Space Summary

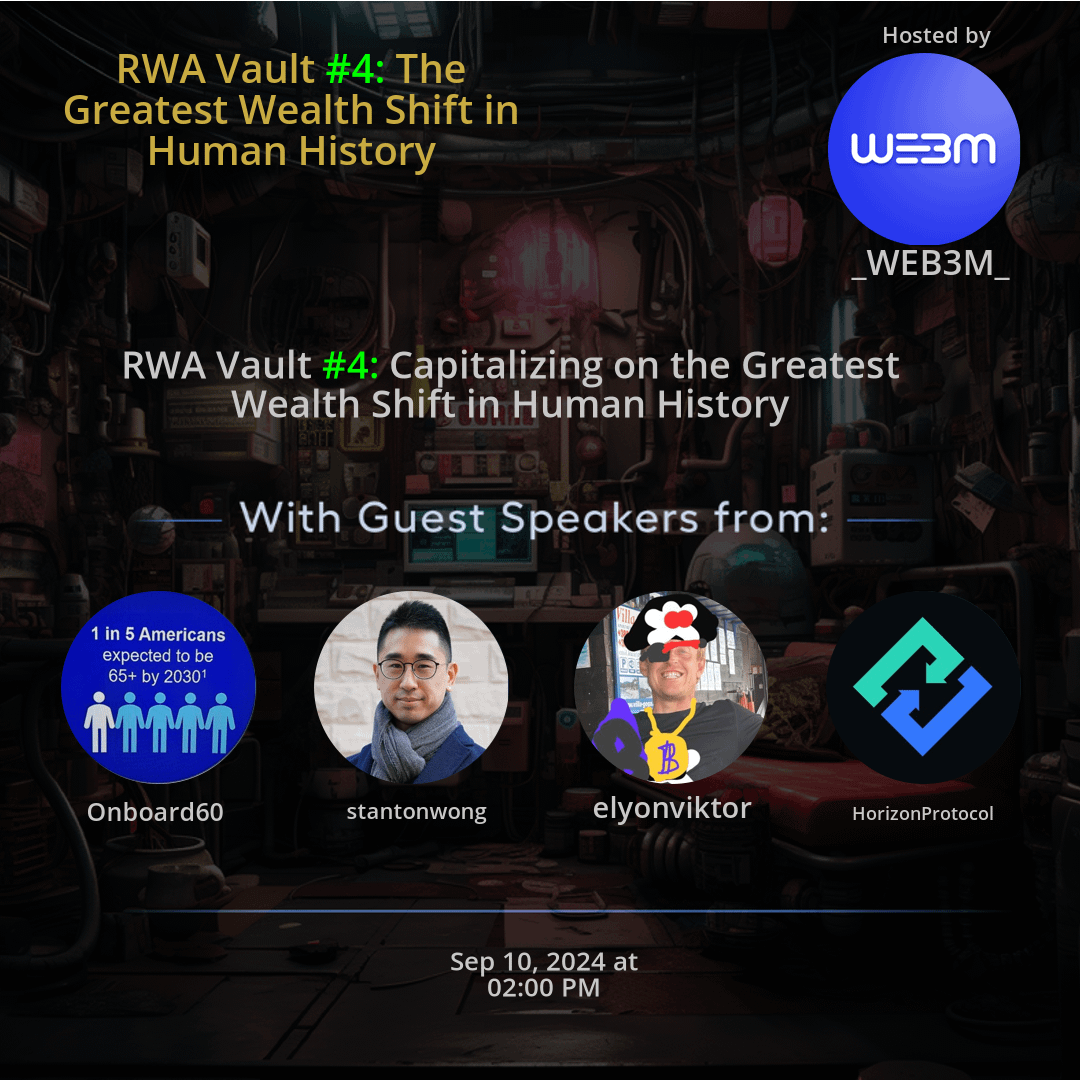

The Twitter Space RWA Vault #4: The Greatest Wealth Shift in Human History hosted by _WEB3M_. RWA Vault #4 delved into the significant wealth shift occurring globally and provided valuable insights on strategies for capitalizing on this transformative period. Discussions emphasized the importance of diversification, financial literacy, and technological adaptation in wealth management. Expert recommendations highlighted networking, sustainable investing, and informed decision-making as key factors in maximizing gains. The space focused on empowering individuals with the knowledge and tools to navigate the evolving landscape of wealth transfer effectively.

For more spaces, visit the Development Agency page.

Questions

Q: Why is understanding the global wealth transfer important?

A: It enables individuals to identify opportunities and adapt to the changing financial landscape.

Q: How can diversification protect wealth during economic changes?

A: Investing in various asset classes reduces risks and enhances financial resilience.

Q: What role does education play in leveraging the wealth shift?

A: Educating oneself about finance contributes to making informed decisions and seizing opportunities.

Q: Why is networking essential in wealth management?

A: Networking provides access to valuable insights, partnerships, and potential investment opportunities.

Q: How do technological advancements impact wealth transfer strategies?

A: Adopting technological innovations can improve investment decisions and wealth management practices.

Q: Why is sustainable investing important in wealth creation?

A: Sustainable practices not only benefit the environment but also contribute to long-term financial growth.

Q: What factors should individuals consider in global wealth management?

A: Geopolitical events, economic indicators, and market trends are crucial considerations for effective wealth management.

Q: How can calculated risks lead to financial gains during wealth transfer?

A: Taking calculated risks based on thorough research can result in significant financial returns.

Q: Why is expert advice valuable in wealth management?

A: Experts provide guidance, market insights, and strategies that can optimize financial decisions.

Q: What role does financial planning play in leveraging the wealth shift?

A: Planning and setting specific financial goals are essential for maximizing opportunities during the wealth transfer.

Highlights

Time: 00:12:10

Global Wealth Shift Insights Exploring the macroeconomic factors driving the significant wealth transfer worldwide.

Time: 00:22:45

Diversification Strategies Discussing the importance of spreading investments to mitigate risks and enhance wealth protection.

Time: 00:33:20

Tech Trends in Wealth Management Examining how technology innovations are reshaping traditional wealth management approaches.

Time: 00:45:55

Sustainable Investing Impact Highlighting the benefits of sustainable investing in wealth creation and environmental stewardship.

Time: 00:55:30

Geopolitical Considerations in Wealth Management Analyzing the impact of geopolitical events on global wealth trends and investment strategies.

Time: 01:05:10

Expert Panel Advice Gaining insights from financial experts on navigating the wealth transfer and optimizing investment opportunities.

Time: 01:15:40

Financial Planning for Growth Tips on effective financial planning to leverage the wealth shift for personal and professional advancement.

Key Takeaways

- Understanding the significant wealth transfer happening globally is crucial for seizing new opportunities.

- Diversification across different asset classes can help in safeguarding wealth during economic shifts.

- Education and awareness about financial literacy are vital for individuals aiming to benefit from the wealth transfer.

- Strategic investments in emerging markets can lead to substantial financial growth and wealth creation.

- Networking and collaboration play a key role in accessing valuable insights and opportunities in wealth management.

- Adapting to technological advancements and digital trends is essential in navigating the changing landscape of wealth transfer.

- The importance of sustainable investing practices in contributing to wealth creation and long-term financial stability.

- Considering geopolitical factors and global economic trends is necessary for making informed decisions in wealth management.

- Taking calculated risks and being open to innovation are key factors in maximizing gains during the wealth shift.

- Seeking expert advice and staying informed about market developments can aid in making sound financial decisions.

- Financial planning and goal setting are crucial steps in leveraging the wealth shift for personal and professional growth.

Behind the Mic

Introduction

Hello, everyone. Let's get this space started. I think we have all our speakers here. Welcome. Welcome. I was planning to let that music roll a little bit longer. What do you guys think? It's form PM Ben starting right on the dot. We've got Ben up. Nice. For some reason, it's still showing Ben as a speaker on my screen, but, like, I can hear him, which is the important thing. Is Sku up as a speaker. Still a listener. Inviting. Yeah, I'll invite him now. Just a second. Amazing.

Opening Remarks

How are you doing today, Arjun? Can you hear us? Can hear you loud and clear. Doing very well. Very well. Okay. Hope you didn't bring any of the riff raff running the orderly network official account. Hope you didn't bring that intern into the space. Comes with me by default. Like a shadow, in fact. All right, well, we'll make do. If he starts to unmute himself, we'll have to take action. All right, let's get this thing rolling.

Intro by Ben York

As many of you know, my name is Ben York. I've been the ecosystem stalwart here at Wu for the last four years. A lot has changed, obviously, and one of our strongest ecosystem partners, a project we incubated, orderly network, is joining us here today to talk about, well, a few different things, but maybe go back through the background of what's happened thus far and then looking forward to how they're actually going to bring some more real innovations to the space on the defi side. And because we don't want to entirely bore you with a space talking about how innovative we are, we've also brought along a friend, Skew, who is in a trader by trade, and he's going to talk us through some of the trends and things he's seeing in the market, and we're going to tie it all together into a nice, complete bow. What do you guys think? How does that sound?

Discussion on Innovations

I like it. You're at the ship, Ben. Lead us to where we need to go. All right. I'll stand up here on the mast with my bidoculars and guide us to the promised land. We can do a little Titanic thing if you want as well. I can stand behind you if you want. That would be fantastic. Make an epic photo for the upcoming quarterly report. We can put it on chain. We can sell some nfts. Love it. Love it. You said you were going to come on here and riff. I didn't know you'd prepared your own joke, sergeant. No comment.

Introducing Arjun

All right, let's just bash out some intros then, while we're here. I kind of did one on my own there. So I'm now going to pass it to Arjun. And then from Arjun we'll go to SkU and then finish with big George. How does that sound? It's good. Hi, everyone. My name is Arjun Arora. I'm Coo at Orderly Network. I've been with orderly network ever since were incubated by the fantastic team over at Woox in keep me honest, Ben, late 2021, I want to believe. Prior to that, I was working hand in hand with Ben on the ecosystem side over at Woo and focused on Wufi as well. And prior to that, I was running business development and ecosystem teams at Google.

Skew's Introduction

Skiw. Hello. Hello. How is everyone? We're doing good, sir. Thank you for joining us today at short notice. Totally fine. I mean, I always like doing this. Space is quite fun, you know, it's like interactive. You get to talk about new products being built and you get like a good sense of where the industry as a whole is kind of heading to, which is like always really important. Especially for, you know, our bags, because everyone wants our bags to go up. So we need to build and create cool things, which is, I think it's going to be the next year.

Looking Ahead

It's going to be big innovation. At least I think so. Yeah. A little bit about myself. Everyone knows me, more or less is the CT, quant or trader. But yeah, behind the scenes I do a lot of coding and building a. So I'm actually very into Dexs and Defi. Have been since like 2020. and yeah, I'm looking to also build some cool stuff next year along with Wufi and others. Awesome. I can't tell you how happy I am to hear that. You got my bag's best interest at heart. They definitely need likewise. All right, and we're going to finish off with Big George.

George's Contribution

Yeah. Hello. Yeah, thanks for having me here. You know, it's great to be here with some of the, you know, some of the people that I, you know, admire the most. You know, Skew and Ben. My name is George. I'm the growth leader Wufi. I've been with Wu for about. Just over two years now. And, yeah, I do a little bit of everything. Write content, you know, organize campaigns and occasionally hop onto spaces like this and get to chat with some great people. So, yeah, really excited to get into it today and hopefully give Arjun a good grilling and figure out what it is that they're up to over at Audley these days.

Social Banter and Humor

You know, for Ben, I don't know if you thought this as well, but for a long time, I thought George's full name was just Big George. I've never seen anyone not call him Big George, so I just thought that was his name. Yeah, we actually dug deep into that in a previous spaces with arbitrum, and apparently it was a schoolboy nickname as well. Something to do with the size of his head. Understandable. Met him in person, so. Very understandable. I'm not really sure what to say about that, but I'll take it on the chin.

Agenda and Updates

All right. Sure, there's some puns there, but we'll skip ahead. We have a pretty packed agenda if we hit it all, but I don't think we will. So maybe a good starting point then, just to get people up to speed. I'm sure everyone's been following a lot of that's happening around orderly, especially if you are a member of the woo ecosystem or the orderly ecosystem. But, Arjun, maybe you can just get us up to ground speed. Give us the 62nd rewind on what you've been doing for the last three years and how we got today. 62Nd rewind on the last three years is a tricky one.

Arjun's Summary

You have 55 seconds left. Yep, fair go. All right, where should we start? So, 2021, late 2021, incubated by Wux. Moved from there to our fundraise, closed the fundraise, $20 million by February, March 2022. Built out the first iteration of orderly. And I would probably just add as a Spratly. And for those that don't really know it, the vision of orderly is to be this, like, permissionless liquidity layer for all web three trading. So we built out the original version, which was actually both spot and perpetuals on near.

Growth Overview

I would say probably were responsible for more than 80% of DeFi protocols in the near ecosystem, integrating with us from dexs, sexes, wallets, play to earn apps, et cetera. Moving swiftly throughout our journey on Nier and aligning towards our more bigger vision is really being this omnichannel trading infrastructure, unifying liquidity across blockchains. It was important for us to think bigger and grow bigger. So, moving from there, we therefore then created Audley Omnichain, or our orderly EVM version, if you will, which effectively is our own chain custom built layer two off the back of an op stack.

Technology and Performance

It leverages Celestia for data availability. I believe with something like more than 30% of all congestion or all data availability on the Celestia network, we leverage layer zero for cross chain messaging from our chain to other layer zero integrated chains as well, almost acting as if a settlement layer. I think we're probably the second largest protocol on layer zero, second to stargate. We're probably responsible anywhere for between sort of 15 to upwards to 30% of all messaging on layer zero. We launched the official orderly omni chain version in November 2023.

Recent Achievements

And since then things have been growing. We have more than 21 plus protocols built on top of orderly. There's an additional 1520 plus more in the pipeline just for the next four to six weeks. And since then, we've just been growing rapidly, whether it's trading volume, whether it's amount of users and so forth. So since that November moment, we've done more than 81 billion of cumulative volume across more than 425,000 accounts with, you know, 300,000 plus unique wallets as well. We tge'd. Last week was one of the largest events for us in terms of TgE.

Future Plans

And now we. Since then, the last however many weeks, what is that? Three weeks? I guess since TGE has been just a blur, you know, in terms of what we've been doing, 25 plus different exchanges for spot and perpetual listings and then. Yeah, I think that was a round. Trip in 5 seconds time, 60 seconds on the dot. Well done. Was that all right? Perfect. Perfect. No, that's great. I'm just. I'm going to dig in a little bit on that. Arjun, if you don't mind. You mentioned you're one of the biggest apps in layer zero.

Layer Zero Insights

Also. Also a title that Wufi holds as well. What are most of the messaging doing on layer zero? So in order for us to be like a true omni chain platform, allowing users to come to deposit and withdraw from the chain of their choice, we're really pro chain abstraction very much through the thought process of the team at Wufire and their ambitions in terms of being able to allow users come from the chain of their choice for us, because we have our own settlement layer, as I mentioned, the settlement layer effectively talks to our matching engine and order book and puts every single trade on chain.

Real-Time Updates

We then have to update trades, user balances, deposits and withdrawals in real time. So we leverage layer zero to send messages from our chain, the Audi chain, up to the deposit chains and those asset management vaults, every single block. Fascinating. All right. And you mentioned your 30% of the data on Celestia. I guess the TS stakers are pretty happy with their airdrop, were they potentially.

Discussion on Celestia and Data Availability

Can you talk a little bit about how you use Celestia as well? Because just. I'm sure there are people out there, the space like me, that, you know, they hear these terms data availability celestial all the time, but they could really use a very short and easy to understand version of that, how projects are actually using it.

Exploring the Ethereum Ecosystem

Yeah, I wish I knew, Ben, if I'm honest with you, I thought were just going to come and riff on the. Riff on the tool. I'm just a BD sales monkey. I'm not the product guy. No, look, long story short, were leveraging mainnet Ethereum, realizing gas costs are too high. Understanding the benefits of data availability partners like Eigen Layer and Celestia. Celestia allows us to be able to do that and still be secured by Ethereum in a more cost effective way. So we decided to push in that direction.

Transitioning from Near Protocol

Can I also ask a question as well, Ben? I just think about this. You mentioned Arjun, about being like 80% of the volume back on near in the day. Do you guys ever talk about what orderly might be like now? If you guys hadn't made that transition away from near, do you think you would be in the same sort of position of success with this 80 billion cumulative volume and the 420,000 plus accounts if you guys had stayed over there? And then maybe like as a segue from there, we can talk a little bit about like maybe other chains as well that like you guys are maybe currently eyeing up.

Vision for an Omni-Chain Future

It's a good question, right? So as I said at the start, the goal and the vision was always to be this permissionless liquidity layer, fully omni chain, abstract the chain away from the user. At the time, there weren't obvious solutions. There wasn't as many sort of roll ups or layer twos coming out that was relevant for us. So we did what we thought was right at the time and we still think that was the correct decision. But as we want to explore a more omnichannel future, we had to go out and build our own chain.

Challenges with Near Protocol

Nier is fantastic in terms of speed, reliability, security, but in terms of being able to go fully connected to multiple different chains and allow users to be able to deposit and withdraw freely without bridging, without wrapped assets, without waiting whatever the transaction time would be for block confirmation, it just doesn't make sense for our, it didn't make sense for our future. So we had to go up and spin up our own chain and leverage that as a settlement layer. The near version for spot and purpose still continues to work, but the mind share sits in the EVM ecosystem, so pushing towards that was essential for us but again, I don't want to contradict myself.

Managing Stress in a Growing Team

You know, we are. We do want to be fully omnichannel. There will be things coming up in the future that can bring EVM and non EVM vaults into one unified order book powered by orderly. Nice. Yeah. Good response. And maybe one more question for me as well, because you've been, like, one of the longest serving, like, team members. Right? Orderly. You were there from, you know, like, the birth of the protocol. What do you think has been, like, the most stressful moment, like, in all the time that, like, you've been there?

Stresses Related to Protocol Development

Oh, God. So hard to. Yeah, so hard to pinpoint when there's been so many. You know what? It's probably not too different to crypto cycles. We have, like, internal bull and bear cycles, and the stress comes up and down through those cycles. Some of the early days of just, you know, even with Ben as well, like, trying to figure out what the strap line would be on the original 1.0 website or trying to figure out something very basic. These were stressful times because we didn't want to make any mistakes, and the original messaging was so important.

Complexity of Technical Narratives

Other areas have been trying to get our narrative right. It's a very complex and technical tech stack. Retail audiences can, depending on the audience, if they're not trader friendly, they need a very easy version to resonate with and understand and compare it to that. That has also been very stressful across times. And then, you know, as we position and we pivoted and created the omnichannel version was also stressful. I would say the stress is probably more reliant on deadlines with the tech, working with the roadmap, understanding the market.

Daily Challenges with Team Dynamics

TGe, of course, is an exceptionally stressful but enjoyable time at times as well. Ben is probably in my DM's about 45 times a day, 24/7 telling me that we're doing something wrong and that we need to adjust something that can often be stressful. I actually have, like, you know, like, on a. IPhones, you can, like, put a timer on for how much time you can spend on, like, Instagram and stuff like that. So you don't. You're not doom scrolling. I got a timer on my telegram so that I just don't talk to Ben all day, just. Just to manage my own personal stress levels.

Finding Balance Amid Challenges

So, yeah, stress comes in different waves. I would also say enjoyment and satisfaction comes in waves as well. So it's all about balance, right? 100%, yeah. Because you can't have, like, the good times without the bad times. You know, the bad times are the ones that make you appreciate the better times. Our struggle defines us as some might. Say, you can't have a rainbow without some rain. Hey George. Absolutely, brother, right?

Reflections on TGE Experience

And skew. Feel free to ask any questions you want as well. As you can tell, we're just riffing at this stage, but maybe just to keep pushing things along, I mean we could talk a little bit about the TGE and how that went down. Maybe it started off, you could just maybe give some color into like how your life has changed pre TGE to post TGE. Honestly, nothing has changed. We're still pushing 24/7 most people would think there's more of a magnifying glass to have more urgency.

Maintaining Urgency After TGE

But the truth is as a team we work with the utmost urgency. We're trying to find and execute on the things that have the best impact for orderly as a protocol over an exceptionally long period of time. It's more of a continuous build it and they will come style ethos if we continue to ship and build a fantastic product that creates a flywheel effect. Right? Better product, better liquidity, more brokers, more community members. All of these things turn into more trading volume turns into more rewards for orderly stakers, more rewards turn into higher APY, more buy pressure and so on and so forth.

Evolving Responsibilities Post-Token Launch

Awesome. Yeah. I'm trying to not grill you too much on the token side of things, but I mean, I guess now you're probably doing a lot more listing AMAs and token BD talking about which exchanges you're going to partner with. Obviously that's not new or obviously that's new, right? Yeah, that's new there. I mean now that the token is out there and it's liquid, there's so much that we can do with it. There's so much that we're pushing to do with it.

Utility Expansion for the Token

So many different use cases driving more utility for the token. Again, the ethos of Audley is being Omni chain and chain agnostic. We're not a quote unquote adding your random layer one layer two chain specific token where we can only do things in that ecosystem. We're working with every single ecosystem where we're figuring out more utility for the token, more use cases, more liquidity on those chains as well. It's a constant push, but it's actually enjoyable because we're not stuck to a specific chain.

Objectives for Future Growth

I've got a real stinker of a question for you, Arjun. If I do ok, have you guys just paid me to come into this pool. Ok, so hear me out. So if you look back at like for instance, like you're doing analytics and you look at the volumes and user activity that you guys were seeing, like, let's say like in the real mania phase of like orderly merits, and I think, you know what I'm referring to, there was a period where, you know, volumes were literally just going parabolic and I think even I felt a little bit euphoric just like just looking, you know, at that dune chart.

Anticipating Future Volumes

And I think what my question is, do you think in the future you guys will be able to, you know, effectively bring back those glory days and maybe even beat them? You know, Senna's like volumes higher, those fees higher, because at one point you're making like a hundred as well as like 100k in dollars a day in fees, right. From all of, across from all of these different Dexes built on you, are you gonna be able to do that? And if so, like what do you think in your position as CoO is going to be the catalyst or the tool that sort of gets you guys there?

The Path to Future Success

You finished with that one, George? That's my stinker. Over to you sir. Oh ye have little faith. Come on Arjuna. Yeah, it's an easy one. George. We are not here and I forget and I'll get grilled for this. I can't remember how many epochs it was. Twelve with an extension of four potentially. For me, a 16 week period that is driving awareness and incentivizing users, potentially airdrop farmers as well, is a drop in the ocean in terms of were not building a protocol for 16 weeks worth of activity.

Long-Term Vision for Building Protocols

Right. Were building a protocol and Im going to sound like Im exaggerating here, but were building it over a multi decade piece here. Right. The merits campaign was an exceptionally small element of what were doing at Audley. The vision is not about executing against a specific cycle and making hay whilst the sun shines. I actually think the, to your point, not my words, the euphoria of the 700 million billion dollars plus days is a drop in the ocean to what our true vision is over the coming years.

Building Brand Confidence in the Long Run

I truly do believe that it will be a drop in the ocean. I think there are multiple different catalysts that will drive that, for us doing that, continuing to create orderly as a brand, where again, quote unquote powered by Audley, is a safe haven for users. So users can sit on any chain of their choice, on any Dex or DeFi protocol of their choice. And if they see that powered by orderly stamp, they feel confident in the liquidity, confident in the security and the risk that they're taking to be able to trade.

The Importance of Community Engagement

And I think that takes years and years of brand building and community building to showcase that. And I think when we get to that point, we will be at the very top of that list in terms of volumes. And I think as we see a shift over again, a multi-year, multi-decade approach, where DeFi volumes hit that inflection point and exceed traditional finance volumes, which, let's just say we are all in this space to see DeFi overtake traditional finance volumes to some extent, then a billion dollars per day is not even close to good enough to what our expectations are.

Confidence in Future Trends

So, yes, I do believe we're going to be seeing 100, 200, 300 plus builders, brokers on top of orderly. I feel users will find an exceptional confidence in the powered by orderly brand, and they will go to the chain of their choice, on the venue of their choice, knowing that they are safe to be able to trade on orderly liquidity. And I really do think that is not a million miles away. I do think there is obviously an airdrop meta in place that could potentially have helped the Defi ecosystem for perpetuals in general.

Long-Term Expectations for the Ecosystem

But when we see more of these protocols, TGE and those users leave those more weighted protocols, and they decide to go where the best liquidity is, where the best fees are, and where they trust the security of the protocol, that will eventually even out and orderly will come out on top. Wow, doctor, you know, no one is bullish enough. What's that phrase that you always say, Arjun? I feel like you murmur this in your sleep.

Community Spirit and Merchandising Ideas

Soon everybody will be an orderly. I feel like you should get that as a tattoo, or someone in the orderly community should get that as a tattoo. All right, we can go to the tattoo parlor together when you get the big George tattoo, and we can make it happen. Deal. You know what you could do is create some merch with that slogan and then give it to, like, stakers or big users of orderly. That'd be pretty cool.

Exciting Developments in Merchandise

Like, merge, drop. I like that. I tell you what, though, this is some alpha. In fact, actually, we have some really cool new merch coming out. Ben will know. Obviously, I'm a big. It's very rare to see me not wearing an orderly t shirt, especially the retro 2020 ones that I think Ben actually maybe even helped design. And they were terrible, but I still wear them all the time.

Community Appreciation for Merchandise

I did. I did. We have some super cool stuff as well. Some stuff coming for the community. I think the community actually on the orderly side just received a bunch of our ambassadors have just received some fantastic merch as well. But skew. Yeah, I love the idea. Soon everybody will be on Audley Merch will definitely be coming.

Future Merchandise Ideas

Yeah, sounds cool, Mandy. Yeah, it'd be nice to see some original orderly merch instead of just copying the previous year's woost. Never mind. Not going to roast you on that one. And maybe a sir Otterly plush. You know, if you could get out a little plush. I think that's already out. Shit. Is it? Yeah, I saw one the other day.

Merchandise Distribution

Why don't I have one of these? I saw one the other day. It's a giant one. Storage, you'd get on the mailing list.

Market Buying and Deployment Plans

God damn. I need to start market buying. Hang on, give me 1 minute. Deploy funds, George. Deploy funds. I actually saw some custom Hermes leather Nike dunks with Sir Ottilie on them, so those will get seen very soon as well. Incredible. Okay, good stuff. Why don't we move ahead to the second part which talking about what's coming next, right? So obviously like perp Dex is a pretty, it's not that innovative of a defi advancement, right? Like obviously there's much more things that you guys are planning to build on top of this super chain, I guess. So maybe you could talk a little bit about the direction there, Jin. And how you see the product moving along and pushing forward.

Discussions on Innovations and Future Developments

Repeat that to me again. Blade. I got it cut out a bit. I heard super chain and then Arjun. Yeah, that was it. Now basically just the first iteration here is perpetuals. It's not that innovative. There's a lot of perpetual dexes. What are you guys building? What are you guys cooking up? That is going to really differentiate orderly for users of Wu Fi pro the innovation here that they can look forward to. So there are lots of different pieces. Like I said, I would question that you say it's not that innovative because the autolytextack is very innovative and very detailed and has taken many years to build out. But one thing that I am excited about is supporting non EVM chains as well and having one true EVM non EVM unified order book settled by orderly chain.

Expanding Collateral Options and AI Integration

That to me is super exciting. Probably in the next five to eight weeks, we'll see our first deployment of a non EVM asset management vault. So users in that ecosystem will be able to natively deposit and withdraw the collateral on that chain. That's dragon chain, right? Dragon chain being part of that. Yes, you could be correctly right. I don't know if that's been leaked, but I mean, maybe it hasn't, but I definitely won't be getting in trouble for leaking that as well. I think diversifying collateral options right now, it's native USDC expanding those collateral options, very similar to what you would see on centralized exchanges where they can use different assets for margin. So BTCE, Sol, different asset types, yield bearing, stable coins, rwas and so on and so forth. I also think that we're up to some interesting things in the AI space that can definitely move the needle in terms of AI powered trading with AI agents and more efficient, streamlined trading opportunities.

AI and Its Impact on Trading Strategies

You could think of it as social trading, if you will, but with more robust non manual inputs from AI agents as well. I think there are many other different areas in terms of strategy, vaults off exchange, settlement, etcetera. By the way, my assistant just handed me a note card. She said that I need to plug the earn vaults right now. The order earn vaults on WX. If you go into wix or centralized exchange, there is an orderly campaign going on now. So if you stake order, you will get order. But it's also interesting that you mentioned AI driven social trading, not because social trading is our buzzword that we just launched yesterday, but maybe you could talk a little bit about how you think AI will impact this.

Market Insights and AI's Role

You just end the question, how AI will impact this? Yes, this. Defi in general, orderly woox on chain trading. On chain trading. So I think it's just a hot buzzword right now. And I think we haven't really scratched the surface and I think many teams don't know how to push in that direction. And I think we're going to see infinite scale when it comes to the possibilities of AI in the future. I don't know whether that takes away from manual traders and that intuition that they have outside of fundamental and technical analysis as well. But I do see it as potentially a very large area that can, you know, catapult defi trading in different ways, like enhancing security, reducing risk, building more transparency for blockchain, improving efficiency, but then specific to like, AI trading, I think like, you know, being able to back test and, you know, develop different models very quickly is very important.

Autonomous Trading and Future Innovations

We're going to be able to, like, I find AI agents in general extremely interesting as they're able to almost create these like pre roots, if you will, and fire off different strategies all at once infinitely quicker and optimized to anything that can be done. On the manual side of things. We had to find inefficiencies and profitability trees by the millisecond hundreds of thousands of times at once. And I think when you can truly unlock autonomous trading, that can probably build some very exciting things in the future. If you want me to leak anything, I probably won't. But there'll be some interesting things coming out this time next week regarding that and what we're doing. This time next. Week, something like that. Maybe Wednesday, Thursday, Friday, I don't know.

Future Announcements and Team Strength

Maybe even the week after. Who knows? Sounds like you got some announcement lined up for token 2049. Your words, not mine, Ben. Okay, big joy. I'm about to pass it off to you. I know you have some questions lined up. Yeah, yeah. I think there's one thing that I can ask Arjun before, you know, we bring SKU in and sort of finish up on some market insights. That's like one thing that I'm aware of and I don't know if everyone is. You guys are building out like an absolute unit of a tech team, you know, like on the back end developers. Do you want to talk a little bit more about this, Arjun? I've noticed this. This is like a backhanded compliment, but sort of like, you know, the orderly all hands, you know.

Tech Team Dynamics and Hiring Strategies

You guys like to do introductions, right, of new team members. And sometimes, you know, it can be a little bit awkward. But I recognize that's because, like, people who work in tech maybe sort of a general assumption, but aren't always the most sociable or outgoing or, you know, individuals. But I. Sometimes those calls are a little bit awkward, but I feel like it's because you guys are just going wild on hiring people on the backend. Like, why is that? And what is it? You know, tell us a little bit about your thinking in terms of just like, building an army of back end developers.

Innovative Culture at Wu Fi

So two things, right? Number one, what you're saying is no one is a box of sunshine like you, George, I assume is what you're saying. Secondly, let me put it back to you guys. Wufi is probably, maybe I'm biased here as well, right? Because I've been a Wu fi user for years. Woofy is probably one of the most innovative teams when it comes to like, research, tech, speed of deployment. How big is the Wu fi team? Yeah, all in all, probably, you know, 1515 people. Yeah. On the tech side, maybe like half of that, I guess. Maybe. I guess two thirds. Fine. So let's say like 1011 people on the Wu fi side.

The Ambitions of the Team

You guys are shipping innovative, doing everything you can, blue chip brand within DeFi across multiple chains. All right. I would probably assume that the majority of DeFi protocols are probably around about that same size. Audley is around 55, 60 plus team members. I would say more than 75, 80% of that is across research and development, engineering product. For us to be able to build a protocol with the ambitions that we have and what we're trying to do, it has to be that if not bigger, back end teams, product teams, R and D teams, front end teams. It really does take an army to be able to do that.

Challenges and Innovations in DeFi

Despite Ben's point that it's not very innovative, I assure you that building an omnichain settlement layer for perpetual trading with the throughput and efficiency that can act like a centralized exchange with the liquidity that can mirror a centralized exchange with a fully chain abstracted use case and an EVM and non EVM unified order book really does take an army. If we do want to go out and do this and meet our vision, putting all of our eggs in the basket of strong product tech and engineering is going to get us there. Wow. Bullish on the orderly dev army.

Transitioning to Market Insights Discussion

If you guys finish cooking me now, are we going to turn it around? That's great. I'd love to hear that. Arjuna. Yeah. What we do now is we transition to the second, you know, the second half of the spaces. And which does not mean Arjun's off the hook. We're still going to grill him on the markets. Absolutely. And, you know, Sku has come on spaces with us before. You know, skew is an affiliate of Wufi. You know, he supported us in the past and he's just like an all around great guy that has provided, like, advice and sort of feedback to us before.

Excitement Over New Developments

But I'm sort of spilling the tea a little bit here and. Yeah, but I feel like, you know, now is probably a great time. Whilst we've got, like, so many, like, I can see a lot of woo, community members here. You know, we are going to be bringing on. I'm really excited about it, but we are going to be bringing on skew in a more official capacity, essentially. Sort of. He's going to be helping us officially test products that we're releasing, give feedback, advise on things that we're doing in terms of strategy and campaigns, and we just sort of help us write content around the product, sort of initiative, things that we're doing and trying to spotlight on what we're up to, and I really cannot think of someone better to sort of be essentially fill that role because Sku is actually going to be the first ever person that we bring on kind of in this capacity.

Initial Collaborations with SKU

And it was like an absolute no brainer. We were like, bouncing ideas about, like, internally, and the first name that came out was his. That's just very much a reflection of the kind of guy that he is, you know, and I really enjoyed, like, working with him in the past, like, yeah, like three months or so and just, yeah, I'm really excited to, I guess, be taking it to the next level. Is there anything that you want to say, skip? Yeah. And like, firstly, honored and very kind words, man. yeah, the past, like three months, you know, working with campaigns and obviously playing around with Wi Fi pro and, like, seeing where you guys want to go.

Strategic Alignment and Future Goals

And I can say I definitely align with that. So I think, yeah, me joining the team is an Abraham. It's definitely along with what I want to do as well. So it's going to be a great journey for the both of us and also the industry, I think, as well, we can cook up some really cool stuff. 100%. Yeah. I routinely say that skew is very much a unicorn in terms of, like, kols out there in Defi, and he truly is like a well meaning individual. So, yeah, really excited to work with you, brother.

Transition to Market Discussions

And also excited to put your brains in the last, you know, in the last remaining bit of the spaces. There's one way that I can sort of bring you in here. I see a segue and that is, you know, one of the things that I remember is that with orderly, there was a point, right, where you guys were planning to do the airdrop actually earlier on in the year. But I believe it was like you guys wanted to sort of wait a little bit, wait for, I guess, better market conditions. I think that was part of the thinking, right, in terms of, like, extending the epochs and sort of pushing it back a bit.

Market Conditions and Future Expectations

And that makes sense, to be honest. Yeah. I'm just kind of thinking about the state of the market right now and there's a lot of doom posting and stuff, right. And people are like, every time I go on Twitter now, it's like another, I just read another doom post. It kind of feels like we're at that phase where it's like every rally is like, doomed to fail. Right. And I kind of want to ask you, Sku, just get your general feel on the market. Like, do you think we are closer now to better market conditions? Is there hope around the corner?

Analyzing the Crypto Cycle

Or do you think there's a possibility that, like, potentially this cycle has been sped up, right? And I've seen a lot of people talking about this idea that I think Defi llama recently covered it and they're saying, like, pump fun has, like, extracted $100 million, like, in fees, right, this year. Like, that's just like what they've taken, right, from their 1% fee that they charge, just like their flat fee. Do you think it's possible that pump fund and maybe other things as well, like friend tech, right? All of these things that have just been extracting fees, extracting value out of the market, is it possible that they've effectively sped up the end of this bull market and that we're almost sort of like, we haven't realized it, but the bull runs over and no one wants to accept it?

Insights on Market Dynamics

I think as a cycle, we all know the crypto cycle, the bull and the bear market, right? This cycle predominantly has been driven by big money. So if we take the spot ETF's that launched bitcoin almost 80% to 90% just in the matter of a few months, from beginning of the year to, I think, March, April. Right. And that's kind of the forefront of what I want to talk about because I think this cycle as a whole is far closer to being more of a institutionalized cycle than driven by retail, like 2018, which was, you know, like a open market, so to speak.

Market Sentiment on East

Right. I think, like, you know, east is probably a good topic here. Like, a lot of people are pretty butthurt about east, you know, underperforming the market, right. Even though it did have, spot ETF's approved and there's been some inflows, but, like, hardly any traction. I think, as a whole, that's because largely this, there's not much focus on it, and the markets as a whole are entirely focused on two key words, and that's rate cuts and also the recession. So when is the recession? When are rate cuts coming? And everyone's focused on that and they're kind of being more defensive about their money. So that's something definitely. I mean, you can see it in the charts, right? It looks very closely to 2019 as well. So in 2019, bitcoin, for example, only went to 14k on a gigantic bounce from three k. So it did relatively very well, percentage wise.

Comparing Cycles

But it wasn't something like 2021. In 2021, you had all that excess capital where everyone was throwing it into assets that were critically appreciating. I think that will come actually. But I think its going to be a lot later than people think. So it could be. I think its more probable to be next year as more people are not financially stressed. So they can actually bet on assets more. Most people are focused on food and rent and stuff rather than the meme coins. However, when it comes to products and businesses, I would say theyre products and businesses, like you know, pump fun and friendtech. Right. So they're more products. Right. So yeah, obviously they will make, you know, a lot of money just based off the fees. but I don't think it really has like a huge effect on cycles.

Impact of Retail Investors

It probably did have a financial hit on retail. Right. So a lot of retail unfortunately lost a lot of money, betting on stuff like meme coins and whatnot. Like that, which is. Yeah, obviously not really how you should be, you know, spending your money. You should betting on like good projects like you know, orderly and Wufi. and yeah, I think the bigger, the biggest cycles to come. Honestly, I don't think this cycle is over. I think we're like very much mid cycle awesome. That's really, that's so helpful because I feel like there's a lot of like, I don't want to say like, yeah, I guess people like me who like maybe struggle to understand the bigger picture of where we are at in the cycle and we just appreciate some sort of like, you know, guidance and actually just some hopium, you know, that everything is in fact going to be okay and that my bags, you know, may potentially resurrect and maybe just touching on eth a bit more skew.

Thoughts on Ethereum

Like do you see that as like, you know, in this like let's call it like an accumulation phase? I don't know if you would agree with that. Terminal as we like look to build strength or whatever before 2025. What are your thoughts on ETh? Because I feel like it's been so bashed this year. There's been a lot of people hating on Vitalik, the ETH foundation calling the chain a literal scam. Do you think that's warranted and would you be cautious longing ETH as opposed to another large cap like Solana? Well, I think with each cycle you get the new shiny chains and coins. They tend to perform a lot better because theres not as much supply overhanging the market and thats obviously a much more positive thing for price with ETH. Theres a lot of bag holders over years in my opinion. Thats probably one of the biggest reasons why it underperformed this year, because a lot of people are just selling when theyre back to neutral, as in no negatives, as in they just close out the position they took in 2022 or 2021.

Market Trends and Future of ETH

So I think going forward, its going to be more about seeing probably two factors, like what the ETH foundation are going to do to bring back more hype, more utility to ethnic, and how theyre going to obviously ship it, as well as the market as a whole. When the market as a whole becomes more positive, and I think global markets start to appreciate thatll be probably when crypto does even more better than it did last year. Awesome. Super helpful. And maybe there's one other question on my mind. I've seen, like, a lot of bears actually talking about this recently. They've been saying, like, the bulls have sort of been sweeping under the rug. The fact that BTF, bitcoin, ETF flows have been negative. We've been having outflows rather than inflows, and not just small ones, but big ones. Right. We had, like, eight consecutive days of outflows. I think it totaled like that. This was just, like, literally in the past eight days, whatever.

Concerns About Bitcoin Outflows

And it was like 1 billion. Is this something that you think we should be alarmed about, the fact that tradfi boomers are selling their spot? Bitcoin? Why is that happening? Why isn't the appetite there? It's a bit of a complicated one. Because equities and you have margins, right, with both, equities and our market as well, like crypto. So when you have these huge holdings, right, it affects the margins of whoever's holding it. So if their equity book is under underweight or performing, like, pretty badly, they have to sell something. And they've probably been selling bitcoin lately, because it's obviously the more volatile asset. It moves more, so they lose more, but they can also make more. So that's kind of like why they like to bet on it. So, yeah, there will be, like, outflows and whatnot. But I don't think it's scary until we're below, like, 40,000, because below 40,000, then, like, I think all the ETF holders are underwater.

Potential Market Moves

And that's kind of where I would honestly be a little bit scared, because, I mean, even then, like, if there is a capitulation, right, it's, like, huge opportunity. It'd be the same as, like, buying in March after the COVID crash. Yeah. I mean, let's hope it does not happen because like, you know, my bags. Yeah, the whole ETF stuff is really fascinating. I feel like maybe a lot of people understand where I come from here. But I thought as well, like when the ETH ETF got approved, I had this sort of feeling or thought that like, oh, you know, all the guys that bought the bitcoin ETF are, you know, they're significantly up right now and they probably have like a very positive feeling towards crypto now, right? Because they're up substantially in profit and they're going to look at Ethereum.

The Transition to Ethereum

They're going to, they're going to think, well, you know, my bitcoin went up, so it's probably likely that, you know, Ethereum will, so I should scoop some of that. And that never really happened, you know, I don't know, for one reason or another, but yeah, I don't have the necessarily the answer to that. Let's bring, you know, to sort of finish things up. We can bring Arjun back into the conversation and kind of get the opinion from someone on the other side of the spectrum. You know, we've got skew the master trader and we've got Arjun maybe on the counter trade, you know, side of wux over here. Arjun, I'm interested to hear if you had, you could only log one coin for the rest of the cycle, right? What's it going to be and why? Tell us and is there a way to counter trade you.

Final Thoughts on Strategy

Interesting. Very, very interesting, George. So that was a complete, that was completely out of the blue. I thought it would be fascinating to throw it at you and see what you come up with. So just basically, any answer I give is to short. It basically is your request. That's right. Can we get, we should get you up on the WX social trailer. I'm sure we could do that, couldn't we, Ben? We probably could, yeah. We've always talked about having just a very retail type of social trader who's very emotional based and longs resistance shorts for support. Could be a good one, ladies and gentlemen. We've got it. So, yeah, go on. I'll let you let, you know now.

Conclusion and Wrapping Up

I could just, I could just. I can't give financial advice for anything related to orderly. So I won't be obviously saying that, especially if you guys want to short it or counter trade, but given the grief you guys have given me, I just tell you. Whoo. And then you guys can figure out that yourself. I like the wild cardinal that's a. Good wise man, Arjun. That's the, that's best I can do because I'm on a work space. So the likelihood that price only goes up and then I'm not going to look like a counter trade indicator. So I think that's a plus EV answer, to be honest with you. I think you found your way out of the sticky there. Yeah. We'll be having words after this one, though, George. That's absolutely for sure. We won't be calling you big George for too long.

Looking Ahead

Ben, do you want to ask any questions or should we look to wrap things up? No, I think we could wrap it up just to kind of go back. Remind everyone to check out the order launch pool on WX. Stay tuned because it looks like the orderly team and their dev army is cooking up a lot of innovations. And I know from talking to you, George, and the rest of the Wu fi team, that we're banging our heads together about how do we maximize having this platform underneath us to where we can build a protocol that really stands on its feet, competes with the biggest ones right now. I mean, obviously you guys have seen the DeFi llama rankings. You know that the hyper liquids of the world, the DyDx v four s of the world, still have a slight advantage in terms of volume.

Innovative Approaches and Gratitude

So what innovation we're going to need to bring on the product side to overcome that. And, yeah, again, just extend a welcome and a thank you to skew for coming on, and I'm really looking forward to his inputs on how we can accomplish those goals as well. Yeah, and Arjun, as always, for coming on with that amazing sense of humor. Even if you were just covering up for things you didn't prepare for. I still always do enjoy the jokes and the quips. No problems. Always appreciated. This was obviously a. A paid guest, Ama, thanks to our sponsors at WoOX. So myself and Stu are looking forward to our ten USDC rewards at the end.

Final Reminders

I should always do the mandatory plug for skew, you know, since he's such a gentleman. Always comes on and obliges us. If anyone is a trader here and they're looking to sign on to a good code, sign on to. Onto woof. I pro and trade. You want to get onto code sku? That's skew. Skew. And what is it? What is it? Skew. It's pretty crazy. No, 45 stand. 45. Geez. 45% off your fees. So remember that one. Write it down for later. Skew. Code sku. Thank you so much, guys, for coming on skew. Arjun, Ben and I thank you everyone for listening in. Appreciate everyone who's tuned in.

Closing Thoughts

Hope you have a wonderful rest of the day wherever you are in the world and we'll see you on the next basis. Thank you guys. Yeah, and it just a note, if you do want to catch the next spaces with Arjun, you won't have to wait long. I believe he's going on with Bing X shortly and there will be about $25 in USDC rewards for ten lucky winners. So definitely check that out if you're looking for high quality audio entertainment. Nice. Thanks guys. Take care.