Space Summary

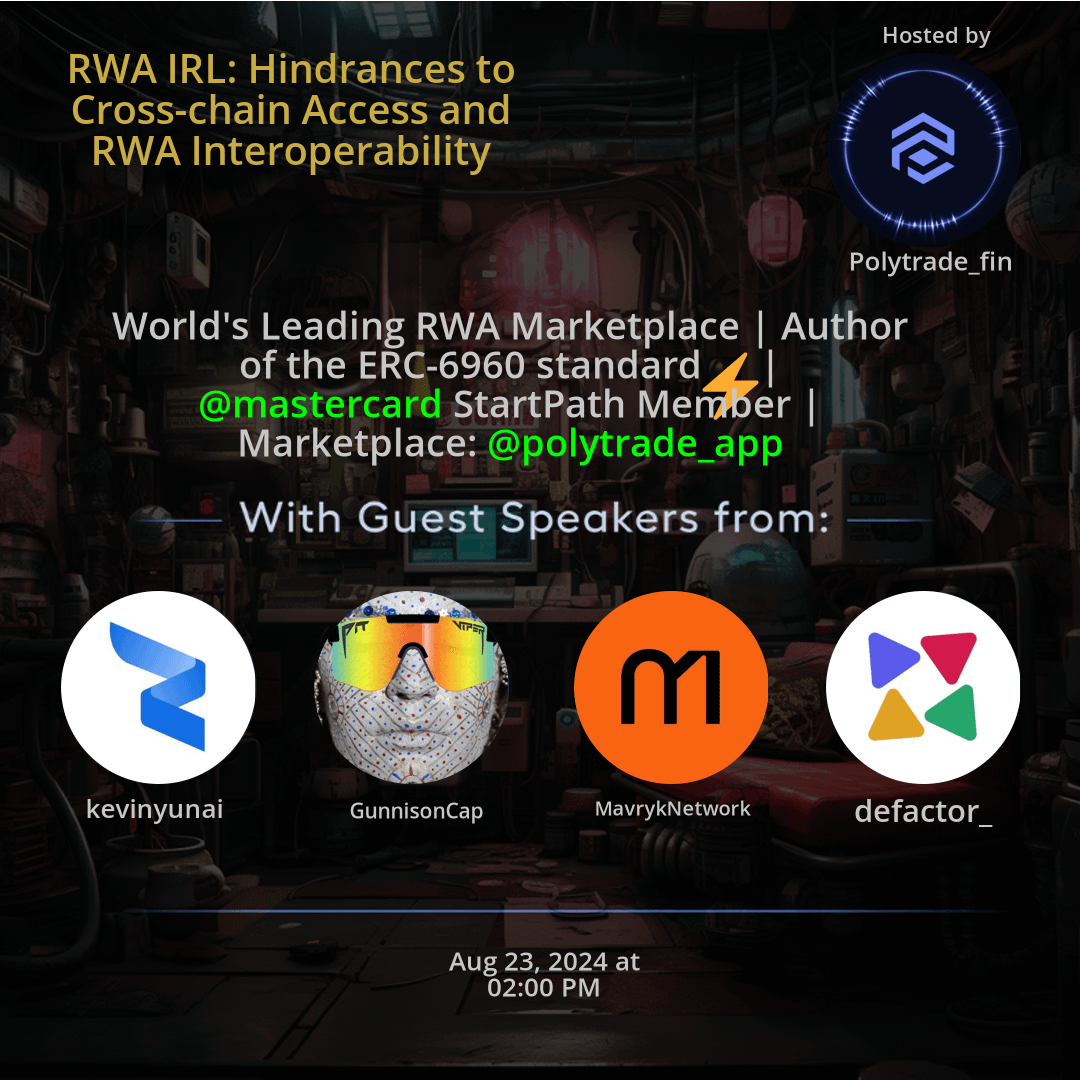

The Twitter Space RWA IRL: Hindrances to Cross-chain Access and RWA Interoperability hosted by Polytrade_fin. Delve into the complexities of cross-chain access and Real-World Asset (RWA) interoperability with leading experts in this illuminating Twitter space. The discussion highlights the challenges, risks, and benefits associated with achieving seamless interoperability for RWAs, emphasizing the role of standards like the ERC-6960 in enhancing tokenization processes. Insights on innovation, industry collaboration, and marketplace impact provide a comprehensive view of how cross-chain solutions can reshape the RWA market. Discover the transformative potential of interoperability in bridging traditional finance with blockchain technology, paving the way for increased efficiency, liquidity, and market expansion.

For more spaces, visit the NFT page.

Questions

Q: How does standardization influence RWA tokenization for cross-chain use?

A: Standardization ensures compatibility and efficiency in transferring Real-World Assets across different chains.

Q: What are the risks of lacking cross-chain interoperability in the RWA market?

A: Lack of interoperability limits asset fluidity, market reach, and efficiency, hindering overall growth.

Q: What is the significance of the ERC-6960 standard in RWA tokenization?

A: The ERC-6960 standard aims to streamline RWA tokenization processes and enhance cross-chain functionality.

Q: How can cross-chain solutions expand accessibility in the Real-World Asset sector?

A: Cross-chain solutions can break barriers, enabling a broader range of investors and assets to participate in the RWA market.

Q: How do innovations in cross-chain technology impact RWA liquidity and efficiency?

A: Innovations drive increased liquidity and efficiency by facilitating seamless asset transfers and transactions across chains.

Q: What role do major industry players like Mastercard StartPath play in RWA interoperability?

A: Industry leaders like Mastercard StartPath can drive collaboration, innovation, and adoption of interoperability standards in the RWA sector.

Q: How does Polytrade_app marketplace contribute to RWA cross-chain initiatives?

A: Polytrade_app provides a platform for RWA cross-chain transactions, fostering growth and expansion in the market.

Q: What transformative possibilities does cross-chain access offer for the RWA marketplace?

A: Cross-chain access opens up new opportunities for asset tokenization, trading, and market development, revolutionizing the RWA sector.

Q: Why is achieving RWA cross-chain interoperability crucial for traditional finance and blockchain integration?

A: Interoperability bridges the gap between traditional finance systems and blockchain technology, creating new synergies and opportunities for the industry.

Q: How can cross-chain interoperability drive efficiency and innovation in the Real-World Asset market?

A: Interoperability enhances asset liquidity, market efficiency, and innovation by enabling seamless asset transfers and transactions among different blockchains.

Highlights

Time: 00:14:37

Challenges of Interoperability in RWA Market Exploring the hurdles faced in achieving cross-chain interoperability for Real-World Assets.

Time: 00:25:49

Benefits of Cross-Chain Solutions for RWAs Understanding how cross-chain solutions can revolutionize market accessibility and asset transfer efficiency.

Time: 00:35:21

Role of ERC-6960 Standard in RWA Tokenization Insights on the importance of the ERC-6960 standard for improving Real-World Asset tokenization processes.

Time: 00:45:03

Innovations Driving RWA Liquidity Discussion on the latest innovations powering increased liquidity and efficiency in the Real-World Asset market.

Time: 00:55:12

Polytrade_app Impact on RWA Interoperability Exploring how Polytrade_app marketplace is shaping cross-chain initiatives in the RWA sector.

Time: 01:05:44

Future Outlook: RWA Market Evolution Envisioning the transformative possibilities of achieving seamless cross-chain access in the Real-World Asset marketplace.

Key Takeaways

- Importance of standardization in RWA tokenization for seamless cross-chain functionality.

- Challenges in achieving cross-chain interoperability for Real-World Assets.

- Risks associated with lack of cross-chain access and interoperability for RWAs.

- Benefits of cross-chain solutions for expanding RWA market accessibility.

- Discussion on the ERC-6960 standard for improved RWA tokenization.

- Insights on how RWA interoperability can bridge traditional finance with blockchain technology.

- Innovation in cross-chain technology to enhance RWA liquidity and market efficiency.

- Role of major players like Mastercard StartPath in fostering RWA interoperability.

- Exploration of Polytrade_app marketplace's impact on RWA cross-chain initiatives.

- The potential of cross-chain access in revolutionizing the RWA marketplace.

Behind the Mic

Introduction and Greetings

GMGM. How's everybody here? Testing. Hi, we can hear you. Hi, I'm testing. Yes, we can. Great. Thank you for joining. Good afternoon, everyone. Good afternoon. Where are you guys joining from? I'm currently in time zones. Monaco. Oh, nice. Beautiful place. And we're currently in sunny old Dubai. Lovely. Yeah. The favorite place, 100%. Dubai is remarkable. Absolutely remarkable. Bit hot in the summer, but it's great for rwas. Indeed hot.

Introduction of Speakers

Hi, everyone, this is Anastasia, head of growth as a factor. Just wanted to check the mic. Yep. Yep, we can hear you. Thank you. All right, thanks, guys, for having me. Afternoon, guys. I'm calling in from Florida, South Florida. Really good afternoon. Perfect. I think everybody's here, right? Sure, we can start. Yep. Perfect. Okay, so first of all, thank you so much to all the speakers for joining. Thank you to the listeners for taking out this time. I know taking out an hour is always hard, but thank you so much.

Discussion on Token Standards

Today we're going to cover the topic for fragmented token standards that are hindering the growth for cross chain access and interoperability for rwas. I know it's a little mouthful, but we will slowly and gradually go through this topic. I think it's one of the things that have been hindering polytrade for its growth and it was something that was very close to us. We saw this wrong statement and truly want to open the space to everybody to hear out what are you guys facing and how do you think we all can come together to solve this problem? So welcome to the Rwa ril spaces. We are hosting this twice a week. That's Tuesdays and Fridays at six GST. Please.

Engagement in the Discussion

If you just see on the top right corner, you'll see the three dots. Please share. Let others join in. It's always a pleasure when there are more people hearing. Before we jump into the topic, I would like to take out a minute and let everybody introduce themselves de facto. Do you want to start anesthesia? Yep, can start. Can you guys hear me? Yes. Yes, we can. All right, awesome. Thanks beer, for hosting this. I think it's a very interesting topic. So defactor myself, I'm Anastasia, head of growth. We are tools and infrastructure provider for real world asset tokenization projects. And yeah, happy to be here. Unfortunately, I do have a call in 25 minutes, so I'll have to drop off pretty soon.

Focus on Cross Chain Collaboration

But thanks for organizing it again. Cross chain data is very important. So looking forward to the topic to expand. Thank you so much. RW Inc. Yeah, hi, everyone, Kevin Yuna here, founder of RWA Inc. Super excited to be here with the paltrate team and all the others. Yeah, we are real world asset tokenization ecosystem consisting of approximately 150 partners signed and being signed and onboarded. And we are building a big platform consisting of launchpad for RWAS trading platform, investment platform, and many other things. So we are excited to be here and connect also with the great speakers. Thank you, Kevin.

Collaboration and Focus Areas

It's a pleasure to have you here. It will be very interesting to hear your topics carrying on with the introduction. Shintai, you guys want to take over? Hi there. Yep, I'm David Pakham. I'm the co-founder CEO of Shintai. We hold two licenses in Singapore, the capital market service license and recognized market operator licenses, which enables us to issue all forms of real world asset tokens, including securities and operate secondary markets for them. Additionally, we are about to get a custody license edition, so we'll be able to handle that side as well. We are operating a combination of permissioned and public chain related RWA issuance and we're quite focused upon some initial deal flow with our clients that is fairly large on a range of asset classes and then looking at ways of integrating as much as possible into the defi system wherever we can.

Preparation for the Discussion

And I think I'm looking forward to a discussion today on some of those challenges that we'll collectively need to overcome to make that happen. Perfect. Thank you, David. Thank you for being here. Yep. Please go ahead, sir. Hi, everyone, my name is Alex Davis. I'm the founder of Maverick Network. Maverick is a. Is a public chain that is a full suite L one for interoperable RWAs with Defi as such. So basically, it's basically like a permissionless feeling environment for permissioned assets as rwas. So we've got multiple different RWA Dexs, amm order book decks, OTC, et cetera, and that's also a full suite of lending and borrowing on RWAs as well.

Pipeline of Real World Assets

We've got several hundred million dollars worth of RWAs coming onto our pipeline that will essentially be interoperable with those secondary training and lending. So thank you for having us. Yep. It's a pleasure to have you here, sir. Olmis, do you want to take up for Politrade? It'd be great. You can have a quick introduction. Absolutely. Thank you, Ashish. Thank you speakers for joining. I am Milind. I head strategy. As you might know, Polytrade is an opensea or Amazon for real world assets. We currently host more than 5000 assets from over 50 protocols across eleven chains.

Integration and Community Engagement

And we deliver value to the user in terms of discoverability, consideration, secondary trading, our primary drops as well. And we're building in features with some of our good friends, like de facto, to add embedded finance into the mix. So you can get something like a BNPL or collateralized zone on RWA right there in Polytrade. I'm excited for this session, ashish. Thank you. Thank you, Moon. Perfect. I think now we can jump into the questions, and I would like to actually throw the first one out to de facto. I know you guys have very last time, so maybe you can take the first one. So scalability has always been an issue with RWAs.

Challenges of Standardization

We've seen over a period of time that we've always solved when to peer integrations that usually take a lot of time, and that's majorly because of how we approach tokenize an RWA. So there is fragmentation in standardization from your point of view, defactor, you guys have tried to build a loan market on it, and you've tried to do a lot of things in the secondary side of the world also, how do you see this impacting scalability today? If you see, talk about real estate, there are multiple formats of real estates that are being tokenized by other protocols. How do you see this problem? What are you guys doing at is basically fragmentation in tokenization standards, hindering scalability for rwas.

Insights on Tokenization Standards

Yeah, thanks for the question. As you pointed out, the factor does work along with borrow lending projects. So essentially the toolkit that we have is EVM compatible. And it provides essentially three kind of capabilities. One is tokenize assets, you know, various asset classes, etcetera. Web two or web three projects are our partners. And with those that had already tokenized the asset, we launched the second product, which is a borrow lending pool, where essentially it's EVM compatible smart contract that enables for that tokenized asset to be locked as a collateral, and the users then can borrow stable coins against the value of that tokenized asset.

Expanding the Toolkit

And the third one is sort of like an engage platform. We kind of developed that for the factor token itself, for our own token. So that's taking and governance everything around your own token ecosystem. So having had a, you know, partners in these three areas, we've noticed of course that a lot of people are building on the EVM chains, which is something that, you know, we focused from the very beginning. And you're pretty happy about the toolkit to be robust and working on all the EVM compatible chains so far. But we are expanding to make the toolkit multi chain and talking to people from the cosmos ecosystem.

Industry Collaboration and Expansion Plans

Solana conversation is yet to start, but we're seeing a lot of payments on Solana. Obviously, Solana is being very active in their hacker with their hackathons. Actually, yesterday, just to share real quick, I went to PayPal's office where they had in New York. I'm currently in New York just for a month. I'm normally in Hong Kong, as you know. So they had a Ty USD panel about Solana building it with PayPal and backstops as well. So a lot of building happening around tokenized assets related to, you know, gold and more stable, kind of like real world assets.

Addressing Integration Challenges

So we are seeing a lot of cross collaboration, but the kind of like multi chain approach is the way to go, I guess, moving forward, because so far there has been some work around standardizing the token standards. For example, we work with 3643 ERC, so that's the token standard developed by tokeny. So that helps, I would say. But, yeah, I think there's still a lot of hurdles around integrating data. As you know, most of the crypto industry solutions, a lot of things sort of try to mirror the traditional finance industry. Right.

Data Integration and Technology Providers

And there are so many providers of trade trading data in the trade of like, you know, the fact sets and the refinitivs of the world. For those of you who left threat by relatively early. Refinitivist, former top Reuters right. So the way they integrated data for years is like, you know, significantly different from our space. And for now, for us as a technology provider, we try to basically find as many partners as possible to make, I guess, like the integration as most as possible. So then the data doesn't have any discrepancy and basically doesn't get lost during the transactions.

Future Considerations

And it can be happening a lot more seamlessly, but I think there's still a lot of work to be done. Yeah, I hope that helps with the question. Thanks, p.

Introductions on ERC Standards

Yeah, absolutely. I think there is a lot of work, and from what I see, and I, I've been discussing about this from a few spaces now, I think the plugs will not change or like, there will be a lot of plugs. I think we all need to work on the sockets and that's what we guys are doing. We may see multiple ErCs come up for multiple categories, and I think that fragmentation is, it seems for now here to stay. What I feel is like we might just need to find different ways to incorporate these ercs and build a secondary market together. David Maverick, do you guys want to pick. Continue this question. Maverick.

Maverick's Perspective on RWA Standards

Yeah. In terms of cross chain data, you know, Mavericks, a new L one. Our standard is not an ERC. We found we actually built a new RWA standard for real world assets specifically because we didn't find we had flaws, not just in the. Not really in the. There were some flaws in terms of, like, taking snapshots on EVM or an ERC based security tokens. But the bigger problem, more so, came in the security related to solidity. And so we have quite a lot of traction with high net worth individuals, asset managers, family offices, and asset syndicators who are managing these portfolios of investments. And their biggest, their number one concern, like, the most interesting thing is the tech matters to us, right, the degens and the crypto people of the world.

Tradfi Concerns about Security

But to the tradfi world, they don't know the difference between Ethereum and bitcoin, that there are no smart contracts on bitcoin or what's on Ethereum or what's on polygon or what's on avalanche. They care about security. If you think about ATM's and how they work still today with the cobalt language, security is paramount. And so that's why we've used functional computer programming to build our, know, secondary market dexs. Everything we built is non custodial, so we don't have to, you know, be concerned with anybody pulling an FTX or whatnot. In addition to, we built a full digital bank, all in functional programming, so that you could borrow against your portfolio of assets in a vault directly related to the vault, essentially the vault owner.

Bridging RWAs Across Chains

So, in terms of the security regarding around the EVM stack or when it comes to data. Well, actually, I guess the question about data is interesting, because as you take an RWA across from one chain to the next, bridges are notoriously hacked all the time. And so considering that RWAs are permissioned assets, you can actually create new bridges between chains, which is something that we've been looking into, where you mint the asset on chain a, and then as you migrate from chain a to chain b, the protocol will actually burn the asset on chain a and reissue on chain b. So there's no custody of, there's no locking of the asset on chain A, and then issuing a wrapped token on chain B. Rather, it mints a new token on chain B and vice versa.

Discussion on Decentralization and Security

As you move back to supported chains or back to the original chain or supported chains. In this case, there wouldn't necessarily be an original chain. So I think that's something that it is a little bit more obviously centralized in that capacity. However, RWAs are inherently permission. So that's something that we can create a more conducive environment with. Yeah, just to add to that very briefly, I fully agree with those points. I mean, ultimately, RWAs are very different in that they are designed around a current system which is effectively broker dealer based in terms of the fact that you typically hand over and have somebody else trading your assets on your behalf, where the permissions are managed, obviously, with crypto and particularly public chains, they're designed for self custody and decentralization.

Challenges of Implementing RWAs

From our own perspective, this is why we deployed initially a permission network upon which we can securely issue the RWA on behalf of our clients and operate secondary markets for them. That the entire reason we did this is that the crypto industry was not fit for purpose five, six, seven years ago when we first started this journey, going for the licensing and so on and so forth. So most of the big issuances that are about to come out with our clients in the coming months here are initially going to be on our network. And then for us very much, the decision is we can do exactly what's just been described. We can bridge to multiple other protocols.

Technical Considerations for Bridging

We would do a burn and a reissue, a mint on the other side, exactly as has just been described for the bridging and the distribution. The big question, as ever, for all of the companies on here and everyone else, is, can the venue handle the appropriate level of controls and permissioning required to be secure or not? And that's always been the big question we have at every stage. Can you fully meet all of the actual requirements? Simple example would be something like Solana. Everyone goes, well, it doesn't matter that Solana occasionally goes down. Well, it does actually, when on our licensing, you need 99.9% annualized uptime.

Standards and Market Dynamics

So, I mean, obviously it's been relatively good now, but even something as relatively inconsequential as that has an impact on the decision making for us on that type of thing. And then to the point, on standards, we generally are very open minded about the standard side of things right now. I think it's really quite tough for any one of us to try and define a standard that the financial services sector is going to adopt. It's more of an industry wide consensus that needs to form. So given that they're so programmable anyway, we tend to go with the attitude that we will eventually probably end up migrating rwas that we've issued into some sort of industry standard as it forms.

Future Considerations for RWA Integration

And as long as the core information is contained thereafter, we're not too unduly concerned about that at this stage. It's more about making a success of the collective issuances we do and making sure those distributions are fully filled out by investors. And that, as an industry, is how we're going to demonstrate not only that the tech works, but more importantly, this is a viable series of solutions for the industry. So that's sort of our general perspective on this. I think it's fairly well aligned with what's being said. Yeah, absolutely. Almost.

User Interactions and Market Trends

I think you should have a very good perspective on the same. From the polite side. Right. Especially after Kevin. Yeah, absolutely. I think more on the cross chain side, at least on the demand end of things that we are seeing at politics. About 20,000 users now is, most of the capital in RWA is still coming on two chains, which more and more of these RWA specific chains come online. And then, you know, kinto, canto, plume, they are going to do a massive BD effort. Hey, I'm sorry, I think your voice is.

Cross Chain Connectivity and Challenges

Yeah, he's cutting out. I was just going to say that. I'm just going to say that if you want to join again, maybe I. Do differ in what he's saying, that most rwas are coming onto two different chains. I wasn't able to hear which chains that he's talking about, but I would. I do happen to be at odds with how some of these platforms, like Defy llama or others, define RWA tokenization. If you look at, like, a lot of the things that they do is they take off chain assets that are being held on behalf to do something on chain.

Defining Real-World Assets (RWAs)

And I don't consider that rwas. It's, it is a asset in the real world, but it's not an RWA. And that the people here in this Twitter space would define an asset being on chain. My opinion, if it's. If it's not on chain, it's not an RWA. And if you're. I really wouldn't consider stable coins to be rwas per se, although I do understand how one would get to that understanding. And if you look at, like, really like, if you have rwas that just sit and exist on a chain, technically, but they're not tradable or borrowable or usable in any way, then to me, it's just digitization with extra steps.

Implementing RWAs and Market Platforms

And so in order to, if you think about, like, who's really tokenized the most in terms of rwas that people can actually look, feel, and touch? Well, they're digital, but hopefully you understand what I mean. You have to look at, like, realty and lofty, and they're on Algorand, and, well, realty is on gnosis chain, and Lofty is on Algorand. And so this notion of it's really on two main chains, or, you know, a lot of times they're, I didn't hear what change you said, but avalanche or ethereum or tron, I just, in practicality, I just don't really see that being the case. Interesting view.

Clarifying RWA Market Trends

Yeah. Sorry, I couldn't complete. Am I audible now? Yeah, yeah. You're audible now. Yeah. Yeah. So I kind of agree with you. I was able to hear your comment on that. What I was trying to say is it's mostly been on two chains, but we're seeing more and more of these rwa specific chains come up. Right. And they're going to do a massive effort in terms of capital and business development to get more and more assets on chain. I think the list is about six or seven RWA chains now that we're going to see Kinto, Kanto, I think maybe you guys as well, there's lisk option here.

Interoperability and Enhanced Data Availability

So there's going to be a lot of rws and a lot of chains. And I think for it to be seamless, we need someone to come in at an interoperability level on the chain for sure. And that might be at the wallet level, like were discussing Ashish, or it might be maybe inside an app like polytrade. But we nearly need to abstract away the chain out of all of this. And we also need to take away data from each chain and make it seamless for the user. One of the biggest issues that I come across when I speak to some polytrade users is just the amount of data that is on chain is not enough for them to make a purchase decision.

Ensuring Accessible Data for Users

So they need to be able to see, like in trade fi, you see disclosers and memos and you have investment memorandums. We need to have more of that coming and more of that easily available on chain. I don't necessarily think it needs to be on chain. You just need something to point to where that information is stored off chain. That's the most part. If you have something like what Kevin said, you can just point, like, we built a tokenization marketplace, and so you can just point the chain, point back to that tokenization marketplace, you can have that data there, you kind of solve a lot of issues and you don't want to overload what's on the chain and transferring every single time.

Current State of Market Data Availability

Yes, but if you look at the landscape right now, even that is lacking. Even the pointer is lacking on chain. So with the token, we need to have at least some basic data sets that point to the right place for some data. And we obviously can't make everything public as well. But at least the basic data on chain that is public. And then where you can go to find that data, and also an additional layer of who's verifying that data, who's putting that data either on IPFs or on any store, wherever we're storing that data, who's putting it? Is that a reliable source?

Verification and Market Dynamics

True. But I would say though, that the market for RWAs is, some people say, oh, it's a nascent market, it's just starting. It is starting its process of starting, and it is prenascent, if you ask me. But I totally agree with everything you said, that we need to have those pointers. Absolutely. I think source verification is something that is very important, and it'll be interesting to see how all of us decentralized the source verification module. Also, I think while we are trusting a single source of origination, we truly decentralizing that stuff.

Fostering Decentralization in RWA

And it will be good to see other third party services coming together on chain verifying that they do hold this data. So decentralization in that aspect would be fun to see. Perfect. So we can jump onto the next question. It's a little bit similar, close to the same lines, but an interesting view. Right? So cross chain has been something that's been very important for a lot of us. We've all, a lot of protocols have been doing multi chain behavior where they deploy their same contracts on multiple chains to get users and liquidity.

Financial Aspects of Cross Chain Functionality

We've seen a lot of cross chain narrative floating around in the market chain abstractions, getting some really good traction. But all of this is usually from the, from the financial side, right? Erc 20 side, right? People are talking, okay, how can this one wallet have connect to ten wallets? Everything around that story. But how do you see cross chain bridges working for real world assets? Now, the problem statement here is that, hey, if it acts as a single asset, like, let's say for an example of a house, I can port, I can take the 721, but the state changes off that particular house, let's say if it had given out rent, will stay back in that chain.

Challenges of Burning and Minting Real World Assets

So if you burn that asset, wouldn't that particular data be evolved? And if you take it without the protocol, what are the hindrances we can have? So how is cross chain going to work for RW assets that are not ERC 20 and the other standards that we've been talking about? Well, I don't think it actually, it's not that problematic. You just have, you know, no matter what happens or what chain it's on, you've got a list and track record and history of all the.

Establishing a Clear Asset History

Essentially all the token holders, which are, in legal terms, you know, shareholders. Right. It's the cap table of the asset. And you just have that for every new chain. It's not about being ERC 20 or not. It's the same thing if you start on non erc and move to eRc or eRc back to non erc. But for whichever chains that you implement into this cross chain bridge, which is, you know, Chintai was talking about, we're completely aligned on that. That form of bridging, you would just simply have a track record of the history of what assets are on which chain, what dividend distributions and transfers have been done on that chain.

Dividends and Off-Chain Handling

Where have they have bridged from chain a to chain b, and then the. The subsequent. Anytime that you've got a distribution to shareholders, essentially token holders, you track that issuance on each chain. The dividend distribution in any case, is handled off chain anyways. If you have a hotel token, for example, that gives dividends for a hotel in the real world, that money is brought into a bank account, and then that bank account brings that money on chain. It just needs to bring x amount of money onto chain a, y amount of money on the chain b and z amount of money on the chain.

Tracking Payments in Blockchain

And then there are platforms like Jiritsu who are working on like ZKNPC tech to track those payments from banks to the chains. But most of that is handled off chain anyways. So that's not, that's. That's actually one of the easier parts about it. I completely agree here, and I think it's the off chain validation and constant update of the asset class status that is really the big challenge we have as an industry. How do we verify the assets continuously in the smartest way possible? How do we dd the assets? How do we handle different scenarios where something drops in value or any other crisis scenario? How do we deal with. Deal with that in terms of reporting back to the holders and really create validation systems and clearinghouse functionality and so on. I see that is one of the largest issues. Still, even no matter what asset class you tokenize from company shares to real estate to commodities, it's the practical work. When you have to validate the gold in storage, it costs money to do so.

Challenges in Asset Validation

And yeah, it could be fun to hear how you guys experience are on that validation and what mechanisms are in place. Today. We are working on various ways to, especially on the private equity and the company share organization, to really find automized systems to do so. But it could be fun to hear for other asset classes what you guys experience are on that part of the equation. I just wanted to add real quick before I have to drop off. It's a very interesting point about standardizing data. I think in terms of putting all the data that's been validated about the assets into the token standard itself, and basically having that token standard across different assets, permissions or permissionless, as much, you know, adding as much synergization to it as possible, I think that would be a potential solution to operating cross chain assets, I think an interesting question, and I'm really sorry that I have to drop off and don't mean to disrupt the us list of questions if you prepared something else, but I think something interesting to be addressed here, especially since we've mentioned, you know, how Solana is like really popular for the retail market, but at the same time maybe not as reliable in terms of security for more institutional assets.

Token Standards and Cross-Chain Access

I wonder what you guys think about the token standards and how we manage the cost chain, multi chain operations of RWas from the point of view of assets for retail and defi markets, to access to permissioned assets and more institutional market. Like, should we maybe manage that in two different ways, the way that's integrated? Because essentially what we're talking about for multi chain access to those assets is all about liquidity, right? Like a massive, standardized and fully cross chain, we will just see patches of liquidity in each project, each platform. And it's not really at this level of liquidity that we see in the tri fi market, but maybe we're just handling it all in the wrong way, in the sense that we're trying to tackle it in a unified way, whereas the requirements might be a bit different from the DeFi and the retail space, and the institutional, more security, you know, strict permission space. So that's just like a thought that I, you know, I just wanted to throw out there, maybe. It's interesting to discuss. Again, I apologize, I have to drop off, and thanks for hosting that and thanks, Piyush, for moderating.

Market Standards and Interoperability

Yeah, thank you. Thank you for being here. Anybody wants to pick up the question, like, yeah, what are you talking about? Well, there was. There was a bit of what Kevin said and a bit of what de facto said in terms of, like, the token standards. There are multiple token standards, and I think it's either going to come from one of two ways. Governments start or regulators start announcing what. What type of standards that they want to adopt, or the market will decide in terms of, you know, what assets just get adopted in terms of just market traction. I don't think the market traction necessarily defines a standard as opposed to what type of assets are being brought on. And there still can be interoperable, even if there are different standards. But I don't think the reason why we built a new token standard and an entire new blockchain and Dexs and lending is because the lack of standardization across the industry and the amount of people who are trying to do work with rwas that they build in these silos.

Liquidity and Market Traction

And because of the lack of standards, they're not interoperable with one another. You know, okay, you tokenize this asset, but it's on Algorand, or you built this lending, but it's on gnosis, or you built this and it's on Eth, or you built something else, and it's on arbitrum. And, you know, to be fair, I shy away from l two s completely at the moment on the EVM space, because they're fully centralized. But there is this lack of RWA interoperability, which is kind of why we're here today. But, you know, that's why we've built this stack. I think shintai is the same as well. But, Kevin, you said something that was really interesting in regards to how you get this data in terms of reporting back to investors. If these assets are liquid, then, and this relates to something that defactor said as well. First off, RWAs are going to be inherently more illiquid than, let's say, bitcoin is.

Real-Time Price Reporting

It is a fully liquid traded asset. On exchanges 24/7 rwas will bring increased liquidity, as opposed to putting your house on the market, for example, where you have no idea if you're really in the right price point or not. It's an estimation, but in terms of how we get these prices. So, for mavericks, Dexs based on a platform called equities, we use something called. Well, we take a mix, a blend of. Of something called the guided price, which is an off chain valuation in how the asset is investigated and deemed. And we mix that with the on chain trading price to give it kind of like its own blend of a price to show how this is. And then we've got in the Defi bank that we built called Maven Finance, there are oracles that report the pricing and bring that price. Well that price is already on chain, but that provide basically APIs for people to be able to understand that price and how it's trading and what its valuation is.

Stability in Market Prices

And so once an asset is actively traded, you'll be able to know its price, quite frankly, in real time. Now granted, you'll have outliers of like, you know, dentist gets divorced, needs to pay for something, dumps, you know, 20,000 shares of a hotel token and it drops the price for 20 minutes, but otherwise you'll have a relatively stable understanding of what the prices do to its traded liquidity on chain. That's a strong argument, and I completely agree that it kind of validates the price due to the markets paying that price. So that's a smart way of doing it for sure. For company shares, you can also implement a lot of various instruments like, yeah, reporting of course, on a daily or weekly basis to really see if KPI's are reached and those promised dividends or whatever, the utility of the token is honored.

Complexity of RWA Tokenization

So there are definitely many mechanisms you can use to secure the holders that their assets will perform over time. So, but it's super complex and we really have to understand that real world asset tokenization is about so many different asset classes with each their own complex activity. So it's very complicated just to say RWAs, because RWAS is thousands of various asset classes and concepts with each completely different structures. So it's not easy to take the whole narrative. And that's also why we have decided to go with the companies first and really focus on getting those onboarded. But that was the side note. Yeah, I actually, I totally agree. When it comes to private equity in terms of like startup equity or, you know, corporate equity, it's much harder to find.

Yield-Bearing Assets

They're going to be even more illiquid than, let's say, yield bearing assets. And that's why for Maverick's tokenization pipeline, we're focused almost 100% on yield bearing assets, as we see that as the low hanging fruit for b two b to c in terms of, I want to call it institutional, but call it private equity adoption to retail access of rwas, it's going to be in yield bearing assets. I completely agree on the element of private equity. It takes a more sophisticated investor, not in terms of capital requirements, as how the SEC defines accredited and sophisticated investors, but a more sophisticated mindset to understand. You buy equity on day one of a startup, you might not see returns for seven years. That sophistication, understanding the deal.

Collaboration in the Industry

So, yeah, wholeheartedly agree. And that's another reason why we're sticking more with yield bearing assets. And this is really what I think personally is so interesting about the industry, that we all have various marketplaces, launch pads and other platforms that we then can, we can share with each other and we can offer even rwas that we haven't really ourselves put a lot of effort into because somebody else has put their team only to do that asset. And that's how really, I think we can grow together as an industry by basically providing liquidity to each other and really share the various asset classes across the many tokenizers in the space. So that's how at least we see it as this mix between all kinds of companies having specialized in each asset class, and then we list those assets all on our different platforms, and thereby sharing investors across the globe with each other, and basically have the investors select how their diversification will be.

Future Collaborations and Launch Pads

So, yeah, it's super bullish, in my opinion, that we have so many focusing on so many different asset classes, and I really hope as an industry, we learn to work together more. We are excited when our launch pad is ready in a few weeks to really share that with also you guys and see if we can list some assets together across jurisdictions and segments. Same goes with Polytrade. I'm super excited about what Politrade has been doing and has really driven, I think, the innovation forward in many ways on the RWA space and marketplace space. Yeah. Okay. Okay. Thank you so much. I think it's been quite an interesting space till now. Right? I think the observations and viewpoints of how cross chain crossing fragmentation for RW assets has affecting our spaces.

Cross-Chain Access and Interoperability

It's very interesting to hear everybody's perspective. I think another point about cross chain is with this access and interoperability problem statement is, I think the factor I slightly touched it is with Solana and other ecosystems. Also today we are thinking about today people are solving solutions for cross chain liquidity problems and bridges are individual ecosystems, like EVMs and cosmos and stuff like that. How do you see the world evolving over a period of time where products from cosmos could simply get a loan on Ethereum and vice versa? Or an asset from Solana can get access to liquidity on Ethereum, Bibi, let's. Get to a point where we can get loans on assets on a single chain first.

Challenges in Cross-Chain Solutions

Yeah, that's true. That's like one of the problems I think polytrade is solving. Yeah. Actually, I first learned of polytrader at RWA event in Dubai, and it's quite remarkable on that. There's still some more digging I need to go into on it in terms of its use. And that's one of those things where, you know, you have providers who are going to be building you. You're going to have these niche chains that come out to bring, you know, to get adoption of their chains, either through in house bringing this tokenization to their platform, to their. To their chains, or by integrating with apps like Polytrade to then support their chains as well.

Industry Collaboration and Interoperability

And that's something that I'd love to speak to you guys about also, because you guys are going down, as Kevin said, there's so many different routes of rwas, so many different assets. And what, you know, what politrade is working on is different than what Maverick and equities and Maven are working on in our ecosystem. And so to have that interoperability, you know, that cross chain, I want to call it cross chain support in terms of bridging assets, but cross chain support in terms of supporting chains and different asset classes would be huge. But right now, we still need to work on getting, I mean, a, let's just work on getting tradable assets on chain, because to be fair, there's, you know, there's basically, there's only a handful of, I would call authentic rwas on chain.

Limitations of Current Asset Adoption

I mean, people want to say there's 11 billion on chain today. I would beg to differ. But we still need to work on getting that onto a single interoperable space. Then we can get to thinking, how do we move from Cosmos to. I mean, even Cosmos is still trying to figure out how you move from one cosmos chain to another one properly. So if you want to talk about mainstream adoption there, that's a whole completely different story. But for me, it's, let's get single ecosystems understood. Then we can start moving into bridging ecosystems. Absolutely. I think that is a very valid point.

Identity and Cross-Chain Transactions

So let me just jump to the last question that I have. And I think just for the space of time, with assets going cross chain, there is also an aspect to it that is the identity piece to it. How do you see identity traveling with the asset for a cross chain asset? Let's say, for example, if a particular asset needs to be KYC, and the KYC data is on chain a and the asset goes to chain b, can he actually settle the asset there? How does identity get ported? An interesting view is how provider is taking a take on it, right? They're trying to create an identity chain where all other chains and protocols can simply get access to that central identity chain and it will hold only identity of users and assets.

Whitelisting and Regulatory Compliance

So is that a way we can solve cross chain? Or how do you see identity getting solved? Maybe I'll just give a view on this one. So I do think that the effective white listing of market participants is a fairly essential component in this, at least in the immediate terminal. We may be as an industry able to solve the decentralized identity problem, and I think we will over time. But in the interim, an effective way of doing this, let me give you an example, is that we carry out, for example, the fully licensed regulatory compliance RWA issuance, say, on our chain permission. And at that point, if we wanted to move, say, 25% of the supply across to ethereum or one of the other chains, it needs to be going to a venue where that secondary market, the trading of that, the buying and selling, can only be taking place in accounts that have gone through a verification process and they're deemed to be white listed.

Managing Compliance with RWA Assets

And then the onward sending of anything has to be controlled as well. So you can't buy off a market and then start selling it to whoever the hell you want off market account to account. That's just not compatible with reg compliance related to most of these assets. So these are all things that have to be dealt with. I'm sort of minded, therefore, to say that where solutions like that exist, they're fantastic. We're prepared to partner with them and explore how we can broaden the liquidity depth that was touched on before. Broaden the distribution side for the clients, because they will want access to as many investors as possible, and they want access to as much liquidity as possible.

Defi and RWA Synergy

But it is about generally making sure that we can handle those problems on the other side. And that's sort of where we're at with regards to how we're approaching this. Another way to look at DeFi, though, is to think that it sits alongside the permissioned RWA token ecosystem as well. And what I mean by that is, if you think about DeFi and the huge amounts of liquidity in it's mostly chasing yield. And that's really been the story of DeFi since its inception. But if you actually look at what's been actually paying out the yield. It's not been a sustainable thing at all. It's not been commercially driven.

Challenges in Sustainable Yield

It's been tokenomics that have largely been designed to create an artificial yield for short periods until the whole thing typically comes crashing down because it's not sustainable. Now, what's going to be different about RWA is it's bringing on board a huge number of completely new users outside of the ecosystem. It's also bringing on board, obviously, real world assets for the first time, which is a huge amount of value. But they're going to need people to deepen liquidity pools to enable effective secondary market trading. And that can be paid for by the clients, and will be, and that can be utilized, in theory, to provide a sustainable yield for deepening of liquidity pools on the DeFi side.

Ensuring Quality in DeFi

And that can be done in controlled ways. You don't have to just sit there and start throwing any old random crypto that could have been money laundered straight into pools and cause problems that way. It can be done through high quality sources. For example, there are rigorous controls around account holders for most of the larger crypto exchanges. And if they are depositing, say, bitcoin, ethereum and other blue chip crypto, if we call it that, into certain secure vaults that are effectively then enabling deepnear liquidity pools that pay them yield, then that is a viable, I think, early solution that could solve that problem and enable defi to sit synergistically alongside.

Future of Cross-Chain Solutions

So there are a variety of problems around all of this on the cross chain side and so on and so forth. I think personally we're going to move to seeing industry solutions, probably from some of the people here too, that do work for us as an issuer, and then we'll be able to actually integrate with them as much as possible and start to realize this future collectively.

Closing Thoughts on RWA Solutions

And I would just say to close that. It is a collective series of tasks that we have upcoming here as an industry. Anybody who's focused on making themselves the one solution everyone uses for RWA is an idiot and has missed the point of all of this, which is we need to be giving issuers, investors, as much distribution as options as possible, across as many chains as possible, as many protocols. And that is going to enable effective decentralization, even where there is the permissioning around this. Because if they have control over the fact that they can migrate their RWA to a better solution or a different protocol, etcetera, then great, as far as I'm concerned, and that's why we don't place controls around that on our own network either. It should be that the optimal solutions win on this. And I think cooperatively and competitively working together is going to make the industry deliver solutions that eventually are indisputably better than the current system that we have, which is obviously very restrictive, but also very unnecessarily expensive. Thanks.

Discussion on Decentralized Identity

David. Absolute music to my ears. I have to say, there's so many things that I wanted touch on upon there, except one thing I didn't necessarily agree on was decentralized id, because at some point, your id will always be hosted by whatever party that you are interacting with. So, for example, if you're buying an RWA off Marketplace A, they have to store your data. Always. It's not enough to just have a soul bound token to just check off a checklist that you're, that you are KYC, they have to have your data as well. And then that's the same for marketplace B, that's the same for defi app A and defi app B, and lending and trading. You're not wrong on that point. The only thing I would say is though, that's based upon the current rules and regulations as it pertains to this type of thing. It's not beyond the realm of possibility that over time, regulatory change could happen if we can show a decentralized identity solution that actually meets the full standards such that it were. But you're absolutely right in the interim period. Completely impossible. I agree. Yeah, I just, you know, I'm building for today, not about where, you know, rules may change in the next.

Building for the Present and Future Regulations

I don't see regulators changing there. You know, I completely, I don't think RWAs should be treated as securities. I think, you know, regulating RWAs according to securities laws from 100 years ago is like trying to say, you know, put the same rules that we had for the horse, for riding horses, as to automobiles or to aircraft. Right. So I completely agree that regulation needs to change, but we, but I. But, you know, just practicality sake, we have to build for the way we have today. The rest I completely agree with on your take on all of that. It's something that's, you hit several factors on it in that, you know, for starters, like what we've done for the marketplaces that we've built on chain is now Jv. We're going to be open sourcing it all. We're actually jv ing our tech to two other parties that will be using it to launch their own RWA marketplaces on our chain. So it's, you know, the element of a rising tide raises all ships, which goes hand in hand with everything you've been saying is something that I really see. As you know, there are no, like one of the biggest RWA marketplaces.

Importance of Collaboration in the Industry

Their CEO is a GP investor in a fund that I co founded. I don't see us as competition. I see us as allies in boosting the industry and raising it all up. But to add on to one more thing, and this hasn't been brought up, but I'd like to say it for everybody, both speaking and down below, and it's a little bit off topic in a sense, but if you turn an RWA or an asset into an NFT or into a token, that does not mean it's not a security. I know that we haven't talked about that, but it's something that almost on a weekly basis I have to deal with. And it's remarkable how not true that is. I just wanted to add in there. I think all mills is going to love it. He talks about it all day. We're just continuing the conversation. Ole Miss, do you want to give your last notes, your thoughts on this question? Six minutes time, maybe post that? Kevin, you can.

Regulatory Compliance and KYC Perspectives

Yeah, I mean, I also see a lot of people thinking that the regulators can't connect various data sources, like IP address, mobile data, and also wallet addresses. And my personal take is that they're not, when we speak identity, there are not so much you can do to actually keep your identity hidden when really governments have all the tools in the world to actually find out who is the owner of that particular wallet. So I think in terms of, we see many wants to be secret in the space, but I think that over time we'll see a lot more onboarding to the KYC and AML procedures and being more compliant in their ways of behaving. So that was just a little side note that we have seen what technologies are out there to really find out who is who and that you can connect your social media to that wallet and so on and so forth. So there are many ways to, for governments to find out what they want to find out anyways. So I think the way the industry should go is really to be compliant and onboard via KYC and AML, register all that and we'll be very transparent with what you invest in.

Industry Perspective on KYC and Regulatory Framework

And when that being said. Yeah, that was just a side note to that. Yeah, I completely agree. And I think agree with broadly what may have said as well, most of the RWA, just because you tokenize them, I think theyre still representing the underlying asset, which is still kind of, in most cases, already have a legal framework to deal with. And thats absolutely true. And I do not understand when people think that just tokenizing something takes it out of the framework. So completely agree on the KYC front. I think Maybrick is also correct. We're building for today. It is going to be in the model that he suggested. But there are a few offshoots I think I can mention where, Ashish, you and I live in UAE that we have now a central wallet for documents which we can use across multiple banks linked to our national id. It's the same case india as well.

Centralized vs. Decentralized KYC Solutions

So we are moving more and more towards one, at least one trusted central hub for a jurisdiction, at least in this part of the world, which can be relied upon by third parties to KYC. They don't have to keep all the documentation and go through the entire KYC process themselves. And maybe that will catch on. I'm not sure when we'll see a totally decentralized solution. Will governments actually, you know, agree to something like that? But I think at least we're moving more and more towards a centralized KYC solution, which could be at the national level in a few jurisdictions. 100%. Almost. It's good to, it's good to know you're in the UAE as well. Yeah. You basically use your MRT's id for everything. But I don't see a world where governments give up any form of control over identity.

Government Control Over Identity and Compliance

If you look at it, they are, they're radically, every government around the world is radically moving towards more information transparency towards the governments. The. So I. The. Actually, it's very interesting is that the UAE is a place that has. Because, I mean, id is centralized in any country you go in the world basically, right? You don't. You get a driver's license in the United States. That's still centralized to the DMV. Now, why? The idea that if you have a centralized id from the federal government, it's unconstitutional? It's a little bit ridiculous because now we use Social Security in the US, the Social Security number as your centralized id. So in a way we still have it. So it's basically the same thing with extra steps and more idiocy. But the way that the UAE has done it is actually incredibly smart.

Utilizing Centralized IDs for RWA Platforms

So I don't see did solutions necessarily coming out because governments will never rescind their, like, abdicate their power on that. Now, where that can actually help is that every RWA asset platform can now go by your id number and then use your id from that centrally held id solution from the government and understand that, okay, you know what? This person is working with us, too. And so they don't have to, like, collect and redo KYC data all the time. It's just held by that central government power as the way that, I mean, you go carting here in Dubai, and you still need to use your emirates id. So it's like, have like a membership in places. So there's that angle of it. And there was one more element of, now I'm blanking on it. But there was an element that you touched upon where these RWAs.

Interoperability in RWA Platforms and Wallet Solutions

God, I'm blanking on this. I'm sorry, but the did solution, I don't see that happening anytime, anytime soon. But the centralized id sure did now. Yeah, probably with you on that one. Oh, this is actually what I was thinking of. So on the Maverick network, we've got the Maverick Wallet, which is a non custodial wallet, and it's non kyc, you know, use it for apps, gaming, DeFi, nfts, etcetera. And then there's a Maverick pro wallet, which is a KYC and whitelisted wallet. And the DeX, the RWA Dexs work in tandem with the RWA token contract and the Maverick wallets whitelist, blacklist and token standards for. Well, it's really built into the RWA token standard for transfer restrictions.

Decentralized Use and Permissions in RWA Ecosystems

And so once you have a Maverick wallet, you're inside this walled garden of permissioned assets, but in a permissionless manner. So you can then in the entire network, once you're using that, the Maverick Pro wallet, you can use any RWA app that's on the chain or DeFi lending, borrowing and secondary markets. And I think that format is going to become more popular. It's kind of like centrifuge, where centrifuge has a walled garden, but it's, everything is closed inside their network, but it's on a public network with us. So, Chintai, I mean, I'm sure you guys might have something similar to this, but I'd love to hear your take on how you guys handled that or. David, really? I'm sorry, David, you're representing Chintai.

Questions About KYC and Custodial Routes

I'm sorry, could you say again what the specific question was? So how are you guys handling non custodial wallets that are KYC in order to interact with, let's say, permissioned defi apps and secondary trading on the chain. Are you guys using a KYC non custodial wallet? Are you guys going the custodial route for apps? At the moment, we're having to go the custodial route because we don't really have a choice at this stage. On the other hand, if anybody has developed a solution that was viable, we're more than happy to work with them on that because that would be my long term preference.

Regulatory Compliance Solutions and Challenges

So at most stages right now, when people are looking at the technical solutions, they're having to compromise around limitations of what's available on the market in a variety of ways. It's never been my choice, for example, to build a permission chain, and long term, we'd like to decentralize our own as well, but it's just a necessity in order to meet the regulatory requirements. Permission or custodial. Say again, permissioned or custodial, two different things. Well, it's both in the sense that we're handling it's self custody in the sense that there are, on the account level, the holders have their own private keys and they hold the assets there. But there are permission controls built into the chain at the protocol account token levels that stop you moving them around if they breach compliance rules.

Addressing Compliance and Transfer Restrictions

So there's an on chain compliance engine that enables that. So it enables full automated compliance across the full trade lifecycle for the RWAs, that's what we built out to handle these problems. But when you start to go then onto other chains, obviously they don't have those controls at the moment. And therefore, either there has to be some sort of custodial holding of the asset on behalf of the client, or there needs to be something built in, either at something like the token level or something else that is going to enable that. Controls around things like transfers and who can participate in the secondary markets. Oh, okay, I understand. I think we built something very similar.

Focusing on a Single Chain Ecosystem

However, when it comes to the DeFi applications, though, we're not focused on the cross chain side at the moment. We're focused more on building the entire interoperable ecosystem on a single chain. But when it comes to we built vaults that can do loans on RWAs, those vaults are completely non custodial. It's only between the wallet owner, the wallet address, and the vault contract. And it's the same with the RWA Dexs. They all work with that on chain permissioned mechanic in terms of transfer restrictions. But each individual, like, we built three different RWA DeXs, OTC, AMM and orderbook, and also the lending with Maven finance. And so all of those are non custodial, but they still work with the transfer restrictions that we've built into the token standardization.

Concluding Remarks and Future Outlook

Understood. Yeah. Happy to actually give you. Perfect. Okay, thank you, guys. Thank you so much. I think we've come to the end of the space. It's always interesting to hear so many point of views. We've been doing this for quite some time, and I think you will soon see some other documents and things coming out of these spaces that will give you a gist about what were the best clips. But yeah. Thank you so much for being here. If anybody has last commands, please go ahead. If not, thank you. Thank you for joining today. Thank you. Thank you for having us. Polytrade and everybody else on the panel, thank you for being here.