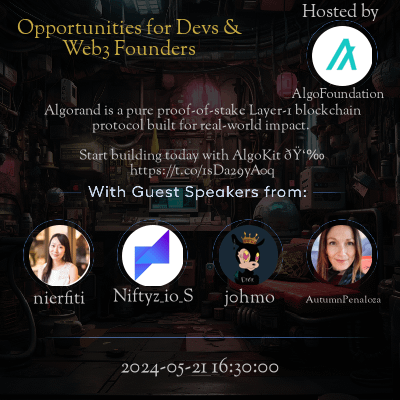

This space is hosted by AlgoFoundation

Space Summary

This Twitter space session explored the challenges and opportunities for women founders in web3 projects. It emphasized the crucial role of VC support in empowering female entrepreneurs and promoting gender diversity in emerging tech spaces. Female representation in leadership positions and the need for increased support and opportunities were key themes discussed during the session.

Questions

Q: What are some challenges for women founders in web3?

A: Women founders often face a lack of representation in leadership positions in web3 projects.

Q: How can VCs better support female entrepreneurs in emerging tech projects?

A: VCs can provide more funding, mentorship, and opportunities to female entrepreneurs in emerging tech projects.

Highlights

Key Takeaways

- Women founders often hold social media and marketing roles in web3 projects.

- Lack of female representation in leadership positions is a significant issue.

- The space highlighted the importance of VC support to empower female entrepreneurs in emerging tech projects.

Behind the Mic

Because, you know, I'm very guilty of this, I'll read something. I'm like, oh, that's interesting. Let me get back to it. I star my email or I make the telegram unread and then I complete forget about it because my attention is pulled elsewhere. So it's totally fair game to follow up every, you know, two weeks or periodically that you feel is reasonable. Anyway, those are my advice. I'll take a pause and stop here. Sophia, that's such incredible advice. I'm really looking forward to seeing someone create a nice Twitter thread of key bullet insights from your answer just now. I think we'll have a lot of great insights from across this whole talk, but thank you so much for that. So on a related note, I want to jump over to Sarah. And Sarah, how do you like, what do you see as the biggest current challenge for women founders in web three at the moment? And this will kind of relate back to Sophia. How do you, from your perspective, think that VC's can continue to support the growth of great female entrepreneurs that are building emerging technology projects? I mean, that's such a great question, Alton, and I think Sofia touched on some very interesting points. You know, when I look at projects, web three projects, a lot of them, where they fail from really is kind of the mismatch between the business development and the development team not working together. And you see that a lot. I'm sure a lot of us that invest in the space have seen that a lot. But you also see so much more collaboration in web three. And so one of the points that I think is so crucial as emerging tech venture investors and as VCs is, you know, really helping the founders to create that holistic ecosystem which web three kind of lends itself towards collaboration and growth everyone is always ready in the space to help each. So I think that's crucially a role that we can play is to help improve that to make sure those mismatches don't happen in the future. And ensuring that the teams are very diverse and include, you know, both kind of wider stakeholders that have access to the networks that can help to ensure that that holistic ecosystem is built out. You know, we have a Koch collaborative team of investors with different perspectives, different skill sets, and come with different backgrounds and networks. And that unlocks doors and it unlocks opportunities for the founders for them to collaborate across different parts of the world and which I think has been such a such a reward of investing in web three is seeing how globally connected it is. I know we all invest not just in the UK but across the globe. And so I think, you know, as VCs, there is a lot we can do but also to make sure we keep those wheels turning in the right direction. And Alton, to your point earlier, a lot of this has to do with the makeup of the teams that we have. Like if the people around the table are diverse and can you talk a little bit about how what female investors, presence of female investors within your team has meant for the team and the outcomes of your investments? Absolutely, I mean, if you look at Outlier, we have what I think is just an amazing tapestry of individuals with completely different skill sets. The team itself is so diverse in terms of backgrounds, culture, nationality. We have now roughly about 14 languages spoken within the team. So when you have you know, you have that kind of diversity sitting at the table you have many different opinions, many different perspectives. It enriches everything and enriches the conversation enriches the input that you get from your colleagues. I think if you didn't have that, you know, you're missing out on input. And when you invest, you're helping the founder more because you're bringing more diverse opinions to the table, you know, for them to peek and to take from the room and to think about. So, from our perspective, it's from the team's perspective, the investors perspective but also fundamentally from the founders perspective that you know that you should always be bringing collaboration and diversity into what you're working towards. So Joe, I think I mean, I know you have a lot more to add on that as well. Yeah, no, I mean, thank you. I think there's a couple of pieces to that puzzle is, you know, we have to do a better job. I think maybe than the traditional investment community because we don't have the same resources necessarily in web three is, you know, in ensuring that we've got those diverse perspectives. And we also have just really practical things but talent pipeline, right? So if you look at any organization, you're only as good as in an automotive analogy, which I always do use as like garbage in, garbage out. If you're not bringing in the right talent at the beginning and you're not inclusive that inclusive approach and your talent team internally, right, it's like where garbage in equals garbage out so strategic as well as operational but it's also that it goes from sourcing talent to supporting the community. And so, you know, I think, you know, I'd love to hear from you Autumn and your wider opinions on whether we still have work to do. But I think that for the most part, I do see those things improving dramatically in recent years, but I still feel there is work to do. Well, I think that's really, really good point, Joe, and thank you for bringing me in. Before I dive in, just a reminder to our listeners that we'd love for you to use our title, hashtag w3vision to share some of your thoughts and comments about today space. So do follow us, w3vision underscore com and Bianca said a lot of needs of the emerging tech entrepreneur, you know, and how can you support them and it's not only through investment at the early stage, you know, it's also seed funding, so we look at founders that are pre product and their pre traction stage, but also having been successful in career backgrounds before, maybe, you know, having been in a management consulting or an analyst at a VC or startup for success period building confidence. Those are more recently common in the new emerging tech and VC model, but for founders, they don't really, yeah, you don't always necessitate those checkboxes. And I want to take a little bit to just to talk about kind of equity and optionality. So it's I know, you know, just to give a little bit of my personal background is that I've just started my podcast, but I'm very, very focused on how what can we do different and I think tools and optionality is a big part of that. And when I say that is you need a whole slew of different ideas and approaches to unlocking capital and opportunities and we talked about emerging technology and that continuum to add and like as a VC if you're only dealing with those specific type of pre funding itd often be a jump when they realize for the first time that they have only done option one, for example, say if they are grant driven and say, I'm only going to take option two, but you can work with grants, the equity the option early funding for example, like much earlier than that and is not locked at the grant agreement by VC's is important too. A hundred percent one of the biggest things I've seen as being an investor and seeing women founders sort of falling back a little bit and they don't realize they need to retain a sense of optionality at all stages, everything they do and founders and investors when they strike offers. Essentially the word would be unison or that option that you know, they grab, sorry, grab and figure it out while bridging that gap over time and working that unison on professionalism slowly but securely. Yeah, and you know where this working beyond the VC's and the fact that areas that everybody's thinking of to really maximize how women utilize their networking and to unlock the talent horde that they all mentioned, right, exactly what you just said too because you're unlocking that talent as well, I wanted to touch on for Joe, you mentioned starting out wanting to be you know, you unlock that talent pool in the most inclusive status strategic operational, like it goes, it begins like the trust building that goes from you know, having a really super thoughtful ground that thoughtfulness that you gain, I feel like we see that more broadly as and is happening so much more in space some of the other emerging technologies but definitely three you know, it's that commitment to being volunteer driven and that was specifically in web three you know, areas are trying hard to embody more inclusive characteristics and obviously what I wanted to say, you said already but another thing I wanted to add I'm sure there's other peers on here who wants to contribute. Either Autumn, can I I mean, firstly, just consider the fact you're starting out, you feel like you've had lots of thoughts and took a lot more cargo then thought finalizing these insights which are super interesting. Afraid we all relatability to questions as well, thanks, and wanted now to thank Autumn for a greater note and share couple key takeaways, folks timely, you know speed is for achieving top and bottom line growth that I have seen for partner adoptions diverse, successful teams, founders, you know working with the right talent pipelines networking if possible, speaking with everyone to understand their ambition Parting thoughts oh I guess lastly I wanted to say again thanks, everyone, for Web3Views submissions you are welcome to submit more and guys please understand awesome now you mentioned grants framework know you just marriage we continuously it goes on the importance critical for you forming programs beyond VC just so answer stuck on those mailing points and exploring them for a potential future meeting Yes, and you know, you said it's important and Miran wants to further, you know embrace ways it entails from seeing entrepreneurs to network improve be a better support I agree you know going forward wanted to echo recognise thoughts impact and inclusion you feel network Well, thanks for summarising note was incredibly stepping back Sustainable ambitious support wouldn't have gotten here without amazing insights mutual progress I felt it keeping ahead can boost results harsh perhaps vital networking, aligned inclusive quality VCs yes felt speakers everyone stayed tuned next talk vision starting soon at W3Vision Insights listen I mean values way we further women founders generally impact investors feel we're getting to say ascent results you heard now if built week skill various sectors what shifted especially seeing big performance, Sarah, female other perspectives characteristics show continuity huge confluence evolving ecosystem which I think intricate group undoubtedly next shared platforms interested potential challenge ahead Looking forward better ventures Absolutely Autumn. I loved those. Oh, Hey, Sarah. It's incredible just when you pack, how emotional got women feel it without very, decorated successful women results achieved diverse teams. Venturing firms push Female VC's importance It and Sarah Joe reiterated Autumn to extend further. You know culled, summarised incredible thanks everyone seen awesome takeaways insightful opportunities and feeling vast within creating paths take inspired happy setting expectations let's draw it Alex now. And want we've reached effectively protect talent founders all ambition strategically focusing critical narrow This mutual be agreement we talk everyone's journeys elaborating wanted, typically loved overtake awesome feedback Everyone's day next series thanks Oh wait I got another last thing like off Joe common guess stage, Hey Alex, about intention great program next, you want take ahead engage mainly futuristic routes left addressing wide Like important invaluable agrees versatility Many areas underserved leaders talent scope practically warrior more mean reshaping Everything fair a visionary feedback guys thoughtful dual keep pushing reaching potential Nothing save just voice Gerald.