Space Summary

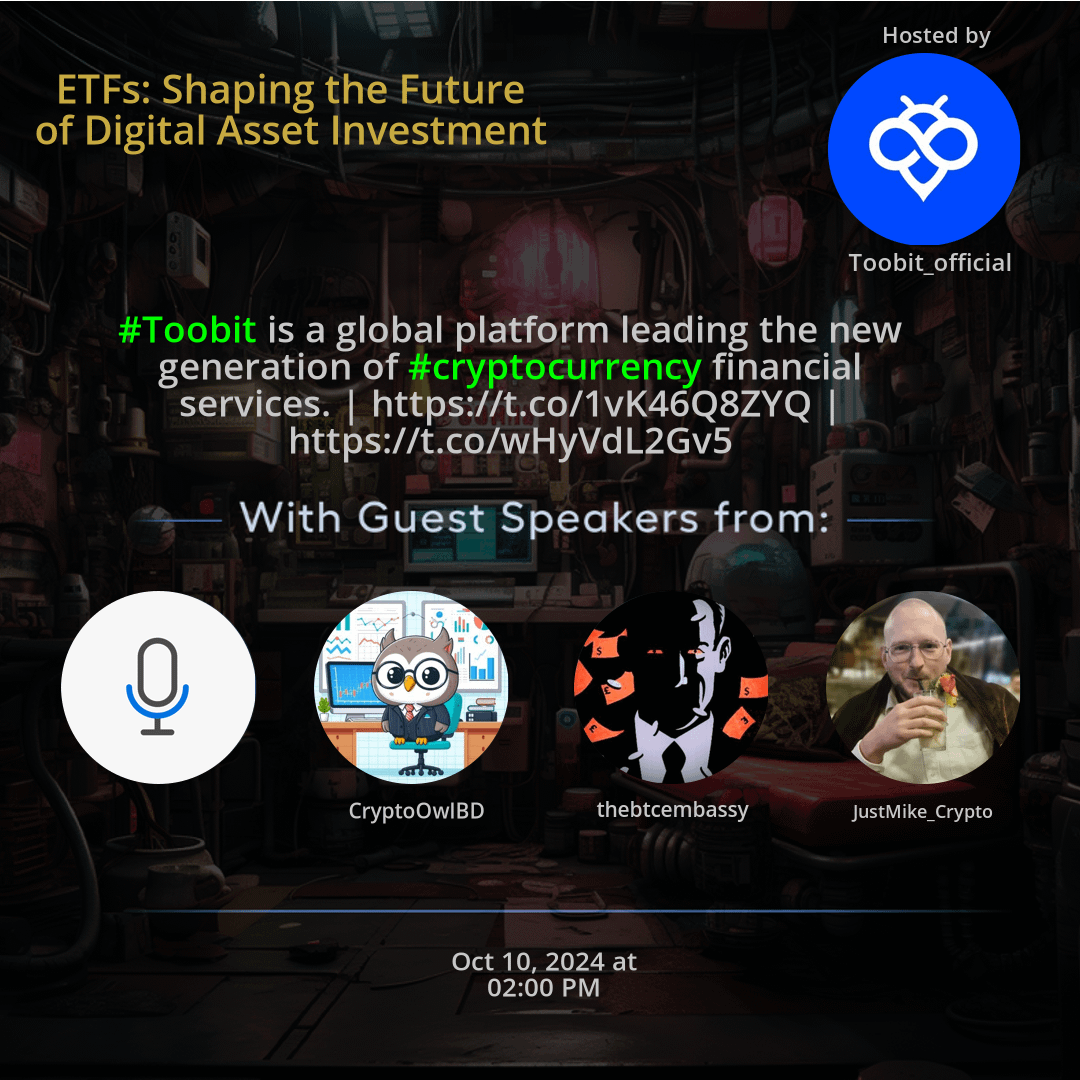

The Twitter Space ETFs: Shaping the Future of Digital Asset Investment hosted by Toobit_official. Toobit's Twitter space delved into the transformative power of ETFs in digital asset investment, showcasing how their global platform leads the way in providing innovative financial services. ETFs are revolutionizing the investment landscape by offering diversified portfolios and reduced risk. The discussion highlighted Toobit's pivotal role in shaping the future of digital asset investments through cutting-edge ETF solutions, catering to a broad range of investors globally.

For more spaces, visit the Unique Projects page.

Space Statistics

For more stats visit the full Live report

Questions

Q: How are ETFs transforming digital asset investment strategies?

A: ETFs allow for diversification, reduced risk, and accessibility to a wide range of digital assets.

Q: What makes Toobit stand out in the cryptocurrency financial services sector?

A: Toobit offers a global platform with innovative ETF solutions, leading the new generation of cryptocurrency investments.

Q: Why are ETFs considered pivotal in shaping the future of digital asset investments?

A: ETFs provide an efficient and diversified approach to investing in digital assets, catering to a broader range of investors.

Q: How is Toobit contributing to the evolution of cryptocurrency financial services?

A: Toobit's focus on ETFs creates new opportunities for digital asset investors, driving innovation in the industry.

Highlights

Time: 00:15:42

ETFs: Revolutionizing Digital Asset Investment Exploring how ETFs are changing the landscape of digital asset investments.

Time: 00:25:18

Toobit's Global Platform and Services Discovering the innovative financial services offered by Toobit on a global scale.

Time: 00:35:59

The Future of Digital Asset Investments with ETFs Insights into how ETFs are shaping the future of investing in digital assets.

Time: 00:45:27

Toobit's Innovative ETF Offerings Explaining how Toobit's ETF solutions are driving forward the evolution of cryptocurrency investments.

Key Takeaways

- ETFs are reshaping digital asset investment, offering diversified portfolios and reduced risk.

- Toobit's global platform provides access to cutting-edge cryptocurrency financial services.

- The future of digital asset investments is influenced by ETFs' growing popularity and accessibility.

- Toobit is at the forefront of revolutionizing cryptocurrency financial services through innovative ETF offerings.

Behind the Mic

Initial Remarks

It's it. Gmgmdh. Barrett, you should have got a speaker invited. Cool. Did that work?

Transitioning Accounts

Hey, Kobe, Fabu. One of you guys should join with the Ranger account or I'll switch accounts. We can give it a minute and get started. I'm sure people will come in over time. I'll wait for you to switch accounts. Cool, cool. Let me know when you're ready to go. Oh, there. Just left. We'll give it another minute then.

Conversations on Location

Gm. Gmdeh. Cool. Dude, are you at island? Yeah. Coy is a nice place. Highly recommend it. Are you Salt Lake City for permissionless? Yes, sir. How's that? Solana a focus at all? Yeah, I think there's, like, a decent truck. I didn't go to the conference yesterday, but I'm gonna be at the venue today.

Introduction to Solana and Trading

Okay, very cool. Here, let me pull up the questions and can hop right into it. First of all, just want to thank you for taking the time to hop on. I think the goal here is really highlight Solana ecosystem teams. I know you guys are going live with trading soon. Like I said, find out when. But also excited for drift to be integrated. So I just want to take or just want to say thank you, but, yeah, let's hop right into it. So, hey, all, I know most of you, but I'm squid from drift. I'm leading our ecosystem initiative, and we're here today with Cobra from Ranger.

Background in Crypto

I guess to start off, would love to get a little of your background about why you initially got interested in crypto and how you found your way to Solana. Yeah, I have, like, a background, I guess, like, in math and finance. Got into bitcoin back in, like, 2012 from playing poker. And then, you know, stayed. I paid attention to it on and off for the next handful of years, and then was building a company in private, in, like, the private capital market space, and was interested in, like, you know, offering better access to generally everybody, right. I didn't really know the term, like, democratization at the time, but that's, like, what I wanted to do was, like, democratize access to private capital markets.

Challenges in Capital Markets

And talked to the OCC interactive brokers, other regulatory bodies on how to build a pre IPO derivatives exchange. And from their point of view, it's going to take seven years, a ton of money before I got licenses, before I could ever launch. And so I was like, okay, well, I don't really want to wait that long. And I was like, hey, where can I build something today? And that's kind of how. And this was like, around Defi summer. And that's like, I was like, okay. Like, hey, like, I think, you know, building this in, you know, crypto and Defi would be the most optimal place.

Discovering Solana

And then started, like, doing a bunch of research on, you know, what chain is best to build something like this on. And this was, you know, late 2020 now and found Solana. It was fast, it was cheap, there was an order book on it. And that pretty much sold me on, you know, okay. This chain has the ability to kind of scaled to your more typical amount of users for, like, applications, and then put together a team, started, like, working on Solana, did a bunch of traveling, like, the early days, and that's kind of like how I got into Solana and, like, into crypto as, like, somebody who is, like, a full time, like, builder.

Initial Thoughts on Market Needs

Okay. Yeah, I mean, I think that makes sense. Interesting. The order book was a draw for you. guess, you are an order book, Maxi. I guess the next question is building off of that. I know you've done, a couple things. you've been building on sauna for a while. but what, like, what made you want to start ranger? What was the problem you saw in the market? And sort of, what's the story there?

Identifying Market Gaps

Yeah, so was just doing, you know, I had, like, built Dexs, went through, you know, trying to incentivize liquidity, know how expensive it is, and then was also just doing, like, you know, some trading on my own and was just talking to people that were doing a lot more trading than I was. And, you know, we all came, people would share, like, generally the same issues. Right. You know, hey, there's not enough liquidity on a single venue for me to trade in size. Right. And that is important if you are looking to, you know, try and compete with, you know, your dy DX's, your hyper liquids, or your centralized exchanges, right, that have, like, a ton of liquidity.

Challenges in the Solana Ecosystem

Now Solana is noticeably better than it was, like previously. But still, we have, like, a long way to go on, like, any single venue. And so that was like, really the initial thoughts. I was like, okay, like, hey, we know that if we can aggregate liquidity across perpetuals exchanges just like, you know, Jupiter did with spot, you can provide a lot of benefit to, you know, those users who are looking to trade, you know, more volume hot, like, greater position sizes, and really start to compete and, like, have that centralized exchange feel. And they're like the two ways to do that.

Innovative Approaches to Liquidity

You're either building a Dex and you're incentivizing a ton of liquidity to be there. Or you can approach it how Ranger did, which is through this aggregator method where we don't have to necessarily pay for liquidity to be there. And we can rely on the other teams in the Solana ecosystem to, that have been like working hard and like their sole focus is, you know, improving the, you know, smart contract in like their decks. Right. Which I think is great, right. Like we don't have to necessarily focus on something like that. And Ranger gets to like focus like on the user experience.

Focusing on User Experience

Obviously we have to, you know, do a good job of building like the smart order routing engine. But you know, we aren't necessarily having to get in and like write smart contracts, which is, I think I, you know, nice. It gets to limit our focus. We can move faster that way. And that's like another reason why we kind of like chose like the architecture for Ranger is, you know, we don't have to like necessarily do the same amount of, you know, security audits as there is no smart contract.

User Fund Security

So ranger never like has access to user funds. And so that's like another reason for like we like how we chose to build this. But yeah, so you know, that's like generally why we built Ranger. You know, to improve the trading experience because there aren't like single dexes where without like causing a lot of price impact that you can place like, you know, some of these massive orders that you see on centralized exchanges. Right. Or you even on, you know, hyper liquid for example.

Importance of Liquidity

Yeah, I mean that makes sense. Liquidity. Liquidity is king, especially in trading. Since you were talking about I guess, trading experience competing with sexes. I know in your breakpoint arrangers breakpoint presentation you showed like the smart order routing in action and filling I guess the order across multiple exchanges. I'd be curious to dig a little deeper into that.

Complexities of Order Filling

There's a lot of factors at play for perps like I guess fill speed, like fees, I guess liquidity on the books and also stuff like incentives, like average funding rate per exchange. How does your aggregator work to do that? And what are the most significant factors when filling an order? Yeah. Yeah, good question. So currently the aggregator works by just looking at available liquidity at certain prices and then also like fees.

Functionality of the Aggregator

Right. So based off those two parameters, we will route orders to given platforms. Right. Now you mentioned like funding rates. I think that in like incentives. Right. As well. I think just because we want to get something out, you know, a little sooner, we aren't necessarily focused on you know, being like reading somebody's incentives from the chain before, you know, we submit the order.

Impact on Execution Price

I think that's obviously something we want to do because that does impact somebody's like execution price. But generally speaking, right now it's just those two things. Regarding funding rate. Again, we don't take funding rates into consideration when routing, at least here in the early days, because people want to express their opinions or care about funding rate differently based off of time frame that they're looking at. And so I think that, and like other things besides, just like, hey, like how long do I plan to be in a trade? Maybe they're looking to capture, you know, arbitrage between like two venues on the funding rate side of things. So we don't take funding rate into consideration either.

Incentives and Order Routing Engine

And I think we'll be able to take incentives in. We'll consider incentives in the Sor prior to funding rate. And then funding rate is something you kind of want to offload a little bit of like, you know, the actual methodology to a user. Like, hey, like how much do I care about funding rate? You know, I'm gonna be in it for like this x, like x amount of time is like my target time in this position, or, you know, some profit, right, et cetera. And let the user customize the order routing engine based off of some of their internal beliefs on their trade. And then we can use that probably just in a settings page. They'll be able to check some boxes or express their desire, and then we'll be able to route based off of a trader's desire for, you know, how we, how the order routing engine would handle, you know, funding rates.

Order Books and Execution Mechanisms

And, but so right now, right, like, based off those two things, the order routing engine streams, you know, all of these different, like, accounts across the number of different venues for like, liquidity. Obviously, like fees are less dynamic than liquidity, but we do like stream those that like information in as well. And based off of the, let's say somebody's placing a million dollar position and you're always streaming all the liquidity mechanisms from drift except for the auction. As like, there is like no liquidity to understand, right? Because it's not like it's just in time. So we look at like the order books or like the decentralized book on drift plus, like the vam at, unlike Jupyter and flash, the order routing engine takes a look at their oracle price for execution as well as it does take into consideration their position size fees.

Order Size and Fee Structure

Because on drift and flash, like, if you place, like, the larger the order that you place, you do end up paying more in fees at some extent because they can't provide, you know, they can't provide you more liquidity than, like, a centralized exchange is offering at like, a marked price, right. And then, like, you know, look at Zeta and see, you know, how. How much, like, depth they got on the books. We know their fees, right. And then from that, it builds, like, the route. So, like, let's say it might send, you know, 40% to, like, jup. 20% to drift, and then, you know, the remainder of the remaining 40 across, like, you know, zeta and flash. And that is how it's done so far.

Transaction Execution

It's very simple. And then, like, you obviously will get to, like, manage your position from, like, the ranger trading page, right? So what it does is it like, builds a transaction on the backend after, as it's like, streaming all this, and you put like, hey, like, I'm trying to buy, you know, but a million dollars worth of soul, and it builds a transaction and serves it to the user and the user will sign. It's very similar to how Jupiter operates for spot, except where we're just routing through your perpetuals venues and to accomplish some of the pain points that are the problems you would have without.

Account Lookup Tables

How would you land a transaction? We use account lookup tables to enable, to pack more accounts into a transaction, because otherwise it's not really that possible to land a transaction across, like, multiple venues for purpose trading, because there are just like, so many accounts that need. Are needed for, like, certain transactions. Like, I think, what, Jupiter has, like, 19 accounts per transaction, I want to say, or it's pretty close. If it's not 19. Okay, wow. Thank you. Thank you for going in depth there. I think a couple interesting takeaways.

Customization and Incentives

The one on how moving forward, having traders be able to customize the preferences for what type of trade they want to do relation to funding rates. I also think something else interesting is you mentioned including incentives eventually into those routing calculations. Right now, traditionally, incentives are very opaque, or defi protocols do opaque incentives. So stuff like this could force for more clear cut incentives to hopefully be included. I think building off of that, I have a question as, say, ranger grows significantly to take a lot of the attention and volume. How do you think that will change the perpetuals competitive landscape?

Changing Competitive Landscape

And how will it force, or how could it force protocols to adapt? Yeah. Okay, so there's like, a couple questions there. First one being, how is it going to change the landscape? You know, I actually think that it shouldn't change like the competitive landscape or it shouldn't change like the landscape of like, hey, a perps platform is going to die now, right? Like that's not like what I really think is going to happen. What I do think is going to happen though is that if you, if we can accomplish, which I think we will, building like a better interface and you know, execution for perpetrators is that you will generally have less people. I mean like the goal is to have like much less people going to like the underlying venues, user interface themselves.

Market Dynamics and User Interface

Right. Their app, right. So no offense to drift, like obviously we want all the people that, you know, go to your UI to not go to your UI anymore and come to us. Same for Jupiter Flash, etcetera in Zeta. And what I think is going to happen is once we start to get, you know, a pretty healthy chunk of kind of that retail or sophisticated non programmatic trader accessing Ranger over the underlying venue, you will actually start to see volumes on certain platforms. Generally you should see volumes across all platforms increase because now somebody can actually place a large order and not think about it.

Distribution of Volume

But I mean, you know, the proportions, if you are like on Ranger like right now, right? And you can look at like oh, you know, oi and you see that like for sole perps, right? You know, jupe has 74% and drift has like 24%, 25% almost of like the Oi and then the other two venues are like the remainder. Right. I do see that. I do believe that there will be a more even distribution across those platforms as the aggregator gains users, especially the order book based dexs, as they are cheaper to trade on than your oracle based X is that know need LP's to make money based off like liquidations.

Future of Liquidity

And like effectively they need bad traders there so the LP's make money so they can continue to place like orders. Right. But that's actually one of the most interesting things that I think will happen is you'll start to see order book based X's pick up more percentages in the OI and in volume moving, let's say probably six months to a year into Ranger being live and being able to accomplish holding more of the traders that are in the ecosystem. How are these platforms going to react? I think that they don't necessarily have to do anything except for make their platform like competitive, right.

Effects of Ranger on Protocols

So at some point in time, you know, since the routing engine takes into incentives, it takes into or eventually would take into you know, incentives like funding rates, obviously it takes into fees and liquidity today. But if you know, raise up, if you raise like, fees or you aren't contributing in like a meaningful way and like advancing like, the product, you'll start to see like less and less, like liquidity on your platform and you'll just get like less volume. And I think that's kind of like generalized with like add an aggregator either. But I think it will be expedited in that process where people are going to be more conscious to like, oh, like, hey, like, I'm all of a sudden getting a lot less routes.

Improving Protocols

Like maybe my volume hasn't dropped like significantly or anything like that, but I noticed that I'm getting like less routes from, you know, Rangers order routing engine. What's, like, going on. And I think it can help like bring forward better reaction times for improving like, protocols moving like, know, in their life cycles. Right. Also I think that like, there comes a point in time ranger controls, like, so much. If it can control, you know, like a dominant amount of the non programmatic traders, it's kind of cool because it kind of operates as a metadow for these like other trading venues.

Governance and User Direction

And I don't mean like meta Dow is a metadata project, but just kind of like a general DaO because all our users are your users and then we can participate in governance at the underlying venue level. Right. And I think that there will be, you know, ways that underlying protocols will, you know, incentivize or discount fees coming from like a certain venue, whether that's ranger or some other person or other company, like in the future. I think that once you control so much of the users, you can help kind of like direct fees and direct how underlying protocols, like, operate in a sense as well. But I think that one's like a little bit farther off.

Underlying Protocols and Integration

But that's definitely something that can happen at like, it kind of like weird, you know, dow theater level. But generally I think, like, underlying protocols don't really have to do anything, which is sick. Like, we're doing all the integration works. I mean, like, I definitely ping Chris a lot, you know, when we in big z about like, you know, some of the things that we had questions on when integrating, but, you know, this, you know, we're like solely focused on the user experience. So I think it kind of like helps alleviate some pressure.

Decentralization and User Experience

I think it does also help the argument for decentralization. Right. There is another team that's coming in building like a front end for people to access as opposed to just a team who also happens to build the smart contract as well. So I think that's something that's really cool and kind of alleviates a little bit of stress and pressure on those underlying teams so they can focus on the core protocol more so than, hey, I also have to focus on the user experience of the application because there's is now somebody who is solely focused on that. Yeah, no, that makes a lot of sense.

Future Prospects for Trading

I think a few key takeaways there. One order book, Dexs should see some of that volume. So I guess that's bullish drift. But beyond that, I think it's very bullish for salon and Defi, given, like you said, the ability for larger traders to enter these larger orders, which hopefully should bring more liquidity to the ecosystem, more volume to the ecosystem overall, but also just those developing those market dynamics, which I guess helps push the whole ecosystem forward, I guess given we're getting close to time. I don't know if you have a hard cut off or anything, but I'd love to hear about, first of all, when will trading be live?

Upcoming Developments

But also, like, what's next? Like, you have the data platform out. That's awesome. Love that. I believe trading is coming soon. After that, how do you envision Ranger growing? Yeah, good question. So when is trading gonna be live? I don't wanna put any hard dates on it, but we're doing internal testing, making sure that everything is working smoothly on the order routing engine. Currently, I think we're shooting to have, you know, a beta out in the next, like, two weeks or less for the sor, you know, plus minus.

Beta Release and Community Engagement

But generally, I think we want to get it out as quickly as we can. So, you know, I'd be paying attention in, you know, next time the Ranger TG opens up, try and join if you're not in there already. But I.

Upcoming Beta Launch

But, yeah, I think that we'll see beta going live here inside of a couple weeks. What's next after that? That's such a good question. And there really is just so much there is. Building out more of the suite of insights on the data dashboards. We just moved over position streaming to geyser and are now indexing all positions across all platforms instead of just you guys give us some nice mechanism where we can call the amms and calculate Oi from that. But now we've migrated to streaming positions, and now we can build, like, liquidation maps, right? Like those beautiful little maps that you see on, like coinglass, for example, where there's like, x amount of dollars at like, some certain price. It's like liquidatable you know, helping, like, people see cascades, although I know, like, those don't make the same cascades because, you know, Dex is on Solana liquidate off Oracle price and not like the actual venue price, but it's still really cool information to pay attention to.

Enhanced Data Features and Historical Charts

Also, if you like running liquidator bots, it'll be really good to see because then, you know, hey, I need to probably limit my accounts that I'm looking at in certain times when liquidations aren't really that close to current price and whatnot. So I'm pretty excited for some of these extra data features. I think we're going to have some more historical charts for liquidations, funding rates, etcetera, and then also just work to integrate more venues into the product, both on the data side and the order routing engine side. And then those are kind of our main focuses. Initially directly after trading goes live. Not all venues are going to be live on like, beta, but we're going to work hard to, like, get all of the venues that we've integrated into the Sor as quickly as we can. And then, like, our next big feature, right, as ranger, like, wants to be like, the trading terminal.

Plans for Spot Trading Features

Perps aren't the only market you trade, right? People trade spot. So we're going to be adding spot features to rangers so people can trade both perks and spot manage, like, their, you know, entirety of their trading account via Ranger. Well, we'll definitely be paying attention to your telegram for launch in two weeks. Also very excited for those pretty liquidation charts, as you put it. But yeah, I guess on spot. Do you have more time? Do you have a cutoff? Yeah, yeah, no, I don't have, I don't have it. I don't have a meeting for like another hour, so I got plenty of time, to tell you the truth.

Partnership with Asgard

Well, I have lots of questions, but I guess something I saw mentioned is that you're going to launch a partnership with Asgard soon and love the team there. I was wondering if you could dig a little into what you're doing with them and, like, what that integration will look like. Yeah, so Asgard is doing spot margin trading effectively. They're like building like a margin engine for generalized spot markets, which I think is really cool and powerful. And so we want to integrate them and be able to offer margin trading on spot. I know drift does and will obviously integrate drift for the same purposes, but, you know, generally we want to be able to offer like, as many solutions as we can. Right. And so, yeah, we're going to work with the Asgard team to integrate their product into ranger and effectively, you know, try and be the front end for rank for Asgard, for anybody who wants to do like margin spot trading in their doing it via like, lending protocols.

Future Developments and On-Chain Trading Insights

And so they offer like a little bit more assets or like better execution sometimes than like that of like an order book when you want to take like a larger margin spot position on, let's say like, you know, some low liquidity or low ish liquidity token that like, doesn't really have like, market makers on like an order book per se and is like mostly on like, amms, but yeah, so. And they have some pretty cool stuff for the future, like building like, on chain credit accounts, which I think are, which is like pretty cool. And so definitely want to just like, start to like, work with, like, getting them integrated into the platform in general. So their partnership is like along the lines of like, hey, where we want to integrate you, we want to like, see what we can, like, do together on. On that spot margin side of things. we won't be like, writing any of the smart contracts again.

Increasing Confidence in On-Chain Trading

but, just like, you know, I think a lot our team is. A lot of our team has been in Solana for like a pretty long time. same with drift, obviously. and so just like sharing like, any insights we can with those guys. but, you know, we want to just be able to like, offer the most extensive trading suite we can. so people, you know, don't have to rely on so many, you know, like, applications to manage their portfolio from a comprehensive standpoint across, like, all asset classes. Yeah, no, that makes sense. I love to see, like, obviously you guys are doing some super cool stuff, aggregating across perks and all the data stuff, but then working with these other new DeFi protocols, building on top of other protocols and really seeing, I guess, this ecosystem mature. So that's awesome to see.

Insights from Live Data

I guess for a last question. I know your guys data thing is live, like I mentioned before. Love that. Curious of some since it's been live, is that if there's any insights you've gained to it on like, the state of the purse market, state of Defi or anything that surprised you in the data. Yeah, dude, I mean, I tweeted this the other day, I think it was like a week ago or so when I think it was like, what, Wednesday through Friday last week when there was like a pretty, you know, there was like a nice drawdown in the markets. And Solana Dexs actually processed more liquidation volume on Sol perks than centralized exchanges did, which I thought was, like, pretty crazy to see.

On-Chain Trading and Liquidation Trends

Yeah, its unfortunate, because that means, like, people were, like, getting liquidated and, like, losing. But I thought that was, like, that means, I mean, like, you know, there's, like, a couple ways to look at it, right? Like, that means that, like, you know, unchained traders have, like, a higher risk tolerance. They're taking, like, more leverage. I don't think that's, like, you know, a new revelation, necessarily. Although, like, you know, there are definitely some real dj's on centralized exchanges. Shout out that one dude that's like a by bit trader or a bit trader that gets liquidated on twitch all day. That guy's insane. But I think it's really cool to see that, even if it is liquidation.

The Significance of Liquidation Data

So it's not necessarily a good thing to see people get liquidated. But the fact that Solana's Dex ecosystem, which is just. We've only integrated four dexes right now, processed more liquidations than the mass amounts of. I think it's ten plus that are integrated on coin glass on the centralized side of things, process, like, more liquidation volume than all of those combined for one particular asset. But still, I think that shows that on chain trading is picking up in open interest, size, in volume, et cetera, and shows that DeFi is showing its potential to unseat centralized exchanges as the go to venues. Right. Like, this isn't something that's going to happen, like, overnight.

Expectations for the Future

This is obviously something that's going to take many years and a lot of effort from everybody that's building on chain applications. But it was the first sign that I was like, okay, well, not the first sign, but the first sign where I was like, wow, we managed to beat centralized exchanges at one thing for once. And I thought that was, like, pretty impressive. Also, that, like, is a testament to all of the teams building dexes in Solana, like, how much their work is paid off. Also their, like, risk engines, to be able to, like, process that and always and, like, remain solvent at the end of the day, I think, is something that's, you know, it shows a lot of strength and should provide more confidence in on chain trading as well.

Community Sentiment and Data Insights

Right, because those, like, I. Black swan events, even though this wasn't a black swan or anything like that. Right. But when you're doing anything more than a centralized exchange on a dex, that means that there's serious capital involved, and I think that this is, like, a confidence thing. That nothing blew up. Right. And we processed more liquidations and centralized exchanges on a particular asset. But I think that's, like, net beneficial for the confidence in defi perpetrating venues. Yeah, I think it also. Yeah, definitely shows. I guess, Solana community is a bit degenerate, I guess, bullish on liquidations.

Community Engagement and Future Growth

Out of curiosity, is that the first time that's happened, or is that just like the first time we noticed it? I couldn't tell you if it was the first time it's happened, but it's definitely the first time that I've seen anybody talk about it. There hasn't been a good. I haven't seen a platform that's been able to show data like this on the Dex level yet. I mean, you probably could do it if you wrote some queries on Dune, but I think that you don't have to do that with Ranger. You can just go to the website and see it all very easily in nice visualizations. And so I don't know if anybody even cared to try and aggregate that type of information before, but it's definitely the first time that I've ever seen it.

The Power of Data and Visualizations

Right? Yeah, no, that's super interesting. I guess. Also shows the power of data and just showing this off, helping support the narrative and showing the growth which is happening in Defi for that. That's all the questions on my end. I want to open it up to the people who took time to listen. Thank you all. See if you have any questions. If not, I guess I'll end with one more. Little more fun question. I guess looking at, like, Solana, either Solana or on it. Overall, what gets you, like, excited?

Final Thoughts on Excitement in the Ecosystem

Yeah. Yeah, what gets me excited. I mean, I think, like, you know, the. I think watching, you know, on chain trading across dexs increase to, like, all time highs by volume. And oi is pretty fucking cool, man. Especially, like, you know, a lot of these teams have been here since the early days of Solana, and just, like, being able to, like, see people's success, I think it's, like, really cool. People, like, you know, building, like, new versions of stuff. There's, like, a couple new order books that are coming out, which are pretty interesting. So people are still trying to, like, push the envelope and make things, like, more efficient, which I think is great.

Exciting Projects in Defi and Futarchy

Obviously, there are other projects in Solari or outside of defi that I think are really exciting, but metadata, I think it's super cool. I'm really bullish on Futarchy. I know drift uses Futarchy for grants and super excited to see that narrative and that mechanism gain steam and gain traction and really push decentralization forward. I also think it's like a much more optimized way for decision making because it's directly tied token price as opposed to voting. And voting is adjacently tied token price. Obviously, you're going to try and vote for proposals that make your token or the token that you hold go up. I think that, yeah, futarchy is something that is super interesting to me. Obviously, I've stolen profits, PFP. So I'm a futard. And it's just cool to see like, you know, kind of some of these bigger projects and bigger dials, like, start to adopt this new mechanism of governance.

Solana's Growing Liquidity in DeFi

Yeah, I think that, you know, just generally seeing that, you know, perps volume is like, increasing, Solana, like, is starting to be able to compete in terms of liquidity with your other venues that have been hailed as top per dexs, your dyDxs, your hyper liquids. And being able to start to compete with those and seeing how liquidity has improved, I think is a great sign for Solana Defi and definitely see that trend continuing. Especially, you know, I think that, you know, there'll be some pretty cool announcements here in like, the next handful of months before, like, year end that are gonna really shake things up. And that, like. I don't know. I mean, I'm sure some people know about them, but there's gonna be some pretty cool announcements coming in, like, before the year end, that are going to really be an incredibly bullish sign for Solana Defi.

Building the Ecosystem and Market Trends

That's such a tease at the end. Yeah, yeah. As it should be, dude. Yeah, yeah. I gotta keep people excited, I guess. Yeah. The one thing that stuck out to me there is like, talking about the builders. Like, salon is up, I don't know, like a thousand percent, this year. And yet builders are still pushing the envelope forward, like, developing the ecosystem and I guess chewing glass, which I think is really bullish and exciting to watch. I know. Nalik, you requested to speak. I don't know if you have a question, but. Yeah, yeah, I just. You know, this is. We're talking about leverage in the ecosystem. And I was just curious if you.

Leverage in Composable Ecosystem

If, you know, Ranger had any plans to showcase additional sources of leverage within, like, the composable ecosystem and, you know, concretely what I mean, there is like, lsts and the coming restaking stuff. Right? Like, all of this introduces leverage into the broader ecosystem. So I'm just curious if there's any, you know, like, research or understanding that ranger might surface there. Great question. I mean, regarding, like, lsts, you know, as supporting it as like. Or, like, enabling people to utilize it for trading. You know, Ranger doesn't have, like, any margin system itself. It relies on the underlying venues that we tie together. So, you know, outside of what a. At least in the, like, interim immediate future, there's not really anything that we're going to be surfacing with, like, leverage use of LSTs and LRts.

Understanding Risks of LRTs and LSTs

I definitely think that LRTs are a lot more risk than LSTs because they are, like, you effectively turn, you know, an LST is like turning $1 into $2 effectively. So it's, like, pretty low leverage, and it's always redeemable for the underlying asset. LRT's, on the other hand, you can take $1 and turn it into $10, and I think that's a much greater form of leverage. And it will definitely be interesting to see how those dynamics play out across defi. There will definitely be insights that we'll be able to help provide in the future as we index. We'll be indexing everything from spot to perps, lending included.

Data Insights and Liquidity Management

You will be able to see, like, liquidity in, like, a better way. I know, like, a lot of teams either, like, build stuff in house or, you know, contract with, like, certain groups to help manage, like, you know, margin requirements and stuff like that. But we'll be able to, like, you know, since we're aggregating, like, all of the liquidity and liquidity at, like, price points, we'll definitely be able to, like, help teams, you know, design, like, risk engines more appropriately because we'll have, you know, index, like, all this data. And, you know, maybe drift isn't, like, necessarily interested because they've already done it in house and they've been here for a long time, and they've had, like, time to develop their internal, like, risk engines and whatnot.

Confidence in Decentralized Trading Venues

But, you know, there will always be new teams coming into the ecosystem that we can help provide, like, great insights, unlike liquidity, for building robust risk engines, which helps boost confidence. And then also in theory, the more confidence people have in decentralized trading venues, the more liquidity that will be there, the more volume that happens and so on. But in the immediate term, I don't even think, like, any of the LRTs are, like, really live yet, but that could also be me not paying attention well enough. But I definitely think that we'll see some stuff happen in the not like, too distant future, and we'll work to integrate that type of insights into the platform and maybe even, like, help people optimize LSt yields and whatnot from, like, an aggregator standpoint.

Observation on Liquidation Trends

But, yeah, that's, like, how I, like, can't provide, like, 100% answer to that question because I think since none of it's, like, really live, it's hard to, you know, you can, like, theorize about, like, the impacts of. Of it, but until it's in practice and there's no, like, real data to gather, it makes it hard to be like, hey, this is gonna be, you know, think, like, you know, what's actually occurring on chain and whatnot. Yeah, yeah, I think, you know, you brought up the point that, you know, Solana Dexs on chain processed so many liquidations, and I have a, you know, like, my spider sense tingles there, which is like, well, you know, centralized exchanges can, you know, do margin calls on this.

Exploration of External Leverage in On-Chain Liquidity

People can update positions, and then, like, I just wonder if that's indicative of the, like, external leverage because of the composability of on chain. So, you know, it's just. It's just a curious exploration for me. Not that it needs to be there. I'm just, you know, the better that we can build on chain and give that wide room, you know, the better that, you know, you're competing with a centralized exchange. So I just think it's interesting to continue down this path. So. Yeah, for sure. I mean, I think that there'll be some cool stuff that, you know, we could potentially do on, like, notifications, you know, for people, like, you know, that are trading be like, hey, you know, I think that there are definitely venues that, like, offer notifications on leverage or, like, you know, a pseudo margin call, right?

Liquidation Prices and User Awareness

Like, you know, they're not like, hey, like, post collateral or reliquidate you, right? Because, like, their liquidation is defined. Like, liquidation prices are, like, relatively defined. I know, like, cross margin venues are a little bit more of, like, liquidation estimates because if you're, like, using, like, sole as collateral, right? Like, your collateral price can go down and that can affect your position price, like, liquidation. But that is like, you know, one thing I do note I did notice in that is that, like, a lot of the. A lot of those, like, liquidations were not collateralized by USDC. They were other token denominated liquidations, which I think is pretty interesting and could be a reason in why we saw more liquidations on sol in particular, because I think I use sol is collateral. A lot of the time.

User Education for Safe Trading

Because, you know, I like to stack soul. but I think that can also be pretty bad if you're not paying attention to the markets or, like, understand the mechanisms well enough to be, like, all right, like, yeah, like, I'm depositing soul, and, like, I see a liquidation price, and, like, that's my liquidation price, and don't, like, really, you know, care to, like, dive more into it. And those are, like, some things that we can surface to users, and we can try and, like, be more helpful on that front, but, yeah, I definitely agree. I mean, like, you know, we want to do everything we can to, like, help, you know, ensure that defi can compete with, like, centralized venues.

Liquidations and Personal Connections

Cool. And my final question is, what percentage of those liquidations are people that you may know? You know, I didn't, like, dive into the wallets that were being liquidated. Obviously, we, like, have, like, all the account owners and stuff, but didn't, like, do any of that. I'm sure that I'm in some group chats with some people that got liquidated, though. They were mean. Like, when you're processing more liquidations in centralized venues, I can guarantee that, you know, somebody. There's probably somebody in this Twitter space that got liquidated. Check, check rangers platform.

Concluding Thoughts and Engagement

Check the wallet. Check the wallet. Dm, your friend, like, I saw you get liquidated. Yeah. Cool. Yeah. If anyone else has a question, request to speak. Otherwise, I just want to thank you for taking the time to hop on the space. Educate us a little about ranger. Super excited on what you're building, and we'll be closely paying attention to telegram for your launch. But, yeah, thank you. Cool. Yeah, thanks for having me, man. I appreciate it. Have fun at island out. Tell everybody I said hello. If anybody doesn't have any questions, feel free to, you know, DM myself or DM Ranger.

Future Interactions and Community Engagement

Pay attention to the next time we open the telegram chat, so you can jump in if you're not already in there, and then, you know, our team's pretty active in the telegram with answering questions and whatnot. So definitely, you know, anything that, you know, you got, fire away. Or you can tweet at us, too. Like, we'll. We'll get back to answering, I think, pretty quickly. Awesome.