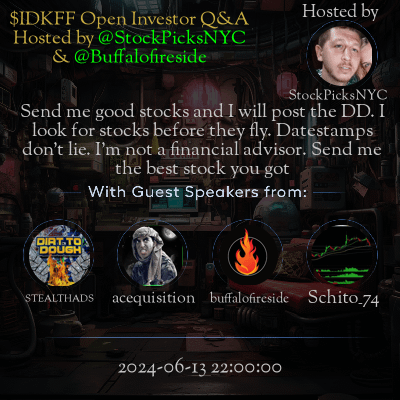

This space is hosted by StockPicksNYC

Space Summary

The Twitter space conversation focused on digital assets within the DeFi space, highlighting delays in public offerings and funding challenges. Emphasis was placed on transparency, thorough preparation for investor interactions, and the importance of open communication with stakeholders. The discussion stressed the need for patience given the unpredictable nature of development timelines. Despite current market challenges, optimism for positive outcomes was expressed, with plans for ongoing engagement and updates with investors. The company's values of transparency and respect towards stakeholders were evident throughout.

Questions

Q: Are all digital assets ready to be public soon?

A: No, some face delays and setting timelines is challenging.

Q: How does funding affect going public?

A: Dry funding, especially in OTC and small-cap segments, hampers public launches.

Q: Are bold predictions about company timelines reliable?

A: Timelines are unpredictable, and disclosing developments as they occur is advisable.

Q: How important is open communication with investors?

A: Essential to maintain trust and transparency.

Q: What is advised to stakeholders during uncertain times?

A: Patience is crucial as developments may take longer than anticipated.

Q: What does the company believe about future outcomes?

A: Despite challenges, positive outcomes are anticipated.

Q: Will there be future updates and communications?

A: Yes, plans for continued communication and updates exist.

Q: How does the current funding landscape affect companies?

A: Companies struggle with uplifting due to dry funding environments.

Q: What respect does the company hold for its stakeholders?

A: High respect, appreciating patience and open communication.

Q: What's the advice to keep investors updated?

A: Follow the company and related tickers for the latest information.

Highlights

Time: 00:53:05

Discussing the readiness of digital assets for going public.

Time: 00:54:01

Description of dry funding in the OTC and small-cap landscape.

Time: 00:54:05

Companies' struggles with uplifting in current market conditions.

Time: 00:05:26

Emphasizing the importance of following the company for updates.

Time: 00:45:01

Highlighting the need for patience from stakeholders.

Time: 01:05:22

Company commitment to future investor engagements.

Time: 01:05:13

Plans for future communication with investors.

Time: 00:53:50

Company belief in positive outcomes despite challenges.

Time: 00:05:06

Discussion on ongoing market headwinds.

Time: 00:05:29

Conclusion with an invitation to follow company activities.

Key Takeaways

- Digital assets facing delays in going public.

- Thorough preparation for investor questions is crucial.

- Bold predictions about public offerings are unreliable.

- Financial constraints impacting public launches.

- Open communication with investors is highly important.

- Patience from stakeholders is vital due to unpredictable timelines.

- Optimism for favorable outcomes despite current challenges.

- Future engagements and updates with investors are planned.

- Company values investor respect and transparency.

- Market struggles due to dry funding landscapes.

Behind the Mic

Great questions, guys. Oh, yeah, definitely. Yeah. I did have a follow up. Of all the companies that you guys have investments in, how many do you think could reach public in the next year or so? I don't have. I don't know. I don't know. I'd have to prepare for such a question. But, you know, I could say, well, yes, but again, I can't commit to timelines. You know, we believe. We believe we have a number, for example, of digital assets that were, I thought, supposed to be public by now, and they've been delayed. So I don't really want to make any bold predictions. We'll just kind of disclose them as they occur. Yeah. And I wouldn't doubt. And this is me talking. Obviously not you, Sheldon. But I wouldn't doubt that funding has a lot to do with the issue, especially with companies going IPO and launching into the public markets. I think it's a funding issue overall, and they could be profitable as hell but may not want to go public unless there's a very receptive audience. But I think everything's going to find its path, but very understandable. Yeah, you got it. We're very disciplined. And again, we have different buckets of funds. We have funds that are basically very short term, which it's our goal to pay the dividend out of there. And then we have the ones that have higher potential, but they may not be, you know, liquidating this year. But saying that out of our digital assets, there's been a huge fluctuation with them. They've gone from 600 to 5000 to 3000 to 4000. They're all over the map. But besides, we've all allocated $7 million at one time, which we've, for tax and accounting purposes, have written down anyway. They could go up, down and around. Okay, so, I mean, if there's no more questions, I actually like to close with a thank you from Sheldon to everyone. Yeah, thank you, Sheldon. Thank you guys for the time. I've really enjoyed this. It gives me, you know, a chance to really understand what shareholders are thinking and with limited one on one meetings these days, this works very well for me. So again, you have my email. Send me those requests. I'll get to all of them. Thanks, everyone. Thank you. Bye now. Bye now. Thank you so much, Sheldon. Thank you, Sheldon. Bye-bye. Thanks a lot, everyone. Appreciate the questions. Goodbye. Goodbye. Thank you. Bye-bye. Goodbye. Thanks again, Sh. Yeah, thank you for your time, Sheldon. Thank you for answering everyone's question. I know it was a lot thrown at you and, you know, we give you a lot of respect for that, especially having this open line of communication with investors. So, you know, we do appreciate that. So, yeah, I just think everybody should try to be patient. It's not going to happen as quick as we want. But, you know, at the end of the day, I think it's going to be okay. We're just fighting a bunch of headwinds right now. Thanks again, Sheldon, on behalf of the BFC, too. Really good to hear from you and hear the updates. And I look forward to hopefully having you back on the show again, too, so you can reach out to the BFC community. Okay. No, I'd like that. Thank you. Bye-bye. All right, see, everyone, looks like this is the end here. So anyone just follow the ticker IDKFF to stay updated with the company and follow their account and look forward to seeing them on other interviews they have lined up."