Space Summary

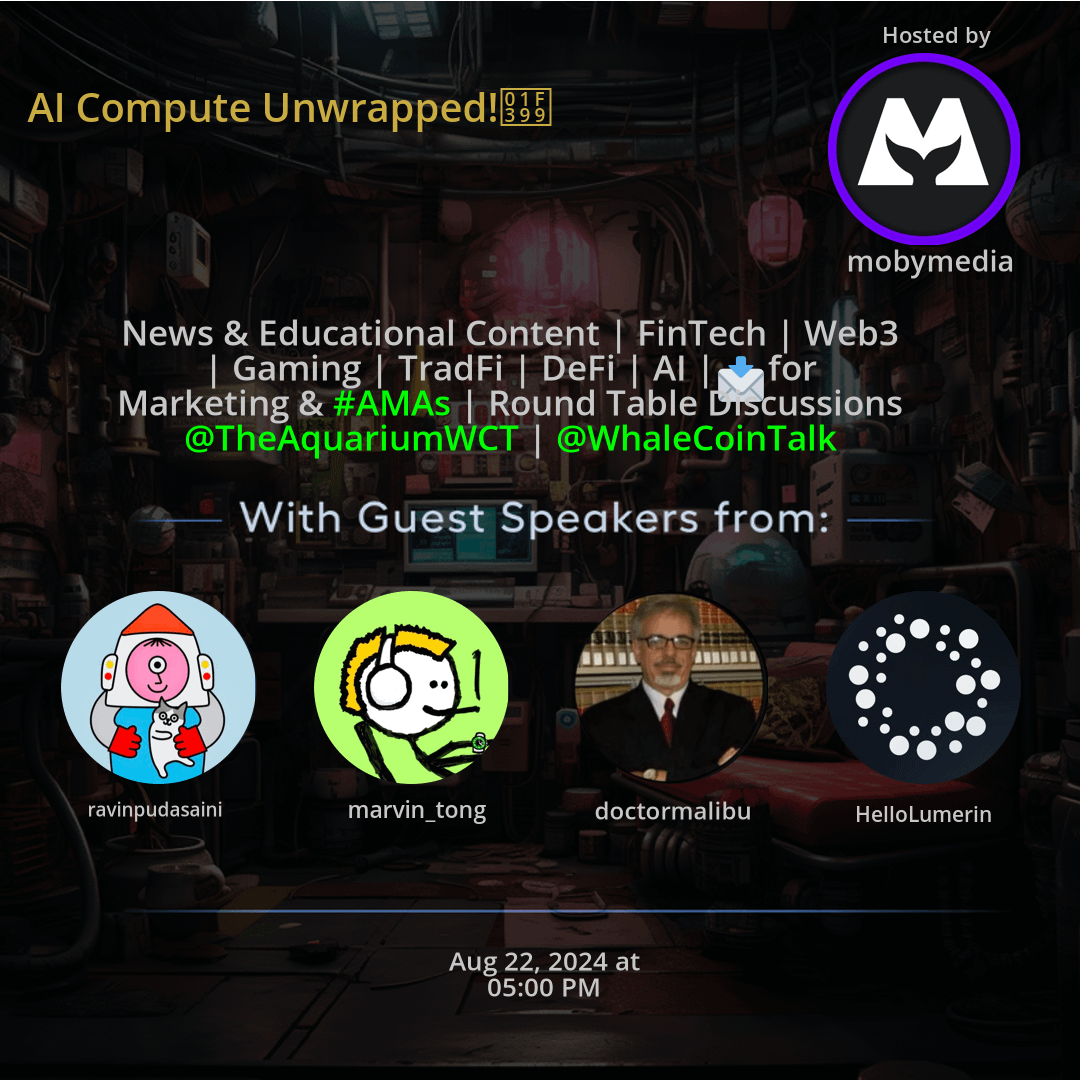

The Twitter Space AI Compute Unwrapped! hosted by mobymedia. The AI Compute Unwrapped space delved into the transformative role of AI across FinTech, DeFi, web3, marketing, gaming, and traditional finance. Discussions highlighted AI's impact on data analytics, marketing strategies, user experiences, and innovation in various industries. Collaborative insights from The AquariumWCT and WhaleCoinTalk emphasized the importance of continuous learning for businesses to leverage AI advancements effectively. The space showcased how AI optimization is reshaping industries and driving efficiencies through personalized content, immersive experiences, and enhanced decision-making processes.

For more spaces, visit the AI page.

Questions

Q: How is AI transforming the FinTech and DeFi sectors?

A: AI is optimizing data analysis, decision-making, and risk management processes in financial technologies.

Q: What are the benefits of integrating AI into marketing strategies?

A: AI enables targeted campaigns, customer segmentation, and personalized marketing approaches.

Q: Why is AI crucial for enhancing user experiences in gaming?

A: AI drives immersive gameplay, personalized content, and dynamic gaming experiences.

Q: How does AI contribute to innovation in web3 technologies?

A: AI enhances efficiency, data processing, and automation in decentralized systems.

Q: What insights were gained from collaborative discussions at The AquariumWCT and WhaleCoinTalk?

A: Valuable insights into AI applications across various industries were shared, emphasizing its transformative role.

Q: How important is continuous learning for businesses to leverage AI advancements?

A: Continuous learning and adaptation are essential to harness AI's potential for improved efficiencies and performance.

Q: What impact does AI have on traditional finance and investment decisions?

A: AI optimizes risk management, investment strategies, and financial decision-making processes in traditional finance.

Q: How can AI be used to enhance customer engagement in marketing?

A: AI enables personalized marketing campaigns, customer behavior analysis, and enhanced engagement strategies.

Q: In what ways does AI drive innovation and efficiency in web3 technologies?

A: AI contributes to data processing, automation, and enhanced functionalities in decentralized systems.

Q: What role does AI play in creating personalized content and experiences?

A: AI drives personalized content creation, user-specific recommendations, and tailored experiences across sectors.

Highlights

Time: 00:15:42

AI Optimization in FinTech and DeFi Exploring how AI enhances data analytics and decision-making in financial technologies.

Time: 00:25:19

AI-driven Marketing Strategies Understanding the role of AI in targeted campaigns and customer engagement.

Time: 00:35:55

AI's Influence on Gaming Experiences Discovering how AI personalizes gameplay and creates immersive gaming experiences.

Time: 00:45:33

AI's Role in Traditional Finance Examining AI's impact on risk management and investment decision optimizations.

Time: 00:55:48

Insights from The AquariumWCT Discussions Valuable insights shared on AI applications in various industries for enhanced efficiencies.

Time: 01:05:27

Continuous Learning for AI Implementation The importance of ongoing learning for businesses to effectively utilize AI advancements.

Time: 01:15:09

Enhancing User Experiences with AI AI's pivotal role in personalization and improved user experiences across sectors.

Time: 01:25:16

Innovating Web3 Technologies with AI Exploring AI's contributions to efficiency and innovation in decentralized systems.

Time: 01:35:42

Personalized Content Creation with AI The impact of AI on tailored content and user-specific experiences.

Time: 01:45:55

Adapting AI for Business Advantages Insights on leveraging AI for improved performance and operational efficiencies.

Key Takeaways

- AI is revolutionizing FinTech and DeFi by enhancing data analytics and decision-making processes.

- The integration of AI in web3 technologies is driving innovation and efficiency in decentralized systems.

- AI plays a pivotal role in marketing strategies, enabling targeted campaigns and customer engagement.

- The intersection of AI and gaming is creating immersive experiences and personalized gameplay.

- AI is reshaping traditional finance by optimizing risk management and investment decisions.

- Collaborative discussions at The AquariumWCT and WhaleCoinTalk provide valuable insights into AI applications.

- The space emphasized the growing importance of AI in various industries for improved efficiencies and performance.

- AI's role in enhancing user experiences and personalization across different sectors was a key focus.

- The discussions showcased the evolving landscape of AI technologies and their impact on diverse sectors.

- The importance of continuous learning and adaptation to leverage AI advancements in business and marketing.

Behind the Mic

Introduction to the Session

All right, what's up, everybody? We're back on avalanche spaces. I haven't been here in a while. So excited to kind of jump back into a really awesome and unique conversation today with a couple teams that we have surrounding our ecosystem and really focused on some of themes and topics that are being discussed in our code base program. So we're jumping back into spaces and it's excited to have folks here. So we're going to give it a few minutes. Got the room open, let some people kind of come in and join in over time. We'll also get our speakers up here so we can kick things off. And we got a good mix of people today. So let me add some of the speakers up and then we're going to start our conversation here in a minute or two. So thanks to everyone for joining right on time. And, yeah, it's going to be, going to kind of be a different conversation that maybe normally used to around some of the other topics we've covered.

Welcoming the Speakers

So gonna pull up some of our speakers here. There's Mark. Mark, how you doing? Hey. Hey. I'm doing well. How's everyone doing? We're doing well, man. Thanks for coming through. I added Michael up here, too, and it looks like David's here. So let me add. And then Anisha's here. So let me get these added up here. Sometimes it takes a little bit for this app to load. All right. Looks like Anisha is working. Sending invites to David and Michael. Hey, how's it going? Can you all hear me well? Yeah. Aneesh, how are you, man? Doing fantastic. Went up to the east coast for a bit, so it's a nice change of pace from the regular west coast. Kind of working from home. Yeah. Nice, man. Well, hope you're enjoying it. Michael's. Michael's is up here.

Speaker Introductions

Hey, guys. How you doing? Good. Good. Thanks for having us, Kyle. Appreciate you. Yeah, man. yeah. Excited. It looks like David's got loaded up here, too, so let me. How's it going? Good. How are you? Good, good. Thanks for having me. Yeah, man. Welcome. Thanks for taking the time out of your day to come join us. And we got our speakers up here, too, which is cool. We got Michael, who is our lead at Codebase, and I'll let him introduce himself. And kind of the code base program. We got a new guest who's joining us, David from jerk Race. And then the winners of season one's co. And so they got a very interesting story to tell as well. So we got a lot of ground to cover here.

Discussion on Founders and Cryptocurrency

And so I'm just going to jump right into things and I'm going to let our guests introduce themselves. And then, Michael, I'll let you take it away from here. Fantastic. Yeah, thanks, Kyle. So today's conversation really is around lessons from early stage founders and consumer crypto. This is a new. I wouldn't say a new, but certainly a space that we're deepening our interest in, specifically with the code base program. My role here is, as Kyle mentioned, the director of Codebase. Codebase is the official avalanche incubator, if you're not yet familiar. And really our goal is to invest in early stage teams who are going to help us grow the avalanche ecosystem today, tomorrow, and then further into the future.

Focus on Early-Stage Companies

One of my focus areas for this program specifically is thinking about, like, what are these moonshots types companies that we can help really grow into, grow from builders into founders. And that means for us, a ten week program where we have people effectively doing what we're starting to think about more as an almost a proto web three MBA, but with like, deeply practical. So we're going to be having coursework. Over the course of the ten week program, people will put together a roadmap. They'll be building an MVP and a testnet to launch with. And then they'll also be having really intensive and supportive conversations with myself, an internal avalanche team writ large, and a dedicated advisor, as well as a dedicated storytelling coach. We think that being an early stage company, when you're this early, that story is the best and most important thing, in addition to, of course, your ability to actually stand up a product.

Codebase Program and Future Opportunities

So the reason I'm having this conversation today, as I briefly mentioned, is because this is an area for. This is an area where codebase is particularly interested in and is like, how do we reach the next billion users? And I think that there's a lot of ways and a lot of conversation around how that could be done. I believe some of them more than I believe others. But at the end of the day, it doesn't really matter what I believe because this is why we have our founders joining us today, David from Jokerace and Anish and Mark from inertia. Because they're the ones in the trenches. I have more of the outside perspective where I'm able to prognosticate and see from the sidelines, but these are the folks who are building it, who are in the space, who really know the tiny nuances of what's going to work, what's not going to work and really where things could be going.

Application Openings for the Codebase

So with that, I'm going to stop my intro and just actually, I'll close with this as well. But before I go on, Codebase currently has applications open for its second season. Thus we are having this conversation now because of that. So we'll be accepting five companies from around the world. Each of those companies will receive a $50,000 non dilutive grant, which no other accelerator does. Non dilutive grants. And we will be having a demo day prize pool at the end where people will pitch for three term sheets that will equal a million dollars. So there'll be a $500,000 term sheet, a $300,000 term sheet, and a $200,000 term sheet.

Opportunities and Advantages for Participants

So three of the five companies will be walking away with a minimum of $250,000. And we're really focusing on super early stage companies. So if you don't yet have an MVP, if you have an idea, if you have college students in your network, if yourself are a college student, recent alumni come find us also. You don't need to be those things. But really what we're looking for is folks who haven't, don't yet have an MVP who can spend that ten weeks working closely with us to get you there. So with that, I'm going to drop the code base. You can go to my Twitter profile, actually to find the codebase website. But with that, let's go to David for his introduction, and then we'll go to the inertia team from there.

Introduction to Jokerace

Gmgm hi, I'm David. I am co founder of Jokerace. We do on chain contests. And so probably the easiest way to understand a contest is people submit entries, people vote on entries, and then they can earn reputation, they can earn rewards. And I think on the surface it's really that simple. And so you can imagine, really anything is a contest. When you look closely enough, even when you're on Twitter right now and you're liking something, you're effectively uploading it for others to see. That's a contest, I think. So we think about it. It can encompass everything from hackathons and grants rounds and those kinds of traditional contests, stuff like demo days, which were just talking about, where you can have a few contestants competing and then anyone can vote on them to anything from being able to build a product hunt in web three, where you're running weekly contests on what products you want to see featured or reality tv shows, and people are voting on the winner, it can get quite broad and quite fun.

Excitement and Innovation with On-Chain Contests

I would say the things that get really exciting, just in terms of building on chain is one you can let anyone vote, which just has never been possible before. It's something that's really unique to blockchains because you let people pay per vote. And so that means that you don't get sibled and you don't have random bots giving random number of votes to people. And so it creates a whole new opportunity to let anyone vote. It also enables a whole new form of monetization. And I think the other thing that gets really exciting is what we think about as programmable money, which is just this kind of unique thing with blockchains where anybody who's creating contests is earning. So we split fees with them and they could keep those fees for themselves, but they could also put that back towards, they could donate it automatically, they could have it automatically go back into the rewards.

Future Possibilities and Conclusion

And so you could have self funding contests where you don't put up any money, but there end up being huge rewards for winners anyway. Or you could have it go into a smart contract where every time somebody's voting, they're minting an NFT or they're buying a token. And that's all done entirely through smart contract logic. So I'll cut myself off there. But just to say, really excited to be here and just thinking through all these kind of fun things that are enabled by on chain experiences that just frankly never were possible before. Amazing. Thanks, David. Aneesh, why don't you, Aneesh and Mark give your own personal intros quickly and then can dive deeper into what inertia is building and share there? Yeah, I can start off here. So I got into crypto.

Aneesh's Journey into Crypto

My first interaction crypto was way back when I was in 6th, 7th grade. So super early on the Minecraft server, I used to play, like factions and stuff on accepted crypto for payments, for ranks. So I go to my dad, I'm like, dad, let's buy this Internet magic money. And he's like, no, this is completely a scam. And he totally regrets that now. But it got me kind of interested, you know, in crypto as a whole. But my interest really took off when I was coming into high school. So 9th through 12th grade, you know, I was really getting deep into the weeds of kind of finance, economics, trading, crypto stocks, everything. Eventually I started up an esports startup which got acquired and it threw me down this whole blockchain gaming rabbit hole. And coming into college, I started up our university blockchain organization.

Development of Blockchain Skills

So, you know, we started up a researcher team, which, you know, Mark actually ended up leading as well for a little bit. Developer team, worked with pretty much any major protocol you can think of, helped onboard lots of, you know, students onto web three. Eventually I, Mark and I started doing a few projects together.

Introduction and Concept of Prediction Markets

I'll let them kind of expand on that. And then I. Yeah, went through Codebase, won first place, and now we're building out a social community based prediction market interface where users come in, they'll join communities, Reddit style communities, and they can create markets about stuff they're interested in and earn revenue from the volume traded on their markets that they've created.

Mark's Introduction to Bitcoin

Hey, hey everyone. My name is Mark. I guess uninsured myself, you know, my first introduction to bitcoin was through forums and YouTube videos. Eventually I went to Walmart and bought gift cards, traded them on this platform because I couldn't open up my own exchange because I was too young in 2012 and tried sending my grandma money, lost those keys, so that was terrible. But throughout high school I kept looking at the space, got really interested in it. My freshman year of college, I started working for web two and web three startups as bd. My second year of college, I met a niche through blockchain at UCI. He was hosting a panel. We spoke for like 2 hours and the only thing that pulled me away was because of some meeting I had. But that year I joined blockchain at UCI, and since I've helped them research for a few protocols here and there, that was a lot of fun.

Building Community and Entering the Field

We've had to wrangle college students to go to East Denver, hackathons across off the country making our own little cabal. That was plenty fun. And last year I graduated from UCI, I hit up a niche. I was like, hey, we've done so much together and I'm pretty bored just because I graduated. So why don't we do something? And so for a few months we made a few bucks making trades here and there, very degenerate. But we eventually found ourselves in the prediction market space and we saw a lot of problems that we ourselves were encountering and were wondering why no one was trying to pursue this. And it just seemed like a lack of focus in this space and that's kind of how we got started here.

Consumer Crypto Excitement

Great, thanks, guys. I kind of wanted to jump into it really more than anything is like, what is there to be excited about in consumer crypto today? You know, I know that we're going to talk about lessons and we can get to there, but I kind of want to start high level, like, what's cool? But also then after that answer, I would love to hear, like, what's overhyped? What's the, you know, what's the shit talk? I suppose that, you know, you don't need to say it publicly, but you're maybe say the public version. So let's start. What's exciting. David, why don't you go ahead?

Consumer Crypto Products Discussion

Yeah, I'm actually thinking about doing a post on this right now. I think, like, if you look at consumer right now, there's kind of two big products that are probably the big winners right now, which are polymarket and pump fun. And these are interesting because on the surface, they're kind of opposite projects. Polymarket is very focused on real world events and prediction markets and what's actually happening. And its users don't even know that they're using a crypto product at all. Whereas pump fund is very crypto focused to buy meme coins. It is for crypto native people. And its go to market is entirely by focusing on degens in the Solana community. And it kind of identified Solana as, like a degen chain and went after it knowing that was, like, where it was.

Contrasting Aspects of Crypto Projects

So on the surface, they seem very opposite. But I think what I think about a lot is there have always been these kind of two strands of crypto that have been kind of at odds with each other. And I would say on the one side is, like, the social consensus people. And these are the people who see crypto as this utopian project where you can actually coordinate millions of people to be able to share their views and be able to get together, validate one another, build interoperable reputation, and create these new societies of tomorrow. And that's the social consensus piece of ultimately, a blockchain just comes down to a bunch of people all verifying something together.

Speculation and Community-driven Crypto

And then on the other side of crypto, you have the speculation side, the casino side. Right? And I think even in, like, you read like, Chris Dixon, he, like, kind of, you know, puts these two sides against each other. Like, the casino culture of crypto, which a lot of people look down on, you know, is this speculation gambling, you know, botted area where people are just trying to cash out and they're mercenary. and what's. What's really interesting with both polymarket and with pump fun is that they combine these two things together, in a way I don't think we've really seen before. Like, they're both speculative. Right. It is people who are there to bet and like, you know, try to make money. Like they're betting on, you know, prediction markets are betting on these tokens, but it's done in a way that is built entirely on tribalism, of getting people together into communities that matter to them.

Tribalism and User Engagement

So, you know, for the prediction markets, they're betting on their team. Like, you know, they are team Republican, they are team Democrat, and they are voting for their team and trying to support their team. And same thing is true for pump fund. It is really, it is tribal, it is team based. And so there's a social coordination piece where you actually manage to coordinate financially all of these people at a scale that was never possible before thanks to crypto. But you also have the speculation piece as well. And I find that really interesting that's kind of what's winning right now. Because I think for years were told that these two things were opposite to each other and that they were fighting one another and that only one could win.

Limitations and Ownership Concepts in Consumer Crypto

And for years we also were told that ownership was the real use case for consumer crypto, and neither one of these has anything to do with ownership whatsoever. You could probably say maybe owning the meme coin is something, but the point is not to own the meme coin. The point is to trade and dump the meme coin. So I think it's kind of fascinating that these are really making us, I think, rethink a lot of the kind of priors that we've had in this space, especially building in consumer. Yeah, it's really interesting. And obviously prediction markets are increasingly, I mean, I guess let's say that's probably been a big thing of this year, 2024.

Collective Reflections on Consumer Crypto Landscape

And we have inhersor here to represent that perspective. We'd love to hear your guys thoughts on really like, you know, what David just mentioned, but also just like generally anything else that you're excited about as well in the space. Yeah, I can go first here in terms of what we're excited or what I'm excited about. Ownership, I think is an interesting concept in web three because it's not just like you own an asset. The thing in consumer crypto is it seems like all the founders have some kind of shared language, that ownership means shared economics for its users. So when the platform wins, more people are using it, there's more transactions being made on that specific platform.

Impact of Ownership in Web Three

Its users should also benefit in that in some sense. One of the reasons I was really bullish on nfts as a technology is because, not because of a profile picture. But the sense that if an artist makes a piece of art on chain, they can actually benefit from that along with their users or along with their followers. So, you know, royalties back to artists and you see that a bunch in on chain gaming with items that you can trade with other players, you. As a gamer myself very early on, who was pretty interested in mmorpgs, I would grind for hours to get these rare items and I would be pretty disappointed in terms of like, oh, like, I've spent this much time and I can't trade these items for real money.

Challenges Faced by Gamers and Consumers

Like, why not? You'd have to go through these sketchy, like, you'd have to go to these sketchy websites to actually do that, and you'd probably get hacked. And that was no fun. So what I'm really excited about in terms of web three and consumer, it's just like giving more ownership to users to enhance the behaviors that they already have and using tokens to actually give them ownership over that. Now, in terms of how we're seeing that in the landscape itself, I thought this was a shit talking space. Go for it. I don't think we really see that much other than defi.

Difficulties in Consumer Crypto Adoption

In Defi, you can stake a token and you have shared economics and you're essentially owning a piece of that protocol. But in terms of consumer crypto, we're seeing a lot of what we're seeing from web two translating over to web three, which is really unfortunate, which is like, as a user, you go into this platform, you provide value through the content you make or the liquidity you provide and so forth, but you're not really being provided back any of the success that you bring onto the platform. And that's really unfortunate. And that's something that guides our thinking into building inertia.

Providing Value and Ownership in Inertia

We want to provide people ways to enter the crypto space without knowing that they're going into the crypto space, but also letting them have ownership over the protocol just by providing value and entertaining each other. Yeah, I mean, Mark and I have had pretty long conversations about these sort of things, so I don't have a whole lot in you to add. But I think the biggest piece here is that blockchain technology as a whole offers this base to build really cool things off of that I think, for the most part gets overshadowed by, again, as David mentioned, the gambling aspect, or as Mark said, really just tokens and mostly the financial element of things.

Addressing the Overshadowing of Blockchain Technology

A lot of cool stuff. I think. I haven't really seen anything taking innate advantage or rather what I'm really excited about is things taking advantage of the decentralized aspect to provide benefits to consumer application users and places that may not, you know, be able to use a particular application because of regulatory issues or, you know, like irreversibility of crypto payments. So I think like, blockchain technology as a whole is often overshadowed by kind of the financial side of things, whereas there are lots of really cool ways of using the tech itself in the backend, you know, without kind of screaming, hey, we're crypto.

Challenges in Consumer Adoption of Blockchain Applications

Hey, we're blockchain out loud. That can really help drive consumer products to kind of the next level, in my opinion. And I just want to add really quick as a response to David, in one part of this thing where, you know, people in the crypto space, see, polymarket is really user friendly when it's really not like Vitalik Buterin posted this like, screenshot of the before and after on, you know, Polymarket's on ramping feature. We have had like five friends try and use polymarket organically and them reaching out back to us just because they know we're building inertia. And five of them are computer science majors, four of them couldn't do it.

Issues with Polymarket and Crypto Accessibility

One of them almost got to it. But all of the tools that we have in this space, unless you're crypto native, you don't know where to go or what to use. So I would say that the consumer space is actually really difficult if you're not crypto native. I think a lot of crypto people, like people in Web three, have such a high tolerance for these things because we've been super deep in the weeds, super deep in the trenches. But your average person, even if they do have a CS or finance background, is going to get stuck in one of the many kind of steps you need to take, whether that be what wallet do I choose?

Navigating Crypto Complexities

How do I save a seed phrase? I need a kyc on an exchange. Okay, what's a different chain now? Like, what does that mean? I thought I only hear bitcoin, I only hear ethereum. So I think these things that come as second nature for any of us, you know, folks that are deep in the trenches, it's not really something that your average person ever even thinks about or even knows that they have to know. It's an issue, I think for us too, right? Because like if you're building an app that isn't for crypto native users, but the UX is only going to be able to be used by crypto native users.

Challenges in Consumer-Oriented Development

Like, you have this problem, right? And I think the result of that is that a lot of what is built in consumer crypto is built for crypto native audiences. We're mainly devs, right? Like, let's be honest, like 90% of the space is devs. And so it's like, you know, if you're building forecaster, like, it makes sense. Like Farcaster is built for devs. Like that is the community it went after because that is the crypto native community. But you know, that's, it's a tricky trade off because if you actually want to build something that's for mass adoption, the UX isn't good enough for you to reach them.

Future Directions and Emerging Solutions

And I think that all changes with stuff like embedded wallets. I think we're like really on the cusp of that being like a kind of breakthrough point where we actually will be able to build for non crypto native users. But yeah, the point that like, we're close. I mean, telegram kind of is doing this in some ways, but like we're not quite there. It's just a real, it's a massive limit. I mean, even with us. I think we just have to be really creative because it's like we know our only users right now are going to be crypto native and so we have to build towards them even if they're not the end game, I think, for what we're building.

The Tolerance in Web Three Development

And it's fun, but it's a challenge. Yeah, I think it's really interesting that you say that because I think while we do have a lot more infra now, I think the point again of like, we're so used to dealing with kind of clunky products. I mean, like everyone in the web three space is just anyone who's deep in the trenches is really used to dealing with just shit. Like we've personally had to switch out of different infra providers left and right because, you know, they'll push new changes to their code base without updating their documentations or, you know, just a myriad of issues where they don't have support for particular things, etc.

High Tolerance and Infrastructure Issues

That really, you don't see this in the web two space, obviously, because it's more developed. But, you know, you'd assume with, if they've raised like $40 million in funding that these wouldn't be an issue like any traditional web two company did. This pushed code breaking changes without even updating their documentation. They just would cease to exist. So I do think the tolerance of both builders and users in the web three space is so high that it makes it so that even a lot of these infrastructure projects, which I think are doing really good things, they can just get a little complacent when it comes to serving developers, because it's really easy to just fork something and create something that's for web three natives make a ton of money out of it and then not even care about abstracting away the complexities for normies.

The Market Dynamics in Web Three

Because, hey, if you made a few million dollars after forking some project and tossing marketing into it, then why would you care? One, I want to actually get into a question around this, which is focused on, really what you guys are all doing about thinking about that massive option piece. But before that, I want to say I was just thinking, as were talking about this, I was thinking about online shopping and how that is the most normie of Normie behavior, myself included, of course. And the rate of abandonment for online shopping carts is 70%. So for the past 30 years, we've been building e commerce, and it is ostensibly, like, the reason that the Internet exists in a consumer form, and therefore, it has been optimized for consumers over that 30 years.

Consumer Behavior in E-commerce Context

And shopping carts are still being abandoned at rates of 70%.

Usability Challenges in Adoption

Obviously, you can attribute that all to usability, but certainly a percentage of it you can. So those are the numbers we're looking at when we're thinking like, okay, this is the best in class stuff. So if crypto gets anywhere near those numbers, if crypto can get anywhere near those numbers of, like, successfully completing a full transaction, I mean, that it would be incredible, but I don't think we're anywhere close to that today. So I think what you guys are saying is totally spot on. And obviously, I believe to be one of the biggest hindrances that we have. Back to the question, though, would love to hear, when you're thinking about usability, when you're thinking about that adoption.

Elements of Usability

There's a couple of elements here. One of them is Ux and ui. And I know that you both are inertia and jokerace have both really super streamlined, easy to spin up stuff, which I adore. But then the other is also that go to market. How do you actually get to those people? We're all stuck here on crypto Twitter for better and for worse. It's like the asylums, the inmates have taken over the asylum, and we're only now, like, trading meme coins with each other. So would love to hear how you think about breaking out of that as you start to grow your company. So, David, why don't you give us a kick here? Kick off?

Challenges of Reaching Non-Crypto Users

Yeah, I mean, I kind of go back to the embedded wallet's question, which is like, if you actually want to reach non crypto native users, it's like there's kind of two challenges, I think, that they face right now, and one is just getting money into an app. Like, fundamentally, I will take the old school crypto approach. Like, these are financial rails, and what makes an app powerful is the fact that you can put money into it, which you could never do before. This is not possible in a web two app. If you want to have transactions, you have to double tap and approve your credit card every time. But unfortunately, that's exactly what you're doing right now as well in a crypto app, which is every time you want to do a transaction, you're opening up a separate wallet and then you're approving it there.

Need for Embedded Wallets

Embedded wallet solve for that, which is nice, but I think for crypto native users, that's really just an upgrade. It's nicer that you don't have to switch out to another wallet. You can just do it internally with game changing for non crypto native users is the ability to fund that wallet easily. Right now, the way that you fund wallets is you go to coinbase and you create an account and you wait seven days to fund it. And then you go and you set up a metamask, or then you fund that and you have to know what a wallet is and how to get an address and how to send it out. You know what that zero x 64 characters are, and then you send that, and then after two weeks of waiting, then you can use your app. And this is crazy. This is not a viable way for someone to experiment with an app.

Meeting User Expectations

We all know you need to be able to use an app, download it, and engage immediately. And so problem one is, how do you open up an app, double tap Apple pay, put in your credit card, and immediately just put $5 in the app and you can start using it. It, right? Like, what is that flow? And so I think that's what I referred as embedded funding. And for me, it's like the next step of embedded wallets. Players like Privy capsule are really deep in on this right now. The other challenge, I think, is the question of chain abstraction, and that's, I think, a really interesting one for us to probably get to, which is just a question of, like, should users, should your end user know what chain they're on?

User Awareness of Blockchain

Do they need to know that they're on Avalanche? Or does that only matter for the app builder, for the end user? Can they just know, hey, there's money in the wallet, I don't know what it's on. And again, polymarket's a little bit interesting here because I don't think many people even realize it's on Polygon. But on the other hand, as a chain, if you want to build liquidity and you want people to be loyal to it's important to have them know what they're using. I think those are the two big ux questions, I would say that just kind of haunt the entire space right now.

Finding Solutions to Onboarding Issues

No, no. Yeah, no, I think, David, you pretty much hit the nail on the head. I mean, the ideal user flow in my eyes for a consumer application would be like Google or Twitter SSO or something like that. And as soon as you hop in, you can again just easily on ramp money. But I think there's another issue with the on ramping kind of crypto into a consumer application as well, where it's like, you know, a lot of these onramps have really high spreads or they have really high fees. So your average user, if they're bringing in like $100 into an application, they're going to be pissed if they end up with only like 93. So that's kind of another issue, I think, that the infra side of things has yet to fully solve.

Backend Utilization of Blockchain Technology

I think there are some great applications that are coming out, but it is still kind of an issue there. and on really the other side of things, I think blockchain tech should just be used silently in the backend for most consumer applications. I mean, obviously this doesn't hold true everywhere. but I think most, you know, consumers don't really care, what blockchain it is. and oftentimes, especially with how nascent this industry is, how many scams that they're genuinely have been. You know, a lot of the people that, you know, I've spoken to from blockchain at UCI, or externally, they get all these red flags in their head once they hear the word blockchain or once they hear the word crypto, a lot of the times bitcoin, just hearing that is like, oh, that's a scam, right?

Branding Issues Within the Blockchain Space

And it's something that, again, us as web three users, we don't immediately think about because we know of how cool this technology is and what can be done with it, but it's a branding problem. Externally, your average user, they get red flags. So I think silently using blockchain in the back end to kind of improve your own consumer application through the benefits of decentralization, through the benefits of, you know, crypto and stuff is something that the good consumer applications are really going to be utilizing. And I guess for the second part of Michael's question, in terms of go to market, right.

Shill Marketing Phenomenon

Without delving too much into what we're doing, there's phenomena in the web three space right now where it's essentially shill marketing or newsletter marketing, something of that sort, where it's probably going to happen in the comments here, but someone's going to shill their token or their projects, so forth, essentially trying to just funnel people into this project without really understanding what they're doing. The way that we think about this is rather than this hype channel, there should be community, meaning if you have friends, you're a cluster of people and you should join our application.

Community-Driven Growth Strategies

And the way that you go about that is through word of mouth or you have a champion in that space. You bring them in, you show them the product, they actually use it, they like it, and organically, they should be able to use the application. This works in web two a lot. Why shouldn't it work in web three? Yeah, great points, everyone. I want to actually ask a question really specifically about your companies themselves, and I know David probably has a little bit more substantive answer, just given how early inertia still is.

Founders' Lessons Learned

But David, I'd love to hear more about, you know, we're getting into the lessons from the founders, if you will. Where, when you started company, where did things go awry? And then, like, what was the pivot points that you thought were interesting and kind of brought you to where you're feeling good about things today. I know that you've been now deployed across what I believe, over 100 chains, so you've obviously seen some things.

Embracing Early Challenges

Yeah, I mean, well, one thing is, like, I'm a big believer you want things to go awry. I, because that gives you data, but you want them to go awry as quickly and cheaply and as low consequentially as possible. so, like, you know, just being able to ship and get data is really helpful. And I think, like, you know, like our, I would say our site today isn't a version I'm proud of and works really smoothly, but it was not always that way. And, that was fine with us. Like, you know, we wanted to ship this as an MVP, make sure there's actually usage and that people actually cared about it and then improve it and make it better.

Reputational Risks in MVP Development

But that also means that you are incurring reputational risk because people are using what is a, I don't want to say jankier product, but a less advanced one earlier on, and they might have the brand association, too. So I think that is always the trade off. And do you ship the fully fledged product versus the MVP? And I'll always just take the side of shipping the MVP. I would say the only thing I really regret doing is trying to build off of our own site into other platforms.

Building Upon Existing Platforms

That's interesting because literally almost every conversation I've had with any of our investors or any of our users, they've asked us to do that. They're like, why aren't you building where the users are? Go build on the platforms where there's already users, and then embed these functions there. And it's crypto, it's easy to embed and you can do that. It's actually not easy to embed. It's really hard, and you're dependent on third party dependencies that you can't control and will break. And so that's the first challenge.

Addressing Challenges of Third Party Dependencies

But the second challenge was it didn't actually change anything. People didn't use it. When we did that, it was a novelty because fundamentally, the reason to participate in a contest is the base incentives, which are financial, social, reputational. And if it's like, if you make it mildly easier for a few more people to reach into the contest and get there, that's a top of funnel that can mildly expand your audience. But it's nothing compared to actually being able to build a better product at your core.

Focusing on Core Product Development

And so I actually think there's a lot too much focus on this idea of being able to embed anywhere within crypto. It's actually very hard to do that. And ultimately, if you can build a strong front end, that's what builds a strong product is like, if we have really good users on our site every day, that's going to be more incentive for people to create content, to tap into those users as well. And so, like, I I would say I've just come down on the side of, like, when you came into this space, like, the focus was that you build moats through financial liquidity.

User Liquidity as Building Moats

And I think what we're seeing today is that's only true for very few defi products. Like, the way you actually need to build a moat is user liquidity. It's the same thing as in web two. It's having a bunch of users on your site every day that then draw other users to want to be there in order to interact with them. And if you can get that kind of network effect going with user liquidity, like, that's actually the real winning play. It's just a lot harder and a lot more time consuming to pull off.

Takeaways from Building in the Space

So, you know, I don't know. I would say that's been one of my really big takeaways, for sure. So it always and always comes back to Daus, basically. Yeah, I thought. I thought we. Yeah, sure. I think. I think it's quality though, too. It's like, you know, you can. You can bootstrap traction with a ton of bots and, you know, you can pay them off to use your site, and you can get farmers, you know, and it's like, actually, for defi, that's kind of useful.

Quality Over Quantity in User Engagement

Like, you need as much liquidity as possible. So, like, you know, getting more people to give you money for points is like, that's a road action. That's really good. But if you're a social app, just juicing your numbers to try to get fake users actually really kills your network, because then everyone is coming there and seeing bots, and that actually makes them less likely to want to participate. And so, like, having 50 quality users on a social site is way more valuable than having 10,000 bots.

Reputational Element of User Experience

And just no one thinks in those terms, unfortunately. Well, I think that gets into a lot of that reputational element, too. Right? And I think that this is where the divergence perhaps comes in of crypto native versus non crypto native. Those of us who perhaps may be more crypto native are maybe less averse to a botted environment as long as there are x number of people who are actually participating, whereas someone who is typically used to, I don't know, whatever, using Instagram or TikTok, that might be a bigger issue.

Navigating Reputation in the Market

So, actually, curious, Aneesh and Mark, as you guys are still very early in the process, like, how are you thinking about reputational? Reputational, let's say risk versus shipping versus building out an actual beta user base? Yeah, I think on the reputational side of things, like, if you are putting something out there that money is going to flow into, you just have to audit. You have to make it sure it's super robust.

Balancing MVP and Product Integrity

And with that, you know, kind of comes a problem of balancing between, do I push out, like, this mvp, something that's, you know, kind of duct taped together, you know, build fast break shit or kind of a fully fledged product that needs to be really kind of locked down. And I think the answer there is somewhere in between, right? Because you don't want to play with people's money, quote unquote, and have things go awry and then, you know, lose your own reputability in the space.

Understanding User Trust

You know, if you do get kind of hacked, if you do get exploited, you die. So I think that's something especially with sort of the immutability of smart contracts as a whole. And, you know, it's something that is a big, I think, different way of doing things in the space. But kind of going back to the initial question here, I think one of the large issues that we kind of early on saw was this sort of cold start problem where, you know, again, going back to the primary issue of consumers have difficulty bringing crypto into, you know, a consumer application.

Solving the Cold Start Problem

So for us, you know, we're solving that through, you know, allowing users to directly have very different amount ways to, you know, earn USDC on our platform without even having to, you know, put down, you know, credit card or connect your Apple pay bank, whatever. So I think that cold start problem, especially, you know, in a space that is already, you know, pretty difficult to use for a normal person, was one of the harder things that we really had to think about and, you know, attempt to implement.

Third Party Dependencies and Challenges

And I guess another smaller thing would be, and I think David briefly did touch on this, but third party dependencies, having to rely on so many infra products to really abstract. While these infrastructure products are still technically startups or later stage startups themselves, you're effectively building a startup on different startups. So it does pose a significant amount of reasons to or like needs to pivot every now and then. But it's something that I think will I hopefully get better as the space grows.

Optimism for Blockchain's Future

I mean, I'm very, very bullish on the blockchain space as a whole and kind of the impact and good that the tech can do. So. Yeah, but for now it's startups building on startups.

Understanding User Needs

So something I resonated with David on is getting real users. And the way that we're de risking that at our very early stage is just being real users of the platforms that we're talking about that we are, I guess, competing against and also just talking to users. So understanding what communities people actually want and stuff like that. For example, I have three applications on my phone that are competitors and sometimes they range from unusable to they're usable, but they're missing a lot of things that I personally would want. And yeah, that's just a way for us to think about what do people really want in the prediction market space? I think it really just goes back to what do your users want?

Market Dynamics and User Engagement

Right. Like, I think in this space we have such a tendency, and I think like to be just like, oh, let's just launch some sort of airdrop program and get a bunch of farmers and stuff. But then you see this huge spike down once token launches or once speculation dies out and, you know, again, tapping into the kind of the gambling monkey brain of this entire space. You know, people do launch these sort of specular speculatory campaigns or these short term kolbis based marketing campaigns, really just trying to bring in as many people as they can without, you know, at least personally. From what I see, you know, a lot of these products don't actually effectively talk to their users, do like the basic steps of customer discovery and target people that, and target the people that are actually gonna use their product and find out why they wanna use their product.

Shift in Project Approaches

It's very much a fork and market sort of mentality, which I think is unfortunate, because oftentimes the web three space has rewarded projects like that. But I think finally we are seeing good projects come out that aren't doing this and are taking more of a native approach to understanding who their end user is and providing value directly to them. You know, we have 15 minutes left, so one of the things I'm really thinking about now is what's, what do we do moving forward? You know, sitting along between my role is often finding myself being the facilitator between investors and startups. So I kind of hear it from both sides. And I can also therefore, like, really easily see the misalignment between building long term high value companies that take time to grow those network effects, versus the immediate liquidity that often VC's, let's say, and investors broadly have structured their funds to necessitate.

Addressing Future Challenges

So given those tensions, would love to hear maybe David, you can start, is really like, what's the roadmap for the future between those things? Who's got a blink first one? And then secondly, what does that even look like should we decide to move forward? Right now I feel like we're in the standstill with, let's say, three month token lockups, which if you're bootstrapping a global network of individuals to use your social five product in three months, you know, you're doing better than Facebook did. So I think what are we doing here and how do we figure that out together? Sorry, sorry. Can you elaborate just for a second in terms of like, yeah. Who you see as the, yeah, what are the roads here that we have to pick?

Navigating Growth Strategies

I don't know. I mean, I think the roads we're potentially choosing between here are like fast, like basically like fast fake growth versus long term viability. And we can talk about bringing the next billion users on chain, but if the incentives are aligned in such a way that, well, doesn't actually matter and everyone gets paid anyways, it's never going to happen. Right, right. Okay, so I think one is web two right now, is being bought it really badly. Like, bots are a huge issue and with AI this only increases. and so we have this kind of mentality from web two that you want quantity. Like, at all costs, just get quantity, get bots. And then I think like, that's been on hyperdrive because we have the financial incentives that can drive that kind of botting right within crypto.

Quality Over Quantity

And we also have this kind of regulatory incentive which is like people want to decentralize a token, so the more people they can decentralize to, the better. And that's kind of like focused crypto to go into overdrive in the past two to three years and just like hyper growth in terms of quantity and botting. and I put out a post two days ago, but like, you know, we're alive in 100 chains and I would just say everything has kind of shifted in the past month. It's, it's really felt like the number of calls I've done with chains being like, oh, it was actually a mistake for us to get bots. like, those aren't real users and they all hate us and they're just mercenaries farming us and they're nothing actually building or doing anything of value that's helping us get the real users.

The Value of True Community Engagement

And they're creating a kind of like degenerate but toxic community that's putting everyone off we actually want to work with. That's been a recurring theme for a lot of projects, I think. And what's interesting is actually what crypto is really good for. As much as you can have those financial incentives to try to bolster botting as much as possible, what it's really good for is actually building out really differentiated use cases for very few users. NFTs was a good example, actually, of how you don't need that many users to change someone's life. You just have these collections of 10,000 and it can be really powerful. You don't need to create a consumer brand that's going to reach millions of people for it to be a huge success. Crypto often is operating more like an art market in that way.

Realizing the Potential of Talent

I think the same thing is true for reputation. Like, you can build really differentiated on chain reputation that's interoperable across any platform for you to see that you're a valuable contributor. Right. And yet, no one's done this. And, like, I think that's the thing I just keep coming back to is like, if you were to say, like, what's the community of best devs in crypto? What's the community of best designers? What's the community of best artists? What's the community of best researchers, best analysts? It doesn't exist. Like, no one has tried to create those communities. Literally no one has tried to create those communities.

Building Differentiated Communities

The closest we've gotten is like, people selling off nfts, where you're just buying your way in. No one has put in the work to create communities of actual differentiated talent, even though the technology itself enables us to do that. That's one of the use cases of what we're building. With Jokerace, you could vote up people and build a reputation, see who's valuable, and then incentivize people to participate because they're building that reputation and it lets them. 17 year old Nigeria, nobody knows can get a start and get reputation because they're contributing something that people find is valuable. and it's not happening. Like, and so I think, like, we are kind of at this turning point where like, we're realizing, oh, wait, we actually need quality.

The Future of Communities in Crypto

Like, quantity actually doesn't matter that much. What we really need is quality. Because if we can get those 50 top devs, like, yeah, that's all you need. Remember, there's only like 3000 devs in like, all of crypto or something, right? It's like, you know, this whole thing was built with very few people. And, and I think, like, that promise of being able to create these small subcultures of really valuable people who you align with in terms of taste, interest, talent, like, that's actually what crypto enables. And it's just not something that anyone's wanting to go after yet, but everyone is starting to realize that they have to.

Reflections on Community Building

That's great. Yeah, I love that. Anish, Mark, thoughts on. Thoughts on what David mentioned, sir? Yeah, I think. I think a lot. Like, it's really easy to build something and get paid for it, right? Which led to a lot of people building a product around a token rather than the other way around, they would figure out what token incentives are, how to drive value accrual back towards the token and then build a product around it, which ultimately means that, yeah, we will use these bots, we will do these things to show fake engagement, fake quality of growth.

Sustainable Growth Through Real Engagement

So then our token gets pumped and then everyone gets paid. But I think longer term, if you build out a product that's successful, that can stand alone without a token, and then introduce a token later and then drive value back to that token, you'll have much better token incentives. Longer term, you'll have something that's a lot more sustainable. And I mean, in crypto as a whole, everyone wants to see graph and that line go up, right? That's like the dream. That's what everyone is chasing. But if you. But unfortunately, with a lot of the projects that do build out kind of a token first and then build their product around that token, you see these large spikes driven by this inorganic traffic, these bots, and then it's kind of almost just like a high level grip and they just completely dump.

Encouraging Community Growth

So I think longer term, building something that actually provides value without at first having a token and then introducing a token later is something that's going to be really crucial to building out a strong longer term consumer crypto application. David, you're really optimistic, and I really like that in terms of people realizing, or developers realizing that you need to build a community. You need to put in the work to build these communities up so that they use this product in a way that's organic. You guys are doing it. At Jokerace, we heavily align with that. At inertia, pumped up fun is doing that with meme coins, agglomerating them and helping them build communities.

Innovative Community Platforms

And at the end of the day, it's based on the product, what the product allows these communities to do. So, for example, we at Inertia have these sub communities where people can break down into their specialized interests, whether that be reality tv, esports, politics and so forth, just expanding the blue ocean that people can actually pursue with pumpkin fun. They have these live streams that are attached to their meme coins, and that's pretty engaging. And you guys, you have these features where people can upvote and talk about these contests that people can create, and that's really fun.

The Evolution of Consumer Products

I don't know if the space is really headed that way as a whole, but I think we're really mimicking the 2012 era of startups where there's a bunch of consumer products that are realizing that there are a lot of people here, they're looking for something to do and the product needs to reflect what people actually want. Yeah. It's great. I really love all these thoughts and it's fun for me to just get to participate in a conversation like this. So thank you guys for. We're really bringing that to bear.

Key Takeaways for Mass Adoption

To me, the big takeaways are really like, if we're going to do mass adoption, it needs to be done through network effects, of course, incentives, alignment and then also UX and UI embedded wallets being a really obvious use case. Exciting, obviously, to hear, of course, how you guys are all doing that on your own and continue to do so. We're at time, so I'm just going to do a quick close out here, which again, course, thank you all for that. Looking forward to chatting with all of you more.

Information on Codebase

And, you know, as just a brief reminder for those who may have joined late, you know, we're doing this as part of a series of conversations that are to recruit folks for the next code base cohort. So codebase being the official avalanche incubator. Excuse me, I'm the director. If you are building something in consumer crypto, not exclusively, but this is an area that I'm particularly interested in. If you are building something in this area, apply ASAP. We're just starting to do interviews and that means we are accepting people on a rolling basis and we're only accepting five companies.

Opportunities for Startups

So the sooner that you apply, the sooner you have the opportunity to potentially be selected as one. And this cohort, it means being selected as one is a $50,000 non dilutive grant rent and the opportunity to pitch for three term sheets of $500,000, $300,000 and $200,000. So, you know, we're really excited about all of the potential here and, you know, really looking forward to you all keeping involved, whether as participants and or people are the sideline.

Next Steps and Farewell

Cheering cheering folks like David and inertia on. So with that, I'm going to sign us off and hand it back over to Kyle. Awesome. Thanks, Michael. And thanks David and Aneesh and Mark. Great conversation. I'm sure there's a lot of great takeaways that others could have learned here, and I'm sure there's even more that we didn't get to, but really wanted to thank you for taking the time out to join us today.

Final Reminders and Closing

For those of you who are looking for Codebase, abax.com network is the site. We also pinned some posts here if you want to click them before we jump out. That kind of gives you a rundown of season two for code base. Season one was a really great program. We're looking forward to the next teams that we're bringing on board. I don't know if Michael mentioned this too, but for season two of Codebase, the five teams that are accepted get to celebrate the kickoff welcome week in Buenos Aires, which is right after our summit.

Upcoming Events

So Avalanche summits coming up October 16 to 18. So if you go to avalanchesummit.com, you know, we're taking over a really awesome venue in Buenos Aires. And for those of you who've been to avalanche events before, you know, they're super unique, done very differently. Not your typical crypto conference. We have a lot of activities, experiences, side events, music performances. And then right after that, the five code based teams, we'll be kicking it off and staying in the house down in Buenos Aires.

Encouragement for Startup Founders

So another great reason to apply if you're a startup founder. And we're looking forward to all the applications coming in. But again, thanks, David, Aneesh, Mark, appreciate you all. Good luck to what you're building and I'm sure we'll talk again soon. And thanks, everybody, for joining. We'll have a record of this in the next couple days.

Conclusion

Appreciate you. All right, bye. Thanks, everybody. Thanks.