Space Summary

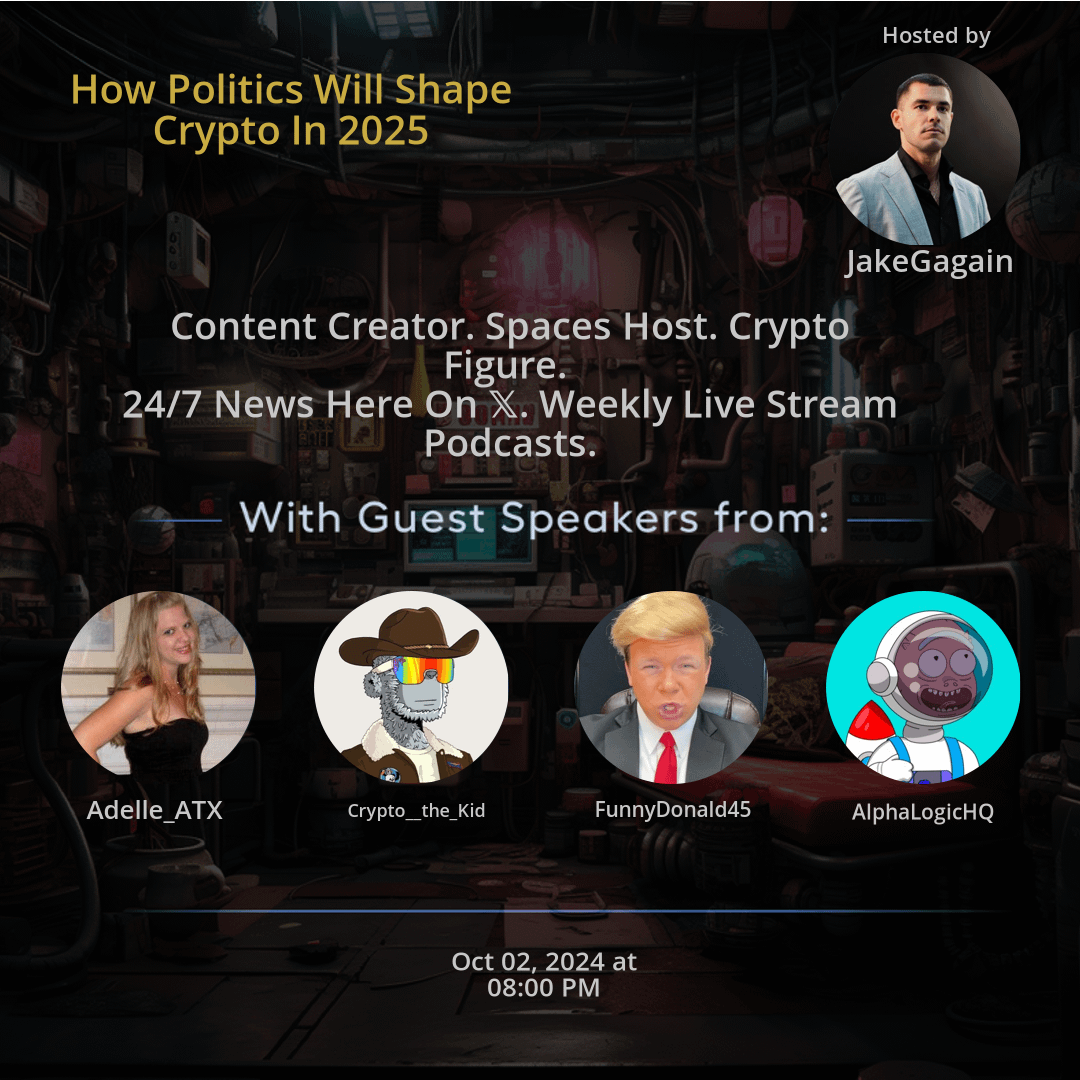

The Twitter Space How Politics Will Shape Crypto In 2025 hosted by JakeGagain. Gain insights into how political dynamics will impact the crypto space in 2025 as discussed by content creators, hosts, and crypto figures. Discover the crucial role of regulatory decisions, geopolitical events, and global cooperation in shaping the future of blockchain technology. Learn how transparency, compliance, and education play vital roles in ensuring sustainable growth within the crypto industry amidst evolving political landscapes. Dive into the effects of media narratives, public perception, and investor behavior influenced by political factors on the cryptocurrency market.

For more spaces, visit the Unique Projects page.

Space Statistics

For more stats visit the full Live report

Questions

Q: How does political influence affect the cryptocurrency market?

A: Political decisions can impact price volatility, regulatory frameworks, and overall adoption of cryptocurrencies.

Q: Why is regulatory compliance crucial for crypto projects?

A: Regulatory adherence fosters trust, legitimacy, and sustainability within the crypto industry.

Q: What role do policymakers play in shaping the future of blockchain technology?

A: Policymakers have the power to introduce laws that can either support or impede blockchain innovation and adoption.

Q: Why is education about blockchain important for political leaders?

A: Understanding blockchain technology enables policymakers to craft informed regulations that drive growth while mitigating risks.

Q: How can global cooperation benefit the cryptocurrency sector?

A: Collaborative efforts among nations can create cohesive regulatory standards, enhancing market clarity and reducing uncertainty.

Q: How do public perceptions influenced by politics impact cryptocurrencies?

A: Media narratives and political rhetoric can sway public opinion, affecting investor sentiment and market dynamics.

Q: What considerations should investors bear in mind regarding politics and crypto?

A: Investors should analyze political events, regulations, and geopolitical risks alongside traditional market factors when assessing crypto investments.

Q: Why is transparency crucial for crypto projects amid evolving regulations?

A: Transparent operations help projects navigate regulatory changes effectively, build credibility, and maintain community trust.

Q: How can industry leaders and policymakers collaborate effectively in the crypto space?

A: By engaging in constructive dialogue and sharing expertise, industry players and policymakers can develop regulatory frameworks that balance innovation and compliance.

Q: What challenges do cross-border regulations pose for the cryptocurrency industry?

A: Divergent regulatory approaches across countries can create complexities for businesses operating in multiple jurisdictions, necessitating harmonization efforts.

Q: How can political uncertainties impact investor behavior in the crypto market?

A: Uncertainties stemming from political changes can lead to market volatility, as investors react to shifting policies and geopolitical events.

Highlights

Time: 00:15:42

The Impact of Political Decisions on Crypto Prices Exploring how political events can cause fluctuations in cryptocurrency values.

Time: 00:25:19

Regulatory Challenges in the Crypto Industry Discussing the hurdles posed by evolving regulations for blockchain projects.

Time: 00:35:55

Global Perspectives on Blockchain Governance Insights into how different countries approach and regulate blockchain technologies.

Time: 00:45:30

The Role of Media in Influencing Public Perception of Cryptocurrencies Analyzing how media coverage and political narratives shape public opinion on digital assets.

Time: 00:55:12

Strategies for Mitigating Political Risks in Crypto Investments Tips for investors to navigate political uncertainties and mitigate risks in the crypto market.

Time: 01:05:47

Collaboration between Industry Leaders and Policymakers Exploring the importance of dialogue and collaboration for creating effective regulatory frameworks.

Time: 01:15:22

Standardization Efforts for Cross-Border Regulations The need for standardized approaches to address regulatory challenges across different jurisdictions in the crypto sector.

Time: 01:25:18

Building Trust through Transparency in Crypto Projects The significance of transparent practices in maintaining credibility and community trust amidst regulatory changes.

Time: 01:35:40

Educating Political Leaders on Blockchain Technology The importance of educating policymakers about blockchain to support informed decision-making.

Time: 01:45:29

Navigating Geopolitical Risks in Crypto Investments Strategies for investors to assess and manage risks associated with geopolitical events in the cryptocurrency market.

Key Takeaways

- The political landscape will heavily influence the trajectory of cryptocurrencies in the future.

- Regulatory decisions can significantly impact the adoption and value of digital assets.

- Geopolitical events may introduce volatility and uncertainty to the crypto market.

- The intersection of politics and crypto requires continuous monitoring and analysis for informed decisions.

- Government policies can either boost or hinder innovation in the blockchain and cryptocurrency space.

- Collaboration between policymakers and industry leaders is essential for a sustainable crypto ecosystem.

- Educating political leaders on blockchain technology is crucial for effective governance.

- Transparency and compliance will be key focus areas for crypto projects amidst evolving regulations.

- Public perception of cryptocurrencies can sway based on political narratives and media coverage.

- Global cooperation and standardization efforts are vital to address cross-border regulatory challenges in crypto.

- Investors need to consider political factors alongside technical and market analysis when evaluating crypto investments.

Behind the Mic

Introduction and Context

Our channel it. Hello, everyone. We're going to let the room fill up a little bit. Let Soka get into the space, and. Then we'll get started. It's a hot topic, how politics will shape crypto in 2025. I have some things to say about this, but let's let the room fill up. All right. All right. What is up, you guys? Thank you, crypto the kid, for getting it flowing. We're going to let this room fill up like. Like crypto the kid said. And we're going to talk here about how politics are going to shape crypto in 2025. And obviously, the hottest topic, the probably two hottest topics right now are the meltdown that's going on in the Middle east and the vice presidential debate that went down yesterday.

Discussion on Political Influence

So we're gonna have some people up here, if you have some thoughts, you have some opinions on how potentially crypto will be shaped in 2025 by politics, or you have a thought or a comment on what's going on in the world of politics or crypto, we're gonna bring people up. You guys gonna be able to share your thoughts? We're gonna do it respectfully, because I know, as many of you know, politics can get off the rails pretty quickly, but we do a good job here of keeping it nice and reined in. Crypto the kid politics Crypto 2025 did you by any chance catch the vice presidential debate yesterday? No, I'm a total loser, and I just. It wasn't even on my radar. But I did see some highlights, and it's interesting. I don't put too much weight on the vice presidential candidates, except for the future of their potential presidencies, which I would say JD Vance, I don't know. I've done a little deep dive on him.

JD Vance and Political Analysis

There's some interesting things on the negative side, but also there's a lot on the positive side. And then, look, I'll be fair to Mister walls in saying that I have explored the conspiracy theories more about him than I have about his actual policies. So I don't have a fully formed opinion on him, but he is quite the character. Yeah, I did catch it. To be honest, I don't think the VP really matters that much. Like, in any capacity, really. It kind of did when, you know, the Senate was at 50 in the states and the VP, as you know, the US is structured, is the tie breaking vote. But for the most part, they're going to just vote, you know, in that scenario, with the party that they are aligned with, I would be pretty surprised if there was ever a situation where a VP went against their party, which, to be honest, would be maybe even good at sometimes to get some different voices in there.

Shaping Crypto in 2025

But let's start with crypto, with how this is going to shape crypto in 2025, because I think that's a good, a good place to start. Start. There are some highlights from the VP debate, but for the most part, overall, you know, nothing too much was said, in my opinion. I think that it wasn't really even about the vps. They were kind of just hitting at the top ticket candidates. So they're really more just using opportunities to bash the other party's candidate. So Trump and Kamala, in this instance, I think, like, the first question to Tim Wallace was about the iranian strikes, and he took shots at Donald Trump and his age, which, again, is, look, we talk politics, we talk strategy. It's not really answering the question.

Political Strategies and Messaging

It is pretty smart. On the Democrat side, I think that they have a plan to attack Trump on age. And then, of course, the Republicans have their alternative strategy against the Democrats to really attack Kamala on her economic policies and her track record in the Biden White House. So everyone's going to have their strategy. And the sooner that you realize that and understand, like, oh, got it. This is kind of what they're doing. They just have a strategy and a plan and they're executing their plan. The easier it gets to consume some of these political things, and the easier also it gets to kind of just wash them away and ignore them. One of the things that, though, I wanted to really touch on is, I know. I said, let's talk about how politics will shape 2025.

Update on Politify

But I also want to kind of get a little bit of a given update on politify because I was and probably am still one of the bigger supporters of politify in this space. And I, I don't want to say, like, I thought that it would be bigger because that makes it sound like it's not going to get to the levels that I thought. But I think that we're probably not going to get to the levels that I thought because I thought were going to hit very significant levels of politifi. And we got John up here, who has actually a politifi project that's doing well, that's out there grinding that, you know, can withstand the test of time. So it's not to fund any individual project. But I thought that we'd see, you know, Maga sitting at over a bill by this point, I thought that we'd see potentially some other projects that, were pushing that number, and it didn't really play out that way.

Concerns About Politify's Direction

And I think that what happened? This is my thought, John, I'm interested to hear your perspective. I just think that politify never really took off in the way that it doesn't fit the meme coin narrative that's successful. It doesn't really fit into a mold that was kind of trying to force politics into the meme coin space, just because there's a lot of money in meme coins. And I think that people recognize that, and they created tokens to try to, like, merge those two. And I think they're very difficult to merge. So I'm not saying that it can't happen, I'm not saying that it won't happen, but I thought at this point in the cycle, I have solidified projects that I bet on, and I'm not up on those investments overall. And I don't think that's anything against any individual project. I just think it is very difficult to merge meme coins and politify.

Future of Politify

And I think that maybe it's early, maybe they're still figuring it out, maybe it'll come in 2026 or 2028, etcetera. But that is something that's top of my mind as someone who is sitting here preaching. Go pack your meme coin bags. Sorry, your politifi bags. So I'm always looking for what was right, what was wrong. I think that it was the right idea. It might have been a cycle too early, I'm not sure, but I want to go to John. I see the kid. You got your hand up. I see you to four and four l but we'll go to John first because he's got actually a politifi project. So, John, I wanted to get your thoughts on that, because it hasn't really hit in the way that I thought it would. And I'm curious, your thoughts as to why.

John's Perspective

Yeah, I mean, a couple things. One, you know, thank you, Soca and crypto the kid, for co hosting. Thank you, Jake, as always, for presenting a space where we can talk. Shout out to some of the 1776 community in the audience, our favorite MMA fighter who's part of the community. Let's go. Brandon Lewis is down there. But, yeah, I think there's a lot to it, right. I think there's two big pieces, from what I see, and that is when. When Politifi started to be, I guess, a thing when it started getting on people's radar. There were a couple projects, and since then, and since, let's say, since Trump got shot, I swear to God, dude, I've seen like a thousand different projects come up just with Trump somewhere in the name.

Market Saturation

There's, like, Pepe Trump and pega Trump on every single chain. There's a Trump token on every single chain with a different colored face each time. There's, you know, Trump with his ear, Trump with no ear. There's like 17 Kamala Harris tokens. And I think it's just. It's so saturated. Like, imagine if when Pepe came out, there were like 15 different pepes and people like, I don't know what the fuck to do. So I think that's part of it. I also think that. I think that politify is more because it's not really a deejan space. I mean, there are some degen projects, like the Jones guys and took her, that are just funny. Like, they make funny cartoons, they make funny memes, and they make fun of a bunch of stuff.

Engagement and Audience Factors

And I think they've both found a niche, and I think based on social media engagement, they're both gonna do really well, especially Jones. But I think that where. And I don't wanna speak for everybody, because I do think that a lot of these projects will sort of lose their narrative after the election. I think what sets us apart is, and I'm not trying to shill, I'm just trying to get into an explanation. I think what sets us apart is like, freedom of speech, the individual determination to succeed, and freedom from large, oppressive government and excessive taxes and all that shit are things that are going to live as a message and a narrative long past the election. Whereas Donald Trump with an ear doesn't really have longevity.

Political Narratives

Like, people forgot about it a week later. But I think that when you look at politify and you look at the audience, it's not the same person who's going to buy a cigarette in the butthole or church of the smoking. Chicken, fish, most likely. I mean, I've bought some pretty dumb shit because I think it's funny. But those aren't going to be like, that's not normally the same customer or client or investor or whatever, or trader. I think that what we'll see is when the normies come in, enforce and mass adoption of crypto happens, that we're going to see a lot of them pick projects that they resonate with the narrative.

Normies and Political Crypto

And that's where I think politify will have its heyday, because a lot of these normies are hearing about crypto from people like Kennedy or Tulsi Gabbard or Donald Trump or JD Vance. And I think those people will come into the space and pick the things that they resonate with. And, I mean, don't get me wrong. I'm not saying that it's just gonna be politify. I mean, there's gonna be people who want to see a cartoon dog. There's probably gonna be somebody out here, out there who wants to see a cigarette in the butt. But there's a lot of different memes that they could jump into. But I think that politify, because of the people who are going to be coming in and what those people believe in and where they have faded crypto for, you know, ten years, and they're finally deciding to come in because of the America first movement or MAGA or, you know, because they hear Trump talk about it.

The Future of the Crypto Market

And that's the catalyst to bring them into crypto. I think that there is still a strong. A strong argument to be made for politify doing well. At least I'm banking on it for. For obvious reasons. But, yeah, I think that's where we see the really take off of politify projects. And I think that the ones that are going to do the best, at least this is my strategy, is to sort of integrate web two and web three so that they can find out about the project through things like podcasts and merchandise and things like that before they make the jump to buying. I do think that, like, if someone who is a normie who's considering getting into crypto and is on the fence, and they hear one of our podcast episodes where we talk about individual freedoms, civil liberties, you know, why our country was founded on small government and the bill of rights and free speech and all that stuff, I think that those people are likely to jump into a project like 1776 or whatever, one of the ones that's America first and patriotic and shit like that, because that's something that they really resonate with.

Conclusion

Especially if we can get their eyes on us before, you know, they see, oh, wow, there's a baby hippo that just absolutely sent, you know what I mean? I think that there's some. And we're. We'll go to you, crypto the kid. I just want to make one comment. Yeah, I think there's some. Some truth to this. Like, overall, I think overall, I think that the path forward to politify is probably going to be more on the community building side of first, and then it flows into something that's captured. Think about, like, in the US, there was the Tea Party movement way back in the day, and that really was kind of like a grassroots type movement, whether you agree with it or not. It was kind of a conservative approach of getting candidates, you know, on ballots and things like that.

Liquidity in the Crypto Market

But I just think it's a matter of liquidity at this point. I mean, liquidity is fundamental in everything that goes down. I want to give a couple of shout outs before we go over to you, to four and four lithe. Good point. Good points. Crypto the kid. We're going to add up a few more speakers and anyone that has a thought or an opinion, definitely get up here. You know, I think, look, not even just taking anecdotal evidence, you know, we have politics in the ticker. That used to be a pretty big draw. We would have 150 people in here when were talking politics. It's a. It's a smaller room today, which is not a knock. I get crypto. Twitter's a little bit quiet today, but just talking politify, it's a tough game. A couple quick shout outs, then we'll go to hands, we'll go to you. Four and four, lithe and alpha, if you got something to say, I know you're one of the first people up here, so just rich hand, let me know.

Acknowledging Notable Projects

Big shout out to chuck down there. They've been. They've been popping off here lately and I think, you know, it's a project on base that's going to be doing really well. Dag, night dog. If you have not seen. They are maybe, I don't know if it was in July, early July, late June. They had a white launch. Sorry, white launch. They set out like their white paper and their white list to get allocation. It's a very transparent project and I believe that they are pushing extremely hard and they're going to be launching here soon. I've seen them popping up around. They have a great group of people who are on the core team. They have it very outlined, like, down to the detail of who gets what. In terms of allocation, I believe 75% is to the holders. And I might get some of this wrong because I haven't fully studied the breakdown. I know that it's there, but I think it's like 75% or something like that goes to the holders.

Details on Token Allocation

There's some amount to the core team. There's some amounts towards, like, marketing and allocation reserve for, you know, exchange listings there. They have some that are to be sold to be able to fund animations and things of that nature. It's something like that. It's close enough. You can. You don't quote me on the exact numbers, but more or less. So shout out. I've seen them kind of walking around and, you know, they're. They're crushing it. And I'm not going to say anything else yet because I don't know who it's, like, public on or not, but once they are, I'll definitely mention some of them because they're all cool. You know, it's the kind that you want to put at least some of your faith in. So much love to dag Knight. Let's go ahead and go to four and four l. Looks like you've had your hand up for a little bit. What are your thoughts?

Geopolitical Influences on Crypto

Yeah. Hi, guys. Nice to meet you. Jake Soaker, cryptokun, and. Hey, Banksy. Yeah, no, I was taking notes while you guys were speaking. I have a list of things like, politically, how they could play a critical role in shaping the future of crypto and regulation and stuff. But, yeah, things like regularity, regulate, regulatory clarity, global coordination, CBDCs, international cooperation, especially right now. Especially right now. DeFi, crypto markets, environmental, energy. These are just things that came to my mind. Energy policies and elections and campaign financing. Speaking of Donald Trump and Maga, token consumer protection scams. But most I want touch on geopolitical tensions, like, for geopolitical rivalries, like, for example, us, China, maybe Russia, Israel, Iran, you know, shout out to them. But, like, the advantages, I think crypto could be seen as more of a means to bypass sanctions, giving, like, countries, like, more financial autonomy.

Financial Autonomy and Economy Stabilization

And I think it could help stabilize economies in regions with weak local currencies. And I think my opinion. But disadvantages of geopolitical tensions or not of geopolitical, but the disadvantages that fall under geopolitical tensions would be like weaponizing crypto, which has happened a lot in trafficking and stuff, and, like, restriction of use for geopolitical reasons. And this could lead to, like, fragments in markets, I think, where only certain cryptos are allowed in certain regions, which is happening right now. But I think the future of crypto is really, truly bright just because, I mean, obviously it's defi, and it could increase, but because of the distribution disadvantages, I think it could increase illicit use of crypto as a loophole for sanctions. So, yeah, thank you for having me.

Discussion on Regulatory Clarity

Of course, I actually want to. I want to zero in on a few. A few of those points, because I think that there was a lot there, and there's many good points, and all of those are going touch crypto, I think, in some capacity. So I'm going to. I'm going to start with the. It's like one and a half, because I think that they're really going to the one and a half things that I want to talk about, because there's a lot of overlap between. Between them that you mentioned, and you talked about crypto as something that's going to be used as a loophole to bypass sanctions, which it depends on who you talk to. That could be good. That could be bad. It kind of depends. It depends on what you think if you are in the camp and the belief that the United States should be able to sanction countries and withhold their money that are in. That's in us banks for committing human rights atrocities.

The Complexities of Sanctions and Human Rights

And I don't know how to. How to really, like, vote on that. You know what I mean? Like, I get it. I understand it. Shoot. If there's a country that's gonna go to war and we can say, you shouldn't do that because we're gonna withhold your money, well, then, without any blood being shed, we stop a war. That's, in theory, really good. I get that. But at the end of the day, it's not like the US is the United States responsibility, and it's also not the United States. It's not even necessarily like their God given right to kind of police these types of regional conflicts. So, like, from my point of view, and again, this is just mine, which I completely understand that this is not black and white. Right? It's. It could be good, it could be bad. But in general, crypto, the promise that it gives to each individual, it gives that same promise to states.

Financial Freedom and State Sovereignty

And if Russia wants to put $200 billion worth of their oil reserves in bitcoin instead of the us dollar, that's a massive win, in my opinion, for financial freedom overall. Now, what they do with that money, that's not really up to me, and I don't think it should really be up to us banks either. Now, the other point that I'll make, and this is why I said it's one and a half, because I think they're related, is the regulatory concerns. Now, I was talking. We had actually a long discussion about taxes today, and I was talking to my tax accountant, and the regulation needs to come into this space like it really does, because right now, all that people really do, the taxes are a complete disaster. Like, if I am trying to buy a coin one chain and I have my money on another chain, I have to, like, swap to a native token to bridge across, to swap to another native token to buy the actual asset that I want.

Taxation Challenges in Crypto Trading

That's like five taxable events in one. And it's a complete mess. And no one really knows what to do about all this, and no one definitely knows how to track it. I mean, my accountant was like, and he is a crypto expert in bitcoin, not so much meme coins. So I am going to have to figure that out. But point being, he's like, okay, cool, just tell me when the date was, you know, when you bought, when you sold what the price was, what this. I'm like, there's like 50,000 transactions across hundreds of wallets. It's never going to happen. So I think that there's going to be some regulatory clarity coming in 2025. And honestly, regardless of what comes down, regardless of who wins the election, I think they have to have some regulatory clarity. And I think overall, it will be healthy for the crypto space, for the meme coin space generally.

Future of Crypto Amidst Geopolitical Tensions

So I think the points that you made are all really interesting points, and I definitely would love to hear more. But from the. Just my final closing thought on the geopolitical tensions that happen, understanding that could be weaponized, like you're saying, to kind of scare people away from crypto. Well, I think the cat's out of the bag. I honestly believe bitcoin is again going to be worth a million dollars a coin by 2030. I think that's pretty comfortable. I think. And you know what? If a country can do things to bypass us sanctions, but it also allows general freedom, financial and monetary freedom, to individuals, I would rather. This is my personal point of view. I can understand if people disagree, but my personal point of view is you take the good with the bad, and overall, allowing people and countries and individuals to make choices versus trying to restrict those choices, it's better.

A Pragmatic Perspective on Sanctions

And to be honest, look, Russia doesn't have to keep their money in us banks either. They could sit there and say, man, they sanctioned us last time, which, by the way, I don't necessarily think they should be invading another country, but I'm also not an expert on the, you know, all the history there, etcetera. But, like, they could just go buy $200 billion with bitcoin tomorrow, and they don't do it because to be honest, they know that it's in their best interest to be part of the international banking system versus putting all their money into a cryptocurrency, at least for them right now, that's what they believe. So, you know, whenever these things come up, you got to kind of look at how people behave. And there's a lot of saber rattling, and the US yells at Russia, and Russia yells at the.

The Reality of Military Presence

And they're all bickering. But I'll tell a quick story. Then, sorry, foreign for, I'll go back to you. I had a friend who was in the US Navy stationed in the South China Sea. One of the most, like, volatile, dangerous areas. There's Taiwan. Everyone's freaking out. It's going to be a war. And I asked, like, you know, how was it over there? Was it crazy? Was it scary? They talk about these planes flying over. He's like, dude, we literally patrolled the same area of water for six months. We saw the same chinese boats for six months. We'd wave, we'd say hi to them. They'd say, what's up to us? And we just rode the boat back and forth between this area and this area. Six months straight. Nothing happened. No one ever did anything. We always got yelled at by our commanding officers for not keeping busy.

Day-to-Day Life in Tense Regions

We honestly cleaned the boat a lot. They did a lot of sweeping, a lot of painting, a lot of washing. And I was like, man, in the news, they make it this, like, really dramatic thing. Like, the angry chinese boat is one side of the angry american boat. He said, no, dude. No one was, everyone was chill. No one was even doing anything for. And Pharrell, go for it. Yeah. Thank you. what's gonna touch on? yeah, first of all, fuck Myron Gaines. second of all, yeah, I mean, back to your point. I think there's gonna be, like, of course, in America, there's like, a bunch of, like, crypto robbers and, like, scammers. Of course, we all see that here in web three. Well, I'm in web four. Just kidding. But, like, I think we need to focus, like, in terms of increasing global coordination among major economies like g seven and G 20.

Global Coordination in Cryptocurrency Regulation

It's. They're going to be used to, or crypto is going to be used to, like, standardize. They're going to need to standardize regulations, focus on consumer protection into AML, anti money laundering, and CTF laws, so anti terrorist financing, and, of course, taxation frameworks, which we have never, and we're probably never going to figure out, but yeah. And then as for CBDCs, like, I think by 2025, hopefully it's going to be, they're going to be widely adopted, but we're going to need to increase, there's going to be an increase in government control over monetary systems while potentially reducing the influence of decentralized cryptos like bitcoin. So that's my opinion, though, but yeah. And also, lastly, trick CBDCs and the relationship with, like, triggering geopolitical competition nations.

Strategic Dominance Through Digital Currencies

I think are gonna establish dominance in digital currencies as a strategic, economic and financial tool. And, I mean, of course, that goes for fiat historically. So, yeah, I think, you know, well said and all good points and all things that are going to impact our crypto, you know, going forward. So much love. Thanks for coming up and sharing your thoughts. Obviously, stay up on stage. I'm sure there's going to be a lot of other, you know, comments here, you know, as we move forward and as we move along. And the good thing about politics and politifi is everyone can have an opinion. Like, you don't even have to be an expert. You could just straight up say, this is my thought. And that is, and that was a really well reasoned, I mean, you had, like, probably 15 things that we could have touched on each single one.

Regulatory Influences on Geopolitics

And I thought the two major ones were regulatory and how it's really going to shape geopolitical tensions and cooperation and things like that. So you nailed a bunch of great ones, and I think it really helped further the conversation and sinks. That's top of mind for everyone who's here in crypto. Let's go ahead and go to funny Donald first. John, and then we'll head over to you because I'm sure you're going to have a lot of thoughts on everything that was said and how some of that works. Then we'll, then we'll head on up to Alpha. Go for it. Funny.

Compliments and Conversations in the Crypto Space

First of all, I just wanted to say this is a tremendously smart space. It's a beautiful space, very nuanced, a lot of good information. And soka for being a green monkey. You're tremendously smart and very strong with your words. So I wanted to congratulate you. And a huge hello to Jake Agan. I love Jake very strongly. He's very good looking, does a tremendous job. But I wanted to say that crypto, the kid made some very smart points. You know, I used to be of the belief that the politifi meme coins were going to take a life of their own, that they were going to be all of a sudden going boom, bam, bam, thank you, ma'am. And going like a rocket ship, you know, regardless of what happened with the general macroeconomic environment.

Observations on Market Liquidity

But we realized that's not what happened. That's not what happened. A lot of the liquidity left the markets, and so did the politicized meme coins. And a friend of mine phrased it this way, what he loves about the politifi meme coins is he loves the fact that it's almost like tokenizing beliefs on the blockchain. And I thought that was very smart. Very smart. And I think that there's a YouTube out of room for that to occur, for that to be prevalent within this space. But I think a lot of it, once I win the election, and I'm going to win it so bigly, so strongly, I think what's going to happen is shortly, around that time, shortly afterwards, we're going to see more liquidity in the markets and politify will piggyback on top of that.

Future Predictions and Market Dynamics

So I don't think politify meme coins will necessarily go boom, bam, bam, thank you, ma'am. On their own, necessarily, except for a few key winners. But I think what's going to happen, this is my prediction, is that once the general sentiment of the market goes huge, then those will explode on top of that. And then once I'm back in the White House, then I think that a lot of the politifi meme coins go explode. Splody even more. That's a very strong term, by the way. Explodey. Explodey. I invented that. I coined it. Very smart. But I wanted to ask you a question about the taxation part of it.

Proposed Taxation Structure

When I come back into office, should I propose something where I make the tax structure simple and I say something like, all right, Congress, here's an idea for taxation. Any money that you put into crypto, it doesn't get taxed until it turns into fiat. And when it turns into fiat, we just apply a flat, let's call it 10% tax. Because in my opinion, crypto is a lot like property. It's a lot like property. It shouldn't be taxed necessarily the same ways as stocks. So would you support that? Just don't worry about reporting all the transactions over here and there. Would you support something like a flat tax? Whatever you take out, whether.

Discussion on Tax Simplicity

Whether you win or lose, it's just a flat 10%. Would you support that? Yeah. So, first of all, I love. I don't know how you guys do the. I mean, I guess this is, I was going to say impersonation, but that's. That is disrespectful to the president. Obviously, this is the real Donald Trump we have up here. He's just on his alt account because he doesn't want to crash our space, which I appreciate. It's very kind of you to do that. So thank you very much for. For coming up here. That's very true. Very true. It's like doctor Strange in the multiverse there are millions and millions of versions of me, and quite frankly, I think I'm the hottest one of them.

Tax Policies and Economic Efficiency

Oh, it's true. Amen. And to your point about the taxation, for sure. I mean, this is something that whatever keeps the taxes lower, I'm usually a fan of in general. Whatever keeps the taxes more simple, I'm usually a fan of in general. And I 100% believe that there should be, if I put some amount of money into crypto, I shouldn't be taxed until it actually turns back into a fiat currency. And I get there's going to be little nuances. It's like, okay, well, then you can just keep all the money in bitcoin, whatever. I don't really care. I'm not even here to figure that out. Just please, God, make it so that I don't have to, like, go through so many hoops to try to figure out taxes on cryptocurrencies.

Critique of Real Estate vs Crypto Taxation

And yes, keep in low. I never, you know, even people I talk to who, you know, support, you know, maybe a higher tax structure because they believe it's going to help you, which is okay. Again, that's the point of tax. They're supposed to go to help people or keep the country going and pave the roads. And I get that. Okay, cool. We all want that. That's fine. But even the people who I talk to who are in support of these, you know, higher taxes, there's all these things, like you said, property where you can, like, buy a property and then you can roll it into another property, and then you don't get taxed like that, to me, artificially inflates the real estate market in a way that keeps people, individuals who should be living in the houses from owning a house, at least in the States.

Concerns Regarding Home Ownership

I don't know how it is everywhere else in the world, but in the US, you have major corporations, Blackrock, et cetera, buying up all these homes. That's not the point of a home. Like, the home is not meant to be owned by a hedge fund. It's meant to be owned by an individual where they can, like, you know, raise a family and join the community and have a job. All these things that really just get crushed because the tax laws in this country supporting real estate are very favorable to people who have cash to be able to do something like that. Now, I know there's a lot of friends that I have in crypto that are also in real estate, and they would be mad if I said all these things, but at the end of the day, why are we going to favor real estate over something like crypto?

Future Prospects for Crypto Taxation

Like, why don't we make the tax laws favorable so that people want to put their money into crypto? Well, it's because the government can't get their cut right now, and Blackrock can't put their finger on the scale and figure out a way to really manipulate. Now they are, they're starting to with the ETF's, etcetera, and that's when you're going to see this. Mass adoption of crypto overall in retail is when Blackrock can make sure they get their cut. Vanguard, Fidelity, JP Morgan, Wells Fargo, once they can start getting their cut, and their financial advisors can start selling products in the crypto space where they make a percent, half a percent, whatever they want, and they can all of a sudden deploy.

The Impact of Major Players in Crypto

You think, you think what happens in the crypto world right now is crazy? Where a whale can dump a chart, you haven't seen whales yet until a major ETF comes in and they say, oh, you want to see market manipulation? How about this? And they pick up the phone and they call whoever's in the White House, whichever side they call whoever's in the White House, and they say, hey, we need you to kill this regulation. Thank you very much. And they hang up. They don't even listen for a response. They just know it's getting done. That's manipulation at the highest level. So to answer your question, of course, if you're able to get in there and you're able to make some tax modifications that keep our tax rate low and simple, you've got my vote.

Final Thoughts on Taxation and Regulation

I love it 100% choka. I'm so glad you agree. I would be more than happy to do that. And honestly, I think that it was result in more total taxes received, because then people will find it a lot easier to report. They would be more likely. Look, you should always, in case the IR's is listening. Look, they hate me enough as it is. They're trying to audit the crap out of me like crazy. But I just want to say for the record, you should pay your taxes. But anywho, I want to say that if it were easier, then more people would report and then more money would be collected.

Complexity in Current Tax Structures

I honestly think that's the truth, because a lot of people just keep it in the wallet or they don't do anything with it in the defi space. And it's just, it's too complicated. It's too complicated. We shouldn't make things this complicated. And that's what I would fight for, believe me. But thank you for having me up here. It's, it's very bullish. Amen. And I, I'm sure this isn't a surprise to anyone. The us tax code is intentionally confusing to keep intuit and turbotax a thing. They spend billions upon billions of dollars making sure that it is confusing. John, you had, you have had your hand up for a while. Then we'll go. Adele came up and put her hand up, and then for n fort l will go, kind of in that order.

Insights on Regulation and Politicians in Crypto

Go ahead, John. Yeah. Foreign for l was talking about, like, regulations coming and stuff like that. I was part of an extremely interesting conversation on that. long story short, this dude who, I met through Web three, he launched a similar project to ours, hopped in our telegram. We start bsing, talking about different challenges, things like that. He says, hey, I do some political stuff in real life, and I wondered if you wanted to join my space. And this is last Thursday, crypto. The kid and I were talking about this earlier. You were having some computer difficulties. So I hop in the space, and on stage it's John with the 1776 PFP.

Notable Personalities in Crypto Discussions

And, like, next to me is the saxophone player from Pink Floyd. Next to him is the founder of a restaurant called Shiba Wings that only accepts crypto as payment. Next to him is Grant Cardone. Next to him is Gary Cardone. Next to him is Senator Cynthia Lummis from Wyoming. So I'm sitting there for, my first thought is like, holy shit, what am I doing up here with these people? They all have, like, millions and millions of followers, and I don't. But anyway, we had a really good conversation, and some of the stuff was about crypto. And we got into, we, I mean, we talked about politics, all kinds of stuff, but some of the conversation was heavy on regulation and crypto, and there were sort of like two sides to it.

Discussion of Legislative Initiatives

It was really good. I'm actually going to post it in the jumbotron if anyone wants to hear a really interesting recording. But so there were two sides to it. There was sort of the libertarian contingent of how do we figure out ways to self regulate so the government doesn't hop in? And then there was the side of, we need all this regulation. You can imagine which side I was on. But anyway, so Cynthia Lummis, the senator from Wyoming, she jumped in there and she started talking about this definitely ties into how top politics will shape crypto. So she is, she's drafted a bill and she's going to try to get it on the Senate floor in the lame duck session.

Prospects and Challenges of Cryptocurrency Legislation

So as soon as the election's over, will it get to the floor? Absolutely not. Will it pass? Absolutely not. But the news of it could be good for the crypto community because it's basically coming up with a strategic reserve for the United States made of bitcoin. So that she's talking about selling a bunch of gold that we have right now and trading it out for bitcoin. And her plan, according to a bunch of economists and stuff like that, is that this would be some way that the national debt would be decreased by 50% in 20 years again, will it pass? Absolutely not. But it was cool to hear her ideas.

Reflections on Crypto-Friendly Politics

It was very cool to hear another politician who's crypto friendly. I don't know a whole lot about the politics of Wyoming. I've never been there. The other politician that I'm aware of from Wyoming and I'm not a huge fan of. So it was really, really cool to hear, and if you guys want to listen to what she had to say, it's about an hour in, and then, you know, Grant Cardone was talking about how to tokenize real estate, but it was a bunch of super cool shit that directly relates to this space. I mean, obviously they're not going to be meme coin people. They're all bitcoin maxis.

Takeaways from the Regulatory Conversation

But I, it was definitely interesting hearing all these perspectives. So I would recommend everyone take a listen. It's about 3 hours long. It was sort of marathon space, but it was very insightful and we had some good conversation. And the big, I mean, the big thing was to me, the regulation piece, because I think a lot of what they talked about was going to be good press for crypto. The regulation piece was what I sort of got into because I think that, I think the government's extremely inefficient. I don't like when they put their hands on things. And the least government regulation we have, the better, as long as the people in the crypto space can sort of self police, in my opinion.

Concluding Remarks on the Discussion

So anyway, give it a listen. It was badass, dude. Love that. And those are some big names, for sure. Yeah, it was the 1776 mission statement was on the jumbotron the whole time, because apparently none of those other people use the jumbotron.

Discussion on Freedom and Engagement

So it was like all these people are talking, and behind it is just the 1776, you know, freedom, free speech forever, individual freedoms, you know, small government, stuff like that. And of course, our CA and telegram group, it definitely helped with engagement, too. Hey, love it. Can't hate that, man. You got to grind. Adele, let's go ahead and go you. And then we're going to go to. Back to. Go ahead, Adele.

Question for Donald Trump

Absolutely. Thank you so much for hosting. I appreciate you and Soka doing this and our Jake and Soca doing this. And I just wanted to say, if you guys haven't shared this space, I mean, we have Trump in here. Come on, guys, share it out. Make sure you guys have follow and put those notifications on. But I really just came up here because I heard Donald Trump speaking and I had a question specifically for him. I just wanted to know if you're going to follow through with your promise when you're elected to fire Gary Genslere.

Donald Trump's Response

I will absolutely fire goblin Gary Gensler on day one. And I call him Goblin Gary because his face looks like a goblin. You know, his face looks like a goblin. And, you know, even Peter Jackson from Lord of the Rings said, you know what? You're not. You're not strong enough to be cast as one of the orcs. I'm going to cast you as one of the weak goblins that get hit in the face with a stick by a hobbit and then you die. So that's why I call him Goblin Gary. He looks like a goblet. He's a week goblin.

Motivation for the Vote

Does that. Adele, does that. Adele, does that make you feel pretty good to give him the vote? I think so, yeah. I mean, fuck Gary Gensler. Sorry, excuse my language, but, yes, you were right. You were right. Fuck Gary Gensler. He's horrible. He's absolutely disgusting. Donald, you had me at 10% flat tax on crypto. Yeah, I was going to say that's a. That's where you had me cooking. That's. That's what made me happy.

Tax Policies Discussion

You know what? It's a bullish policy, isn't it? Because everybody gets a little happy about it. A lot of the crypto people love it because it's not too high. And then the people who love the idea of taxation get a little bit, you know, it's the lowest of the double digit numbers that you could give. So I make them a little happy, too. I will say real quick, before we go to foreign, for lithe, for anyone listening out there, make sure you're super careful about your taxes. You really should be.

Caution on Crypto Taxes

We had this conversation at length, and you'll have people come up who I had to correct many times, or maybe not even correct, but at least just remind the audience that they were not tax professionals, because they'd come up with all these weird ways that they didn't have to pay taxes on crypto. And for the most part, they were very much in the gray and, like, there's a very fine line between a tax loophole and tax. And you do not want to be caught on the other side of that line because it just is not a fun place to be.

Personal Tax Experiences

I've never been there, thank goodness. And I do not plan on being there. I don't like taxes. I don't want to pay them just like the next person. But I also don't want to be caught in an audit where they're saying, what is this thing that you did? Oh, well, someone told me on a spaces about meme coins that this is how I could do all my taxes. And they'll be like, yeah, we're going to double it just for being that dumb, for listening to whatever that guy said. Sorry.

Humor in Tax Audits

Four and four l. Go for it. Oh, go ahead. Let's let Donald speak for a moment. And then foreign for all. Go ahead. I will say it would be tremendously funny not worth being audited, but it would be tremendously funny to be audited and then to have to explain the huge gains I got from a project. I'm coming up with a fake name. Bum rocket.edu floki grow. It would be tremendously funny for that one moment to explain the gains that I got from that.

Investment Stories

Oh, no, no. The worst. The worst is actually the opposite because I have to do that to my accountant. And my accountant sees, forget about the gains. At least that's making money. The ones that I have to explain where I just lost all the money in the span of, like, hours, those are the ones where he's like, so you did. You invested. What is this project? Or they don't. He doesn't even call it project. He's like, what is this investment?

Challenges in Explaining Losses

And I'm like, oh, yeah, that one. I invested ten k, and it went to zero. He's like, what? Over, what, a span of 20 minutes? Oh, yeah, you don't get it. It was a good project. And then it's like some disgusting name with some weird picture, and he's like, okay, you should really be just investing in stocks. I don't know why you played these games. I'm always.

The Lighter Side of Crypto Investing

I'm imagining some dude's face saying, soka, you lost money off butthole skunk inu. And just not being able to keep a straight face. It's. I mean, it's. It's pretty. Pretty much close to that. And that's what you have to do. The crypto bro voice, which is sort of like this. It sort of sounds like no bro, but you don't understand. The team was based, bruh. It was super base. Dev was smashing and cooking.

Crypto Community Characteristics

Like, you have to do that kind of a voice to make it work. But yet, no, I 100% agree. Amen. All right, four and four. I'll go for it. Yeah, I'm gonna just say my piece, and then I'll head out. Yeah. As for tact, I don't know if he's fun to continue the conversation on taxes, but I think on 2025, which I'm bullish on or kind of bearish on, but, like, I think there's going to be clear, definitely clear capital gains rules, like, for example, defined holding periods, simplified reporting, and increased enforcement.

Future Capital Gains Rules

And also with taxing on, staking, mining and defi. I think there's going to be, like, staking rewards, and mining income will be treated as taxable income. So the individuals will need to report their fair market value of their rewards at the time they receive them as similar to mining rewards. And then also crypto transactions exchanging from bitcoin to Ethereum, Solana, Crow, all the above, and the list goes on.

Tokenized Assets and NFTs

And also tokenized assets. I don't. I don't want to talk about tokenized assets. And nfts. Fuck them. I love you, nfts. but, yeah, I think. I think I really want touch upon the global cooperation on crypto taxes. I love you, Trump. Just kidding. I'm. I'm. I'm voting Trump. Waltz 2024, bitches. Anyways, but, like, I think as crypto crosses borders, global cooperation will definitely not likely increase because of international tax standards and, like, automatic exchange of information.

Global Crypto Tax Cooperation

So, like, the OECD, and then, like, common reporting standard for bank accounts and to prevent tax evasion. So, yeah, anyways, I'm gonna head down a listener. Thank you so much for having me, Soka and Jake, and nice meeting you all. Yeah, much love, and thanks for all the clear points. I mean, the thing that I love about meme coins, I'll say this small piece, then we are going to shut the room down here in a few minutes.

Closing Thoughts on Meme Coins

We're going to keep to a nice, tidy hour. But I remember meme coins when I was first, because I was bitcoin Maxi for a long time, and when I was going into meme coins, the general advice that I got or caution that I got was like, oh, those people in meme coins, they're not smart. They're all just djens. They don't know what they're doing. I found so many smart, intelligent, degenerate they have there.

Community in Crypto

Everyone has a little bit of degeneracy in their blood, but I don't think that's necessarily bad. You know, it's part of it. It's. We're part of gamblers. If you're in crypto, you're gonna be gambling a little bit. And guess what? The original bitcoin people, they were kind of gamblers, too. It just is what it is. Whenever you're in a field that's kind of burgeoning and growing, that's what happens.

Positive Reflections

And I found so many smart and talented people here, and I will say there's a lot of smart and talented of people in the bitcoin space, too. I would. I kind of feel like the meme coin people are a little bit nicer, to be honest. Sure, they can be toxic. They could be a little bit tribalistic with some of the coins and projects that they support. But if, you know, bitcoin got to the point where people were like, ugh, if you don't understand bitcoin, I don't know what to tell you.

Conclusion of the Session

And that was like, it. I was never on a space where anyone was happy, excited, explaining things. So I think that is something, you know, that is top of my mind always, and something that I reflect on positively, as when I was really jumping into the meme coin space for the first time, I was, I had an expectation, and that expectation, you know, shifted pretty quickly when I started actually making connections and talking to people.

Final Farewell

So much love to everyone who comes up here and shares their thoughts. I am going to close this thing down here. I think that it's been a very reasonable space, very good space. You know, I think that overall, man, crypto is in a great spot. Going forward into 2025, there's going to be a lot of positive things for and for all mentioned a lot of them, and I think they all kind of shake out to the positive and mean that our crypto experience is going to just continue to get better.

Outlook for Cryptocurrency

There may be some fud, there may be some things that come along the way, but at the end of the day, the cat's out of the bag. You cannot put it back. Cryptocurrency is here to stay, and it's going to be a significant part of what we do going forward. The election will have some things, some ups and downs. Regardless of who wins, I really don't see it having a negative impact on crypto.

Election Influence

I think short term Trump's better, and maybe even long term he's better. But when I say better, I mean, like, Kamala can't stop it. It's too late. There's too many of us. We've done our job. We have kept it alive. They can't ignore it. It's coming. It will always come. And, you know, I'm really excited to see where it takes us.

Resilience of the Crypto Community

We've. We've. We've been called criminals, we've been called crooks, we've been called traffickers, we've been called money launderers, and we survived it all. And, you know, now they're, the politicians are coming for our vote. And that's how, you know, we've really made it. So much love to you guys. Can't wait to see what 2025 holds. We'll obviously be tracking the election and we'll be talking about it.