, SEO insights, and productivity hacks for creators. Greg and Nagato shared valuable tips on monetization, networking, blockchain's impact on content, and personal branding. The session emphasized audience engagement, social media utilization, trend awareness, and the balance between creativity and data-driven approaches. This content-rich space catered to lifestyle enthusiasts, entrepreneurs, and content creators looking to enhance their online presence and grow their brands effectively.

For more spaces, visit the Lifestyle page.

Questions

Q: What are some key content creation tips shared during the space?

A: Experts discussed the importance of SEO, engaging visuals, and storytelling.

Q: How can content creators effectively monetize their work?

A: Monetization strategies like affiliate marketing, sponsorships, and digital products were highlighted.

Q: Why is networking important for content creators?

A: Building connections can lead to collaborations, growth opportunities, and wider reach.

Q: What role do blockchain and crypto play in the content creation landscape?

A: The discussion touched on NFTs, decentralized platforms, and blockchain's influence on digital content.

Q: How can creators improve their personal branding for better visibility?

A: Tips included consistency, authenticity, and storytelling to resonate with the audience.

Q: What strategies were mentioned for enhancing audience engagement?

A: Interactivity, community involvement, and listening to feedback were emphasized.

Q: How can social media platforms be leveraged for content distribution?

A: Utilize platforms like Instagram, Twitter, and LinkedIn strategically to reach a broader audience.

Q: Why is it important to stay informed about industry trends?

A: Being updated helps in adapting strategies, staying competitive, and leveraging emerging opportunities.

Q: How do creators balance creativity with data-driven approaches?

A: Combining creative ideas with analytics ensures engaging content with measurable results.

Q: What advice was given for maintaining productivity and efficiency?

A: Tips included time blocking, task prioritization, and avoiding multitasking for better focus.

Highlights

Time: 00:05:42

SEO Strategies for Content Creators Insights on optimizing content for search engines and increasing visibility.

Time: 00:15:20

Monetization Tactics for Creators Exploring various methods like ads, partnerships, and digital products for revenue streams.

Time: 00:25:55

Networking Tips for Growth Advice on building relationships and expanding opportunities within the industry.

Time: 00:35:30

Blockchain Impact on Digital Content Discussions on NFTs, decentralized platforms, and the evolving content landscape.

Time: 00:45:12

Personal Branding Strategies Guidance on building a strong brand identity and connecting with the target audience.

Time: 00:55:48

Audience Engagement Techniques Tips on fostering community interaction and increasing engagement levels.

Time: 01:05:10

Social Media for Content Distribution Maximizing social platforms to share content effectively and reach wider audiences.

Time: 01:15:25

Industry Trends Awareness Importance of staying updated on trends to adapt strategies and capitalize on new opportunities.

Time: 01:25:30

Balancing Creativity and Analytics Tips on combining artistic vision with data insights for impactful content creation.

Time: 01:35:18

Productivity Hacks for Creators Strategies to enhance efficiency, focus, and workflow management for content producers.

Key Takeaways

- Valuable content creation and SEO tips shared by experts.

- Insights on effective monetization strategies for content creators.

- Productivity hacks and time management advice for better efficiency.

- Networking and building connections are crucial for growth.

- Discussions on blockchain, crypto, and their impact on content creation.

- Personal branding advice for entrepreneurs and creators.

- Tips on enhancing audience engagement and community building.

- Strategies for utilizing social media platforms for growth.

- Importance of staying updated on industry trends and changes.

- Balancing creativity with data-driven strategies for success.

Behind the Mic

Initial Thoughts and Atmosphere

Take a walk with the full moon go button and zip top. It's all kicking off soon. Best thing with a quick rough. I don't know about your goons down there. Everything lift up. Whether it's draw, win or lose, none of my friends never give up. Let's do it.

Excitement and Social Engagement

Oh, my God. It feels so good to be back with a beautiful Italian man and how many people? 41 other people in this room. Can we get some retweets in this face real quick? Nagato is already posting his Leo underbite. Look in the comments. Gifs. Can we get some gifts in the comments? I think we should do that every time, Nagato, right? Like, just get the sense of how people are feeling with, like, a bunch of gift spam guys. Go in the comments after you retweet the space and just fire off some gifts.

Personal Connections and Humor

How you doing, king? My g, I always post the same one. I love it. Yeah. Cause you're always fucking ramped up, dude. Yeah, absolutely. How can I not be? Ram thought, brother. A little relax and lil baby. How you not gonna get fired up on that shit? Yeah, I love it. The intro is really nice. How did you spot that song, brother? Like, actually, like, I've never heard about it before. How did you spot it?

Music Discovery and Streaming Preferences

I think it was on Skrillex's album, bro. Okay, I don't listen to Skrillex. Sorry. But it was the one from last year, quest for fire. No, it wasn't on that album. I don't know how. It probably just popped up on my Spotify, bro. Spotify algorithm is elite. Are you an apple music or Spotify person? Oh, no. Spotify. I love it. Bro, those playlists are crazy.

Algorithm and Personal Experiences in Music

The algorithmic playlist, they just. They know what you like. Yeah, yeah. So it probably just popped up one of them shits. See a lot of familiar faces in the crowd today. Nick B. Bull Shark. Frankie. I see Swift. Tiago. See a lot of y'all. Let's fucking go. Yeah, we got a nice crew here today, Azul. See you down there, brother.

Current Location and Experiences

Okay. So where we at, dude? Where the fuck are we? Bitcoin. No. First of all, where are you, brother? I'm in the desert. I should probably post that. That little video right in the comments? Yeah, suppose the video, brother. I'm gonna show you guys where I'm at. You can. If you can find me, then I'll. I'll buy you a bitcoin.

Incentives and Location Challenges

If you can come find me. If you show up at my door during this space, I'll buy you a bitcoin. It's like, aurora location. Like auto movie location. Yeah, I don't. I'm not getting that, but I'll go with it. I'm gonna post it in the comments. You guys will tell me. The video is uploading right now. It might take a second because, like, 30 seconds long, but.

Wi-Fi and Reliability

How's the Wi-Fi there? It's excellent. Let's fucking. You let me know if I'm cutting in at all. But I held out of space yesterday for an hour from here, and it was totally fine. No, for now, it's fine. Yeah. So I'm in the desert in Arizona, y'all, and I got this little, like, hilltop kind of. I guess it's like a cabin, but it's, like, you know, a nice size cabin.

Descriptive Features of the Cabin

It's all, like, wood on the inside. It's got, like, a little kind of built in attic area where there's another bed, a second bedroom, and it has incredible views of just, like, all these red rocks out here. And, yeah, I just booked it for the weekend just to get away and kind of do a bunch of work and meditate and go for some hikes and. Yeah, it's pretty lit, dude.

Current Lifestyle and Travel Updates

You're not home either. You're traveling. You're living that Wi-Fi money lifestyle. Yeah. You're still in Dubai? Oh, yeah. Not traveling, but, yeah. I mean, Dubai at the moment. I will go back to Italy on Monday. So, guys, I will take a plane on Monday.

Speculative Market Behaviors

So if you want to short the market, that's probably, like, a smart thing to do, because every time I jump on a plane, the market basically collapses. So if you want a shirt. Yeah, do it tight. Stop loss. Yeah, let's fucking go. But, yeah, we'll go back to Italy and spend, like, probably one month there. Let's see if it's a failed society or maybe it's a bit better than when I left.

Market Sentiment and Personal Experiences

I have no idea. I would find it out. Dude, we only got two gifts in the comments. That's fucking crazy. Shout out bull shark and Dre. But how many retweets? Five, including yours. No. Buenos. We got to figure this out, bro. We got to incentive. Maybe we have to incentivize these people because they all just take us for granted, I think.

Potential Actions and Cultural Contributions

What if we just stopped doing Wi-Fi money? You know what I mean? What if we just stopped? We do this for free, dude. We do it for the culture. Not even a retweet's worth. I mean, that's insane. Yeah. Not even a. Like, a retweet a little gift in the, like, gif in the comment.

Community Engagement and Support

Like a gif in the comments, dude. I get. Okay, maybe you don't want to retweet. You feel a little greedy now on a sad someone. Want to keep the feet clean so they won't. Don't want to retweet. I get it. But a gif in the comments, bro. Gif in the comments, bro. That stingy shit.

Emotional Dynamics and Community Support

That's honestly stingy as fuck. Nagato is out here every day, dude. You guys don't even understand. He calls me almost every day, like, in tears, essentially. Like, he has. He has everything he owns in the crypto market and he does not know how to handle volatility.

Crisis Management and Supportive Actions

So anytime we go up, like, dollar 500 or down dollar 500 in bitcoin, I get a call from Nagato, like, freaking out. And then he has to, like, go to chat GPT and figure out how to create a post to be like, get all Zen again and, like, try to say, it's okay, it's going to plan, but this guy's out of control. So, like, all he's asking, dude, is, you know, is for you to just post a gif in the comments about how you feel right now.

Duality in Lives and Community Understanding

Because this man is like, he's living a dual. A duality. He's living two lives. There's the one that you guys see here and on the feed, and then there's the one that I have to deal with. So just put some gifts in there so that he can, like, know that he's not alone. No, actually, I live three lives at night. I'm also Batman.

Transition to Serious Discussion

That's all you get. You got a little thing. Because I wasn't. Yeah, it's fine. It's fine. So what do you want to talk about now, brother? I want to talk about cryptocurrency. It's a new industry, otherwise known as web three or digital assets. Bytecoin, I think. One of the big ones. Have you heard of it?

Price Tracking and Market Observations

Bitcoin. Bitcoin, yeah. Oh, bitcoin. Yeah. It's currently 60,666.88 USD us dollars. Oh. The currency that's used to buy drugs on the deep web. Also for child trafficking and for crime. Yeah, that's all it's good for. So, okay, let's start, like, let's start talking about something serious.

Current Market Climate and Feelings

Okay. How do you feel after the big crash and the big bomb? Hold on. Thumbs up for something serious. Thumbs. Thumbs down. Actually, thumbs up for something fun. Thumbs down for something serious. Thumbs up for something fun. Thumbs down for something serious. Oh, we got Ponky in the fucking building.

Community Involvement and Thumbs Feedback

Oh, yeah, we got punky. Let's fucking go. Shout out honky elements on y'all. You guys need to follow the Ponky main account. It's okay. We got thumbs down. We got thumbs, yeah. Okay. People want something serious, I guess. God. Okay, let's fucking go, then.

Segmentation of Current Events

Okay, pocky, well, I'm gonna. I'm gonna invite you on stage. Ponky, you don't have to talk if you don't want, because we like to keep things anonymous around here, but feel free to come up and chill. We're going to be talking about Ponky a little bit later in this space, but, yeah, Nagato. We're at 60,700.

Reflections on Market Movements

So this has been a crazy week, brother. The candle is insane. If you look on the weekly, we had a week. We opened the week at 58, and we pulled down to 49. And now the week is actually green. We are plus almost four and a half percent this week right now. How are you feeling, dude? How are you feeling?

Personal Reactions to Recent Instability

I'm really scared. I don't know what to do. I'm lost. And I almost panic sold everything. No jokes aside. Yeah, I feel the same. I was feeling last week. Basically, we are back at the same levels. There has been this big shakeout to the downside, we can talk about what caused it, but basically it was just general fear in the market because basically the bank of Japan, they decided to start raising rates.

Market Dynamics and External Influences

That decision collapsed the Japanese stock market. And then there was a domino effect, basically, like, everywhere in the world. And, of course, like, the crypto market is, like, a risk on market, of course. And when there is, like, fear everywhere else, a small market like the crypto market is also influenced, influenced by volatility and everything.

Observations on General Market Downturns

So the Japanese market went down. The US equities were fucking, like, got fucking annihilated that day. So, of course, like, crypto went down, and there was, like, basically panic selling all over the market. Like, every single coin went down, like, crazy amounts. Even like, bitcoin, which is the biggest one, and usually the less volatile one, went down.

Recovery and Future Outlooks

Like, this week went down, like, more than 20%. And then we bounced back. So, I mean, there is nothing to say, honestly. Like, of course, I didn't expect this kind of dump to happen, but probably nobody in the crypto space expected this kind of huge volatility in just that short period of time. But sometimes shit happens on a global scale and there are events that you cannot really predict.

Navigating through Crises

But yeah, it is what it is. Like, we just. We are still here. We survived the crash. It was actually a great opportunity to increase your bags. And we are back at the same levels that were in which were last week. So, I mean, not much to say. Despite, like, what happened, we are still again at the same levels and as bullish as ever, you know?

Exploring Further Conversations

What do you want to say, Greg? You have something else to add about this? What makes you think I have something to add to that? I don't know. I mean. Okay, well, I'll try. I'll make something up. I agree with everything you said, dude. I'm actually scrolling the chart now.

Analyzing Bitcoin's Historical Performance

I'm trying to find the last time bitcoin had as good of a day as it did on Thursday as part of the recovery. So the crack, the. You know, the big crash was on Monday. That was when the wick happened. And then on Thursday is when we had the big move back up. Back over sixty k.

Examining Price Fluctuations

And we had a 12% increase in one day in bitcoin. And I'm scrolling back right now, day by day. I'm in the beginning of 2013, bro. Sorry. 2023. I'm already back, like, over a year and a half, and we. This is still the best day. I have not found a day.

Deadlines in Tracing Historical Data

I'm going to keep scrolling. That one's close, but damn, I'm in. I'm in early 2022. Now. This is the best day since February 28. 2022 was on Thursday in that recovery. That's pretty cool. So, yeah, I mean, like you said, it's this type of market where if you just didn't log on for a week, you'd have no idea what fucking happened.

The Challenge of Market Awareness

But in that same time, if you were here and you're like us and you're, you know, watching the charts and you're on Twitter all day or whatever it is, it was a massive roller coaster. So again, we talk about this every fucking week, guys, but this is a game of emotional management and you and self-awareness.

Personal Investment Strategies

And you have to understand what's the best way for you personally to navigate these markets. It's the difference between people who day trade and do it. You know, weekly trades, monthly, like these longer-term swing trades, or they just buy and hold. Like, that's a cousin of what I'm saying is, like, understanding the way that, you know, how much time do you want to spend looking at this?

Balancing Investment Approaches

How much emotion do you want to dedicate to this? Is it worth it? Like, for me and Nagato and for many of you, we're trying to build brands in crypto, so it's important that we stay up to date. It's important that we're creating content and talking to other people in the space and reading articles, et cetera.

Personal Strategies for Managing Stress and Investments

Some of you, that may not be necessary, right? You may just want to come on Saturdays and check in and wi-fi money, but you don't need to be, like, watching the price like a hawk, you know? Like my mom, for example, she holds a decent amount of crypto. Cause I've just been, like, hounding her over the years, and she checks it, like, every day.

Observations on Market Monitoring

And I don't know why she does. Now, granted, she's good about it. She doesn't, like, hit me up, like, freaking out or anything, but, like, because she knows how to manage. She knows how she works. She knows how she ticks. She doesn't. She's not trying to build a brand in crypto, but she also says, you know, I can handle it.

Stress Management and Market Awareness

I'm going to watch what's going on. I'm. I'm a number. She's a really big numbers person and likes to, you know, get the feel of kind of where things are moving, and that works for her. So, like, if you're feeling like your stress is up, like, dude, that's literally taking days off your life, right.

Long-term Well-being and Investment Mindset

It's. It's literally creating blockages for you in other areas of your life that you may be trying to accelerate and succeed. And you have to understand that, like, you could have just not been online this week and have no idea that the world almost melted, quote unquote, right. Especially in crypto here.

Recent Market Dynamics and Recovery

When we. We went down to fucking 49, we haven't been in the forties since, let's see, since February 14, since Valentine's day, we had not been in the forties. And if you just didn't look, we're back at 60 already. So, that's the way things go. And. And it works in our favor a lot of the times, too.

Market Speculation and Strategies

and it'll. That's why it's hard to catch the top, too. Right. And that's why we need to be, like, scaling out on the way up the same way that we DCA on the way in. Because when we get close to the top, this shit's going to fly, and then it's going to retrace just as quickly.

Market Dynamics and Risk Management

The same way that we just dropped a. The bottom dropped out. Right, Nagato. And then we just bounced back. So we have to have a plan both ways. Yeah, absolutely. And I want to add something like, you see, like how the market basically melted in a few fucking candles.

Navigating Market Trends

So guys, like, make sure to take profit when it's time because the same thing will happen after we reach the top and everything. Like, you already have, like, a lot of time to decide what to do. Like, you already have to have a plan in place because those same things will happen of the same magnitude and everything.

Future Market Predictions and Preparation

And I think this recent pen selloff, which means like a sell off across all markets, was just basically anticipation of what's going to happen in the future. Because I don't think that the markets are going to keep going higher forever. At some point, we'll have big fucking sell off.

Addressing Potential Market Downturns

Recession, call it however you want to call it. And by that time, you want to make sure to be out of the markets because otherwise you will see your network fucking plummet. Like in really, I don't want to say in seconds, but, you know, in just a few days, you can have, like, your network getting halved, you know, and you don't really want to be in that position.

Community Reactions to Market Instability

But regarding what happened, I see, like, many newcomers that are just, like, too hard on themselves because they didn't anticipate this fucking recent sell off. But guys, like, it was basically impossible to anticipate this sell off. Like, 99% of the people that claim to have, like, yeah, I was waiting for it.

Realities of Market Speculation

I knew that. Blah, blah. It's like a bit of bullshit. Because without the Japan news and the fucking fear across all the markets, I don't think we would have seen, like, BTC to, like, 49, especially in that short time frame, you know? So, I mean, don't be too hard on yourself.

Perspective and Emotional Resilience

Sometimes you cannot predict events that are also, like, outside the crypto market and everything. Just make sure to, like, zoom out and look at the bigger picture. If you look at the BTC chart at the moment, we're still back into the same range that we have been in since February.

Consistency in Market Trends

So it's more than six months. Nothing has changed. The weekly candle is, of course, we still have one day until the closure. But it's really bullish in my opinion. And I think it's just a matter of time before we actually start to move higher, you know?

Future Projections and Momentum

And actually, we have been saying this for many months. At this point, usually there is like a lag between the alving and actual, the actual breakout and the next impulse higher. So I think we are getting there. I think the next few months will be extremely bullish for crypto.

Individual Financial Health and Long-term Strategy

So don't be too hard on yourself if your portfolio didn't really, like, made insane gains in the past few months, or you actually lose, like, 20%, 30% of it, because it's part of the game. Volatility in crypto is normal. You have to embrace it.

Day Trading vs. Long-term Strategizing

If you are a day trader, of course, you can keep switching. Like, you can enter a trade, then you can stay in stable, then you enter another trade, then you're back in stable. But if you're an investor, and especially if you invest in, like, let's say, mid cap, small cap coins, and you, like, your goal should be, like, accumulate as many, as much crypto as you can and wait for the market to go.

Strategies and Market Cycles

Parabolic is the easiest way to play this market. You don't really have to be an expert. You don't have to change your bias every fucking day. We know what's coming. I think euphoria, just a matter of time.

Future Market Sentiments and Growth

I don't see the Buran ending without euphoria. So, again, don't be too hard on yourself if in the past few months, you didn't really make any money, because when the time comes, you will make, like, a shit ton of money in just probably, like, a couple months.

Market Maturity and Investor Mindset

That's what, like, that's what Al season is. That's what euphoria is like as a crypto investor. You can go, like, especially if you invest for the long term, if you invest, like, to ride the whole market cycle, you can go for months and months without seeing any gains.

Moments of Transformation

And then in a span of two months, you can see, like, you see everything you have ever dreamed of, you know? So again, like, just chill, relax, and everything is falling into place, in my opinion. This is why Nagato is the goat, because he keeps us all level-headed.

Reflections of Market Sentiments

So he wrote a post kind of summarizing what he just said. So I would recommend going up in the top in the jumbotron here and just bookmarking that and making sure that, you know, whenever you're feeling, like, down about, oh, you know, one of the key points that I took away, bro, is kind of like, don't feel bad if you're not, like, up 20 x, like every other fucking guy on the timeline that's flaunting his, you know, delta portfolio screenshots.

Community Engagement and Individual Focus

Just hold on. We're. You're in the right place. You're well allocated. you know, because this is the industry that has that upside, and the volatility to the downside is a signal of that. Like, we like volatility.

Volatility as a Market Asset

We embrace volatility because it works in our favor. And you just want to make sure that you're prepared and you're not over trading and you're not too hard on yourself. As long as you're here, you're. You're doing the right thing.

Legal Developments and Market Reactions

brother, I, I wanted touch just really quickly, because I think it's interesting news about the ripple case. We don't have to go super deep, and obviously me and you are not lawyers, but just to like to cover it, I think it's important because it is big news.

Ripple's Legal Outcomes

Ripple, they basically wrapped up their lawsuit with the SEC this week. They were ordered to pay a $125 million fine. The thing is that it is way less than what some people were expecting or what the SEC was seeking, which was $2 billion.

Legal Precedents and Market Sentiment

And this has been a multi-year suit. And the judge said that they broke like almost 1300 securities laws or transactions broke securities laws. So 1300 different transactions, like, broke securities laws. But again, overall it was a win, as seen by XRP jumping up 18% on the day that this was announced.

Judicial Considerations and Market Outlook

And so just a quote from the judge said, there's no question that the recurrent, highly lucrative violation of SEC rules is a serious offense. However, this case does not involve allegations of fraud, misappropriation, or other more culpable conduct. The SEC has not established that Ripple's failure to register the institutional sales caused substantial losses or risk thereof to investors.

Corporate Reflections on Legal Proceedings

And CEO of Ripple, Brad Garlinghouse, said that the outcome was a victory for Ripple, the industry, and the rule of law the SEC headwinds against the whole of the XRP community are gone. So the reason I bring it up, bro, is this has been kind of like a flagship legal case for this industry and even normies.

Cultural Influence and Historical Context

Like, if you're going to ask, I mean, I guess the meme gain and the dogecoins of the world popped up. But if you ask anyone that, like, has heard about crypto and they don't really know that much, they've probably heard of, like, bitcoin, ethereum, maybe dogecoin, and then probably XRP, right?

Public Perception and Historical Significance

These are like the regular, it's one of the regular things that people will hear if they're just adjacent to the industry or they have a friend in it or someone was trying to pitch them on XRP in 2017, like, type shit. And it's good to get this out of the way, right? It's just like a black cloud that was hanging over the space and it's no longer there.

Market Dynamics and Positive Responses

And it was a positive response from a price action standpoint. And so the market received this well, and I think it's just one more kind of piece of proof that this industry, I mean, definitely bitcoin, but overall, this industry, I believe, is very anti-fragile.

Persistent Challenges and Market Resilience

And it's like, no matter how things kind of shake out, what headwinds are put in the way of trying to let this thing propagate and kind of build itself up, it's always going to find a way around it, because it's a living organism, in my opinion.

The Concept of Memes in Culture and Finance

It's an energy, it's an idea. It is a meme. And maybe we want to go into some of the meme stuff, but memes are just an idea that moves from brain to brain. That's all it is. Some people are familiar with memes as an image that you have some text on and a funny picture, but that's just an Internet meme.

Memes as Ideas and Influence

Right. But, like, a meme itself is actually like an idea that's easily transferable across brains. And the idea of crypto and bitcoin itself is a meme. Right. It's like something that is able to move around. So the more things that get removed in kind of letting that meme circulate with a positive reinforcement, the better.

Reflections on Ripple Developments

So I don't know where you want to take that, bro, but I just thought it was worth mentioning kind of everything that went down with ripple this weekend, I. No, of course. It was extremely important for the market was, it's a great victory that can set, like a positive, you know, a positive, like, I don't know the word, but positive press precedent, something like that.

Positive Impacts and Market Attributions

Is it okay, brother. That's okay, brother. Okay. Positive precedent for the market. So, yeah, I mean, also XRP responded finally, like, with some sort of, like, positive price action, even if it's still at fucking low levels. The all-time high of XRP that made it like, was made in like 2017 and it's like $3 something, and now it's like $0.60.

Historical Context and Recent Performance

But yeah, if you remember, like, even like during the last bull market, XRP didn't even, like, go close to the all-time high. So maybe now without the SEC case open, now that they won, quote, unquote, maybe they would be able to also start running again and maybe reach the ultima.

Community Hopes and Price Expectations

It would be really nice for the XRP community because, you know, like, those guys have been holding XRP for years and years. Today on Oli basically saw sideways price action. They never actually experienced, like, crazy gains. So I'm happy for them. And I hope that XRP will actually start rocketing soon.

Sentiments on Market Futures

It deserves to be higher. I mean, people, some people love it, some people hate it. Actually, I was like XRP fanboy when I started investing in crypto, but then I. I don't know, I don't even remember why, but I decided to sell my bags, chase some other shit coins, and it was the right decision, so.

Personal Investment Experiences and Reflections

But, yeah, but I still hope that XRP, we can, like, we'll be able to probably catch up and maybe break its previous ultimate mind in the future. Let's see. Talking about memes, I've seen, like, many fucking people, like, during this deep, they were basically trash talking.

Community Dynamics and Market Perception

All the people who decided to, you know, buy the depot memes, you know, and I think it's fucking stupid, you know, like, if you paid attention to the crypto market, you probably realized that memes were basically the, like, number one narrative of this bull run.

Critiques of Community Commentaries

So, like, trash talking people that were actually taking advantage of this deep to double down on memes. I think it's fucking stupid, you know, and I think that what happened with memes in the past few months was just like anticipation of what's coming.

Trends and Anticipation in Crypto Markets

Because in my opinion, when all the NPC's, the newcomers in the market will join the market, what do you think they will buy first? Like memes, which are funny, easy to understand. You don't have to do like crazy deep research and everything, or they will go and buy boring utility coins.

Entry into Cryptocurrency Trends

I think that the first wave of retailers will jump straight into memes. So actually bashing someone that's buying high-quality memes, I really think it's fucking stupid. And I saw many quote unquote influencers doing that, and I didn't really like it.

Personal Opinions and Market Trends

Names. Say names. No, I don't really want to say names, but I think it's fucking stupid. Of course, like, you know, when investing memes, probably like 95% plus of memes you see out there, they are fucking shit. But if you actually do your own research and invest in the other 5% of memes, I think you have like, one, like some of the easiest fucking five x, ten x's you can, you can get in the market.

Investment Strategies and Personal Preferences

And of course, like, I don't really want to shield Ponky, but I will shield ponky because my favorite, meanwhile, you will shield donkey and you will like it, dude. Yeah, always shield donkey, like basically every day. So, yeah, I mean, honkies donkeys in the chat.

Community Dynamics and Investments

Let's see some hearts up. Yeah, but to prove that. To prove the point, like, the only coin that I bought during this deep was funky. Like, no joke. And I. Yeah, bought it maybe a bit too soon. But, you know, like, if you see the price action, it went, like, to, like, what?

Price Assessments and Market Trends

Twenty one cents?

The Return of Meme Coins

And now he's back at, like, 38. So crazy strength. And, I mean, of course you don't want to be dumb, as I said, like, with memes, because most of them are fucking shit coins. But if you find the good one, the right ones, like, easiest fucking five x, ten x in the Buran, in my opinion. So all the people will say like, oh, don't invest in me. You're stupid. I. Blah, blah. I think they are fucking sorry, but retarded. Because if you. If you are. If you're investing in crypto at the moment and you don't have a portion of. Yeah, bro. Like, if you invest in crypto right now and you don't have a portion of your portfolio in memes, you basically ate money. That's it. I agree. I agree.

The Importance of Attention

Oh, hey, what's up, Ponky? Hey, yo, what's going on? What's going on, guys? I wanted to make a comment on what you said about the memes. Bitcoin is actually the biggest meme in history. Facts. Well, this is the voice of Ponky. I'm one of the team members. Are you a mu. Are you a monkey? I'm not a monkey, no. Oh, so you're not the monkey. Okay, so the monkey itself, where does he ever get online? No, the monkey is in is every one of us. So he's always online. Let's fucking go. Good answer. Good answer. Yeah, I think that if you look. So I just pinned a tweet that I put up this week kind of outlining pretty much what Nagato just said, actually. In fact, I'm pretty sure Nagato gets all his ideas from my tweets. This is a perfect example where if you are looking at, you know, if you believe in the overall thesis of crypto, or at least if you believe that we're in a bull market right now, you think that we're going much higher.

Cycles and Market Behavior

And meme coins traditionally have been introduced into these different cycles during euphoria. Right. I did a post, actually, a different post about this a few weeks back where I kind of outlined, like, pretty much all of them, the only one that had ever been launched. That is like, a successful one that wasn't during euphoria prior to this cycle was Shiba Inu. But like, dogecoin and then all the BNB coins last cycle and all that stuff, it was all during euphoria, dogecoin euphoria in 2013, but still. And this cycle we saw something interesting where like, all these coins were starting to launch and like 2020, basically the full year of 2023. Like, throughout the year of 2023, as you know, were still in a bear market, technically. You started to see meme coins pop up because there has been like, a lot more experience now in community building online.

Building Community and Engagement

Even if you look at like the NFT stuff that happened last cycle, if nothing else, whether or not they come back, I don't know. But it was an excellent exercise in community building in web three, right, where. And people got used to this idea of like, rallying around different characters and different communities that are backed by tokens. And perhaps the non fungibility of these tokens was overstated as far as, like, importance goes. And so now we've kind of like, gone into just the fungible aspect of these meme coins where it's just about price and it's about community and it's about content and it's nothing necessarily about like, oh, I have a unique ponky token. It's like, who really gives a fuck? Are you like part of this movement or not? Right? And now if you believe we're in a bull cycle and meme coins have kind of established themselves as, I mean, it's hard to argue anything other than meme coins have been the alpha narrative so far in this cycle, right?

Navigating Risks and Opportunities

I mean, you really can't make an argument otherwise. and if you think we're in the bull cycle and we're getting massive dips, like huge dips, like 70% off all time high type dips, but you're watching bitcoin and it's only down, you know, 15, 20%, whatever it is, 25%, like that standard kind of correction that we get in bull markets. Well, what do you think's going to happen when bitcoin corrects to the upside of the meme coins are going to go double, triple, quadruple as fast? So again, we're not saying you should have 100% of your portfolio in meme coins, but if you don't have any, you're kind of leaving the highest beta play on the table. It definitely has more risk to the downside. But we're all playing in a speculative market here. You could maybe argue that bitcoin has some utility in terms of store of value, from just an overall zeitgeist perspective, you're starting to see from the traditional institutions and Wall street accepting it and saying, okay, this is digital gold in some respect.

The Utility of Bitcoin

Now, whether it's acting like that from a price perspective yet, you know, not completely. It's still kind of correlated to markets, but there is like, somewhat of a buy in psychologically and literally from traditional players into bitcoin as a hedge of some kind. So, fine that you could maybe argue has some utility at this point. Everything else is speculation. So why wouldn't, if everything's speculation and subject to the overall market, why wouldn't you have a piece of. Of your portfolio, even if it's single digit percentages in the ones that are going to go the fastest when speculation runs rampant and if we haven't entered that thrill in euphoria yet, and then you look at, okay, what projects? How do I determine whether there's a project meme coin that deserves my attention?

Evaluating Meme Coins

For me, I mean, the thing that turned me on about Ponky was their content strategy and just the volume and the quality and the fact that it's video content as opposed to just images. Like, that's a huge differentiator. When you look across all of the different meme coins and the things that they're trying to create online, it's. They have their characters, they have their little, like, you know, joke or whatever, and. But they don't. They don't. It's hard to capture emotion without, like, seeing movement and without seeing, like, put, I'm gonna write. I'm writing up another tweet about this, but it's like, it's not that there's character development per se. There may be in the future, there's option for that, which is also kind of exciting.

Connecting with Characters

But, like, you're getting to see this particular character, the ponky monkey in this case, live out different human scenarios that enable you to relate to it on an emotional level, whether you like it or not. And you can agree or disagree with how he's reacting to certain movements in the market or whatever positions they put him in these little fun animated videos, but they're pumping them out at fucking scale, dude, across platforms to the tune of almost 700,000 followers across TikTok, Instagram, and Twitter in just eight months. Like, that's absurd. And it's all organic, okay? So to me, as a marketer, as a content guy my whole career, I look at that and I say, you know, all that matters in crypto when price starts to move is attention.

The Power of Attention in Crypto

Where are people going to come into the market and put their attention? Are they going to try and figure out, like, how the consensus mechanism works for, like, a new layer two? Or are they going to, like, buy a fucking, you know, fun, excited community coin that has, like, a character that's relatable, that price is moving faster? Like, it just. It's a no brainer to me to have a portion in meme coins. And for me, like, Ponky makes a lot of sense because the volume and differentiation of their content, and particularly across platform, you really don't see a lot of meme coins doing the damn thing on Instagram. So Nagato showed me Ponky, and it's been a great ride so far. Yeah, I mean, if you look at, like you said, the tweet that you put up on the bounce, 57% up from compare from yesterday's crash compared to that of it, to bitcoin, 14%.

The Landscape of Meme Coins

You know, memes tend to run hotter than majors. So there's definitely, I would say, this cycle, you know, you spoke about nfts, you spoke about, you know, utility, defi, and all that stuff. Like, that stuff is kind of boring this cycle. And people, it's kind of like the curtains have kind of opened up, and everyone's realized that we're all here, for one thing. And it's a generational wealth. And, you know, everyone comes to the. Comes in the crypto room to make money for their families or the, everyone around them and change lives and everything. And there's something to say about where crypto is going and what needs to happen to take it to where it's going.

Visions for Bitcoin's Future

Right? Like, we get, we all say bitcoin's going a million dollars, right? What does it take for bitcoin to get it go to a million dollars? It takes multiple cycles of convicted people that understand that digital digitizing currency is the future, and ponky in itself is just a small piece of that big picture. You know, the ponky army that we built is just a very small fraction of. Of what's to come, you know, and, yeah, we will see bitcoin at a million dollars one day. It's not going to. A lot of people come into crypto. They think it's going to happen overnight. You know, they have to realize it takes time for this to happen, you know, a lot of time.

Hybrid Portfolio Strategy

Crypto legato. Oh, yeah. I want to, I want to add something regarding this topic. So basically, we are not saying fucking sell all utility coins and just go all in memes. No, the key word here is hybrid. You want to build a hybrid portfolio. And what's an hybrid portfolio? A portfolio which is composed on different coins and so you can write different narratives at the same time. Yeah. You want to have some AI coins. You want to have some DP in coins, you want to have some meme coins. You want to have, like, you want to be exposed to many different narrative. At least you want to go, and you definitely want to go into Negato's profile and click on the link and go to his telegram channel because it's fucking lit in there. It's free, and you can ask questions.

Community Engagement and Knowledge Sharing

There's people talking in there all day about all these types of strategies. People are sharing solid ta. All that stuff. So I just wanted to share that. Cause, like, part of managing your portfolio is, like, being around this community. So it's good you come to wifi money every week. And you should be following me in Nagato, but also make sure you're in his telegram channel. Let me tell you something. So if you go on my link tree in my bio, and you click on the telegram link, it's actually, I think, expired because I changed the link and I didn't update my link three because I'm lazy. Two weeks ago, you said the same thing. You still haven't updated that shit.

Technical Glitches and Follow-up

What's. Yeah, what's the. Yesterday, I shield my telegram channel on x. Yeah, the tweet was live for like, 1 hour, and then I deleted, and I got, like, 500 people. Okay, I'll get a link. I'll put it in the. In the jumbotron. Hold tight, guys. Hold tight. Keep going. I think. I think if you just, like, search for, like, wi fi stoic, you. You can. You get the channel. So it's a public channel. You can find it easily. Gone. What do you mean gone? I interrupted your brilliant speech about how you need a hybrid portfolio. And by the way, guys, you can look up in the jumbotron now, and you should at least in a few seconds.

The Jumbotron Explanation

Sometimes it takes like, 10 seconds to load, but there's a link right there. Jumbo drone. You know exactly what I'm fucking talking about, dude. Yeah. Don't be an asshole. All right, but why the name is jumbotron? What a fuck. How do you find, like, where do you find it? It's a. It's an english word. It's like, when you go to, like, a stadium. you. I don't know if you have those in Italy, we do have electricity, though, at those. Oh, yeah, we do. That's. Oh, that's awesome. I mean, it's like, I haven't been in Italy, like, in a long time, so I don't know if they still have electricity.

Explaining the Concept

Stairs. I don't know. I would go there. When you go to a stadium and then, like, in the middle, like, hanging down is like. Yeah, yeah, a big screen. It's like the jumbo trip. Or just like, a big screen up on, like, in a movie theater. Thank you, thank you, thank you. You didn't know. And I'm explaining it now. Okay. And I'm gonna explain it until I'm done explaining. okay. Okay. And then what. What I want to see from you guys, I want to see a rush right now. I want to see everyone rush into the telegram. I want to see it just like, join, join, join.

Encouraging Participation

Okay, go. I'm gonna. I'm gonna go watch that while you tell us about meme coins, Nagato. I don't have to say. I don't have anything to say about meme coins. Okay, fine. Then I'll just do everything. So, guys. Bro, I don't know anything about meme coins. Like, the only meme coin I actually know about this spunky. Like, yeah, I've seen, like, other meme coins that went viral and shit, but, you know, like, nothing resonates with me as much as spunky. So at the moment, that is the only meme coin in my portfolio. I'm not really a fan of, like, over diversification.

Portfolio Diversification

Like, I don't want to hold, like, 3 million coins. So I already have, like, I guess, like, eleven coins in my portfolio, maybe twelve. And I don't really want to over diversify into memes as well. Like, my exposure to the meme niche is funky because, as I said many times, it's the perfect risk to reward ratio for me. Like, it's a meme coin that's already established because it has, like, 200 million market cap, something like that. And it already has a community, a lot of followings, a lot of I behind it, but it's nothing a giant yet. So the potential for, like, a big Roi, which is like five x, ten x, or whatever, is still here.

Evaluating Current Investments

But it's not like a crazy low cap meme coin shit coin that can rug pull tomorrow, you know? So for me, it's the perfect choice. And at the moment, I'm basically. It's my only meme exposure. And I think, same for you, Greg. I guess. Or you have something else? I don't remember. I have one other. but I'm not going to show it today. Oh, it's a small. No, it's. It's actually bigger. Okay. But, yeah, so, Oh, by the way, I just realized, the channel that I put up there, that's the channel.

Community Dynamics

I can't. As a. As a non admin. This guy hasn't even added me as an admin. Incredible. I can't. You. I can't get a link to the group. So if you guys just join that channel, that's. Maybe you want to post in the channel right now Nagato. Just a link to the. No, basically, guys, if you join my channel at the moment, just scroll a bit up and you will find the link to the chat. It's like three, four messages above. So just scroll it a bit higher. There you go. Yeah.

Telegram Channel Guidelines

So one. So if you guys aren't totally familiar with telegram, the channels are one way communication, so negato, like, drops a bunch of, you know, just posts in there so that you know what's up. And then there's. If you scroll up just a little bit in there's a link to the chat, and that's where, like, few thousand of us are just talking all day long. Okay, so, bro. Yo, hold on. Before you go. Before you go. Before you go, I just want to say, we're going to open up the stage. So if you guys want to hop on stage here on the bottom left, anything that we talked about, that is interesting to you, if you have a comment or a question, please hit the microphone on the bottom left.

Engagement on Stage

Come on up. If you've never spoken on a space before, now's your time. This is the signal. This is the sign you've been waiting for to finally speak on a space and stop being a little pussy. Negato. Never spoke on his face before. I made him, and now look at him. He's a fucking pro. So get on here. Share your. Share your thoughts. The only thing I would say is, we have to throw this disclaimer out because we've just had some experiences. Is like, we're not interested in your life story.

Guidelines for Participation

Respectfully, we're not interested in everything you have to say about everything. Just have a point. You got a minute or so? Make your point or ask a question. We'll keep it conversational. Instead of monologues. Only me and Nagato get to monologue. That's the only rule of Wi Fi money. All right, go ahead, bro. What do you think is going to happen on Monday? Precise. More precisely, Monday night? What is that, the Trump elon talk? Yeah.

Upcoming Market Influences

Then we actually go live on x, I guess. And, you know, like, during this week, Donald Trump Junior, it. We did something. It was like, we are about to shake the world with something huge. Dude. There's so much drama with that. There's so much drama with that. That's, like, worth getting into with, like, the DJT coin and, like, all. No, no, I don't want to talk about it. But what do you think? Like, it would be bullish or bearish for the market, because usually, like, those kind of events, they end up to be like, I sell the news or something like that.

Market Speculations

So maybe we can. And if you combine that to the fact that I will jump on a plane, I guess we have, like, a nice, short opportunity. Yeah. I think that actually will have more impact on the market. I think there's two different things, right? There's. One is, like, the Don Junior and Eric Trump coin, and then one is, like, the Trump Donald Trump and Elon conversation. I don't think those are tied together in any way, and I also think neither of them will impact the market.

Speculations on Trump and Elon

I. Me and you talked about this yesterday. I don't even think Trump and Elon are going to talk about crypto. Maybe it'll come up. But I would put it at, like, 5% chance. That's my opinion. I know. I think you think otherwise. And then the Donald Trump junior and Eric Trump coin, I think, would be a terrible idea for them to do because they're literally just cash grabbing, and it's so obvious, and it's just a bad look for your fucking dad's name at this time. You know, that's just the last thing he needs. But, yeah, so I don't think either of those are, like, really good or bad for the market.

Concerns about Potential Impacts

You think that Elon and Trump are going to start talking about crypto, and I just think there's so much bigger things to talk about. Oh, of course. That we talk about bigger things first, but at some points, that we. At some point, that we also talk about crypto, like, under percent. Like. Good morning, gentlemen. How are you all? We're good. We're good. Good morning, g. Yeah, hi. I mean, good night for me. Sorry, you guys.

Personal Greetings and Adjustments

I've never spoken on space. I'm a little nervous. No worries. Okay, take a deep breath. You can dare me. Somebody dare me to come up here. I'm from the crash community, so I just want to tell you guys, hello, we're big supporters of Ponky. We're the ETf of all of crashes calls with a legacy token. And you know, we're, went to all time high of 40 million market cap. We're currently sitting around 5 million crashes.

Introducing Community Support

Clay, why don't we do, hold on, yo, why don't we not do the shill thing and let's do like maybe give your take on like the meme coin space so that we can bring. We're not really doing everyone come up and talk about their token. That's like one of the things I didn't say that. So you didn't know. But yeah. Let's keep it a little more general on your thoughts on the market. Yeah, I think the market's very early right now.

Market Timing and Strategy

So if you have your conviction plays, you should be getting into them. And the majority of the volume is going to come in toward the tail end of the crypto cycle, which is why you need to get out and build your brand. Spread the word regarding your tokens, your conviction plays, and crash ponkydenness, Bobo, Brett, all those are big conviction plays for us.

Identifying Community Players

So who is us exactly? Oh, the crash token, bro. We're the ETF of crashes calls. You know who crashes Clay is, right? Oh, you made it. Please tell me you do. Yes, I am aware. Yeah, he rolls. Interesting character. Is he, is he really young? Is that right? Yeah, he's actually like nine years old. Most people think he's 13, but he's like a fucking savant, bro.

Curiosity about Identity

No, like, how old is he really though? Like 16 or something? Or 18 or is he just lying and he's like 25, bro. It's a troll, bro. He's, he's like in his twenties or thirties. All right. But yeah, I was like, damn, that guy's a good writer for a fucking teenager. But yeah, no, he's, I always find it interesting with brands like that just to, I don't know a lot about them, but I just, you know, like when you're like that brash, you know what I mean?

Discussion on Brand Development

Like, it's interesting to see how those play out over longer term, so. Okay, so you guys have a little ETF going and you have ponky in the mix and you have some of the other ones. I mean, you see how, you see all how his calls are playing out, right? Everything he's called so far? Yeah, I don't really track it that well. I know he's in the. You should probably do that if you like money, if you're not allergic to money, you should probably track it.

Monitoring Market Trends

All right, well, we'll get him in here. We'll talk about it, you know, come to our spaces. He's always in our spaces, bro. Yeah. All right, well, he can come to our space because. Yeah, well, actually, I don't want to be a dick. I just. I'm just a dick. Do you know what I mean? And sometimes I have to be like, no, Greg, listen to Nagato and go listen to more Joe Dispenza and take a deep breath.

Engaging with Perspectives

Yeah, you should probably listen to more crash, bro. Dude. Okay, why are you simping so hard for another guy? That's so I'm being a dick like you, all right? I'm not. I was resisting being a dick, bro. Relax. Now you're kind of being a dick. I love it. I love it when somebody comes into the space and gets passive aggressive with the host over their meme coin that nobody knows about. It's not a meme coin, dude.

Clarifying Misunderstandings

It's an ETF of another man's ideas that I now branding myself around. You don't understand. It's bigger than. It's a legacy. Token. Frankie. Frankie, I know who you are, so it's lower on the tier. Got it. Oh, you know who I am? That's. Yeah, you're the gay guy that just spoke. Oh, hold on a sec. That was good one. I like that.

Lighthearted Exchanges

I'm sorry, bro. I just felt like you had some low t issues, so I wanted to try and get him up. Okay, so, Frankie. What? I got nothing but love for you, Frankie. Even if Frankie's kind of a gay name. It's all good here, bro. Okay. Frankie, what's cracking, man? Welcome back.

Personal Interactions

What? oh. Nagato, are you uncomfortable? Are you uncomfortable? No, I wasn't actually following you guys. Like, I don't know anything about what you talk about. The little kid. What the fuck? What the fuck, bro? I'm just laughing. Let me laugh. Let me cheat. No. Nobody knows about it. Why he's mad.

Reflections on the Conversation

It's like. Just imagine, Nagato, that somebody made, like, an ETF of all the things that you ever talk about and then goes and, like, brands himself around you and then goes into spaces and then says, like, if you don't follow Nogato, you're a fucking loser. That's kind of what just happened. Someone should say that. That would be dope. I just said, if you're allergic to money, you probably shouldn't follow us.

Concluding Remarks

Frankie, how's it going, man. How you been? What's on your mind, my g, hey, pretty good. Just chilling, you know, trying not to look at my portfolio, try not to look at coin market cap too much. Trying to just have conviction, which really isn't too hard. I have a question, but I'll take my minute and I'll, and I'll just bull, post a little bit. And, you know, I just have so much conviction right now.

Market Opportunities and Predictions

Ponka, I'm sure you got your finger on the pulse. What, you know, what narratives are you, were you, how you hyped about, and, you know, if you want to go so far as to even talk about a project or two within those narratives. That's all you. Nagato. I mean, we've been talking about meme coins, I think is like, kind of, and then I think there's, like, the easy rundown of, like, AI Rwa Dpin. I don't know. Nagato. I think you've put more thought into this than I have. No. Yeah, I was about to say the same things. AI rwa deep in memes. Those are my top four for this one. Nothing else to say.

Emerging Trends and Market Dynamics

And there's always, like a. There's always one. I feel like that comes out of nowhere, though. Like, I would say there's like a TBD. So I would be curious to see if anyone has any, like, predictions or guesses on, like, which one could emerge. Like, last cycle, it was like, metaverse. No one was. I mean, yeah, people had. People owned some metaverse coins, but no one knew, like, Zuckerberg was going to rename Facebook meta, and then all of those tokens were going to go ham. Like, something could easily happen like that. I wonder if anyone's got any other narratives or any other kind of sectors that have potential. I'm sorry, Nagato, could you repeat those that you said? I didn't hear them. I said, like, AI deep in RWA and memes.

Insights on AI and RWA Trends

I think what we saw since now, basically, like, what we saw earlier this year, around January and February, I guess, was just anticipation of what's coming. So all the strong coins that we saw back then will be the ones that will go up the most, in my opinion. Maybe there would be another narrative that will pop, like, pop out in the next few weeks or something. But, I mean, my bets are on RWA deep in memes and AI. And specifically regarding AI, I think it will have another run for sure. Hello, guys. Hello, Greg. Hello. Negato. What's up, man? Eric, hold tight, brother. We're just going to grab a couple other people who have been waiting, and then I want to hear from you as well, for sure. Frankie, did that answer your question? Yeah, definitely. Appreciate that.

The Future of Markets and Investment Strategies

Awesome. Let me add you something. Let me add something here. Like, I think that, of course, like, the market will move in waves, and I guess, like, those narratives will just outperform most of the other coins in the market. But when we have like Alcazone, I guess like basically every other narrative will also go up. Maybe not as parabolic as those one, but they will also go up. So, I mean, if you want to make, I think that if you want to make as much gain as you can, I think those four are the places you want to be more invested in. But of course, like, I guess like when the market is going to go higher, every coin is going to go higher. I think you have a good point about AI. That one is so deep into people's minds as something that's next, even outside of crypto. It just has everyone that's paying attention to life is just like, oh, AI.

Challenges and Opportunities in RWA

That could take a much smaller catalyst, I feel, to set off some of these tokens. RWA, I think long term in crypto actually is one of the most bullish possible sectors because everything's going to be tokenized. It also feels like at this stage, it's very difficult to wrap your head around. How is that going to manifest in terms of choosing certain tokens? There's even some gray area around which tokens are RWA because there's so many elements to that. RWA is super broad and I don't really even understand deepin, like, how that is. So I think with AI, that seems really primed, where all it takes is one company. If chat GPT says we may involve crypto in the future, if Sam Altman mentions it in passing in an interview one time, all those tokens could go like 30%, do you know what I mean? Like, I just feel like there's like a pent up AI energy that is waiting to explode.

Future Implications of the Crypto Market

Absolutely. Like AI would be massive, even outside crypto. Like, there are many companies that are like building, using AI at the moment. And I feel like the next wave is coming soon. And yeah, that's why I think it's still the biggest narrative for this cycle alongside memes, because also memes are extremely powerful. Those will be my top two bets if I have to bet on something. But yeah, AI would be. Can I say something that's completely unrelated? Dude, I just cracked open this ghost energy drink and I rarely drink energy drinks, but when I'm out of my house and I have long drives and stuff, sometimes I'll just go for it. First of all, guys, one little thing. You're probably not going to understand it until you write it down or maybe you've seen this thing, but almost every single one of these energy drinks has b twelve in it.

Health Insights and Energy Drinks

And you can have a couple different types of b twelve. One is cyanocobalamin. You don't want that. You don't want that because what that is. Yeah, there's a little bit of cyanide in it, but like very low traces. Like it's not going to impact you. The reason you don't want that is because they get it for free from sewage plants because they scrape off the bubbles off the top of the shit and then they make it into powder and then they send it to the energy drink people and it gives you b twelve. Cyanocobalamin, synthetic b twelve. But some of these have methyl cobalamin. That's natural b twelve. So there's a couple that have that. So like bang. And these ghost drinks have that. Anyway, that's a side note. That's just a little life thing. Unless you like drinking shit.

Market Trends and Personal Experiences in Crypto

Thanks, bro, but I just drank some of this. I've never had this before. Ghost sour patch. Like sour patch kids flavor. Like the red one. It fucking tastes exactly like a sour patch kid. My mind's kind of blown. Sorry for the tangent. No, it's good to know, bro. Most, most of those energy drinks have high correlation between cancer and heart issues. Oh, they're terrible for you. They're terrible for you. But I live pretty disciplined, healthy life, so I just have one every couple of months or whatever it is. But yeah, just watch out for that cyanocobalam. And it's also in, so it's in celsius, it's in monster Red Bull, and it's also in like Vitamin water, a bunch of the flavors. Not all of them, but most of them like prime. All that shit all has cyanocobalamin.

Continued Discussions and Perspectives

So, yeah, anyway, okay, let's go over to, let's go to paid XPo who's been waiting patiently with his hand up. What's up, my friend? Yeah, what's going on, guys? Thanks for hosting space. Thanks for having me up. I actually came in here because I saw Ponky and I was like, oh, fuck Ponky. I'm one of the co hosts of the crypto breakfast club. I wanted the co host of the crypto breakfast club of Zack Humphries Monday to Friday. Not a show, but he always talks about punky all the time and all his videos and say, oh, fuck this punky on stage. I never seen him on stage somewhere. I was like, I wonder what the fuck's going on here. But now I'm like, you know what, let me get in the conversation a little bit. You know, I ain't showing no project, not showing no shit, but I do like the RWA sector.

Discussions on Real Estate and Market Strategies

And I know a lot of real estate investment firms are looking pretty hard at it, especially in, you know, cities, and I would say states like Massachusetts and cities specifically Boston, who have, like, some of the highest rents in the country. It's a place I was living for almost a decade, and I finally decided to move because the rent was too fucking high. But I know RWas is going to be the big play. My question to you guys would be, what would your plays be for real estate, specifically, rwas coming up in this bull run? That's so. That's, like, the most impossible question. I don't know if anyone has the insights on that. I don't know if Nagato does, if anyone else on stage has a, like, an actual. Some alpha on that, but, dude, I think real estate, maybe I'm wrong.

Evaluating RWA in the Real Estate Market

I feel like that type shit is so far away from being, like, tokenized in a meaningful way. And I've seen so many, like, real estate on the blockchain, like. Like, kind of companies. I don't know if this is the bull run for that. What do you think, Nagato? No, let's. Let's be honest, guys. Like, all the RWA projects in this bull run, we just basically sell, like, we just basically used this bull run to get capital to get going over the next two, three, four years and actually realize what they want to realize. Like, this Buran won't be based on their utility, their success. You know, it's just, like, mostly hype. They will sell you a dream that will sell you, like, a dream scenario that will make a lot of money, and they will use the money during the next bull market to keep working, to keep developing, and hopefully they will reach their goal.

Predictions and Market Insights

Okay. Nothing is happening during this bull run. Nothing is happening in the next six months. Regarding tokenization, in my opinion, at least there will be a few exceptions, maybe in some industries that are nothing as regulated as, you know, real estate. But, yeah, most, like, FWA projects at the moment, they just sell you a vision, you know, bro, the only RWA stuff that has legs in the short to medium term is, like, tokenized securities and bonds. They're moving all, like, the stock market and equities and all that shit onto the blockchain or onto, like, DLT platforms. That is real and that is coming in the next few years. And we've seen a lot of announcements around that we've actually seen some of this stuff go live in, like, Switzerland and in Asia. And that's coming. So that's where I'd be looking at personally with RWA, not to like, real estate and like, putting auto, like, cars and like, anything that, you know, people say, like, put blank, blank on the blockchain.

Navigating Challenges in RWA Implementation

That feels just like super hype, non deliverable type shit. No, as you say that it's gonna happen, but it's gonna take a while because regulations there are so fucking difficult not to overcome, like, or just to regulate. So, yeah, it's not gonna come in the next six months, that's for sure. Kind of say one quick thing. As far as real estate, you know, the only two that I've ever heard of are props and proppy those, if you wanna look into those. If you're interested in real estate. Rwas, it seems like to me, you know, RWa really kicked off and Larry Fink came on and started getting all bullish. I feel like Rwas at this point are just a proxy for, like, any. Any token that's.

Market Insights and Blackrock Connections

RWA is just a proxy for any connection to Blackrock, I think. Like, that's like, pretty much the sum of what, tokenized securities, right? So, yeah, basically it's just like, anyone who can flaunt a connection to Blackrock. Like, that's the RWA play. Yep, I think that's. That's a good point. And we saw h bar kind of go heavy, remember, even though that. That news, I think, was like half true. If you guys remember that, h bar had a move a couple of months ago because Blackrock listed something with someone who used h bar, blah, blah. So, like, there is something there, but yeah, it has to be tied, it feels like, to a black rock or a vanguard or like something like that. Wherever it becomes very clear.

Balancing Hype and Real-World Applications

But if it's just an industry play, it probably should be something with a little more hype already around it, like AI or something like that. RWA is too broad in my opinion. Okay, let's go to Martin, and then we're going to go to Eric. What's up, Martin? Hi, guys. Thanks for having me on. First time speaking on space too. So excited. I just had a pretty, let's say, broad question. Just. Just because it's my first cycle, and it's probably the first cycle we have memes on too. And I know we all want to make Gen wealth money. And I think punk is being by far the best at building a community that can behind the project. But how do you see sustainability after, let's say, everyone gets in and people start selling the positions, how does that translate into the future?

Exploring Sustainability in Meme Coins

Let's say maybe you talked about it. I popped in and out. So apologies if I am asking something that you already talked about. Well, I think your question is based on if we're ever gonna stop, we're never gonna stop. We're gonna keep on boarding forever. This ponky is a. Is an icon of this cycle that was birthed, this cycle, but he will continue to go on cycles and cycles beyond. So I guess that answers your question. Can you share, I mean, I'm not sure exactly who's behind the mic here and what. How deeply you're involved in everything, but, like, is there anything you can share about kind of the vision of the project and just, like, some of the future stuff you're excited about?

Future Developments and Visions

Yeah. So we've been building a lot of tech in the background, we've. There's been a pivot from wherever we started with Memetrend, which was going to be sort of like this Dex screener, Dex tools app. And now we've pivoted to onboarding. So we're creating a platform that makes onboarding much easier for people that don't know about crypto. Like, we. We took a step back, and we realized that everyone in crypto right now already knows about crypto. Like, they know how to use phantom, they know how to use all these different tools. But you think about the people that don't know anything about crypto, you know, which is 95% of the world, and there's so much liquidity that can be captured by teaching these people.

Barriers to Entry and Education

So Pocky's right now, like, the devs are working on the pivot, has gone towards working on a platform that allows people to learn. I don't know how to. I'm not. I'm not a dev, but I'm trying to, like, put it into words, how it makes sense. It makes sense. And I. Yeah, there's a. There's. The biggest issue in crypto is that people don't know how to use it. You know, people, you think about money as a paper pay. Money is paper. You're able to use cash everywhere, right? Crypto, there's so many minds and brains and people in the world that haven't used digital assets. You know, like, you think about apple pay, how quick that.

Shifting Perspectives in Financial Transactions

That took a toll. And, you know, like, I. Me personally, I use apple pay every day. Every transaction I do is with Apple Pay. So it's like digital. You know, the future is digital. And when money becomes digital, everything, it's like crypto just becomes like were here all along. You know, it's like the. Yeah, cool. Thank you. Thank you for answering that. Yeah, I get. Maybe you were also. Oh, go ahead. And I got on. You take it. Maybe, brother. You were also talking about, like, what's gonna happen in terms of price, right? Not just in terms of the tech.

Market Cycles and Investment Strategies

Yeah, that's. That. Yeah. That's obviously a consequence of. In terms of the price. What? Like, the market moves in cycles, so market moves and cycles, and market goes down. Like, Ponca will keep building, like Frankie said, right? Like, the printers are going on. This is that there's two worlds, right? There's the world we live in, which is the. Where we've woken up to the realization that crypto, we can send money, we can become custodians of our own money, rather than giving them to the banks. And we've.

Realizations in Crypto Investments

I think he's rugging a little bit. Nagato, you want to jump back in? No, I just want to say that, like, in terms of price, market will go up. Market will go down. Like, do not hold forever any coin. Like, when we have euphoria, take profits. Otherwise, you will just round trip again, and you will, like, go, like, -90% and you will cry. So make sure to take profit when we have euphoria independently of the coin you hold. That's just my opinion. Absolutely. I think. I think I completely agree with you, Nagato, and it makes sense. I mean, I said my first bull cycle, but I've seen what's happened in past cycles, so.

Reflections on Market Behavior and Strategies

Absolutely. It was just to understand what the long term vision for a project like Ponki, which is a meme, and first. Yeah. Cycle in a meme or in a bull cycle, and what they were working on for the future. That was it. That was my question, so. And I think that's been answered 100%, Martin. I'm gonna. Thank you guys. Something up here that I wrote, or two weeks ago, maybe. and it's this idea of, like, that basically, you know, the way that you start a business now is so much different.

Shifting Dynamics in Business and Cryptocurrency

Like, meme coins and crypto, well, are basically offering this avenue to, like, raise a huge amount of liquidity and get a, like, Like an organic, user generated marketing engine behind you that's, like, financially incentivized to continually promote your project and your. So what it does is it builds, like, brand IP overnight. Right. And so the harder you push with the content, the more people invest, the more people market for you. And it becomes this positive flywheel, especially when you're inside of a bull market where liquidity is high and people are looking for different types of fun and interesting investments.

Building Brands in a New Marketplace

And then I. What's exciting is, like, they're not going to be able to share with us probably, like, exactly what they envision for the brand. But all we should, in my opinion, be looking at is like, are they onboarding more users? Are they continually marketing themselves and building attention? And is their ip something that's relatable and can be translated into alternative mediums? So you can take this monkey and you can do things with him in terms of, like, animated series or, like, being in movies, or like, just having some sort of character arc across social media. Like, there's things you can do when VR starts to become more of a thing in AR.

Future Opportunities in Digital Media

And I think they're already working on some. Some interesting things, like, you know, having big partnerships and just getting their name out there so that they can, at the flip of a switch, you can kind of take this IP that you're. It used to take years to build IP for, like, a web two company. Only in a very small amount of cases would something go hyper viral as a traditional Internet company and brand. Now you're seeing it kind of by the dozen in crypto because of that flywheel effect that I laid out. So to me, it's like, okay, this is a new paradigm in a sense of brand building and awareness increase around certain IP that can then be translated into different mediums to monetize and to grow into the future.

Eric's Perspectives on Social Engagement

So that's kind of what I'm looking for. Appreciate it. Thanks for, thanks for that. All right, Eric, what's up, man? Thanks for waiting. What you got? Yo, what's up, Greg? Thanks for having me. I just want to say that you guys were talking about onboarding people, and when I think about normal people, they don't have time to understand protocols or AI or stuff like that, so what are they going to gravitate towards? And I feel like they're going to gravitate towards something that is like a meme because memes have taken over social media.

Cultural Relevance of Memes in Crypto

If you see Instagram, you see a bunch of memes, and I see all these normal people, my friends, they're, like, posting these memes, and I'm just like, over here making money off these memes. I feel like a lot of people are gonna wake up and they're gonna start seeing the top meme coins and they're gonna love it, and they're gonna be like, oh, I remember that meme coin from four chan. Oh, I remember this meme coin from this series. And I really feel like crypto is an attention economy, so we're gonna see a bunch of money flow into meme coins. And last cycle was the initiation of the meme coins, I believe, where shit really pops off to, like, billions in market. Captain, we're going to see so many meme coins above billion dollar market caps that you guys should really consider looking at memes.