Space Summary

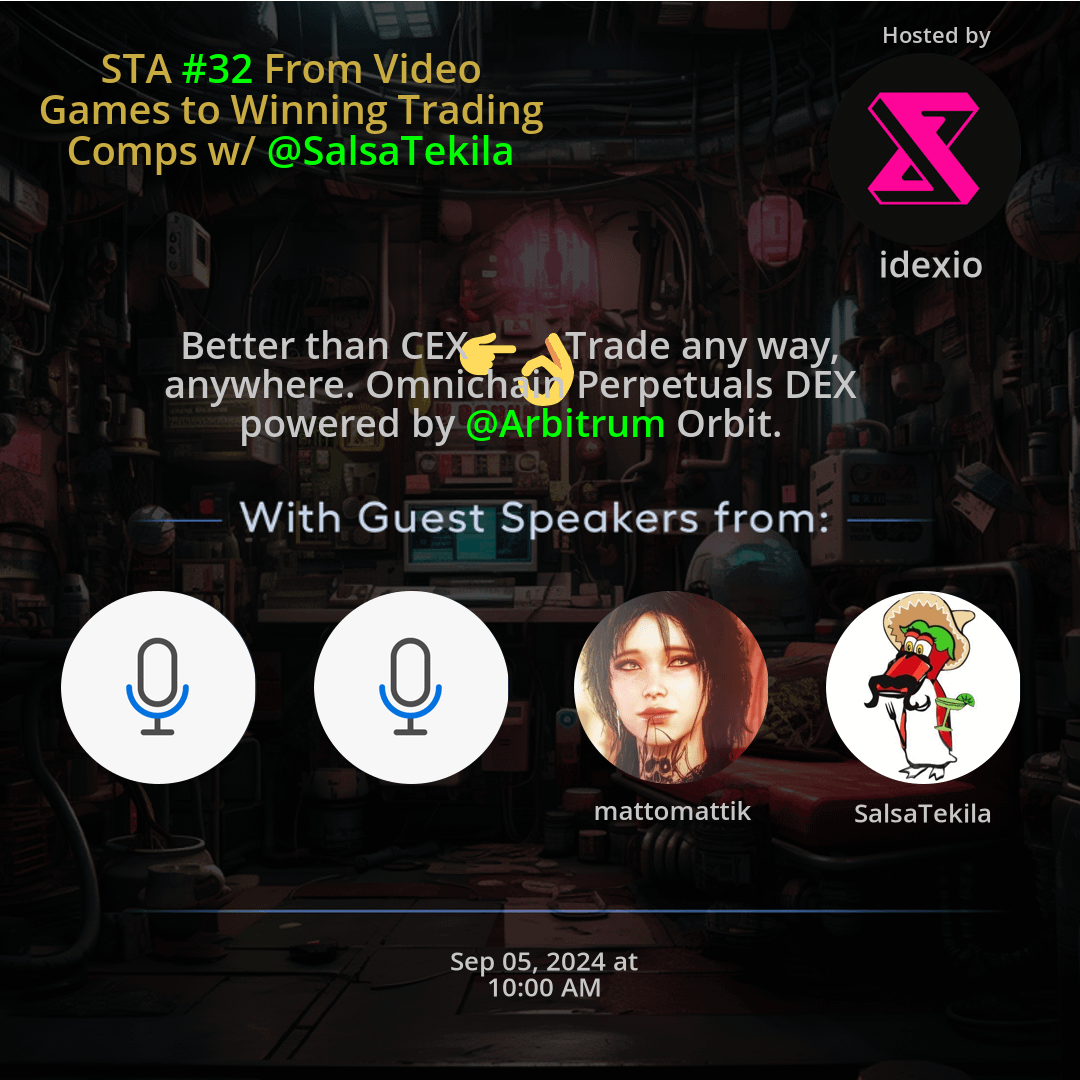

The Twitter Space STA #32 From Video Games to Winning Trading Comps w/ @SalsaTekila hosted by idexio. In the STA #32 Twitter space, @SalsaTekila shared valuable insights on transitioning from video games to trading competitions. The discussion highlighted the importance of emotional control, risk management, and leveraging technology for successful trading. Networking, continuous learning, and portfolio diversification emerged as key strategies for traders. Staying informed about market trends, regulatory changes, and maintaining a disciplined trading plan were emphasized. The space provided a comprehensive guide for traders looking to excel in competitive trading environments.

For more spaces, visit the Trading page.

Questions

Q: How important is emotional discipline in trading competitions?

A: Maintaining emotional control helps traders make rational decisions, avoid impulsive actions, and manage risks effectively.

Q: Why is networking within trading communities beneficial?

A: Networking allows traders to share knowledge, insights, and strategies, fostering a supportive environment for growth and learning.

Q: What role does risk management play in successful trading?

A: Effective risk management helps traders protect their capital, minimize losses, and optimize returns over time.

Q: How can traders leverage technology for trading efficiency?

A: Utilizing technology tools like @Arbitrum Orbit can enhance speed, accuracy, and automation in trading processes.

Q: Why is market analysis crucial in trading competitions?

A: Analyzing market data helps traders identify trends, patterns, and opportunities for strategic decision-making.

Q: What are the benefits of diversifying trading portfolios?

A: Diversification spreads risk across different assets, reducing vulnerability to market volatility and unforeseen events.

Q: How can traders adapt to changing market conditions?

A: Adapting involves continuous learning, flexibility in strategies, and being responsive to new market dynamics.

Q: Why is staying informed about regulatory changes important for traders?

A: Being aware of regulations helps traders comply with legal requirements, stay ahead of industry trends, and protect investments.

Q: What are key elements of a robust trading plan?

A: A strong plan includes clear goals, risk assessment, entry/exit strategies, and ongoing monitoring and adjustments.

Q: How can traders balance trading flexibility with adherence to a plan?

A: Balancing flexibility and discipline involves being open to opportunities while staying true to the overarching trading strategy.

Highlights

Time: 00:15:42

Importance of Emotional Control in Trading Discussing how emotional discipline impacts trading success and risk management strategies.

Time: 00:25:18

Networking for Traders Exploring the benefits of networking within trading communities and building professional relationships.

Time: 00:35:50

Risk Management Practices Highlighting the significance of effective risk management techniques in trading competitions.

Time: 00:45:14

Utilizing Technology in Trading Exploring the role of technology tools like @Arbitrum Orbit in optimizing trading efficiency.

Time: 00:55:29

Market Analysis Strategies Understanding the importance of market analysis for informed trading decisions.

Time: 01:05:17

Portfolio Diversification Benefits Explaining how diversifying trading portfolios can mitigate risks and enhance overall performance.

Time: 01:15:40

Adaptation in Trading Discussing strategies for adapting to evolving market conditions and staying competitive.

Time: 01:25:55

Regulatory Awareness in Trading Emphasizing the role of regulatory knowledge in ensuring compliance and informed trading practices.

Time: 01:35:22

Essentials of a Trading Plan Outlining key components of a comprehensive trading plan for long-term success.

Time: 01:45:07

Balancing Flexibility and Discipline Exploring the art of balancing adaptability with adherence to a structured trading approach.

Key Takeaways

- Flexibility in trading strategies is key for success in trading competitions.

- Understanding market trends and analysis is crucial for making informed trading decisions.

- The importance of risk management and maintaining emotional discipline in trading.

- Exploring innovative platforms like Omnichain Perpetuals DEX can enhance trading experiences.

- Leveraging technology such as @Arbitrum Orbit can streamline and optimize trading processes.

- Continuous learning and adaptation are essential to navigate dynamic trading environments.

- Engaging with trading communities can provide valuable insights and networking opportunities.

- Developing a robust trading plan and sticking to it contributes to long-term trading success.

- Exploring various asset classes and diversifying trading portfolios can mitigate risks.

- Staying updated with regulatory changes and industry news is crucial for trading proficiency.

Behind the Mic

Initial Interactions

Yeah. Yep. All right, perfect. I can hear you now. How’s it going, mate? Is there a way to make yourself push to talk? I want to be pushed to talk. I don’t think so. I think it’s only by, like, clicking on it. Okay. Yeah. Kind of still in development, actually. Spaces is. There’s so many things they can do to make it better, but I don’t know how much they care about it. Probably a lot. If someone asks push to talk, it’s not hard to make, but I realize you can mute yourself, so that does the job. Yeah. At least we got that. All right, we’ll give it, like, another minute. Let some people join in. What’s up with you, mate? How’s your day?

Daily Life and Activities

Good. Just trading, working out, taking care of my family. Nice. Same routine. Are you coming tolkien? I was thinking about that, but it’s so far away from me and I don’t know if I have the energy to just fly again. You’re in the midlands, right? Yeah, I’m in Europe. I mean, I’m in Europe, so, yeah, it’s not that bad, but I just had a trip to answer them. Coinbase invited me and a couple of other crypto people to the Formula one race there, which was amazing. And I just, you know, from trip to trip, it’s kind of exhausting. Yeah. Yeah. Hopefully these will be my problems in life. It’s good problems to have. Exactly.

Welcome to the Show

All right. I think. Jump right into it. Check it. All right. Yeah, I think we can just jump right into it. Well, so, to all our listeners, welcome to another episode of Spill the Alpha. Thank you so much for coming. Really do appreciate it, and we hope that you will enjoy this episode. Today we have salsa, tequila. I’ve been. I’m sure that almost everyone knows who Salsa is. I’ve been following him for actually salsa. You were one of the first people that I followed you, Craig and Don. We’re the first three people that I discovered from CT. Thank that. I didn’t discover some of the fillers and stuff.

Salsa’s Expertise

So, yes, salsa, I think, is one of the best scalpers on CT. I think it’s one of the accounts that really posts some of the best knowledge about just scalping and very clear things, not hiding anything. So, yeah, I think it’s going to be really good one. So, yes, also, thanks for coming, mate. Bro, you’re saying this as I’m underwater for a lot of money, dude, I. Really don’t want to look prices right now. I’m also underwater. Thanks to be here. Glad to be here. Thanks for having me. Yeah, my pleasure, mate.

Engagement with Listeners

I want to remind all of our listeners that on the bottom right corner, you’re going to have a chat icon and you can just click on that. And if you have any questions to salsa, you can just click on that, leave them there. And towards the end of the episode, we’re going to go back to them and go over them. And if anyone wants to jump on the stage towards the end of the spaces and ask of anything on his own. So just request to speak towards the end of the episode, and we’re going to let you guys come on the stage. So, yeah, that’s pretty much it.

Getting Into the Questions

I think we can just jump right into the questions. So, salsa. I heard you in other podcasts and stuff like that, talking a bit about your beginning, but maybe there’s some people who don’t know that. So can you tell us a little bit about your game background and how did you get into crypto? Sure. I said many times, so I’ll try and keep it brief. I was gambling on certain video games. There was some money to be made in the game, and you would sell it for dollars. And for that, I needed crypto. So that’s how I found bitcoin. And the good thing about this kind of ventures was the fact that you needed to think in terms of probabilities, which is something that most everybody who never got used to that are really not capable of doing on a day to day basis.

Trading Journey Beginning

So that means thinking in terms of expected values. And that’s why you see a lot of good traders that come from a poker background. I believe it’s similar kind of thinking where you got to take the bet that provides the positive expected value and you know how to do that. So that taught me this. And then I figured out I should try trading in 2017. When price went up, it was really just pure luck. I had no vision. I didn’t hold any crypto as investment back then. It’s just I got caught up in the uptrend and I got excited. So, yeah, made a bunch. 2017, then I lost it all in 2018, like many. And that was my first rodeo.

Transitioning to Full-Time Trading

All right, nice. And you just started painting in 2017, and you just stuck up with it. Like you fully moved to that instead of continuing with a video game. Yeah, right away, I knew there’s big potential for it, although I even when I basically got washed, like, you know, the meme getting washed, that was most of us at the bottom in 2018, like, flipping from crypto to forex and things like that. So many people got. Got washed, me included. So. But even then, there was no doubt that this was for me, and I wanted to keep trying until I either make something out of it or waste a few years and go back to studying.

Struggles and Profitability

That’s awesome. So, as you started trading in 2017, how long did it take you to feel like you’re starting to get the hang of things and starting to turn a profit? Was there, like, a pivotal moment that made you realize you can do this for a living? Yeah, that was 2017. Even though I was shit and I, like, margin trading was really not for me. I should have never touched it. I lost probably a lot of my profit in 2017, but it’s just every single coin went 100 to 200 x back then. It was way crazier than anything we’ve seen this year. So that’s why I made money. That was the moment, 2017 bubble.

Learning and Evolving

I figured financial markets are awesome, and I want to do that. And then in terms of margin trading, that took a while longer. I realized 2018, I was still losing money. So all the way through 2017 to middle of 2018, I lost money trading on margin, consistently, just dwindling down my crypto coin balances. So you’re losing a margin, but your spot holdings were covering everything up? Yeah, exactly. No, it’s more like, you make a lot of money in spot holdings and then you lose some of it on margin, which is possibly one of the reason, by the way, that when the market goes up a lot, the trading becomes a lot easier because your counterpart is a bit more stupid, like I was in 2017.

Overcoming Challenges

You basically just made a bunch of money, like ten x, and. And you’re giving away 10% of that to the lords of margin. So that was kind of my story with margin, I lost for maybe 18 months, and after 18 months, I kind of stopped losing money. Maybe took two years for me to really be profitable. So when you were going through that process of, like, that one and a half, two years of becoming profitable, what. How did you maintain your psychological side of things? Like, how did you still have the motivation? Because a lot of people, I feel, like, give up very quickly and feel like there is no way out for them.

Mental Resiliency

Yeah. Unfortunately, that’s the reality for many people, in the sense that they don’t have the luxury I had. I was very privileged to be young and to be having my parents basement as the last resort. Right. So there was no stress. It’s not like life or death. It’s just I’m risking, like, two years, and that would put me a bit behind on career path, but like I could always just go back to university. I was like 20 year old. But if you’re a family person you have dependent, then you don’t have that luxury to lose money for two years.

Challenges for Many Traders

So it’s very difficult and you have to quit at some point. I believe that’s what happens to a lot of traders. They never go through that period of grinding your teeth because they don’t have the ability to afford it, which is unfortunate. So for most people, you should not even try. If you can’t afford to lose two years and have a backup plan. That’s my take on that. Yeah, I definitely agree on that. That’s why most people recommend something like one or two years of savings of the expenses you expect and like, yeah.

Significant Mistakes and Challenges in Trading

I would be way more conservative than that, but I’ll get to that later if I think you have more questions. Yeah, well, when you were going through that beginning process of you becoming profitable and like working on becoming profitable, can you share any significant mistakes or any general challenges that you went through in the early days of trading and how did you overcome them? Yeah, the biggest by far has always been oversizing. I like to go all in on a single trade, and I know if I have, let’s say, a certain amount on my margin exchange, eventually I’ll see a bet that I really want to take and I’ll try to maximize my size on it. And sometimes it’s really a bad decision.

Risk Management Strategies

So how to tame it? First of all, I found a way to manage my risk where I only, let’s say, deposit 2% of my crypto portfolio on margin platform, and I trade with that on high leverage and that keeps me from overbetting. And if I really want bigger size, I need a win streak first to build into that size. So that’s the way that I found for myself works. It protects me against myself. And if I lose the 2% deposit, I will at least have a night’s sleep before considering a deposit again, because after a night’s sleep, you’re a bit of a different person.

Managing Risk and Trading Size

So that’s the way I found, and I think it works extremely well. And anybody who’s struggling with risk management, if you just incorporate that, you basically fix it and it forces you to be picky because of the high leverage as well on your entries. And yeah, also the bigger the size you trade, the lesser your edge in general, I would say, because it’s harder to flip around and I do a lot of flipping. So let’s say I open a trade and I have the monster size and then I have to close it, there’s a decent chance that I hesitate to close it where I should really not hesitate because I know that I’m going to lose money from executing that close order, and sometimes the market risks to run away from me, whereas if my size is tiny, the market doesn’t care, it’s just going to close it very quickly and I don’t really lose on the hesitation.

Common Trading Issues

Yeah, and it’s a really good point, especially the part with depositing only a portion of your money to margin exchanges. I feel like the main issue most people have is that most people actually trade with their full balance, you know, like they have their full portfolio on the exchange and they just work with all of it. And I feel like that’s where things can get very slippery and go bad very quickly. Absolutely. Yeah. Well, so your challenges, aside from your experience with interacting with people on Twitter and just talking to friends and other creators and things like that, what do you feel like are the most common or reoccurring issues that other people have, other than yourself?

Lack of Edge in Trading

Yeah, absolutely. This would 100% be a lack of edge. I seen this when I arrived in the prop shop, and I started working with prop shop in 2018, late 2018, and they make us a speech from the start that edge is basically the only thing that makes money. And it’s absolutely true. So an issue that I encounter, speaking with many traders who joined the firm, was confusing different things, and I’m guilty of it as well. So they would have a bunch of different indicators, a bunch of different signals, aggr on the side, mixed with some RSI and some other indicators, and they keep it very noisy instead of focusing one thing that they believe have edge and try to really find edge in that.

The Importance of Focus in Trading

And you can’t find edge if you mix a bunch of different signals and you don’t really have expertise in any of them. You’re basically just trading noise. So I would say, as a general rule of thumb, if you cannot define clearly what your edge is, you don’t have one and you should not put on a trade. How long did it take you to develop an edge? That took at least two years. From the moment, I mean, as I mentioned, I lost for about 18 months. I didn’t really have any edge. I didn’t really know what I’m doing. I just kind of stared at the charts and tried to make sense of order, flow and those kind of things.

Finding Trading Patterns

I’d say after two years, I started developing an edge from different patterns at first. So maybe, I remember I was using a lot of swing failure patterns at the time, which was a popular pattern on crypto, Twitter. I think I helped popularize that. So it’s basically like a stop hunt pattern, and I would mix that pattern with some order flow. So that was one of my first edge. I made a bit of money on that. Although it was not big edge, it did provide some value. So it’s really about finding specific things that provide you value in your trading that you can put the trade on and, you know, you have the upper hand somewhere.

Developing Your Trading Edge

And that took me about two years. From the moment I started trading in 2017, I think I really started having an edge in 2019. So do you feel like if someone is trading right now, you know, one of our listeners, me, maybe, and he doesn’t have an edge, he doesn’t feel like he has the ability to constantly make money with a certain edge, how would you suggest someone starts developing an edge? Just putting in the time, or is there something extra? Sure. So the first step is not lose a lot of money. So obviously, you would only trade a small account, something that you can afford to lose, although you’re not there to lose it.

The Value of Small Trading Accounts

So treat that as your tuition fee, because demo trading is not the same feel, in my opinion. Demo trading is very different from real trading. You need to get the feel for the order book and the way that people can front run and all those beautiful things. So you trade a small account, and then you would try to look outside of the box. So the first thing that you see when you search how to learn trading, is often a bunch of gurus who show you technical analysis lines on the chart. And that’s the very common misconception that it’s the only way to trade.

Alternative Methods of Trading

There’s a billion ways to trade that doesn’t use technical analysis at all. You can watch order books, you can watch the news feeds, you can watch order flow. So I think you have to think outside of what everybody else does. Everybody looks at the same chart. So why would you outperform other people looking at it? What lenses are you looking at the market from? Yeah, I mean, trading with the demo, I agree. I feel like it’s one of the worst things someone can do.

The Importance of Real Trading Experience

Just because I feel like trading with money, that doesn’t make you feel anything is such a huge part because, like. And also you need to get filled. Right. Let’s say you put an order at 56 750 and the market taps 56 749.

Demo Trading and Strategies

Then maybe you got filled on demo, but you wouldn’t in real time. Yeah. Yeah. Well, that’s. That’s definitely something good. I don’t know who popularized the whole demo trading thing. I know that now. Even binance by that have like demo platforms and stuff like that. It’s. Yeah, it’s not a good thing to do. Well, I want to talk more. More about your strategies or edge even kind of thing. We won’t get too deep into the detail, obviously, but have your trading strategies evolved a lot over time, or are there any new methodologies and stuff and tools that you use now that you didn’t in the past or did everything stay pretty similar? Pretty. Pretty same thing.

Evolution of Trading Methods

It changed a lot. Yeah. As I said, I liked swing failure patterns back in the days. Now I use a lot of order books, a lot of news feed. I like to watch how the market reacts to specific news. So you see me post on Twitter stuff like, we need fud to go higher. That’s because the best long setups I’ve seen is often when there’s a lot of fod and the market doesn’t go down on it. So that’s a signal that it’s probably going up. It doesn’t necessarily work the same way on the other side. So you learn some nuances from entertaining those ideas. For example, if there’s good news and the market doesn’t go up, in my experience, it doesn’t work as well as to take the short side than to take the long side on the opposite.

Understanding Market Signals

In order books you watch, let’s say binance futures order books, there’s going to be a lot of spoofing, and it can be a lot of noise and make you take bad decisions if you’re not familiar with this kind of activity. So you need to put the time to develop an edge from whatever you choose to entertain as your path towards finding edge and whatever you choose to use, you must really dedicate yourself to be a master at it. You should not mix different signals. You should focus one thing that you think provides edge and try to be good at it. That would be my advice. And I’m guessing you also journaled quite a lot, right? You were probably documenting all, everything you do and stuff like that? Or did you?

The Importance of Journaling

Not really. Absolutely. I try to write a lot because when I think with words, I’m not as conclusive as when I write. So let’s say you’re trying to write about your trading. You will be able to come back, reread what you wrote, and maybe that will derive another idea that you hadn’t thought of. So basically, you’re more. Your ability to find problems and solutions is better when you’re writing. That’s at least my personal experience. So journaling is very powerful. And it’s not necessarily just about every specific trade. It can be about your trading broadly. Just at the end of every week, once a week. That would be a good habit. You take 30 minutes, you just write about it. How did it go? What do you think you did right? What do you think you did wrong? Did you get stuck?

Reflecting on Trading Experiences

How did you feel those kind of things? You. You may find things that you didn’t know about yourself and your own trading from doing that. And that works outside of trading, too. I found things about different things that I didn’t think of from just thinking. Yeah. Like an emotional kind of journal, not only technical. Yeah. I think it’s. It’s about, you know, I. Finding ideas is, you know, it always starts from the mind, but it’s easier when you put some kind of frame on paper to develop those ideas. Yeah. 100%. I want to talk about your psychological side as well.

Managing Trading Psychology

How do you manage the psychological aspects of trading? Like, if you have a lot of stress or just maintaining the discipline during very volatile periods or just very bad periods overall? I know you love biking. Every time you. You’re stressed. Here we go for a bike ride. Absolutely. Is there anything extra to it? So. So I’d like to. I’ll talk first about, let’s say, 2019. When I was a bit broke, so. So I would. I would over risk. That was one of my. Do you still hear me, by the way? I don’t see. Yeah, I can hear.

Risk Management and Stress Relief

Yeah, I can hear. Okay. Yeah. So back in 2019, I was a bit more, like, I had a lot less money than now. And I risk a lot. I would sometimes risk, like, 10% of my net worth in the trade, which is way too much. But, yeah, that’s insane. I would oversize and I would be on high leverage while doing it. And something I did very often to cope with it was, let’s say I have a high conviction trade, and I take huge size. I would open the trade, set my parameters, and go for a bike ride to let it develop a bit, because I know if I stare at the chart of and I. And I start second guessing myself, I’m going to fuck it up somewhere.

Avoiding Overthinking

So if I have. So you go for a bike ride, you leave. Like, you don’t watch the phone, you don’t watch the cards. I put. I put trading view alerts. So whichever price, let’s say it moves $200 in my direction or against me, I want to pay attention again. I’ll put the alerts and I’ll go for the bike ride. And that kind of helped ease my mind away from thinking about the money that was back then. Now, you mentioned stress. If you ask me now, there’s zero stress because I’m pretty conservative. Earlier you asked, you talked about the two year rule.

Stress Management in Trading

You shouldn’t get into trading if you don’t have two year of living expense. I take it a bit further. I believe you should have at least five to ten years of living expenses outside of crypto. And the reason for that in my case, is because I’m not qualified outside of crypto. With, if the market goes to zero, what am I doing? I might need to go to college. You know, the average person’s, like, cv after trading for a couple of years is so useless. I’m the same thing then a ten years gap in my cv. Yeah. So it’s all about perspective.

Financial Security and Perspective

If you’re, let’s say, a doctor, then, yeah, go ahead, try trading. If you don’t, you go back to being a doctor and you make a lot of money. But I, if you’re like me, you don’t have the qualifications, then you must be a bit more realistic and keep more savings outside of crypto to back you up and your dependence. So I have zero stress right now, basically, because I have that safety net outside of crypto. I know that if I work hard, I can redirect my life if anything happens to crypto. Yeah.

Risk Tolerance and Trading

I want to also ask you about, you said you were risking about 10% of your net worth. Pretty much, for. For any good trade that you find back then. Do you feel it’s. It’s. It’s something that also helped you to. To become what you are today? Or do you feel like it was more of a setback rather than giving you know, the big wins and anything like that? The truth is I. I don’t know. I. I like to think that it was not. I I believe that if I learned the lesson that I learned while doing that without doing it, I would be richer.

Lessons from Risky Trading

But because I learned lessons from doing it and I managed to push the boundaries of my risk tolerance, I think it was not a bad thing. It’s just there’s a way to learn this without going through the losses and the setbacks that I put myself through. I would say in my case it helped, but also it led to financial setbacks. Yeah. Well, so going back to trading, one of the reasons, one of the ways I got to know you and I really started, like, looking at your feed and actually, like, trying to see how, you know, pick into your brain type of thing was after you got really famous and really got to the stage in 2020 when you, I think you took, like second place in a very big trading competition with like 5000 p and l in a week or something like that.

Trading Competitions and Recognition

Right? Absolutely. Yeah, that was wsot. I think it was 2020 or 2019, I forgot. Yeah, yeah, exactly. I turned 0.1 BTC into eight at the time, I think was ten k per BTC. So it’s like one k into 80k or something like that. Yeah. And then you also got like five BTC or something of the prize, which is awesome. Yeah, I shared it with my team, though. Yeah, yeah. I remember the pepper team or something like that. But yeah, that’s how I got to know you. And actually, this is also something you mentioned quite a lot.

Strategies for Small Accounts

Talking about trading competitions with low balances, talking about, you know, trading small accounts, talking about how you’re good at taking small accounts through really big numbers. So you’re known for that ability. And what tips would you give someone struggling with trading small accounts and taking them higher? Well, as mentioned earlier, if you can’t trade a small account up, you absolutely should not size up. Your issue is 100% edge because with a small account, you don’t have a market impact. It’s very easy to execute.

Executing with Small Accounts

So it takes a lot of those kind of stress out of the way, and if you’re not able to make money, it comes back to that question of edge. So basically, we stick to a smaller account. It’s easier, better, and if you can do it with that, you’re probably going to make. If you’re, if you’re trying to size up at first, you need to develop an edge and you need to be able to trade your tiny account up. So you need to be able to generate profit in a small account. And, yeah, if you’re struggling with that, then your problem is definitely that you can’t make money trading.

Finding Your Edge

You don’t have an edge. That’s what I would think, yeah. And it’s funny because you mentioned actually that you very often take small accounts, make them really big, and then usually take a really big haircut after that. Why do you feel that happens? Oh, yeah, that’s definitely because in my case, yes. Also, the bigger size leads to more hesitation at times and it can make you impatient. But I would say you make more mistakes as you grow the account. It becomes easier to be emotional.

Challenges of Growing an Account

And if your size is noticeable by the market, you encounter new issues like slippage. So that would be the case. I made the post. I think it’s pinned in my tweet about the plateau downfall. So basically that kind of depicts it was completely unrelated to trading. By the way, that story, it was a game that the bigger you bet, basically the harder it is to find edge because nobody with the kind of money to call your bets is going to be rich. They’re not going to be stupid, they’re going to be sharp.

Emotional Trading Challenges

So in trading, I would say there’s a little bit of that in the sense that if you move size around, you’re going to be noticeable by the market to a certain extent. So you need to find ways to mitigate that and then your emotions are going to get in the way as well. It’s harder to flip. Maybe the p and l flashing in front of you will distract you from taking the right decisions. Yeah, 100%. It’s something I actually still struggle with to this day.

Cash Out Strategies

If I start growing my account and there’s certain thresholds when I reach them, I can definitely feel how they’re starting to affect my mental state, like whether if it’s getting super hyped about reaching, you know, X and Y or Zed and things like that. So, you know, I have a rule, when I reach a certain number, I just cash out and I go back to where I started. I feel like that’s always helping me. Well, you’re more of a scalper, right? So why do you feel like so many people fail when they’re trying to scalp intraday?

Intraday Trading Challenges

And what tips would you give to someone who wants to go into this intraday trading move and just focus on that? Yeah. Well, first of all, you need to have the ability to go without profits for a while, sometimes even running at the last for a while. Because let’s face it, you have months that are very choppy after trendy months where you might lose some money at the end of the trend, and then you don’t really have an opportunity to make it back for many months.

Recognizing Market Phases

So you need to be able to sit on your hands to recognize the different market phases. And I would say the biggest money to be made in this market is in the uptrends. It goes very fast and everybody kind of makes money around from holding a bunch of coins. Your counterpart is a bit more stupid in the sense that everybody’s printing on holding spot bags and they don’t mind sacrificing a little bit of it. Playing with margin.

Focusing on Uptrends

The uptrends are really easy to trade. And if you can just focus one thing, I would suggest focus on having patience and trading the uptrends and sitting on your hands when it’s not an option. I mentioned earlier that a way that I find useful to detect an option is when, let’s say, for example, there’s very bad news for the market that you would expect the market goes down on and it doesn’t. That could be a hint that it’s time to buy and there’s going to be an option.

Optimal Trading Conditions

So try to focus on uptrends, is my opinion. The market, like now, in September, there’s really no reason you should trade that. You should not waste your energy and capital on that unless you can afford to lose for a very long time and have a painful journey to learning your lessons. Yeah, I mean, it’s a very, this year is a very good example because since April, we’ve been just pretty much standing still.

The Importance of Market Awareness

And every time I made a poll about how are people doing since the beginning of the year with their portfolios, the number of people saying they’re down keeps growing. So it just shows you how much people are getting chopped and, you know, giving gains back in these conditions. Yeah. So really important to know the conditions you should be trading at. Well, I want to touch again back to the competition.

Potential for Future Competitions

So you tweeted last week, I think that you really, that you think you want to try to get into another competition and, you know, try to run that?

Discussion on Public Competitions

Is there a reason you really enjoy those public competitions? And do you think people should, you know, push themselves to trade those kind of competitions, like the Bybit competitions? And I know that Coinbase is launching the competition in their soon. Yeah.

Experience in Bybit Competitions

The first edition of the Bybit competition was very fun because the price pool, it was the first time that the price pool is quite big and the entry barrier was extremely low. So I deposited one k. And the price pool, I think if you’re in top, I think our team finished second and we got like, and I got like 50k or something for it. And the team got more and I had to, I forgot what it was. Net. But basically the payoff was accessible in the sense that it was not heavily botted or whatever was not so many people joining. I would say if you’re looking to trade a small account up and make it entertaining, it’s a good option.

Strategies in Trading Competitions

Like those competitions, for example, WSOT are often incentivized to trade from a small account because let’s say you want to stack a big ROI percent. It’s much easier to do it if you start with the minimum allowed balance to participate. Then if you start with the big balance. So let’s say you’re in a losing straight and you want to just try to get back on your feet with a very small account and try to be profitable and have fun. That could be an option. You deposit the minimum possible and you just play around and you try to make money. So I would say it becomes harder to win those through the year.

Challenges in Winning Competitions

There’s teams that can coordinate together to kind of win and Shenanigan games. People are more used to those kind of competition models, and it’s harder to win basically now than it was before. But I would say it’s fun and I do intend to participate again in those kind of competitions. I don’t see a downside to it. It’s just you should not treat this as a real trading account. Like, if this was your whole account, you would not trade the same way.

Reflections on Trading Practices

Oftentimes what they do is I deposit the minimum amount and I risk it all in one trade. From the start of, I remember you spoke about how I think it was in that competition in 2019 or 2020 where on, like a couple of hours before the competition ended, you almost, someone passed you or something like that with a very big, volatile move or something. Yeah, it was junkie. Junkie, and I think was Mike McDonald’s. We were like top three competing against each other.

Competitive Rivalries

I think there was some beef with Mike McDonald’s team. This is on the personal p and l, right? Or was it on the team? Both, actually. I think our team came just second, just before theirs at the very last minute, they kind of flipped some ROI and the timing, there was some kind of beef with the timing of when Bybit kind of settled the balances and it could have made the difference. Shenanigans at the end. That sounds really fun.

Opinions on Competitions

I really, I never actually participated in any competitions, but I do feel like it’s probably a really good thing to do if you want to, you know, just like you said, have some fun and have the incentive of actually getting extra prizes and stuff like that. I think in the last I’ve seen, I think it was Bybit making some competition something a little bit smaller, not the World Trading series.

Incentives for Participation

And they give prizes to, like, the top 50 or something like that. Like, you really don’t even need to be the top three or something like that. They give millions in prizes and all you need to do is join the team and deposit the minimum and trade, like 50k volume. So there’s some incentive. Like, it makes sense to join. I would say it’s harder to win now than it was back then, but it’s still worth it, in my opinion.

Perceived Value of Participation

If you just deposit the minimum and try to trade properly, there’s a good chance that if you pick the team that wins, you get little crumbs from. From just joining. Yeah, I mean, even those crumbs, you know, you get some money and also nowadays by. But generally they give you some, like, coupons and stuff.

Trading Dynamics

At least you’re going to cover your trading fees, which you’ve already. Yeah, they give you coupons because they want you to go and DG and trade, lose your balances on their exchanges. Yeah, you lost 50k, but here’s. A. Yeah, here’s a $20 coupon. Exactly. So are we, should we expect the Jalapeno Troop 2024? Yeah, I think so.

Expectations for Future Competitions

I don’t know when it’s going to be, but I intend to participate. I don’t see why not. Maybe I do some kind of Twitter alliance. Like, you know, how now it’s only big teams that win and I just want to be in the winning team. So I would say a good strategy would be to just make team as huge as possible.

Team Dynamics in Competitions

Like, don’t try to strategize to win the prize. Just try to have as many people as possible so that your team wins. Just for the clouds. So we need some big accounts who just collaborate together to achieve that. Yeah, that would be fun.

Changes in Trading Environment

You mentioned that trading competitions nowadays are much harder because there’s a lot of different participants are much different than they were in 2019. Do you feel that’s true about trading overall, like, that? It’s much harder nowadays than it was back then.

Current Trading Landscape

And do you feel like the environment changed quite a lot or. Yeah, it changed a lot, but it’s still. There’s still money there. It’s still very fraction and inefficient in some way. There’s like, a different exchange. There’s, like, different exchanges for the same coin, which are effectively different markets, and there’s market makers that kind of bridge them together.

Opportunities in Current Markets

But it’s very. It’s a very unique environment that’s not like you see outside of crypto, I would assume, and there’s money to be made. I don’t think it’s harder. There’s some edges that are gone that I really. That I really enjoyed milking before.

Loss of Trading Advantages

For example, the discrepancies between mark price and last traded, it’s been mostly patched on exchanges. So that was a feature of the different products, and I haven’t seen it since 2020, 2021. So. I would say there’s still money to be made.

Market Perception

Yeah. Yeah. Losing edges sucks. I mean, it’s the same as before, right? Every time the market is dry and difficult to trade, people think that the edge is gone and the institution milked it and all, but really, it’s just a shitty market phase.

Historical Trading Patterns

And you had those in 2018, 100%. And, like, every time we have a big run or something like that, like BTC going up 100% or whatever, so many new things pop up and so many new opportunities for it just come up that you just need to really be active and you’ll find things.

Transitioning to the Last Question

Let me see. So we’re coming to the last question. So if anyone does have any questions overall, if you want to ask, also, you can request to speak, and I’ll let you come and say, by the way, before we move on to the last question, do you actually, did you try to trade Spotify and futures and stuff like that?

Experience Beyond Crypto

Also, I tried to trade forex, and I lost five grand back in 2018. That’s as far as I went. Yeah. That’s my whole trading experience in one sentence.

Reflections on Previous Experiences

I actually, I think in the last two weeks, I’ve seen a couple of crypto Twitter people talking about how they’re gonna try trading forex and things like that, and I was like, oh, my God, 2019 all over again. That was worse.

Concluding Remarks

All right, well, thanks for all the trading questions, the trading answers. That’s really awesome to have. But now, moving to the last question, salsa. What do you think making it is? And do you feel like you’ve made it?

Defining Success

Yeah, absolutely. That would be so. So when I had no money and I was on Twitter a lot, everybody talked about making it and the show materialism. Right. So making money when you have none can easily be your definition of making it, and that’s definitely what I work towards.

Financial Stress and Mindset

So I had the impression that making it was a lot of money because when you don’t have your. You have a lot of stress. It can cause, like, stress and a lack of options. So. So, but. But once. Once I made a decent chunk, my mindset kind of changed.

Understanding Comfort

I’m not Bill Gates, but, you know, I’m somewhat comfortable. I have quite a few years covered outside of my trading. And I’m not. I’m not stressed about money anymore.

Concept of ‘Making It’

So I think making it is trying to be somewhat a good human, which I’m not. Right. Unfortunately, it’s the truth. I’m not really a good human.

Philosophical Views on Goodness

But how would you define a good human? Well, I would say. I would say if you look at different, there’s only one human being in the entire story of mankind that was somewhat like, that was good.

Moral Reflections

And it’s because he has no hypocrisy. So it would be Jesus just because the way he lived was according to what he preached. And, like, if I tell people to be. To be something that I think is my definition of good, that would be hypocrisy because I’m not really good myself.

Pathway to Improvement

So I think. I think those kind of teachings were, he says, like, love your neighbor and try to not be resentful. And those kind of things is the path to becoming better. And if you apply some of this wisdom, then, oddly, I notice my life becomes better.

Stress Management

So I’d say making it is a certain piece where you don’t have the stress related to money at first, and then you figure out that, you know, materialism and all those things is really not it. Like, I don’t.

Cultivating Personal Growth

I don’t really have jealousy towards people who are richer than me or those kind of things. And I strive to just try to better every day.

Financial Stress and Personal Growth

Yeah, that’s awesome, dude. That’s awesome. It’s a really good answer, and I do agree. I feel like once you actually reach, you know, I feel having some money, it really changes your perspective on.

Insight on Financial Stress

We just lost salsa. He’s gone. Let’s just rug this. There you go. All right. You’re like, my job here is done.

Addressing Hypocrisy

I mean, let’s say you take back on this topic of making it like, let’s say you take loving your neighbor, for example. It’s very hard to love everyone and to be good to everyone because, I mean, I’m born in this environment where I would play video games and, like, let’s say you play runescape.

The Impact of Environment

Your best friend will scam you for a rune scimitar. You become very skeptical of people and you start thinking like them a bit, and you become a bit nasty from the inside. But something that helped me was be more family oriented.

Family as a Starting Point

So you can start in your own family by just trying to help them out and to be good to them at the very least. And that’s a step towards being better.

Towards Personal Improvement

Yeah. And it’s really. I really like that. I definitely think that being a good human is a big thing you should do in life.

The Importance of Time and Energy

But I also feel like it’s something that, it’s much. I wouldn’t say easier, but you just have much more energy and time to do it. Once you actually have some lack of stress, like lack of financial stress, you know what I mean?

Reflections on Financial Freedom

So, yeah, I think. I think it’s just. It’s just that when you have financial stress, that’s all you think about at times, because you feel like it takes power away from you.

Challenges of Financial Stress

It takes options away from you. It gives you stress. If, like, tomorrow you get sick and you don’t have medical insurance, then what do you do? So all those little things pile up in your head if you don’t have the money to deal with it.

Relief Through Financial Stability

But once you have the money to deal with it’s not your problem anymore, and you can just move on to move on with your thinking. But really, if you can. If you can realize that it’s not the answer before you even have it would technically be also helpful.

Conclusions on Personal Journey

It’s just for my case to realize that I had to make some money first just to take that stress away. Yeah. We live in a capitalistic society, right?

Societal Focus on Wealth

So it makes sense that this is the main thing we focus on. But then once you have it, you realize it’s not the most important thing.

True Essence of Happiness

And I talked about it in the last episode as well. Well, where, you know, a lot of people think that money will make their. Their life happy and, like, will fix everything.

Beyond Financial Gains

And most of the times when people actually reach that, they understand there’s much more to it. And. Yeah, that’s. That’s how I define it to it.

Conclusion and Takeaways

There’s much more to it. It helps a lot, for sure. It makes. It makes things a lot easier, but it’s not everything.

On Balancing Trading and Life

And it was really an lp as an obsession. But then when you start having a better balance, you realize that you really don’t need to sacrifice as much as your sleep to trade. Like, the market will still be there tomorrow. So I think it helped me, if anything. Yeah.

On Quality of Work and Entitlement

I feel like when I take away in some periods, I know what you mean, because in some periods, I feel like I start putting on too many working hours, but the quality of them starts dropping, you know, and, yeah, and. There’S actually some traps with that and I’m glad you point that out because one of the mistakes that I notice, I do. And again, I realized that from writing about my trading is I felt like the market owes me for the time I put in. And that led to me revenge trading based off of that assumption of entitlement. So let’s say I spend 10 hours on the computer and It doesn’t really go my way. I start sizing up and trying to make up for it by betting more those kind of things. And I’m sure some people.

Realizations Through Journaling

Okay, guys, hear me. I think I’m back. My headset froze. No worries. Yeah. You’re talking about like how you started realizing the issue from journaling it. Oh, yeah, absolutely. So, so spending too much time on the computer is, was counterproductive. Many times you start making mistakes because of the entitlement that you feel the market owes you for your time. Yeah. Start seeing shit, you start forcing trades, sizing up. Like you said, 100% bad thing. If I sit on the PC and I, you know, for an hour and nobody, you know, I have no energy to shitpost or have fun with friends and there’s nothing to do, I just, I’ll just get up and go to the park or something.

Changes in Lifestyle and Responsibilities

That’s something I changed in last couple of years. Like, there’s a time and place for it, right? To put the 12 hours a day on the PC and stuff like that. Now is not the time, that’s for sure. Yeah. When you got dependents, you have to think of them first. So that’s something that changes your lifestyle a lot. Yeah, definitely.

Understanding the Risks of Trading

We have. Let me see we have shrieks asking 99% of day traders lose money. Why should anyone begin trading when the odds are against you? That’s a very good point. You should not. Yeah, yeah, actually I think so, like legit. Most people just couldn’t do it unless you really have the time. And just by eating BTC, like, you really don’t need to trade. I’m not being sarcastic or anything. I like in this conversation, Delta asks me how long it took me to start making money. And my answer, right off the bat, was that I lost money for 18 months at first.

Statistics on Trading Success

so if you’re touching leverage and trying to trade on leverage, you should not. I don’t think it’s 99%. I don’t think it’s that bad. But it’s definitely like 80 plus percent of traders lose money. Maybe, maybe up to 95. But it’s, most people who trade will lose money, so you should not. Yeah, I definitely agree. We have noobver one asking where to start. If you want to be good at reading the order book and tape, I.

Recommendations for Trading Tools

Use trading lite a lot. I like it. It’s pretty good because if you just watch the order book, you don’t really see the sitting orders. And it’s nice to see how long an order has been there for. Is it spoof or not? You need to develop an intuition for it. And for that you need to watch a lot, maybe study it. Trading light is good in terms of newsfeed, you can filter through tweet deck. You make lists of people and accounts that provide news. There’s some service provider like three of alpha and all those like Db tire ten k on Twitter.

Further Insights on Trading Resources

So you can get a decent newsfeed from making lists on x tweet deck. So for news and order books, that’s what I would recommend. Twitter and trading lite does the job. Now, if you want software to help with your execution, well, it can make sense if you get the bigger size. I currently use software called coin routes, which executes for me, and I believe that they might release a retail version soon. So those kind of software are helpful.

Execution Software and Trading Strategy

If you trade bigger size and you’re trying to limit your execution costs, so that can be an option. I think there’s many limit chase type thing. No, limit chaser is shit because it runs the market away from it. I think coin routes is a bit better than that. Just a limit chaser. It’s not very sophisticated. I tried some before and it was not for me. Coin routes is a bit better because it has the ability to also take.

Maximizing Trading Efficiency

So it calculates opportunity costs for me and execute my size. But really, if you’re trading a small account, you should not bother with those software. You should just focus on finding edge. And if you’re trying to trade from the order books, yes, having the order books open is good. And you can visualize with heat maps on trading lights and start from there. Well, we have marusha with us here.

Transitioning from Range to Trend Trading

Marsha, can you hear it? Yeah. Yeah, I was waiting. Very christian. I hope your day is doing well. Yeah, good, mate. Good to have you on. Nice. I wanted to ask you, salsa recently, we got six months of range. What type, how you will adapt when we go out of the range, because, you know, like, it’s been some months, you building some masculine memory of doing the same stuff, but how do you think you’re gonna deal with it once we go outside of the ranch?

Navigating Market Structures

How are you going to redefine yourself a bit to a new trend? Yeah, well, everything’s kind of a trade. That depends what you mean by the range. Like, is it zero to 100k? Is it fifty five k to sixty five k? Everybody defines their ranges in a different way. I kind of don’t think of everything in terms of a range. I know it’s counterintuitive maybe, to some of what people think, but I just.

Conclusion on Trading Strategy

I just buy when I think there’s a chance. It goes like when the odds seems queued in. Oop. I think we lost sauce again. Hello. I think my headset has issues. It’s out of battery and I’ll need to charge it later. But, yeah, what I was saying is I don’t necessarily think of everything in terms of a range. Sometimes there’s trends and I just try to catch dips.

On Entry Strategy and Trading Success

Sometimes there’s downtrends also. And I try to sell the rips. I think focusing on your entries is what matters most. Your entry is basically the reason. The reason that you put on a trade is your edge. And that’s all that matters. It doesn’t matter if it’s a range. It doesn’t matter if it’s a trend, trade. It’s just. It needs to make sense in terms of expected value.

Understanding Expected Value in Trading

So let’s say you think the market goes up $1,000 as often as it goes down $500 and you buy, then that would make sense. So that’s how I make sense of the market in terms of expected value. I don’t know if that answers your question, Maru. Yeah, it does. Don’t worry and give me access to coinwork. I need it.

Coinwork Access and Cost Concerns

Yeah, I’m asking them to make it free because it costs so much money. That’s the reason why I didn’t use before they gave me a try on. I like it and I’m telling them that they should just make it free and try to get a lot of volume because nobody’s going to pay like one. BPS, that’s a very high cost. So they will make a free version soon.

Future of Coin Routes Software

I managed to convince them and you can be sure that I will give you a tour and it will be accessible. I’ll probably shill it. As soon as they have the free. Version, they should just do like other terminal like you do a brokerage. Exactly. Because they can probably. They can because they are basically an institutional software, right?

Target Audience for Coin Routes

So their clientele is, from what I gather is institutional. But I think they will come up with something more retail oriented, which is perfectly fine for guys like me. You don’t need to have the option to trade on bits, them, Coinbase, binance and their bit at the same time. Maybe you only trade on binance so they will make something for retail and as soon as it’s available I will ping.

Wrap-Up and Gratitude

You should be soon. Nice. That’s awesome. And also about what you said about your answer that you give to Mark, to Marutia, it always comes back to just like a lot of times when I’m trading and I’m trying to trade in per day, which I’m shit at very often, your line comes into my mind, which is just lucky. Lucky entries and likely exits.

Lessons from Other Traders

That comes from bitbitcrypto. That was not my line. He kept telling me this at the prop shop and it stuck to me because it makes sense, right? If your entry is your edge, you want to get lucky on the entry, the exit. You should not try to get lucky because if you get a lucky entry, if you’re wrong, you might make money even if you have to close early, right?

Maximizing Trade Outcomes

Because if your entry is lucky, you should not suffer too much from it. You should be pretty precise and you should aim to catch some kind of wick or to be somewhat close to the bottom or the top, assuming you trade mean reversion. So that’s what the lucky entry means for me. It means where your edge is maximized in terms of both opportunity cost and expected value.

Overall Trading Philosophy

So try to get lucky on your entries and then the trading will get a lot better. I guarantee it. You sound like him. Over time I was thinking that the world time I feel like I was listening to him doing, you know, like the usual meeting at the prop. Yeah, he repeats it, but I guarantee you he repeated me this same thing so many freaking times.

Reflections on Trading Experience

And my, I’m a stubborn fucked, like, I will not apply it. I will still spend like ten, do a bunch of mistakes. Like I said earlier, you spend 10 hours on the computer, you feel entitled. And maybe instead of trying to get lucky, you’re trying to get an entry. So you don’t do that.

Final Thoughts on Patience in Trading

If you trade, you need to be patient and you need to wait for the lucky entry if you want to maximize your long-term profitability, this will also help with your quality of life. A lot of trading, let’s face it’s waiting. So try to get luckier on your entries. If you’re struggling, your trading will 100% of the time improve over, let’s say, a month or two.

Life Skills from Trading

You will see the difference. Yeah, I feel like a lot of the qualities you get from being a good trader are very applicable to life. Like you just said, it can literally make you a better person. Like just being, having consistency, having the discipline, you know, patience, things like that.

Trading and Personal Development

Yeah, there can be some parallels, but I wouldn’t say that trading made me a better person. But yes, I see what you mean. There’s parallels to be made. Yeah. Well, I think that’s pretty much it. It doesn’t seem like anyone has any other questions. Let me just double check that.

Closure and Gratitude

Yeah. Well, salsa. Thank you so much for coming, man. It was really awesome to have you on. I think everyone learned a lot from you. Do you have anything else you want to add before we finish this off? I think we covered everything.

Appreciation and Well Wishes

So I’d like to thank you for inviting me. It was a great chat and have a great day if you’re in America, or a great evening if you’re in Asia, or afternoon if you’re in Europe. Yeah, that’s awesome, mate. Thank you for coming.

Accessing Recorded Content

It is our pleasure. And to anyone listening, if you joined in the middle and you missed a bunch or whatever it is, this will be recorded and this will be uploaded to Spotify, Apple and YouTube later on. So you will be able to watch that after we do a little bit of post production stuff.

Final Announcements

Notes will be available on Monday as always. And yeah, thank you so much for coming to everyone. And before we finish off, I just want to mention iDExx did launch their full products last week, so if you are interested to test it out while there’s still different promotions and stuff like that, go check the iDExx discord, you will be able to join right into the chain via depositing from any EVM.

Promotions and Trading Options

Just jump straight into trading up to 20 x leverage. Go check it out. I feel like they’ve done a fantastic job and it’s a really awesome product. So yeah, give that a shot if you want to. You don’t have to. And yeah, that’s pretty much it.

Parting Words

Again, salsa. Thank you so much for coming. Marusha, thanks for coming by asking salsa some questions. And thanks to all the guests for coming. And if you don’t follow salsa, make sure to check his profile out.

Recommendations and Farewell

I do recommend to check out his pinned post about the potoff downfall. It’s really awesome. I remember this day. And yeah, have a nice weekend, guys. Have a good one. Cheers.