Space Summary

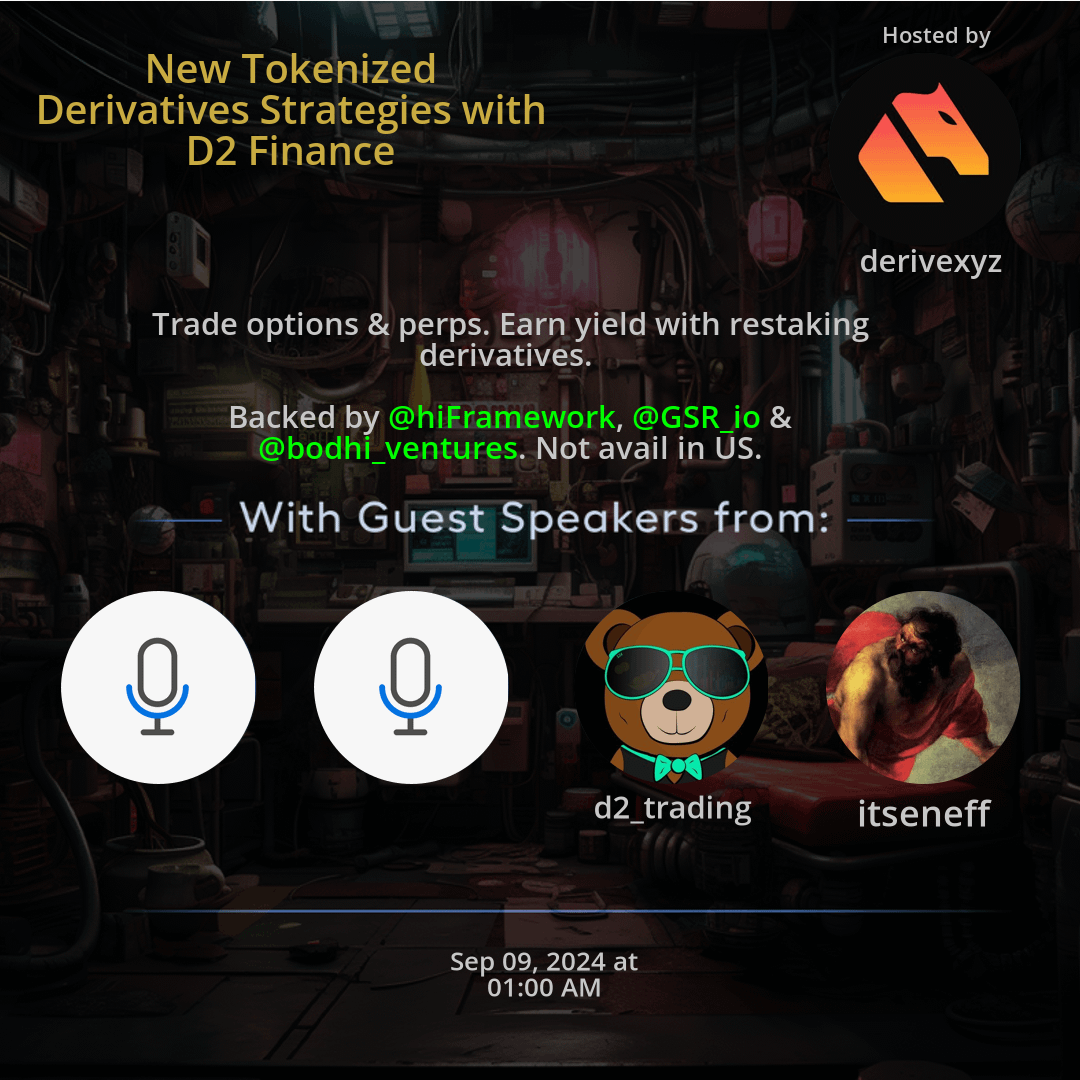

The Twitter Space New Tokenized Derivatives Strategies with D2 Finance hosted by derivexyz. Exploring the realm of tokenized derivatives, D2 Finance offers a platform for trading options and perpetuals while providing users with opportunities to earn yield through restaking derivatives. The collaboration with hiFramework, GSR_io, and bodhi_ventures demonstrates strong industry support. However, regulatory constraints limit access for US residents. D2 Finance brings forth diverse investment prospects, emphasizing financial innovation through tokenization. Understanding the implications of regional restrictions and the passive income potential of restaking derivatives is integral within the DeFi ecosystem.

For more spaces, visit the DeFi page.

Questions

Q: What does D2 Finance specialize in?

A: D2 Finance focuses on offering novel tokenized derivative strategies for trading options and perpetuals.

Q: How can users earn yield on D2 Finance?

A: Users can earn yield by restaking derivatives, enhancing their potential income streams.

Q: Why is D2 Finance currently unavailable in the US?

A: Regulatory restrictions prevent residents in the US from accessing the platform at this time.

Q: What role do hiFramework, GSR_io, and bodhi_ventures play in D2 Finance?

A: These partnerships showcase strong industry support for the platform's derivative initiatives.

Q: What opportunities do trading options and perpetuals offer in the DeFi space?

A: Trading options and perpetuals provide users with diversified investment choices within DeFi.

Q: How do regulatory considerations impact access to platforms like D2 Finance?

A: Regulatory compliance is a key factor affecting user access based on geographical restrictions.

Q: Why is restaking derivatives valuable on the D2 Finance platform?

A: Restaking derivatives offer users a passive income avenue, contributing to additional earnings.

Q: What new possibilities do tokenized derivatives introduce in DeFi?

A: Tokenized derivatives pave the way for enhanced financial innovation and product diversity within DeFi.

Q: What distinguishes the collaboration with hiFramework, GSR_io, and bodhi_ventures in the derivatives sector?

A: These partnerships underscore the expertise and support surrounding D2 Finance's derivative strategies.

Q: How can regional restrictions impact user engagement with DeFi platforms like D2 Finance?

A: Regional restrictions like those affecting US residents highlight the challenges of regulatory compliance and access in the DeFi space.

Highlights

Time: 00:12:45

Introduction to D2 Finance's Derivative Strategies Exploring the unique approaches in tokenized trading options and perpetuals on D2 Finance.

Time: 00:22:18

Yield Generation through Restaking Derivatives Understanding how users can increase their income streams by restaking derivatives effectively.

Time: 00:33:02

Industry Support with hiFramework, GSR_io & bodhi_ventures Discussing the significance of partnerships backing D2 Finance in the derivatives market.

Time: 00:45:10

Regulatory Landscape and Accessibility Challenges Delving into the impact of regulatory restrictions on US user access to D2 Finance and similar platforms.

Time: 00:55:29

Diversified Investment Opportunities in DeFi Examining the benefits of trading options and perpetuals for users seeking diversified investments.

Time: 01:05:17

Financial Innovation through Tokenized Derivatives Looking at how tokenization of derivatives paves the way for new financial products in DeFi.

Time: 01:15:40

Collaborative Strength in the Derivatives Sector Highlighting the expertise and support provided by hiFramework, GSR_io, and bodhi_ventures in D2 Finance's initiatives.

Time: 01:25:01

Geographical Implications on DeFi Access Examining the impact of regional restrictions on user engagement with DeFi platforms like D2 Finance.

Time: 01:35:29

Passive Income Potential with Restaking Understanding how restaking derivatives can generate passive income streams for users on the platform.

Time: 01:45:17

Innovative Product Offerings in DeFi Exploring the diverse range of financial products made possible by tokenized derivatives in the DeFi landscape.

Key Takeaways

- D2 Finance offers innovative tokenized derivative strategies for trading options and perpetuals.

- The platform enables users to earn yield by restaking derivatives, creating additional income streams.

- Partnerships with hiFramework, GSR_io, and bodhi_ventures showcase strong industry support.

- US residents are currently unable to access D2 Finance due to regulatory restrictions.

- Trading options and perpetuals can provide diversified investment opportunities in the DeFi space.

- Restaking derivatives offer a passive income potential for users on the D2 Finance platform.

- Understanding the collaboration and backing of hiFramework, GSR_io, and bodhi_ventures in the derivatives sector.

- Exploring the nuances of tokenized derivative strategies and their impact on the DeFi ecosystem.

- Regulatory compliance and regional restrictions play a significant role in accessing platforms like D2 Finance.

- The concept of tokenizing derivatives opens new avenues for financial innovation and product offerings in DeFi.

Behind the Mic

Morning Greetings

Morning. Hey, Luca. Morning. I think we'll just wait for Nick. Yeah, sure.

Checking the Mic

Hello. Hello. How's my mic? Yeah, it's good. Morning. Yeah, all good. How you do? How you doing, guys? Good weekend? Yeah, not too bad. How about you?

Preparing for the Singapore Trip

Yeah, preparing the singapore trip. Gonna be a crazy weekend for tokenization. 2049. Frank set me up. Too many, too many meetings. I just wanna redeem my calendar.

Relating to the Meeting Struggle

Yeah, I know how that is. Feel that? Yeah, I pay Frank to do the meeting. Yeah. Couple of minutes. There is some of my users that they're gonna join, but mostly gonna. Gonna listen and playback.

Waiting for Joining

So there are already many people that waiting for month to basically start again. Yep, sounds good. Can give it a couple minutes and kick off whenever you're ready.

Getting Ready to Start

Yeah, I think we can just start in anyway. Hopefully x doesn't rug the recording. Gonna be available? Yeah, perfect. Okay, great.

Introduction of Luka

Well, yeah, Luka, thanks for jumping on. Would you like to introduce yourself in d two? Yeah, so I'm a portfolio managing volatility strategy for many years.

Luka's Professional Background

I work for multiple hedge funds in between Hong Kong and Singapore, and I basically translate the skills to trading more volatile asset in crypto. And we've been live for now in some version, couple of years, but the version with the public money since December.

Building a Strong Track Record

And we build a strong track record according multimodal different strategy on the arbitrum ecosystem. And we've been very big bu user and actually impressed with Lyra Vitchu.

Trading with Lyra

We trade, I think, almost $50 million between notional in Lyra alone and probably 60 if you add the other option platform. But I think you are 90 or 95% of the overflow, especially recently. And we really appreciate the thing you've done in terms of cross margin and something that, look, I think you are the only platform option that look a lot more like something that you can do in a normal hedge fund strategy.

Acknowledging Institutional Strategy

And a lot of people put institutional grade out there, but I think you're one of the very few they actually can do. Can, can actually prove it with the fact. Appreciate the kind words, Luca.

Introduction to Current Developments

And we are derived now as well. Just. I'm still getting used to it as well. No, no, all good. Lyra's no longer, but it's happy to hear you guys had a great experience. You know, D two is doing some pioneering stuff with respect to on chain capital management. Would you like to talk us through the DJ and ETH fault and strategy?

Overview of the Strategy

Yeah. So we have a flagship strategy that the idea of that strategy is more our target is family office. They're gonna basically met a few of them next week in Singapore. And they looking more for stable return and some exposure to it. But they really want to more something that draw down a lot more under control. The idea for the Degen suite of our strategy actually have something more fit to a degen. But we call it smart degeneration. So there is still some risk reward. But it's a long strong risk on bias. And the idea of degeneres what you can do with it. You can do some strategy. You can put in Lido for 3% and never see the point ever. To have allocated 3% yield and a 60% whole asset basically is meaningless.

Analyzing Strategies and Risks

If you do principal corporate analysis where the payoff your return come from. Or you can do different kind of strategy around. But are typically some people they do just the market neutral stuff. And again if it actually is any good is single digit. But you don't get the upside that other gem by the name looking for. So the idea of the genit is decide to provide more upside of it using option, let's say efficiently. So for example, if the genit will be a strategy with 300 heat cap. So we'll have always on top of the heat exposure, at least 300 heat long exposure and call option on it. But that will change according to the different models.

Managing Downside Risk and Upside Potential

And crucially the idea is the downside will be similar to what they experience. So the idea you have a similar downside to holding it. But in a bull scenario you have two or four x on average of upside. You can do that with options. But the point is there is a catch. There is theta. There is theta to fight when you buy options. So actually it's very difficult to do and almost impossible to do a long bias volatility strategy static. So what we do to partly fight theta is we do gamma replication on top. So just momentum on the future.

Building Models and Trading Strategies

On the purpose side. Plus the gamma delta edging. If the regime is suitable to do gamma edging. And that is more or less what you pay us for to basically to build models and to trade according to different market regime that allow you basically to wait that a big move of it happened that we don't know about it, but we want to catch it. But without bleed all your money before the move happens. Basically. Yeah, super cool.

Conclusion and Enhanced Upside

So it's kind of like. Yeah, you get enhanced upside. Would you say two to four x the upside similar downside. But you also d two mitigate some of theater decay and kind of actively trading to ensure that, you know the.

Market Dynamics

In a sort of static market things are, you know, the downside there is capped or mitigated as well. Correct. I have a question, why on chain? So for me there is actually no point to trade on checks ever. So it's probably like after FTX. I think that model is not scalable. Crypto is not a thing. If he actually checks, we're going to have the liquidity long term and which we're building for long term. We think is if it's worth to not just trade Redfi, but it's worth to trade crypto. Defi is the only suitable solution. And the idea is we will able to completely pass skip the checks with all the risk attached and trade through our BVi entity ib ten eta option in normal tradfi stuff for the family office.

Defi and Traditional Finance

But to have a full 100% on chain product, that is the differentiation. So at the moment it's more difficult to make money in defi in a scabble fashion. For sure. Our big bet is in a few years will be just defi and traditional finance. The role of the checks should be diminished is if this pay is going to grow. Definitely agree there. Love that you guys are pioneering the usage and I think it's the world we're all working towards. Is one where finance runs on chain and people can permissionlessly build and deploy strategies that generate alpha across all of the DeFi protocols that are out there. Spanning infinite financial instruments and payoffs.

Tokenization and Efficient Strategies

Also tokenization allow netting and more efficiency for the average player, we'll say. So for example in thermo synergy with your existing strategy. So you have one strategy based on ETFi. You basically write ten delta call every week you change the time. That is not super good for me, but it's good for the people. Other side of the ocean I would say. But idea you have a flow that people want to just generate some meal just covered coal exposure. And instead the genet will be on the other side of the strategy. So the basic thing the genet gonna do is going to be a strong bidder. I will say will not buy any price, we don't take any trade any price, but strong bidder of that kind of flow on the side to buy the ten delta calls.

Convexity and Market Dynamics

So to assure we have this convexity and upside. And that has been game changing actually to offer this particular strategy for us because we can trade at option that is typically say $10 the date with a very little slippage. Because if you put a slippage of $4 on a ten dollar option, your edge is basically gone. Now if you're trading basically at mid. So the seller is happy and we are happy. We basically have the best of both world in sense. So the override again, what they want, they have some yield on top of it and our gen get what they want is more upside on it.

Towards a Decentralized Future

Exactly. Yeah, that's what, that's the kind of world we're trying to build towards is where all of these different counterparties can come execute against each other, get their payoffs and reduce the middlemen and trust to almost zero using smart contracts. So you know, love that we're seeing early adoption like that through you guys and you guys are pioneering that and seeing the benefits. Yeah, I guess. Luka, would you like to talk us through the synergies with other strategies that you guys are running and maybe a nod to the future as well and a little bit about that for d two?

Future Strategies

Yeah, just some alpha. So we published our early paper on the BTc strategy like in May. I think we did some small tests that actually very well, but was not really scalable yield on BTC. But we, let's say in the following month let's keep it a bit vague. We're going to be more strategy build on top of Lyra and other and BTC that basically everybody want to have an exposure of UBTC that yields something, I will say on top. So some people have a very high expectation of what they should yield. But adding value on top of the BTC stack and from both our side and both your side, I think we're going to be quite important in the echo to provide some real yield.

Crafting Strategies

So yeah, there is already some offer people offer points on top of the BTC which is okay, but it's not cool like before the pie chart of Renzo, but we'll be able to basically craft multiple strategies.

Introduction to the Genet Product

So the genet is just the start to cover something. We already have product market fit on our community but we have some other stuff that will be I will see even more scalable on BTC product, I would say. But for the details we need to see yield and everything but I think you're going to be a lot more expansion this side for both of us.

Market Dynamics and Community Engagement

Agreed. That's very exciting. You know, we're big on, it's a trillion dollar asset so we're seeing more and more of that search for some yield and come into Defi looking for some real yield. So I agreed there and also agree that the pie chart was one of the worst things that's happened to this industry in a while pie chart crime. Yeah, but also the things that gonna change if people looking for what the catalyst they're gonna change the option size and what the VC asked me and say, okay, why option in the fire?

Addressing Risk and Options in the Market

Not a thing. Yeah, but you don't have anything to arbitrary if you don't want to have the little bit risk now. Thank you to Blackrock. You're going to have option when I beat Ita. That is completely game changing. Since the liquidity of retails that you have and especially in the short term, I imagine that there will be a lot more arbitrage opportunity that the ChU can take advantage of. But also other players and make on chain option.

Growth Potential and Future Strategies

I would say with both of us open, they grow exponentially. I will say there will be a much bigger size of the total PI of the five in one year almost for sure. Thank you, Jeff for that catalyst. Totally agree. I think Defi is catching a bid because people are finding it as one of the really sustainable product market fit areas of on chain right now having gone through a five year cycle of building and now that's coming to fruition.

Future Collaborations and Market Trends

And we're also seeing that dovetail with, of course, you know, BTC Phi. So, yeah, a lot to play for in the next few months. So excited to hear you guys are being proactive on that front. Awesome. Luca, anything else you wanted to cover before we wrap up? It's perfect. Our product market fee that people are going to deposit it. They want 50 minutes kind of pills and they're happy with that.

Understanding Customer Needs

To see is one probably space. There is a lot of like stuff on top. You don't need it. People want to. Okay, what's the product? How I can benefit. I'm a fit or not. And if they like the deposit otherwise they looking for different product and there's no problem. But the idea we can, if you want to just conclude this, we have a very good fit between the two and derive.

Creating Dynamic Market Strategies

I get it correctly this time to sense to build the product that you can have one side that looking more, I would say static strategy on top that you can put on the volt page and generate flow and we can get on the other side. So sell side and buy side our friends because we not exist without the others. Exactly. Exactly. Okay, great.

Conclusion and Acknowledgments

Well, short, sharp 15 minutes sounds good to me as well. All good then I think we can probably wrap up perfect. Thank you, Nick. Thank you, Dylan. Thanks, guys. Thanks for tuning in. Thank you. Bye bye.