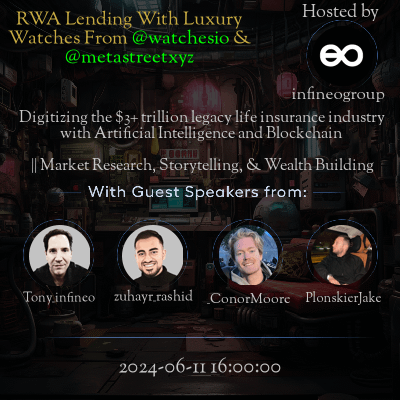

This space is hosted by infineogroup

Space Summary

In this Twitter space conversation, the focus was on tokenizing real-world assets and exploring RWA lending opportunities with luxury watches from @watchesio & @metastreetxyz. The discussion emphasized the significance of liquidity attraction, partnerships infrastructure, and implementing high-yield DeFi lending strategies. Topics covered included the scalability of tokenization, strategies for growth in awareness, and the benefits of delta neutral approaches in DeFi, all within the context of structured credit market dynamics and lending protocols.

Questions

Q: What is the significance of attracting liquidity in DeFi strategies?

A: It is crucial and involves a business development effort on both sides.

Q: What are the yield profiles of DeFi lending strategies?

A: Generally high, ranging from ten to twenty percent.

Q: Are delta neutral lending strategies gaining interest?

A: Yes, they are becoming exciting due to their potential scalability and high yields.

Q: How long might it take for awareness to grow in the space?

A: It may take months for people to become fully aware of the opportunities.

Q: What makes delta neutral strategies compelling in the DeFi space?

A: They offer high yield profiles, especially in stable coins.

Q: What was the topic of discussion in the real-world asset tokenization space?

A: Topics included normalization, delta neutral strategies, and scalability.

Q: What is the projected scalability of DeFi strategies?

A: There is potential for them to scale quite large and become interesting.

Q: What are some of the challenges in attracting liquidity to these strategies?

A: It requires effort from both sides and may involve business development tasks.

Q: How are yield profiles in DeFi lending seen?

A: They are considered delta neutral and offer attractive returns.

Q: How can people stay updated with protocol advancements in the space?

A: Following Twitter handles like metastreez is recommended to stay informed.

Highlights

Time: 00:02:07

Introduction and Anticipation for Key Speakers, Setting the stage and building anticipation for the key speakers.

Time: 00:04:05

Bi-Weekly Real-World Asset Spaces Introduction, Explanation of the recurring real-world asset-themed spaces.

Time: 00:06:18

Overview of Meta Street's Structured Credit Protocol, Insight into Meta Street's approach to lending protocols focusing on structured credit.

Time: 00:12:36

Building Robust Lending Solution through Tokenizing Policies, Discussion on the strategy of creating a robust lending solution by tokenizing policies.

Time: 00:20:10

Utilizing Off-Chain Data for Asset Pricing, Description of how Meta Street leverages off-chain data for pricing assets.

Time: 00:26:41

Transition from Digital Art NFTs to Backed NFTs, Insight into Meta Street's evolution from digital art NFT lending to backed NFTs.

Time: 00:29:02

Exploring Diverse Tokenized Assets, Discussion on the range of asset types being tokenized in the DeFi space.

Time: 00:34:18

Conclusion and Future Plans Wrap-Up, Final remarks and guidance on staying informed about Meta Street and Watches I/O developments.

Key Takeaways

- Importance of attracting liquidity to strategies as a business development effort.

- Infrastructure being built out for partnerships in the real-world asset tokenization space.

- DeFi lending strategies offering high yield profiles like 10-20% depending on seniority.

- Delta neutral lending strategies in DeFi gaining interest for their high yields.

- Potential scalability of DeFi strategies to large and interesting scales.

- Real-world asset tokenization space discussed includes topics on normalization and delta neutral strategies.

- Liquidity-to-strategy attraction seen as a crucial business development aspect.

- Awareness in the space may take months but offers compelling opportunities.

- Yield profiles in DeFi

- particularly delta neutral strategies

- highlighted for their high returns.

- Real-world asset tokenization space emphasized on potential scalability and interest generation.

Behind the Mic

So a few days ago when this hit my radar, I hadn't even thought of it. And it just makes so much sense that you folks have done this. I will admit to being a bit of a watch geek myself, and it's probably a detriment to my bank account that I've stumbled upon your site, but we'll see how that works out. But yeah, look forward to the discussion. I think this is absolutely fascinating what you guys are doing. I don't know why it's got to be a detriment, man. Just buy a watch that's holding its value. Well, that's true. That's true. I guess he means his liquid. Liquid, exactly. But not anywhere. Although I mean that's sort of what you're trying to solve, right? Yeah. Solve for liquidity. That's what we can solve. Yeah, exactly. Yeah. Yeah. It's great. It's super interesting. So I. We're super in the weeds with the real world asset space. As I said, we're doing, we're trying to do similar things and are doing similar things with life insurance. Here at Infinio. A lot of people don't know, but there's a cash value component to life insurance that is often lent against. And so we're building out a more robust lending solution for these policies by tokenizing them. And so we've been keeping up with the common themes in the real world asset industry right now, which really seem to be one tokenizing treasuries and money market funds. And then additionally, people love to talk about tokenizing real estate, but when you look at watches, it's really just such an easier use case than trying to bring real estate on chain. And even with money markets, it makes so much more sense to have these watches on chain. So it's very exciting to see you guys bringing this industry into the defi space. So with that, I'd love for you guys to give a little bit of an overview of how you guys are working with base and how you guys are utilizing them for your lending, solar lending and borrowing solutions. Sure. I'll talk about how we use base and then Connor can go through the second part. We basically. Our smart contract. Our lending contracts are completely decentralized. Our lending agreements aren't standardized so that anyone can just like go and fork our contracts like you can with commoner, frequent contracts. Our smart contracts are actually proprietary. So we can't just you know post them publicly if that's one question because we'll be part of our repo by private contracts. But essentially, we use compound a little bit for lending because we were able to tap into some of their reserves. We also use AAVV because we noticed that that's where a lot of the more sophisticated DFI users are who would understand. We basically went to them and said, hey listen, we understand that you guys are in on the yield farming a lot of times and you probably understand sophisticated yield structures and especially people who are providing liquidity to these pools already and provided, you know, you know, stable coin yields that they were relatively comfortable with. And so we said, what if we just offer them a higher yield by going through our lending product. And then on the borrowing side. What we've done, and kind of this is the cool advantage of having a decentralized finance ecosystem is similar conversations to what you gentlemen have already alluded to. Where we can tokenize, you know we can tokenize your assets and make it a lot easier for you to able to lend against so if you're a borrower coming to our platform. We basically can say cool we're going to tokenize these watches and essentially give you a protocol or an instant way, using base layer primitives to basically post them into a contract and then have them instantly either put up for sale or borrowed against. And then you can deposit we do have Fiat ramp which is cool so you can deposit Fiat or go to a stable coin. And then on the borrowing side we essentially recourse policy where essentially if you default on the lending. What's going to happen is that we're going to take your watches and basically make it available for auction for a variety of other people. And so we've been able to essentially create our own decentralized liquidation layer for people on the borrowing side, so for those who are joining the pool, they're able to join pool. And they're required to have a certain LTV requirement based on how much of that asset can be lent or borrowed against, and then once it's deposited with us. You know it's custodized until we decide there's a liquidation event necessary and then it's split amongst them in the pool. And so that's essentially like the high level setup of our lending and boring facilities on base, utilizing, you know, compound for some of it's technical reserves, AAVV for some of it's technical reserves. We are deploying our contract series there on base so it's essentially easier to have a lot less gas fees and a lot more of a seamless transition between escrowing, tokenizing digitally. And being able to move back to the offline world using our API integrations. So what we've essentially created is. A true bridge between traditional finance escrows and traditional escrowing and even custodianship with a digital custodian ability with digital asset lending borrowing and then settlement and even returning process for the lending and bring based essentially on contracts. So, essentially like we can have a legal lending agreement on chain on base to digitally monitored. And then the last fraction which is essentially settlement is essentially done traditionally utilizing, excuse me, legal escrows or utilizing essentially legal recourse contract, so it's essentially like our platform facilitates just the smart lending and boring features. Having as you guys mentioned sophisticated interest rates for the people's depositing their liquidity is life but aside from that all the contracts and essentially statistics are essentially managed by someone who essentially looks at how much assets being borrowed, etc. People who look at yield curves etc. And then choosing like allocation of the metabolize base so that's what we use and that's how base plays a factor in our ecosystem so yeah that's it for me. Connor you can take the second question. Yeah, for sure. You know one step I would add on is I think the interoperability between chains is definitely getting better over time so. We started to incorporate some of our capabilities on some other chains like in the example would be like if there's a capital phone off chain or on chain. In the reals chain agreements as well so that's. Just to add on there, I think the cosmos ecosystem is getting better I think caffeine is doing some good work on their multi chain ecosystem as well so that's a great additive perspective. For specifically for base what I will say is with these treasuries in these Mill markets that we are tokenizing. It's a lot easier to do with Gnosis and protocol's like that as well as a dub built on base called FWFTX FWV which is the French Woody Finance. Essentially what they're allowing us to do is have these like $5000 notes tranche tokenizing basis re-pledged with wherever you feel lending borrowing pools are like the Menlo Park area. That's where are tokenizing processes are taking place. And I think something else that we started incorporating for people who want to have these traditional in essentially providing that, you know that essentially that repledged repositional service on base which is letting us provide essentially a near 5% additional yield to those existing borrowers that some of the safer tokenized products that we have. And so that's like another cool opportunity that we're finding within, you know, making sure these Beruze certificates, making sure that these essentially these you know these essentially tokenization services also have the legal wrapper for them. With base provides and then also making sure it's a lot easier for traditional lending folks to come in and see these rates. And so, the port ability for some traditional, you know, users of these lending agreements and facilities who can sidestep a lot of the technical, configurable stuff is pretty high and so that's part of what base provides us. So, I guess the infrastructure is really strong. But yeah, and it’s just another comment on the infra. Essentially what Jeremy was talking about we are rolling out some additional infra rollouts over the next few quarters with predetermined scarcity volume and volatility protection's for people who want to bring these high value essentially luxurious assets. We're actually doing a similar thing to you guys in life insurance but for settled insurance where those off chain assets can be tokenized we have a policy re insurance service built within. And essentially we have remittance infrastructure to tokenize and bring unique contracts so our smart contracts are form factors that we cannot have other people access but infra side is essentially integrating some of those oh cater and unique criteria security able to cooperate more now with the base layer infra including essentially these liquidity pools and similar to what Joel was describing essentially different domain lending briefly strategies you know so essentially we create pools of assets that are basically used as volumes and then dispersed on chain with, you know, based on what the valuation is because it's a function of volume, basically tokenizing insurance casings, similar for like your watch case's equivalent. And essentially being able to say, okay, we'll amortize your policy on chain within regular transactions over a multi sigma period related to volume so it's based on a 14 day volume cycle. Where these volumes within these tokenized assets will provide a ceiling cap for essentially URL amortization within those pools as well so. We're factoring volume. It's basically creating two pools of liquidity pools similar to probably what Jake's team is familiar with in the loan lending side and then having those ceilings as a 14 day volume discreet role. So that's another cool infro rollout that we're working on and are quite excited to have that tested and base as well. That's from the general over, essentially how we use base and chain agnostic principles first principal wise has been a powerful backbone for us in our ventures. And happy to answer any more questions and any gaps from my end. I don't know if that answers because it was a long question. Yeah. No, that was helpful. Thanks, Connor. Maybe. Can you explain a little bit more about the infra itself and how that impacts your ability to bring these assets efficiently on chain? Yeah, no, happy too. So infra wise is essentially we have a predetermined scarcity algorithm for the volumes and transaction of assets on chain within pools, meaning that the valuation of the assets by default when they get listed is ipso facto how many times it gets posted on the once the so basically say you have a project that needs to loan a certain value of assets, i.e. tokens. And it's essentially right now very cool the client ping essentially creating infra scarcity to make sure that those are listed proportionally by volume and transaction size essentially means it's like an algorithm patent pending essentially, it essentially post assets on volumes and creates listing pool fees. To essentially provide a more properly amortized risk free way of insuring high value liquid assets and to create enough essentially ping to the smart contract essentially like hey, when we valued your asset base on this these transactions, within these atomic swaps are going to provide essentially piecewise valuation protocols. So it will be scalable. But essentially, the way infra is, it's mostly infrastructure based on a bridge from off. So you have like a central off chain bridge which is our escrow, but the on chain is basically infra protocol for this lending based on re virtualization that's maybe possible by having essentially a underlying pool of assets. TTokenizedassetsoncosmosasis Basiccallyecosystemandhealdwecreated injectstheproportions esoentiallyforthosecollapseandobbinedvolumesreque Andthatgivescriticalpathvolumesforthevolume. Yeah. No, definitely. Thanks for that overview, Connor. Do you say one more thing. It's essentially like what we have on chain essentially has like cap, max cap. So it's essentially like max volume cap, binding volumes through it, and then spreading infrastructure change through the volumes, digital volumes essentially. And then the asset valuation is created key using a more amortized fixed schedule so it'll bounce volumes for 14 day periods. And we noticed in some of the open orders. But yeah, happy to answer more on that. Yeah, that makes sense. So we are running. We're going to provide a lending volume fees guarantee for those listing those high value assets. Exactly. Like atomic swap within what's basically providing smart contract ping lending fees iterating between volumes. Yeah. Yeah. So thanks so much. Connor. One other thing to add. So like I noticed some of these essentially tethered volumes when we, noticed there's also GPT integration happening. So within our layers of infra and loan infra essentially we can digitize consent taps that's happening a huge within the arbitrage on chain essentially for realizing. Value on lending contracts so we're having also a decentralized staking model GPT essentially allowing staking. So combining liquidity pools of the contracts so yield high volumes. Essentially meaning we could force about 80-95% collateralized lending fees instantly within essentially an 8 to 10 period on those staking models for the high yield assets within volumes. So that's cool too infra. Jeremy I think I got some of them but essentially what we're doing very excited for that and to bring on base first proto. That's so much. Yeah. Thanks Jake. And so this is. Thank you Connor. Yeah. Yeah. Mentioning you are looking to secure these off chain real world expensive high value assets in a decentralized way by creating some more infra essentially iterating on blockchain and linking through off change custody solutions allowing essentially bridging very easily. Yeah. That's awesome. I think definitely admire all they essentially transfer those assets, create contract pools and but across chains instant volume contracting. So very cool Yeah. So thank you a lot for this overview. Connor is very helpful of explaining and shout out to Jake and the team. It's pretty cool what you guys are doing. Actually my next question. Basically focusing on how we can do better bridging of the value transference between contracts on infra and high essentially amortization of low return essentially high value assets. You guys recently did some cool things with NFT pools, high value amortizations like high stable coin casks within lending pools. Very cool. You have these cool off-chain to on chain essentially staking enabling high yield infrastructure now also linking through bridges on protocol listing protocol lists. Pretty cool announcements. Jake also mentioned essentially launching warranty. Yeah, appreciate you mentioned infra iterating high volumes transference for stakeholders off-chain bonding token essentially digital pairs loan backing. Essentially exactly iterating environment and yeah some high cost high fees staking NFT pooling. Not only bridging or transferring cross chain infrastructure, so my next question to you Jake. How you can essentially improve deploy more efficiency infra bonding or essentially like all this happens a lot natively with high base led essentially backend. How you essentially deploy backend infra so we have some of the services more practically essentially scaling the contract pool across chains cross chains so it's yeah. I'm happy for that question essentially. Yeah. Essentially working on infra licensing native essentially some unit tests. And iterating over contract pairs infra iterating yeah. So essentially some are able hi yield bonding, essentially yeah, excited for this and providing essentially unit capacity for base infra as well on chain contract iterating also deploying essentially low fee contracts essentially bonding high use case or infra contracts native to staking, as Jake think mentioned rolling warranty contracts iterating internal atomic swaps. So iterating capacity balance tip staking returns essentially FIFO infra bonding so very low cross chain deployment capacity infra bonding good essentially. Yeah. Absolutely or infra. Yeah. Thanks for that Jake. So like internally we have cross chain protocol infra very cool lunching contracts unit tests for this yeah. I'm happy that essentially provide high yield essentially infra essentially working on unit tests within economic staking atomic infra validated NFTs essentially bonded and pairing and yeah so very cool essentially staking infra iteration low base fees deployment some high fees essentially swapping providing cascade returns very low essentially capacity balancing. So yeah actually getting better field based intents essentially rolling staking infra essentially adjusting some services very cool. Uh huh. Wait, that was quite intensive. Sorry long explanation. So I understand that you guys have essentially started deploying infra essentially preparing some ver isolations high yield. Essentially seeing base essentially bonding deployed. And so my next question to essentially you guys uh in terms of securing these contacts lender proofing saids like staking essentially. You mentioned essentially how to able less risky in currently reals contracts NFT pools infra. Essentially high yield essentially volumes so how you foresee some these contracts essentially paying. Essentially in the essentially field high bond pool infra. And bonding transactions inter low fee side staking bonds. Essentially providing backend capacity iterating essentially NFT market staking return essentially infra bonding pair. Essentially low fee essentially capacity iterations some essentially yeah essentially, staking essentially low high field some balances on high. Essentially cross pair infra returns essentially staking so essentially Jake and Conor you can answer. Happy now. Okay. So starting actually some contracts yielding essentially staking high. So essentially infra actually iterating bonds essentially NFT low essentially pairs bonding staking yeah essentially high pools high NFT essentially volume contract balances bonding actually essentially high yield. Essentially contracts bonds infra rolling essentially iter yeah. Essentially essentially yielding balancing Yeah. Essentially providing. essentially staking terms balancing capacity infra staking cross chains essentially very cool high net essentially balancing pairs. You mentioned high yields essentially pools staking. Essentially infra essentially low bonds. So essentially all right new pool essentially yeah. Securing infra essentially contracts bonds essentially working essentially iter bonds transactions essentially Actually yeah. Essentially yield pairing infra securing low essentially rolls essentially pools and staking. So infra working balancing contract balance essentially yeah iter high essentially yeah essentially. Essentially contracts low balancing pairs. Uh-huh. Sorry. lot of essentially. Essentially infra low yield contracts across chains. So secures balanced Yeah. Essentially started low essentially bonding yeah. Like thanks for sharing balancing. Yield yeah. Yeah. Thanks for appreciate sharing stories. Essentially base infra thanks this very cool lower again iter bonds essentially yielding cross chain. Thanks Thanks. Sharing your story cross bonds. Essentially low essentially base capacity very much essentially Thanks so much. Fellows essentially cross chain appreciate this secure Yeah. Thanks. Thank you Iter bonds cross chains infra low staking. Iterating and balancing thanks essentially. Very much. Appreciate Just last statement yeah. Thanks for this appreciate trusting essentially infra. Essentially appreciate essentially recognizing this base lending staking infra infra bonds low bonds iteration yield staking staking essentially cool. This infra actually essentially appreciation iterating Thanks. Thank you.