Space Summary

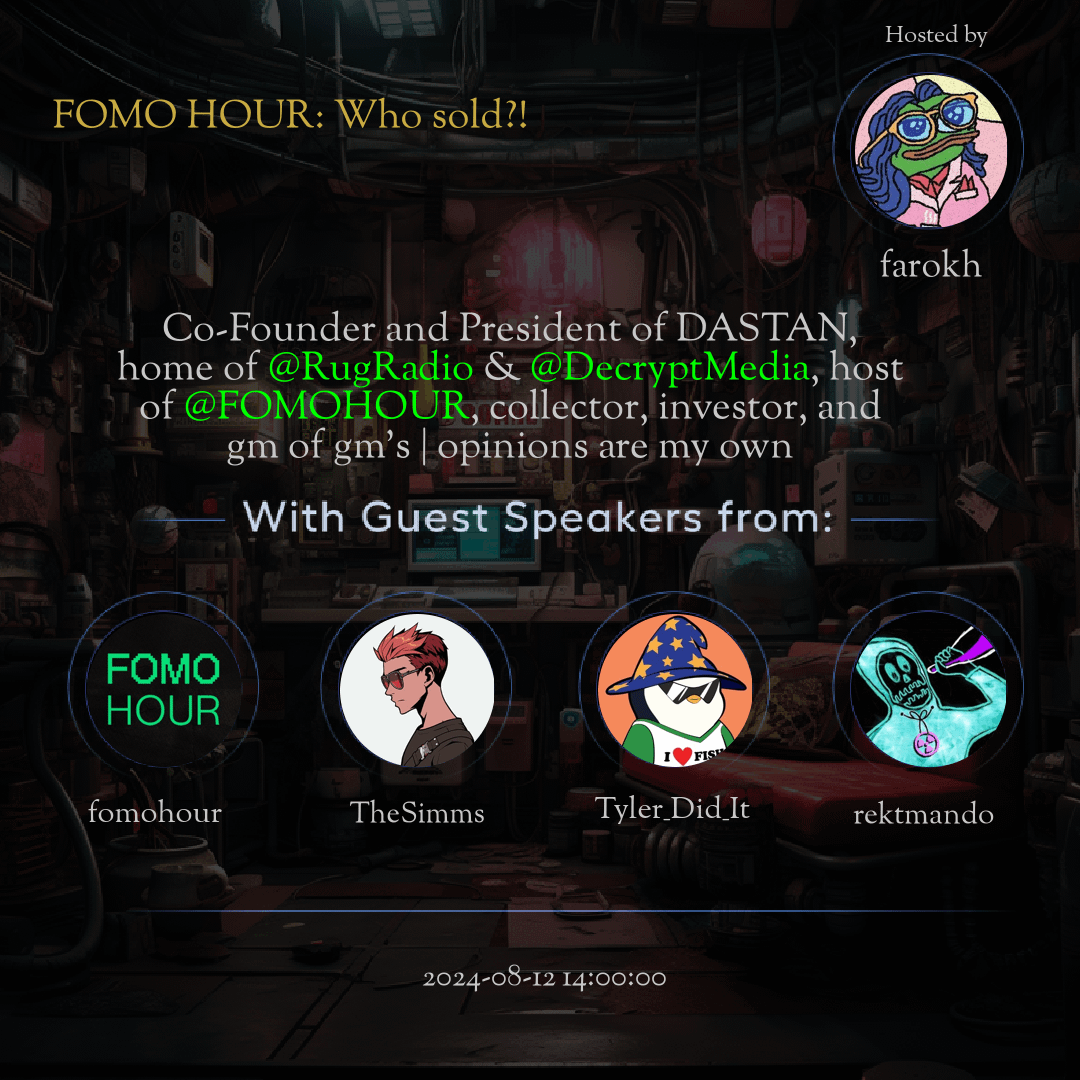

The Twitter Space FOMO HOUR: Who sold?! hosted by farokh. Dive into the world of NFTs and crypto investments with FOMO HOUR, featuring industry experts discussing market trends, selling strategies, and the fusion of art, technology, and finance within the NFT ecosystem. Gain valuable insights on portfolio management, risk mitigation, and the transformative impact of digital assets. Stay informed about the latest crypto developments, learn from insider perspectives on NFT collections, and network with like-minded crypto enthusiasts for a comprehensive understanding of the evolving crypto landscape.

For more spaces, visit the NFT page.

Questions

Q: What insights are shared regarding NFT market trends in FOMO HOUR?

A: FOMO HOUR provides valuable insights into the current trends and dynamics of the NFT market.

Q: How do guest speakers contribute to discussions about the crypto space?

A: Guest speakers share their experiences, strategies, and tips for success in the crypto and NFT sectors.

Q: What topics are covered during the FOMO HOUR discussions?

A: Discussions span from portfolio management and blockchain projects to community building and the future of NFTs.

Q: Why is FOMO HOUR considered a valuable platform for crypto enthusiasts?

A: FOMO HOUR offers networking opportunities, industry insights, and a space to learn about the latest crypto developments.

Q: How do the discussions in FOMO HOUR contribute to understanding NFT collections?

A: Insider perspectives provide insights into NFT collections, trends, and the impact of digital assets on the art world.

Highlights

Time: 00:14:25

Navigating NFT Selling Strategies Expert tips on optimizing NFT sales and strategies for success in the crypto market.

Time: 00:26:40

Crypto Portfolio Diversification Insights on managing crypto portfolios, diversifying investments, and mitigating risk.

Time: 00:39:15

Art, Tech, and Finance Fusion in NFTs Exploring the blend of art, technology, and finance dynamics within the NFT ecosystem.

Time: 00:45:55

Insider Tips for Successful NFT Investing Key strategies, market insights, and risk management tips for NFT investments.

Time: 00:51:10

Impact of NFTs on Digital Asset Landscape Discussions on the transformative impact of NFTs in the digital asset space.

Key Takeaways

- FOMO HOUR provides valuable insights into NFT market trends and investment strategies.

- Guest speakers share experiences on selling NFTs and navigating the crypto space.

- Discussions cover topics like portfolio management, blockchain projects, and token investments.

- Insights on community building, media partnerships, and the future of NFTs are highlighted.

- FOMO HOUR offers a platform for networking, learning, and staying updated on the latest crypto developments.

- Exploration into the challenges and opportunities within the NFT and crypto investment domains.

- Tips on successful selling, portfolio diversification, and staying informed in the fast-paced crypto market.

- Insider perspectives on NFT collections, trends, and the impact of digital assets on the art world.

- Diverse viewpoints on market volatility, risk management, and strategies for long-term crypto investments.

- Valuable discussions on the intersection of art, technology, and finance within the NFT ecosystem.

Behind the Mic

Introduction and Initial Context

Hi, everyone. I think we'll wait for two more minutes. So we will join in and then we can begin. Guest is already here, so. Yes, just two more minutes. Maybe we can begin in terms of. To set the context first, I guess.

Small Talk and Weekend Plans

Yeah, yeah, I can hear you. Great. Yeah, super. So, yeah, how are you? I mean, it's, I guess, supposed to be the long weekend coming in. Any plans for the long weekend? Yeah, I mean, my. My plans will probably revolve around my wife, so I'm pretty sure my. My wife sort of has a few plans. Okay. So I'll have to. I'll have to probably check her calendar and see what my plans are as well. So I only recently got married, so now.

Adjusting to Marriage and Shared Calendars

Yeah. So now I have to sort of make sure that I have my calendar sync with my wife so that we know exactly what we are going to do, even though it's mostly her ideas. So, yeah, I'll have to check in. Yeah. Let me tell you, that just got married as a qualifier won't last. I mean, it will last long. It's been eight years for me, and my plans are still a subset of my wife. Yeah, it's always like, it flows down from there, this thing.

Setting the Scene for the Discussion

Yeah, great to be talking to you. See, that is, I'll just give some context to people. I mean, see, it's a bit early, I guess. 07:00 p.m. usually people come to spaces at 10:00 p.m. in the night when they can speak, listen on an audio platform. Yes. The team requested to make it a bit early, so we did it. No worries. So, so the whole idea about this kind of, I don't want to call it a podcast, but podcast is a kind of a term which has been.

Goals of the Discussion

Everybody has a podcast and an opinion. People say now. Yeah. So the whole idea of this is basically, see, I'm also a first gen entrepreneur. I mean, started my journey in 2019, been five years now, I guess, at the start, in the same time. Because you also started when. Right. The whole idea was to keep it, get founders who are themselves first gen entrepreneurs and figure out what are the problems, what are the kind of way of thinking they have, which makes them different than other people who have generational, entrepreneurial legacy kind to carry forward.

Challenges Faced by First-Gen Entrepreneurs

Right. And because we all have faced different problems in life. I mean, of course, the first problem is, of course, to convince people that this is the right way to go. I mean, after completing kind of 23 years of education, suddenly you are, you don't want a job, which basically, this. This whole education system gears you to get. Right. The whole idea of getting education india is to start working in a firm and continue there and have very kind of linear curve in terms of both earnings, status, reputation, and by the time you're retiring, you.

Education and Career Expectations

You are a respectable person with enough money and, I mean, places to call your own. Yeah, great. So what I'll do is I'll start with you in terms, of course, this is a free flowing conversation. I'll ask questions in the middle as well and begin your life story. How did it happen, this. This whole bit where you come from? And if you can give some details. Right. No, no. Thanks for having me. First of all, I think this is, you know, it's sort of a new opportunity for me because, you know, when I usually speak to other people in the same space and we discuss ideas, it's mostly revolved.

Exploration of Being a First-Gen Entrepreneur

I mean, mostly revolves around the business. Right. I mean, what do you do at ditto, what do you do at fin shots and how did this whole journey begin? But I think very few people have focused on how to become a first gen entrepreneur. Right. Which is a very interesting thing because I sometimes ask myself, what. What makes a first gen entrepreneur like you? You know, I look back, I trace my generation, sort of. I trace my lineage back to my parents, my grandparents, my great grandparents.

Understanding the Legacy of Generational Entrepreneurs

And I try and see, okay, fine. When was the last time we dabbled in something of our own? Right, and you have to go back. Yesterday, I was asking my dad, actually, what was the last instance that he could find, right? And he told me his great grandfather again, right. He was, sorry, his grandfather was an agriculturist. So in some sense, I think you could look at him and say, okay, fine. He was doing something of his own. He was responsible for his own p and l, so to speak.

Reflections on Entrepreneurial Identity

And in some way, I think you could call it a sort of a self owned business. Right. Maybe it isn't business in the sense that we call it today, but, yeah. So that got me thinking, like, why would somebody then decide, okay, fine, now is the time to break away from the mold? I. And I think my journey is a bit different than most people because I think for you in 2019, I'm sure at some point, you were like, okay, fine, I need to do something of my own, or was it something different?

On the Perception of Writing Standards

You will say, even if. And I've seen this happen with me as well, what will happen is I'll not even look at that. Right, right. Yeah, yeah. And I judge it by reaction of other people who are reading it, because if I read it, I for sure sake. And I don't want that. Right. So, that's why. I mean, I want to ask you, is that a problem? Is that an, Is that a challenge you face?

Acknowledging Management Challenges

Oh, it's a massive problem of. Sheikh, I think it's. It's like you know, you. You put it, you know, perfectly, right. I think in many scenarios, I realized that I'm a terrible manager, right? And I think acknowledging that is the first step to understand that, you know, you're a terrible manager. Simply because the things that make me a good writer are exactly the kind of things that make me a terrible manager as well, right? And that does not mean you can't work on it and you can't get better. But acknowledging is the first step, making sure that you are the bottleneck in most cases, right? It's not that people can't write just as well as you. It's just that people write in different ways, they're expressive in different ways.

Understanding Individual Writing Styles

And maybe some things you like, some things you don't like, but that's natural. My content also, I'm sure that people like some stuff. People don't like some stuff, right? But whenever I see it, I want it to be written a certain way because I have my. There's certain nuances that I'm used to when I'm a writer, when I'm writing things, etcetera. For instance, if I have to put together a passage, right, I'm explaining an event, I'm talking about examples, right. There's a certain way I go about it, right? There's a certain sort of, you know, I always like to dumb it down for people, right. I always believe that the best form of content, like easy reading, is very difficult writing.

Struggles with Control in Writing

So I want to make sure that everything that I write is so well put that nobody has to read another line twice. Exactly. Now the problem, however, is that oftentimes when you know, when you sort of probably put such a high standard on your own writing, of course at times you'll feel like, oh, not everybody lives up to that high standard of writing, but I think in some sense, if you're running a business and you can't let go of control, I think you're doomed. So one of the best things that I have had is my co founders, for instance, are extremely competent in domains where I am incompetent, right. For instance, I'm a terrible manager.

The Creative Process Behind Writing

Or say I'm terrible sort of, at keeping a track of things, because I'm a very creative person. I like to think, I like to brute, right. Oftentimes I spend most of my days just thinking for two, 3 hours I'm on Twitter and just seeking out ideas, or at least sometimes just browsing, scrolling. But that's where I generate most of my ideas. Like, I do scroll through YouTube and Instagram, because that's where I get inspiration from, and oftentimes that's where most of my writing skills also emanate from. So in some sense, I feel like that's what I have to do. But if you're doing that at work, I mean, you can't possibly be.

Co-Founder Dynamics and Delegation

Running a business on the side is extremely hard, right? So luckily for me, I've had co founders who managed to sort of supplement my skill set, and they're very effective at what they do. So I can focus on the creative bit of things. When it comes to content, when it comes to copywriting, for instance, I still like to write website copy, making slight changes. I want to invest my time and effort into doing that because I feel like, okay, that's something I'm really good at, so I'm going to spend time, etcetera. So you have to learn to let go of things and also embrace the fact that being a creative person, you have to, or at least to a certain extent, focus on things that.

Balancing Optimism and Realism in Entrepreneurship

That you're good at, right? And perhaps learn or get better at managing a bit, right? Yeah. So that's. That's how I think about it. Exactly. That. That's so anti something what MBA teaches us, right? MBA teaches us to make frameworks, right? To create frameworks which are templates which people be using. But writing can never be put in a framework as such. I mean, people have tried that doing. I mean, if you look at how script writing has evolved, they have this three act things that one act, first act, second act, third act, how they actually teach writing in filmmaking institutes, right?

Intuition in Writing vs. Coaching

But even then, it. Sometimes writing is about being entranced. When you are in front of a blinking cursor, you don't want any distraction. It can never be collaborative. You have to be sitting there and you will be in the flow. Right? Yeah. So sorry, Abhishek, one more thing that I want to add there. Sorry I cut you off, but it's also just extending your point, which is, it's also not intuitive. It. There's a structure you can put into it, but then there are some things that almost feel intuitive, almost feel natural. Like, I can never train somebody to tweet like you or to write like you, for instance. That's never going to happen.

The Challenge of Replicating Writing Style

Right? I. No matter how hard, I couldn't do it myself, right? I mean, in many ways, I'm like, no matter how hard I try, I'll never be able to replicate your style, your ideas and your lived experience. Right. And oftentimes this intuition aspect is very hard to gather also, because I've interestingly learned, or at least, you know, read about this. This idea, which is, you know, great coaches. Sorry. So great players often never tend to become great coaches. Absolutely. Which is this idea that if you ask Magnus Carlsen, right, with chess, right, how do you, like, find the best moves?

Intuitive Understanding in Creativity

And he's like, well, I just know intuitively I know what to do next, right. It's like you can't describe his process. You ask, I don't know, Michael Jordan, what makes you great? Like, he'll probably talk about something that's very generic, hard work, discipline, etcetera. But there's so many people who work hard and are disciplined. They can't play ball like you. Right. And in some sense, I feel like the intuitive ability sometimes for me as a writer, I found it hard to translate to other people because I just don't know how to.

Explaining Unwritten Process and Methodology

How to do it. It just comes naturally to me. Whereas the great coaches oftentimes may not be, you know, good footballers, like, you know, I'm a massive football fan and I know this, you know, the great Liverpool coach Jurgen Klopp, right, who's recently, you know, sort of quit from Liverpool. So this guy used to tell Ydev how he was a terrible player, right? I think he played for Mainz, and he always used to talk about how he was a terrible player in a very good team and he had to adapt. He had to figure out how to get better at football because everybody around him was top tier.

Learning from Adversity

And that enabled him to become a good coach because he could reconfigure his brain, learn how to understand. Like, he almost saw sport from a distance and figured out, okay, this is how you go about becoming a better footballer. Whereas for me as a writer, I feel like a lot of what I do is intuitive, right? So I can't explain why I do the things that I do, and that also translates to me being a terrible manager because I can't explain to others why I write the way I do, right? So oftentimes I feel like that's also a big bottleneck because I can't always explain, okay, this is the framework, right?

The Struggles of Providing Guidelines

This is how you go about it. Yeah, it's there. I mean, I faced that as. I mean that as well. I mean, what happens sometimes is that you will get some thumb rules, right? And that's why. One of the reasons I don't like self help books, right, when people tell you kind of code to success or do this and you'll achieve success, because, see, everyone's environment variables are different, right? Correct. Everyone has learned a different way.

Unique Variables in Entrepreneurial Success

If I tell you that, okay, how did you build a company like Data, Insurance and Finshots? You'll have a playbook, right? I mean, yeah, there's no playbook. If, suppose you, nobody can go through the same kind of skill sets or experiences that you have. Nobody. I can't find another person who passed out from Ayma and Dawad in 2018 in that economy with those writing skills, with those co founders that you got, with a person like Nitin Kamath spotting your talent and writing your check.

The Unpredictability of Entrepreneurship

So all those are like, per chances. I mean, there's no playbook to it. And tomorrow, if I, if, suppose I, someone asked me that, okay, can you write a playbook? How to be, how to succeed at entrepreneurship. I'll be shitting myself. I'll be just lying it, basically. Yeah. That's why I don't like reading it. And usually, initially, what happens is this is the first thing that people do the moment they achieve success.

Societal Expectations and Their Pressures

Right. The first thing they want to do is explain how to go about it. And the society does that. So society will always in your society will. I went to a, imagine, I went to a funeral, and there was this guy who was, who called his daughter and said at Inseco, I said, dude, this is not a place. Yeah. There's a time and place for this conversation.

Acknowledging Luck in Success

So they're like, but I was, I couldn't explain it to him, that it can never be transferred. Right. I, what I can only tell you is to do hard work or maybe, see, there's a lot of luck also involved. People don't know it. People, I mean, a lot of successful people, sometimes to undermine luck, I mean, you have to accept this fact that. You are lucky, 100%.

Analyzing Entrepreneurial Journeys

Absolutely. There are plenty of things that could have gone wrong, right? Yeah, yeah. In fact, in fact, that's a good exercise, you know? So whenever we have new people coming in, one of the things that I do is explain the journey, right. And the objective of explaining the journey, most people, they often get it wrong.

The Importance of Acknowledgment

They think that, okay, this is sort of these, you know, these racks, the richest story. And one of those things that makes you feel good at the end of it, when in fact, the objective is to tell, you know, is to tell the antithesis, which is how come we survived, how come we didn't die, right. All the things that could have killed us. Right.

Luck Plays a Crucial Role

These are all the things that could have killed us. Like, for instance, if I hadn't met my co founders, like you pointed out, right? Or if my friend wasn't this guy, or if this guy hadn't introduced me at this very point in time, or we hadn't made that one video that went viral, or if Nitin hadn't spotted that one video at that exact point in time, none of this would have happened.

Reflections on the Journey

This conversation would never have happened. I concede that, right? And I think acknowledging managing that once again makes you, in some sense, it puts you on your toes, right? And then you can think about how. How lucky you are to be in the place that you are. And you can always think about, you know, you can be grateful for surviving this, right?

Gratitude in Entrepreneurship

And also looking forward to the next day. So I feel like one thing that first gen entrepreneurs should probably do more of is probably, you know, consider how lucky they are. Just make sure that you're grateful for surviving one next year, one. One more day, right? And once you do that, I feel like. And it's worked wonders for us, right? We're constantly paranoid because our story for the first three years before we started Ditto, was just pain and horror.

The Importance of a Positive Outlook

Everything that we did wrong, like, anything that could possibly go wrong, seemingly went wrong. Everything. And we made no revenue, by the way. Abhishek, for the first three years, we desperately tried. We wanted to make money, but nothing came. So it was like zero in revenue. First three years, and you've given up all of this opportunity. You're still making six lakh per annum, and you're just, like, figuring it out.

Navigating Challenges

Like, you're really thinking, man. Like, when will this change, right? When will my life finally take a turn? So now at this point, you know, I'm like, I'm so grateful, right? Blessed to be in this position. I'm constantly paranoid. What could potentially go wrong, right? So, yeah, and, you know, I mean, one more thing, one more learning.

Irrational Optimism in Success

People should have that who have gone through that stage of becoming an entrepreneur and doing well now is to also be a bit irrationally optimistic. You know, what has happened is that sometimes people achieve success and start accumulating, right? Yeah. They're like, we'll sit on this, okay? Whatever we have achieved is great.

Taking Risks for Future Growth

Now we don't want to let go of this. The point is that then you have to take bigger bets, right? People really. Well are people who have used every pedestal to be, like, a first in entrepreneur. Right. To be like, okay, I'll launch this, I'll do this.

The Challenges of Indian Entrepreneurs

And what will happen? I have survived this long, I have done well. Now I should take bigger bets. And that's the issue with a lot of Indian entrepreneurs, is why we are not to be able to make companies like Starbucks. Right. Lack of trust as well. Lack of trust.

Generational Trust Issues

I mean, India, what happens is usually people trust their family members. The next CEO or the next owner of the company would be someone who is my son. Right. Yeah. And I can't trust a professional CEO to take up the reignite and maybe expand it.

Succession and Continuity

PhD Queries

I have people who have PhDs coming to me, right, and asking the same question. It's like, why won't I get anything back, right? I mean, what kind of a product is this? If I give money and they're not going to give anything back if I survive, right? And I ask them a simple question oftentimes is that imagine they can give you money back again. Where does that money come from? It can't come from thin air. It's from money you gave them, right? So if they are going to give you money back, right, they're going to extract their pound of flesh before that. Only oftentimes it becomes a very challenging thing for me. So much so that my advisors spend 30, 35 minutes in a consultation. Just explain to them how this works.

Insurance Examples

So they'll give you simplistic examples saying, okay, imagine you give me hundred rupees, right, I can put this away. And probably something bad happens to you. Like, you know, a simple term insurance policy, right, if a 30 year old buys a policy, they pay around 1015 thousand in premiums every year. And that premiums persist for, you know, the next 25 years because that's the only thing that they'll pay. And if anything happens to them, right, if they pass away, unfortunately during that time, their family will get one 1.5 crores tax free. Right? Now to explain this math right. It's an arduous journey, I'll tell you that much. Right. I have to show Excel models. I have to show them. If you pay this much extra, look how much extra they're asking you.

Psychological Perceptions

I have to show examples. And it's a psychological thing, like you pointed out. If I am paying money and I don't get anything in return, then it means it's a scam, when in fact, you know, and insurance companies, to their credit have realized this fact, which is why they still innovating on Ulips, on endowment policy and savings plan. This market should have died. In any efficient market where people can make purely logical decisions, there is no market for Ulips, endowment plans, guaranteed plans by and large. Right. There's absolutely no market. And yet the market continues to thrive because they've understood human psychology better than most people. They've understood what is the point of convincing them for 40, 50 minutes if they want to buy something with money back, give them money back.

Market Challenges

In fact, even term insurance providers were so fed up with this idea that people are still asking for money back. Now, they've come up with this option called a zero cost options. But they're saying if you surrender your plan in a very critical moment, by the way, during very few critical years, we'll give all your premiums back, which again, is a completely bogus act. First of all, you won't get all your premiums back, right. GST will be deducted, etcetera. And also, the money back you get at 30 years is not the same money you invested right now. Right. So it's sort of, it's ingrained in people that if you do not get money back, it's a scam. And, and honestly, it's you, you have to wage a war against it.

Influencer Insights

And I oftentimes, you know, I mean, I like to complain about sort of, you know, influencers, etcetera. Granted, there are, you know, there are issues there, but I feel like one thing that they have done is at least point out how inefficient some of these things are. So, I mean, that's one of the reasons why we have consultations, right, where we force people to have consultations, speak to us, you engage with us, no compulsion of buying, because I also come with a no spam guarantee. So that's another thing that I promised, right, where I'm saying no commitment, right, to buy anything. I'm not good. Like, if you tell me that you do not want to hear from me again, you will never hear from me again, we do not follow up.

Building Trust

We do not sort of, you know, get back to you five times asking policy Karidlo, etcetera. I'm going to respect your wishes. I'm going to treat you with dignity. And so most people are likely to listen to me, right? They're likely to have a conversation and from there, I build trust, right. And this trust building exercise can go on for three months. Sometimes, right. After three months, they come back and say, you know what, now it makes sense. Let me buy a term plan, right? So I have to play the long game. I have to listen to my customers and I have to sort of get them to listen to me as well. Right?

Insurance Awareness

Yeah, no, great point, actually. See, the thing is this missing has to stop, right? And guys, by the way, I mean there is a link at the, in the same thread of this spaces where you can book a spam free call as shed put and try it for yourself. I mean there's no compulsion. You can just book that. There's a link there. You can book it and see for yourself. Now, coming back to the original point, see, I think there is one more bit of it which a lot of Indians feel they're invincible. They are immortal. That's why they drive on the wrong side of the road. They'll wear the helmet only because a traffic police guy is there, and they'll wear it in their elbows, right, usually.

Cultural Attitudes

And it does. So the helmet is there not to save them, but to save them from a fine. Imagine in such a market, sometimes it's difficult to sell insurance, right? I mean, then a lot of players then resort to ways which is quite gruesome. Like they'll talk of wives talking about their, I mean, husband shaming them on tv that buy a plan for me. That's why. Have you seen the one where, you know, I don't know if you've seen this, but the ad where they show cancer patients, etcetera, which is terrible. I mean, it's really low marketing, you know, I mean if you're sort of.

Low Marketing Strategies

Yeah, I mean that's another thing that comes to my mind. Yeah. I mean, there was this ad which was, I mean, in the nineties when there were not so many regulations, there was this ad of a cooking oil, basically. The begin with the husband dying. Imagine. And the point is the insurance should be something which should be like. It's very obvious to buy. Right? Something people do. And in western countries, it's something that you have to do it I mean, if you can have a mandatory vehicle insurance, every vehicle has an insurance.

Paradox of Insurance

Imagine people's lives are not insured, but their vehicles are insured. Yeah, yeah. It's a strange paradox, you know, the. Money has a bigger value than life, actually. Imagine even people think that, okay, I have to pay a fine, I won't pay a fine, but it's okay if I die in an accident, but I won't be a fine. Maybe that's why I have the helmet. My point is that what is the kind of ratio that is there of the term insurance and normal insurance right now just to.

Insurance Market Dynamics

So it's, you know, we want to sell more term insurance because really, I mean, that's where the, you know, we feel like, you know, biggest problem lies. But you're right in that the obvious thing is health for most people, right? So we, for instance, I think we have a book right now, 60% health and 40% term. But I have to spend significantly more money in marketing term, right. Health people will buy now because there's a lot of sort of, you know, a conversation around medical inflation, etcetera.

Awareness of Health Insurance

Right. People are aware, I think they've heard anecdotal stories of people who've been hospitalized for three days, gathering a bill of three, four lakhs, and suddenly they know that they probably need some degree of health insurance. But term insurance, like you pointed out, it's still not a thing, right? I mean, imagine somebody will insure a car and they'll do own damage insurance, pay 50, 60,000 in premiums, making sure that they have all the add-ons, etcetera, and a 15,000 term policy they won't buy for 1.5 crores.

Purchasing Dilemmas

Right. Ensure themselves. Right. It really, I mean, it is problematic, but also understand the logic behind it. Like you said, people believe they're invincible, right. At the ages of 25 to 30, 35, which is when you should ideally make this decision. You see, oftentimes people just, you know, ignoring this conversation completely or even if they acknowledge the conversation, it's always a matter of next year I'll do it. Right. And, you know, the only thing that will get them to perhaps prepone the purchase or actually purchase at a time when they really need it is to talk about how much the premiums increase.

Understanding Insurance Needs

Just if you wait one year, that gets more people that. Yeah, I mean it's. Again, you have to tell people how much money you can save to once again make them realize why it's important to buy a term insurance policy as opposed to just talking about the actual benefit of a term plan, which is if you were not here, I mean, think about it. We've had one customer, sort of one of our early customers, and we don't get a lot of term claims, right? So we help customers because once a claim is initiated, ditto takes over.

Claims Experience

So we make sure that we help them end to end. And I remember with term insurance, luckily we've not had a lot of claims, but one claim that we had was a very terrible scenario, which was a young doctor, I think it was during COVID or etcetera. I think this was during COVID who unfortunately passed away because he was one of the, at the time he was in the COVID wards, etcetera. And he had sort of insured himself quite robustly. And luckily I think the payout was significant.

Impactful Claims

I think it was two, 2.5 crores. I went to his family and that will probably his spouse wasn't working at the time, she was pregnant. And we're talking about, and this is a story where things work out, where we talk about how granted it's a terrible loss and they'll never be able to make up for that loss, ever. You're never going to get your husband back. And that's terrible in its own right. But the fact of the matter is, for the next 10, 15, 20 years, they do not have to worry about money sorted for.

Realization of Value

And when you look at how much premiums he paid for that, I think it was a 2020, 5000 in premiums. You think about the investment, like you said, motor policy versus someone who's willing to play 30, 35,000 for a motor policy and not do the same for a term insurance policy. Who can afford it, by the way, they can afford to. And it truly, it's very hard for me to sort of fathom. But yeah, I mean, that's one of the things that we want to solve.

Education and Outreach

So we do. One of the things that we do is we do these massive webinars for people just to educate them, right? Again, no compulsion of buying, no compulsion of getting on a call with us. Just understand, right, what you can actually buy for a fraction of the cost that you would pay for. Even things like a Netflix subscription, for instance. Right? And then we sort of get them to think and then eventually, maybe six months down the line, they come back and say, you know what, maybe it's time.

Navigating Insurance Choices

Right? So. So, yeah, so that's how it works. Yeah. There's one. One more flip side I would want to is, the insurance sometimes, of course, it suffers from a lot of misselling. Yeah. It's a bittersweet pill. you hear from people that how, because they got ill or got a surgery done and insurance cover it all. But sometimes what also happens is because people don't buy it properly or listen or maybe read the fine lines. I think it happened in the family as well, that someone on the surgery bed suddenly gets to know that his claim won't be honored because he booked the best hospital, the best doctors, and suddenly one night before the surgery, he finds out the claim wouldn't be honored because the premium duration is not two years.

Claim Denial Stories

Right now. It's less than two years, something like that. And suddenly he was distraught. He was so angry on the insurance. But why the fuck premium? He was so furious. And he. I mean, he deemed the entire insurance industry as fraud. Right. Yeah. What happens is people only get to hear outliers. Right. You won't get to hear because in India, people are secretive about their money. Yeah.

Lack of Shared Experiences

Yeah. They'll only tell you when they have lost money. Yeah. And a very. Yeah. You won't find a happy story. You know, my claim was approved. Yeah. Some socialist overhang is there that we always like to see that when we lost money. And we will tell people that we don't have money. Always. I remember during my childhood, if suppose neighbors are talking among each other and the moment the money comes in.

Cultural Attitudes Towards Money

Right. They'll lower down their voices, their whisper. Yeah. It's Hashem. As if they are in the security of their home. Imagine even that security. Not. They are not so comfortable talking about money coming in. Right. So. And this is the time. And so when they lose money, they make a noise about it. They didn't do my claims. This and that. And. And this is because at the time of insurance, some insurance agent sold you this saying.

Insurance Experiences

Yeah. Made you sign this paper, which has a fine point. So how do you. Do you have had any kind of instances when people have come up with some kind of request like that? Yeah, yeah. No, it's perfectly fair. Right. Abhishek? I mean, think about it like when you're buying an insurance plan, essentially, you're paying premiums under the assumption that everything will be covered. That is the default position because that is what you assume insurance will do.

Expectations vs Reality

It is up to the agent to then add qualifiers. Right. The agent, however, is by and large, focused on wrapping up the sale. They want to make sure that they close the sale as soon as possible because if there's a hot lead, you close the sale within the next 15 minutes or they're not going to be, you know, coming back to you. Right. So that's generally the way sales teams are built. Right. So one of the things that we did, you know, the first thing that we did away when we were sort of building this business is to not hire people with any sales experience.

Redefining Sales Approach

So none of our advisors have any experience doing sales or any experience doing insurance. So we said, I'm going to invest three months of my time, my effort, in making sure that they understand insurance and they can then educate people about buying the policy. So oftentimes what happens is in the first consultation, I'm going to explain to you the fine print in your policy. I can't explain to you the first, all the 35 pages, but I can talk to you about the major qualifiers.

Clarifying Policy Details

I can tell you there is something called as a reasonable and customary clause that if you go to a hospital and they deliberately overcharge, then insurance companies could pull you up and say, look, this is beyond what is deemed reasonable, and I will not pay the full amount. And I will also tell you that if you have an agent with leverage now, somebody like, ditto, for instance, we work with limited insurance partners.

Navigating Claims

Most customers will come and tell me, oh, why don't you work with this insurance company? Why don't you work with public sector insurance companies? Are a public sector insurance company. Forget about me having leverage. People in their own company have no leverage. I've seen people working in public sector insurers come to us and say, these people are not approving my claim. Right? Because you can't even build a case.

Claim Challenges

Oftentimes during the time of claim, you have to build your case. You have to show them why you argue the way you are arguing. For instance, we had a case where we had this gentleman go through an ACL surgery, sort of a knee surgery. I think he fell down from the stairs, etcetera. And the company came back saying, we will not approve the claim because this is part of something called as the specific illness waiting list.

Understanding Clauses

Essentially what that means is a bunch of illnesses that will only cover after, say, two years after buying the policy. Now, the legitimate case is that any person who has no understanding of insurance will say, fair enough, it's in the contract. I got screwed over, fair enough, that's it. And then profess that the whole business is a scam. But if you have an agent who really cares about us, somebody like ditto, for instance, what we do is we leverage our expertise to help the customer battle the case.

Supporting Clients

So what we did was we told the insurance company, look, first of all, this gentleman had, you know, an accident, right? He was coming down the stairs. He felt this is what we qualify as an accident, right? And once it's an accident, the insurance contract states that it supersedes all other clauses, right? So accidental claims are honored from day one.

Sustaining Trust

Right? Which means now I have a legitimate case. And eventually went back and forth and we got the claim approved. Oftentimes customers get, you know, stuck in a lurch because they do not even know how to represent their case. They don't know how to navigate the nuances of insurance. And the agents, when you read them the most, aren't there available to you, right? So they also don't know, I mean, I know of truly sort of, you know, good-hearted people in my community who are agents who have no idea how to represent a case because they don't know what is the name of the policy, let alone the contents of the contract.

Educating Consumers

Right? So, you know, when you. When you have a situation like that becomes very challenging. So what we do is first we educate people. We spend 30 minutes in explaining to them what is covered, what is nothing covered. And the second thing is, when they have to make a claim, we always insist you come to us first. You tell us what is the matter. I will make sure that I am there to represent you.

Ensuring Representation

And God forbid, if the insurance company still says that I am not going to honor your claim. Let us go to the ombudsman together. Let me help you draft the case there as well. We work with insurance, and oftentimes we only take the case, but sometimes when we need special expertise, we work with them and we pay for the costs. So let us go represent the case so that we can honor the original contract at least.

Dual Responsibilities

Right? So it's a dual thing. Right. First you have to educate people about what they're getting into, and then you make sure that you don't let them, you know, you just don't let them be afterwards. Right. You just like, okay, my work is done. I don't care about you. Right. So you have to have some conviction in the fact that this person came to you because they trusted you, they would buy from the insurance company directly.

Building a Sustainable Business

Got it. You have to honor your sort of, you know, role here as an agent. So. Yeah, so that's. That's what we do. By and large. That's quite commendable, actually, that to build a ground up business, which is usually, people will tell you that, okay, this is the easy way to do it right. Hire people who had experience and you'll have your business running from day one.

Question and Answer Session

Right. You get start getting sales. Because ultimately, at the end of the day, everything boils down to your p and l. And P is blind to what the business you are doing. So I think that's a way to build a sustainable business. I would say. Cool. So what we'll do is we'll open the floor for questions. We already are past 1 hour right now. I think that people already have requested guys. Whoever wants to ask a question can just request it.

Open Floor for Questions

I'll get them on the floor and they can ask. I got Shubbo and Ashok who have come in. I think Ashok can speak Shubo. I. Can you speak Ashok? I think it's still connecting. Hello. Yeah. More people joining in. Guys who want to ask a question can raise their hands. I think. Shubo, if you are able to hear me. Yeah, I can't hear you, Shubh.

Facilitating Interaction

Right now. I'll get more people. I think it's nice to whoever can speak and speak. Ashok, is there. Sigh is there. Shubho is there. Whoever gets the mic first. Yes, I. Hello everyone. This is Sai Siddhant. So I just had a question about. Understanding the insurance space.

Inquiries about Insurance

On the side of when we take. A medical insurance for the senior citizens. Or the dependents, is there a kind of a bell curve that you see. At some point of time, do you. Realize that having an insurance is not the right option? And rather, accumulating those funds for an. Emergency is a better option? Like if someone is having some special case, like a motor neuron disorder or something like Parkinson. Like the special cases that I was talking about. Yeah, my question is around that.

Understanding Insurance for Seniors

Yeah, yeah. Very interesting question. Sai Abhishek, if I may take it, you. Yeah, sure. Go ahead. No, this is an excellent question. And I think there is a point in time, at least if you look at the premium charts right now, you can definitely argue that there is a point at which medical insurance becomes too expensive for you to even consider as an option. Let me give you a use case.

Premium Considerations

For instance, my dad, he's currently 73. And he has something called as the Addisons disease. So if I go to most providers, they'll refuse to insure him. So then I have to start thinking about different ways of sort of insuring him. So one thing that I do is because I have access to corporate insurance, I include him in my plan and I buy a separate plan. Right.

Innovative Solutions

So I buy a separate plan so that I have the insurance set aside for myself and my spouse if something bad were to happen to me. And then the corporate insurance I reserve just for my dad, because my dad is uninsurable at this moment in time. And speaking of special cases, right, for instance, people who cannot be insured, or even though, who may have been insured, you know for a fact that at some point the premiums become so expensive that it's simply unaffordable for you to eventually make a claim or even continue renewing the policy, then yes, there comes a time, and usually it happens anywhere between the ages of 70 and 75.

Aging Factor

So beyond the ages of 70 and 75, I think you start seeing that insurance just doesn’t make sense anymore, right. And oftentimes you have to have some degree of savings, or at least incorporate them in a corporate plan. If you have kids, like for my dad, I sort of include them in a corporate plan. You have to find some roundabout way of insuring them, which is one of the reasons why there's so much, you know, there's so much talk about the government helping out senior citizens, right? Because.

Support for Seniors

Because those are truly the uninsurable, right. You can insure young people, and perhaps people who are young and have some debilitating disease, etcetera. But once you go past the age of 70, 75, it becomes very challenging. Right, great. I have shubo. Arpit, guys can go ahead with your question. Arpit, Subo, whoever gets the mic first.

Introduction and Greetings

So I have happy quarter. You're not audible clearly. happy. Okay. How can you say. I mean, I think just heard you. If you want, you can push. Thank you. Got it. Thank you. Okay. Happy decoder can speak. Yeah. Hey, guys. I. Hey, shah. Hi.

Health Insurance Experience

Amazing podcast, guys. So I recently, like, you know, got the health insurance for my parents. And, I mean, they had some, you know, insurance previously, and they're also insured through my corporate policy. But I just felt the need, you know, to get them insured outside of my work and everything to, you know, sort of lose. Can see that. So while, like, exploring about that, I mean, again, every time, like, you get into it's like a whole hassle finding which is the best one. Yeah, yeah. But one of the larger grievances or, like, hassle for, like, people, you know, buy insurance, health insurance is majorly across, like, the claims. Yeah. There are people like me, I would say, who are not, who are probably, like, comfortable with the premiums that they're paying, but would not want to go through. Sort of like, you know, that hassle that happens, like the claims and all.

Options for Insurance

So there are two options, right, for people, like, want to, let's say, getting the insurance for them or for anybody, right. So they can either, like, go through the direction sort of the online portal or the direct channels. Right. Things and they have options to sort of go through the agents or probably that's where like, you know, you get here some of the reliable names like Dito Bay shark. Right? Yeah, yeah. You are just like when you're like sort of researching on them. So thing is, what's your advice? Let's say, I mean if you get the insurance through the official channel. Yeah. Does it like, I mean during the claim settlement all does this third party agents or like how much they can actually help?

Challenges with Claims

Right, right. Like guy directly fight. I mean since there's a middleman involved. So I feel that sort of confusion, you know, how is this and sort of like directly buying through them and what is something that this middle, I mean person can add extra to that to sort of not like, you know, get me through the hassle of claims. So. Right, right. So it's a great question. I'm sorry I did not get your name, but it's a question I think a lot of people have. Right. And you're right in that, you know, why would I introduce a middleman when I can probably go to the insurance directly? So let me probably explain this with a simple use case that I've had. Now I'll obviously be biased. I'll tell you. Okay, go through. Ditto. Buy through an agent. But lets set that aside for a while and let me actually talk about a personal experience.

Personal Experience with Claims

I bought a motor policy about three years back and ive had this motor policy from a very reputed company. And after about two years I was traveling to my hometown from Bangalore and my car fell in a ditch, sort of a ditch. And there was very limited damage. My tire was damaged and the wheelbase was damaged. And I had to make a claim. I went to the provider, I told him I was going to make a claim. The surveyor came in, they surveyed the entire car and they told me, I'm not going to pay for this. And I asked him, why won't you pay for this? They said, no. You don't have something called as wheel and tire protection cover? And I was like, no. What does that mean? I was in an accident, right? Shouldn't this be covered? No, no, this is. No, sir. No, it's not. Doesn't work like that. You have to, if you're making a claim for any damage to the wheel or tire, you have to do it through wheel and tire protection at all.

Understanding Policy Exclusions

So I'm like, okay, what is this? Let me actually go and read the policy document now. Since I'm not a complete dummy, I had the provision to actually read through the document, and I realized I did not have this add on. But then I also realized that the add on specifically was only meant to cover cases of wear and tear. Generally, if you are going through potholes, etcetera, and you suffer damage as a consequence of riding your vehicle extensively, then you need the protection add on, right, to cover for tire and wheel damage. But if it's in an accident, again, it supersedes all the other exemptions, right? So I was like, no, this is an accident right? Now, ultimately, the discussion is, what is an accident? It's about the definition of what an accident is. So I make my representation. I use the standardized guidelines, because, again, I'm a corporate agent. I know about this business. So I write to them. I tell them, okay, standardized guidelines. This is what an accident means, right? Sharp. You know, there's a. I think it's a sharp collision between third party and object, or something like that. And I write the definition, and I'm like, this is exactly what happened. I send them the photos, and then somebody calls me and says, sir, you've raised a grievance, etcetera, what is the matter?

Escalating Insurance Claims

I tell him, look, this is the definition, etcetera. And he tells me, no, sir, we can't pass the claim. No, no. But you read through the document, say, no, sir, we can't pass the claim. But. But at least, no, sir, if you want, you can escalate the matter and case closed, right? And I did not hear from them. I tried to escalate it to his manager. I do not hear from them. You know, when things actually started moving, it's when I had to reach out to the insurance company, see if I know somebody in the industry, get them to listen to my case, and then eventually go through the mail order. Sorry, all the mail trade. And then finally, right after multiple representations, they finally gave me a hearing wherein I told them, look, if you're not going to pass the claim, go to the ombudsman. They're like, okay, go to the ombudsman. It's going to take you three months. You only have to make the representation, etcetera. And you know what happens with the ombudsman.

Navigating the Ombudsman Process

We've represented so many cases with the ombudsman, as we can't represent physically, but we coach clients to specifically tell build their case, etcetera. And 80% of the time, when you go to the ombudsman, who's supposed to be an independent party, what happens is the insurance company will not even make the case. They'll say, we'll pass the claim and that's it. End of. There's no penalty for making you wait. In India, the process is the punishment. So what happens when you have an agent is that you can trauma dump, you can tell them your problem, you can come to ditto. For instance, I was wishing that there was a ditto for motor insurance. We don't sell motor insurance policy. But that day, as close to my wedding, etcetera, and I was really stressed because I dont want to deal with all of this stuff. I need my vehicle. And it was perhaps one of the worst times of my life. And I wish that I could dump my problems on somebody else so that they could deal with this.

The Need for Support

An agent does that for you. Now, im not saying ditto is the best option that you can consider. You can go with Beshak, you can go with the neighborhood agent that you know. Thats a decision that you have to make because you have to be at peace once you make that decision. But if you do not have an agent, right. I can assure you that when you go to the insurance company, they're going to tell you deal with it. Right. They're going to tell you go to the ombudsman, you deal with it. And this is a pattern that we've seen consistently, right. Once you go through an agent via directly, right. It's always a pattern. Right. They'll just tell you, okay, go to the ombudsman. Right. Deal with the problems. Right. And they have nothing to pay for.

Final Thoughts on Insurance

No penalty at all. Like I said, 90% of the cases if, even if you have a strong case, they'll just come on the day and they'll say, fair enough. Right. I'll approve the claim. Okay. Now, you just wasted three months for what should have been solved on the first day. So my suggestion would be to perhaps consider an agent, even if it's somebody you trust in your neighborhood, that would be still better than buying directly. And guys, if you're convinced, then there is a link at the bottom. You can book a spam call. Yeah, I mean, I'd be happy if you consider ditto, but then again, I'm biased. I'm not going to sort of preach. For the company is too humble to not mention it, but I've used it. It's great.

Leisure and Personal Interests

I mean, I mean, it's a call which won't ask you any questions. Just go there and book a call there, right. And get your queries cleared and you can recommend it to anyone else. I mean, you're lucky that you're on this broadcast. I mean with us. I'm also lucky here to listening to Shreya. But people who are not here can learn more maybe. Great. So what I'll do is, I think running out of time as well. But I'll get a couple of more questions. But before that, I want to ask you, I mean, lighten up. A yemenite. What do you do to unwind, man? Unwind. You know, I mostly spend my time indoors. So I, again, you know, I like to sort of maybe, you know, game. I'm an avid gamer, right. So I play video games, for instance, or sometimes now what do you play? So, I mean, I usually play single player games that I like, the adventure.

Favorite Pastimes and Upcoming Plans

It's almost like living out of my usual mundane life. So, for instance, you know, recently I was playing a game called Dragon's dogma, right. So it's something that I use to unwind. But otherwise, you know, we have this policy where everybody in the company who work from office can go play badminton any day. So we book the courts. And so usually I go and hang out with my colleagues as well, who are my friends. So. So we play badminton. We sort of, you know, play cricket on Fridays. And so that's usually how I unwind. But, yeah, I mean, that's what I mostly. And I guess you got married recently, right? When did you get married? Yeah, I got married in Feb. Right. So, yeah. Feb. And since then, yeah. I mean, I've not been able to game as much, so.

Travel Aspirations

So my video game habits have taken. I was hinting at that, right? Yeah, yeah. Yeah. So I don't get to game as much, but, yeah, I mean, I still. And any travel plans? I mean, you're going somewhere? Yeah, no, I mean, we have plans to visit Japan. I've been hearing great things about Japan. Hopefully by the end of the year, you know, I'm planning on going to Japan. I've never been outside India. You know, first year entrepreneurs. Right. So I've never been outside India. So be a nice thing to perhaps once go outside in. Yes. See how Japan looks like. So maybe that's Japan, by the way. Japan is another planet, by the way. It's not.

Shared Enthusiasm for Japan

Is it? Is it? I really want to now, you know, everybody's hyped it so much. I really want to. Everything is. Everything is japanese. Everything that they have is. It's great. I have plans to go as well. I mean, August, I was supposed to go maybe end of the year. I'll go. Yeah, yeah. I've heard end of the year is pleasant, so I'm planning on doing something. Yeah, cool. We'll take two more questions and then we can wind it up, I guess. Anyone? I think Santosh, I've added, I think Alonji is also. Yeah, Santosh, if you can speak, you can ask. Yeah, yeah. Thanks. Thanks to it.

Discussion Wrap-up

So thank you so much for joining me. And like, you know, I would really appreciate the ditto because you have been, you know, doing a fantastic job. You know, it's been a six month, I have been interacting with ditto for multiple instances, even though I have not had a policy. So it's really great to, you know, interact with your team, especially on, you know, a lot of understanding the nuances stuff. It's really great. So I would have a lot of, you know, the word of mouth. I just wanted to, you know, come straightly direct to the point. Yeah, I have seen a lot of your YouTube videos related to the passing the claims currently. You know, I have been a star health policy holder since 2020. I already checked with your team as well.

Sharing Personal Insurance Experiences

So probably one of my case would help other, the Twitter members x community. So you can also let us know. Let me know what I can do. So when I had a personal policy, when we are going for a claim, the hospitals are, you know, aggressively, okay. As you know that, you know, you are just mentioning that customary clause and the reasonable clause. Yeah. So when we are just deliberately, you know, going for a claim. So then we, then the patient, they got to know that, okay, these guys gonna get going to get admitted through the insurance, correct. If the room rent is just for sake for 6000, they are just for 10,000.

Discussing Claims and Insurance Practices

So I don't have any agent. I do have agent, but currently know that agent doesn't know anything. Then I spoke to ditto. Then I got to know that agent doesn't know anything at all. Okay. He just simply saw the policy and he absconded. So how I can learn from this app, right. So this is very tricky, Santosh, because you know this overcharging business, right? So there's both sides of the coin. Like some places they will overcharge, but then there's the other side also where what insurance companies will do is they'll have pre arranged agreements with the hospitals.

The Role of Hospitals and Insurance Companies

So they'll have some like, let's suppose, you know, it's a angioplasty, you know, heart procedure where you're getting a stent. Now they'll already have worked with the hospital because it's part of their network and they'll tell, look, any customer that comes for angioplasty, we are going to make a deal. You are going to charge them 110 thousand, 120 thousand and insurance company will pay for the cost. Now what hospitals do is even though they have agreements saying that we will only charge 120 thousand which is usually at a discount compared to cash paying customers. Cash paying customers usually have to pay higher. But youre right. The real experience is not that.

Challenges in Billing Practices

The real experience is that you feel that cash paying customers pay lower price and insurance people pay higher price. And the reason why that happens is they will charge the one lakh 20,000 according to the package. But outside of that they will include a lot of other items that they know insurance will not cover. But they know customers will have to come. So when you go to the hospital, only you will see that hospitals will start doing this business. They will tell you this is what it will cost, this is what it may cost. And then they start inflating the bill. So one thing that we tell customers, especially we work both ways.

Leveraging Relationships with Hospitals

So with insurance companies, we go and lobby, we go and ask them, look, if you are seeing that the cost of angioplasty that you agreed with them is one lakh 40,000 and now you are telling the hospital has charged two lakh and you are not paying the extra 60,000, then remove from their network. You dont work with them, why are you working with them and why are you putting the burden on the customers? Some insurers will say okay, fine, etcetera, and then they will pay because we put so much pressure. And other insurance companies who we know, im not going to name them, but yes, we have worked with partners in the past that weve stopped recommending.

Insurance Company Relationships

Now simply because they do this, they tell, no, this much. This is what we can pay. This is what is the agreed rate. And then the customer has to pay. We simply stop working with them. There's nothing else. And there's no real way to prevent this because it depends on both the hospital and the insurer. Hospitals can also over inflate and do this gimmicky business. Insurers also do this with insurance. We have some leverage with hospitals. Only the customers have leverage. So we also coach customers who sometimes tell hospitals directly.

Ensuring Fair Medical Billing

Key, make sure you read through every item. Ask them, why is this particular? Like, you know, let's suppose they're charging for the operation theater 40,000. Why are they including an instrument in the operation theater outside that package, 40,000 for operation theater, 12,000 extra for Siam, which is an instrument that's used in the operation theatre. That's because they've agreed with the insurance company. This is the package, right? 40,000 insurance company will pay extra, 12,000 I'll extract from the customer so it works on both ends.

Role of Agents in Navigating Challenges

If you have an agent, I can lobby with insurance company to make sure that the gap is bridged. If you have to pay 60,000 out of pocket, I can probably get it down to say 10,000, 15,000, 20,000. I am giving an example, but it also depends on the hospital. In fact, even if you go to the ombudsman will also tell you something like its incumbent on the customer to negotiate the best rate from the hospital. Even the ombudsman is not friendly to the customer. Imagine that. Right, so we've seen this, you know, it's a very difficult question to answer because you have to work this from both sides, right? From the insurer side and from the hospital side.

Challenges in Claim Processes

Okay, shade. So I, you know, because both of the claims were, you know, made in the network hospital, I see that the bills are exponentially increasing. So when I ask them for the reason, you know, they're just giving some lame excuses. Okay, this and that happened. Yeah. So you mean to say the customer should be, you know, more intelligent and, you know, in order to negotiate with. Them and also with insurers, because there are policies that will sell you policies at dirt cheap prices and they know for a fact that they'll have to cut corners. I'm not saying everybody does it, but there are companies that do it.

Choosing Insurance Providers Wisely

And one of the things that we've done is, look, we could partner with all 20 odd insurance companies if you wanted. And many people ask us, why do you only recommend three or four partners? Because right now I know for a fact that I've worked with them so much that I can build my case, I can work for my customer. What is the point of you buying a policy and if I have no leverage, if I cannot even make my case, if I can't get them to consider your case, for instance, what is the point of me partnering with that insurance company so I won't partner with them? So it also matters.

Analyzing Insurance Company Reputation

It also depends on which insurance company you are buying. Low complaints volume, higher incurred claims ratio, etcetera, could be good indicators for you to look at a company and say, okay, maybe I can go with them. As opposed to a different provider. And generally by looking at online complaints, you'll get a fair idea of who's usually bad Apple, right? Yeah, that is correct. And I also have another follow up question, so.

Insurance Policy Complications

Sorry. Actually, we have a running short of time. I have one more speaker to get in, actually. You can reach out to my advisor. Right. And I. Or, you know, we have. But, you know, since probably just DM. On me on Twitter. Right. I'll reply. Right? Yeah, just DM. Or maybe just reply on this space itself. I mean, people will figure out a. Yeah, yeah. Okay. I just have time to get Narayani in. Hi, Narayani, you can start speaking, I guess. Hi.

Concluding Remarks and Acknowledgments

Yeah, I joined late. Thanks for the forum. So I have two part of two questions, actually, but I'll begin with the insurance since that is what is getting discussed now. Why is the top up plan always so complicated? So I have a base package with United insured. So I am trying top up. So there are so many exclusions. Inclusions. How do I, you know, with age, I would like to increase my sum assured. So how does one do that without getting duped? You know, it shouldn't be tomorrow. If I have a claim, they say this is all excluded.

Understanding Top-Up Insurance Plans

So how does one go about that? So these super top ups and these top up products, right, I mean, generally what they offer is this convenience of you having to pay lower premiums, but also get a lot of coverage. But this business works on a simple matrix. I can tell you, having worked with insurance companies only care about one thing. That is what is called as loss ratio. Effectively, what they are seeing is if I collect rs100 in premiums, how much do I have to pay in claims? Thats their bottom line.

Complications with Economy Policies

Oftentimes what happens with these lower priced policies, these top up, super top ups, is that they collect very little money and if their models are not as robust, right, when they're. When they're sort of predicting outcomes, etcetera, when it comes to claims, oftentimes if they have to make big outlays, they will find an exclusion. I can assure you that within the contract, there is something that they can find that they can then use as a rules to deny a claim. That can always happen. Right. The question is, when will they do it?

Claim Investigations

So, oftentimes some companies will do something called as an early claim investor, if you bought a policy within the first year and you make a claim, there'll be a thorough investigation no matter what happens. And these are patterns that they use to weed out frivolous claims. And even with top ups, it's the same case. So ideally, what I'd say is, if you can afford the money, I'd advise you to buy a more robust base plan, which is increase your summer shot within the base plan only.

Final Suggestions on Coverage

However, if top up plans are the only option, once again, I ask you to probably buy it through an agent or have a consultation. It takes about 2030 minutes to figure out some of the key exclusions so that you know that you are not duped eventually, or at least your expectations are set straight. You know, people don't get upset with Zomato because, you know, I mean, even Zomato is, you know, delivering your food at 35 minutes. It's a great time, but if they promise you I'll deliver it 15 minutes, and then the 35 minutes.

Setting Expectations

Right. Suddenly you're upset. Right. Because the expectations weren't set. Right. So I think that expectation setting has to happen. And I'd advise you to probably take some time to understand your top plan before you double down on it. Right. Because I think that's very important. And if you really want robust coverage, again, my advice would be to actually increase the base sum coverage as opposed to buying something like a top up, because I've seen the amount of disputes, grievances, etcetera that come out of top ups are significantly higher as compared to baselines because baselines obviously carry higher premiums.

Conclusion and Appreciation

Yeah. Okay. Got that. Great. Thank you for that. I think we can allow only one question to be fair. Yeah, got it. Got it. I have. If you have any queries, I will. Yeah, I'll speak on this space. Sure, sure. Perfect. Thank you so much. I think we already passed hour and a half hours limit. Yeah. But no worries. It was a great conversation. I guess anyone who was hearing this would have. Would have been inspired by. I mean, see, inspiration is a big word, but I would say it definitely puts you on that path of introspection that what are you doing in life and what can you do more? So, great story, shade.

Closing Thoughts

I mean, I could relate. Thank you for having me on the call as well. Yeah, I mean, it was pleasant talking. Pleasure talking to you as well. I mean, we did earlier, but yeah, this was a more, you know, longer discussion. So I'm glad that we got the chance to actually talk. Yeah. Yes, yes. Absolutely. I mean, we can. Of course we can continue this. We can be having a discussion on this.

Final Acknowledgments

Yeah, definitely. Right. More than. And thanks to everyone for, I mean, patiently listening in. I know it's time. When you drive back home and asking those enthusiastic questions. Of course. I mean, I thought that the quality of questions were great. Thanks, everyone.